Table of Contents

Toggle5 Money Myths That Keep Teachers Broke — And the Truths That Build Financial Freedom

“Teachers are too smart to fall for money mistakes.”

If only that were true.

As educators, we teach Newton’s Laws, Shakespeare’s sonnets, and the Pythagorean Theorem. Yet many of us get tangled in credit card debt, fall for costly insurance policies, and assume the General Provident Fund (GPF) alone will fund our retirement.

Why? Because money myths are everywhere — whispered in staff rooms, repeated by well‑meaning friends, and pushed by aggressive sales agents.

As a school head, I’ve seen some of the most intelligent, hardworking teachers quietly suffer because of these myths.

One colleague once told me, “Charak Sir, I’ve been teaching maths for 20 years — but I still don’t understand how SIPs work.”

That’s when it hit me: this isn’t about intelligence — it’s about awareness.

And we need to talk about it — openly, often, and without shame. Because financial wisdom should be as common as classroom lessons.

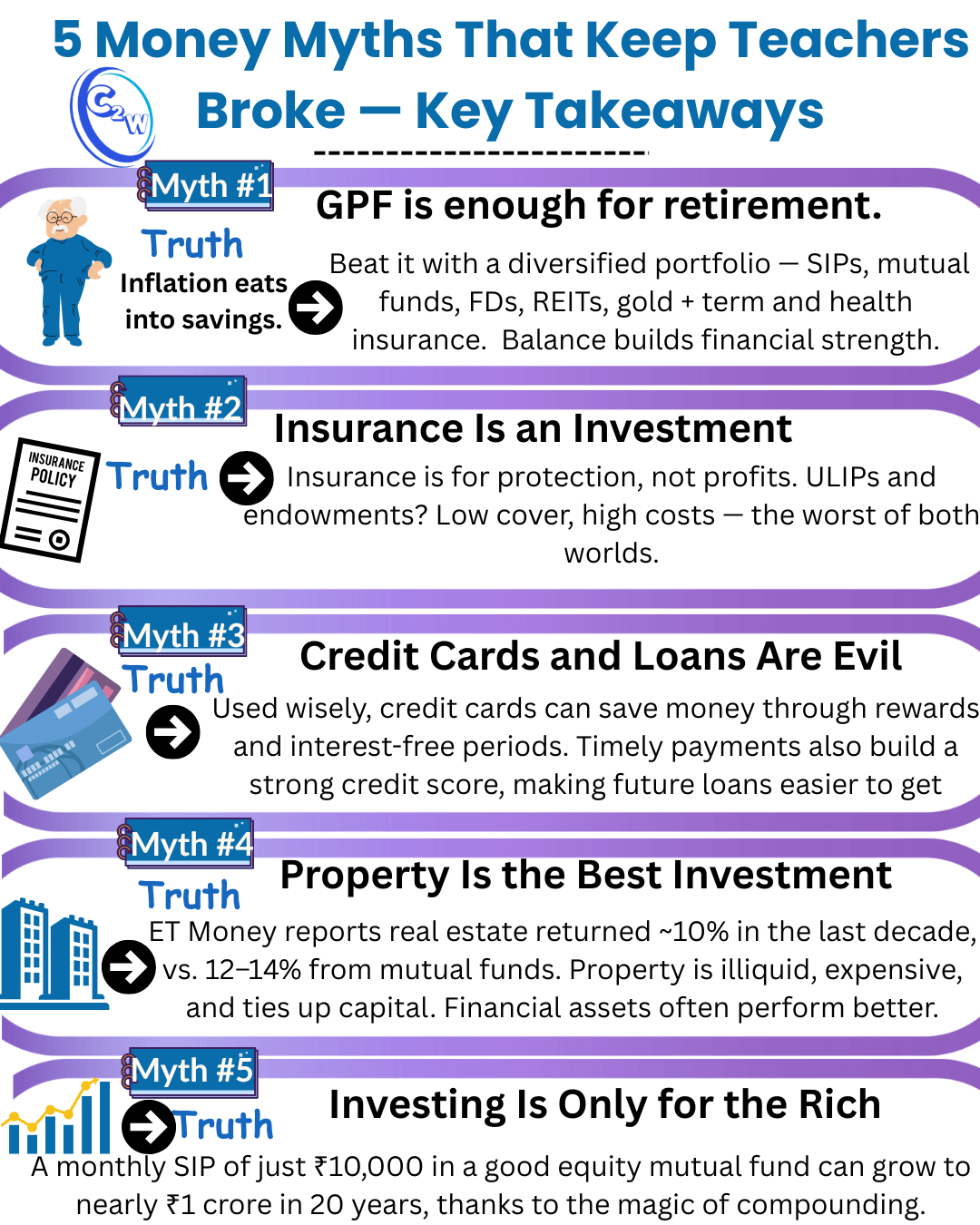

Myth #1: “GPF Is Enough to Secure My Retirement”

You’ve probably heard this line: “I’ll just put money in my GPF and everything will be fine.”

The reality is different.

Relying only on GPF is like expecting one textbook to prepare your students for every challenge in life. GPF contributions and interest rates haven’t kept pace with rising prices. And with only about 27 % of Indian adults financially literate in 2025, many people—even educated professionals—don’t fully see how inflation quietly eats away at savings.

The problem is that real, inflation-adjusted returns from traditional deposits are often far lower than the headline interest rate. For instance, if your savings earn 6 % while inflation is at 4 %, your actual growth is just 2 %—and that’s before taxes. Over 20–30 years, this small gap compounds into a huge shortfall between what you’ll need and what GPF alone can provide.

What should you do instead?

- Think of GPF as just one part of your retirement plan—not the entire plan.

- Use SIPs in diversified mutual funds. Historically, long-term equity funds in India have delivered average annual returns of 12–14 % over a decade—beating both GPF and real estate (~10 %).

- Add safer options like PPF and NPS. These give you tax benefits while offering inflation-beating growth.

- Keep some savings in short-term FDs or debt funds. They provide stability and liquidity, but don’t expect them to build wealth.

Myth #2: “Insurance Is an Investment – It Will Make Me Rich”

In March 2023, Bima Samadhan highlighted the plight of a government teacher who approached Purvanchal Bank (now Baroda U.P. Bank) for a loan top‑up. Instead of processing his application, bank employees told him he would have to buy a ₹ 50,000 per‑year SBI Life policy before the loan could be approved.

Feeling cornered, he signed up for the policy. During a verification call, he explicitly said he did not want the policy, and the caller assured him it would be cancelled. Yet the bank proceeded to issue it anyway and deducted the first premium from the loan amount. When he asked for cancellation and a refund, he was ignored. The bank even refused to provide him with the policy document, claiming it would only be given after he had paid at least three premiums.

The teacher still hasn’t received his refund. His experience shows how banks and insurers can coerce customers—especially trusted public servants—into buying expensive products they neither need nor can afford. It underscores why asking questions, documenting every interaction and knowing your rights as a consumer are critical steps when dealing with financial institutions.

Myth #3: “Credit Cards and Loans Are Evil—Avoid Them Completely”

Many teachers either shun credit cards completely or use them as if they’re free money. Both approaches can backfire.

The truth:

A credit card is just a financial tool. In the right hands, it helps you earn rewards and build a healthy credit history. In careless hands, it can trap you in a cycle of debt. Defaults in India are already rising, with outstanding credit card dues running into lakhs of crores. The danger is real: many young earners swipe cards freely, split bills into EMIs or Buy-Now-Pay-Later schemes, and then get stuck paying only the “minimum due.” The result? A never-ending cycle of 36–48 % annual interest that eats into their salary month after month.

What should you do instead?

- Use it like a sharp knife—carefully and for the right purpose. Always pay the full balance on time to avoid interest.

- Keep it simple. One or two cards are enough; more cards mean more temptation and more chances to miss a payment.

- Create a cushion. An emergency fund of 3–6 months’ expenses ensures you don’t swipe your way out of a crisis.

- If you’re already stuck in debt, tackle the highest-interest loans first (often the credit card), then work down.

Myth #4: “Property Is the Best Investment – Rent Is Money Down the Drain”

Owning a house has long been seen as the ultimate badge of success. Parents, relatives, even society at large often nudge us toward buying property—even if it means signing up for decades of EMIs.

The truth:

Real estate isn’t always the golden goose it’s made out to be. Over the last decade, average returns from property have hovered around ~10 %, while long-term equity mutual funds have consistently delivered closer to 12–14 %. On top of that, property is illiquid—you can’t sell one bedroom when you suddenly need money for your child’s college fees. Add in maintenance costs, property taxes, loan interest, and the opportunity cost of a huge down payment, and the numbers often look less attractive than diversified financial assets.

What to do instead:

- Buy a house for living—not as your primary investment strategy.

- Run the full math before committing. Factor in registration charges, taxes, upkeep, and EMIs.

- Diversify wisely. Spread your savings across mutual funds, FDs, gold, NPS, and yes, real estate (once your foundation is strong)—instead of locking everything into a single asset.

Myth #5: “I’m a Teacher—Investing Is Only for the Rich”

Many teachers believe that investing is complicated and only for high‑income individuals. They assume their modest salaries won’t make a difference.

The truth:

It’s not about how much you earn—it’s about how early and consistently you start. Even investing ₹2,000 a month in an equity mutual fund can grow into a substantial corpus over 20–30 years thanks to compound interest. Financial literacy isn’t tied to income levels; only 27 % of Indian adults are financially literate, which means many high earners are equally misinformed. Starting small is better than waiting for the “perfect” moment.

What to do instead:

- Begin with small SIPs; increase the amount as your income grows.

- Keep an eye on inflation. Remember the inflation‑FD example: a 6 % FD with 4 % inflation yields just 2 % real return.

- Invest in yourself. Spend time reading, attending workshops and discussing money matters. The more you learn, the more confident you’ll become.

Final Thoughts: Your Classroom and Your Bank Account

Teaching is a calling. But that doesn’t mean your finances should suffer. By recognising these myths and embracing the truths, you’ll not only strengthen your own financial future—you’ll model healthy money habits for your students. When teachers become financially confident, they inspire a generation to be both book‑smart and money‑smart.

So, the next time someone says, “Why teach teachers about money?” smile and say, “Because knowledge is power—and that includes financial knowledge.”

Ready to Take Charge?

If this post resonated with you, don’t let it stop here. Financial empowerment starts with a single conversation—and grows when we share what we learn.

- Join the Chalk2Wealth movement. Visit chalk2wealth.com to explore guides, calculators and community stories tailored for educators and families.

- Share the message. Forward this post to a colleague, parent or student; your word could be the spark that ignites someone’s financial journey.

- Talk to us. Have questions or a story to share? Start the dialogue on WhatsApp at 9816480765 and let’s walk the path to financial confidence together.

Knowledge doesn’t just belong in textbooks. Let’s make money lessons a part of everyday life—and build a future where teachers retire with clarity, not confusion.

Which of these myths have you encountered personally? Let us know in the comments or on WhatsApp