Table of Contents

ToggleA heartfelt guide for Indian educators who want to retire with peace, not panic.

👋 When Retirement No Longer Feels Far Away…

Retirement always seemed like a distant thought… until I saw it unfold up close.”

A few months ago, I attended the retirement ceremony of a close relative — someone I’ve always looked up to. The hall was filled with warm smiles, floral garlands, and respectful speeches.

He had served with sincerity for over three decades. Everyone celebrated his journey… but I noticed something quietly unsettling behind his composed smile — a hint of financial uncertainty

That moment stayed with me. On the way back home, I kept thinking — “Jagan, have you really prepared for this phase of life?”

The honest answer? No.

We invest everything in our work, in shaping the futures of others.

But somewhere along the way, we forget to plan our own. We dedicate our lives to preparing children for their future.

But who’s preparing us… for ours

What This Blog Will Gently Open Your Eyes To

By the end of this post, I hope you don’t just learn, but truly feel the urgency of planning for a future we often delay.

-

✅ Why relying only on PF or pension may leave you financially exposed.

-

✅ How simple steps today can give you peace of mind tomorrow.

-

✅ Teacher-tested tools that helped me feel in control of what lies ahead.

We’ve spent our lives guiding others. Now it’s time to gently guide ourselves.

My Story – And How I Got Started

The Silent Assumption That Could Have Cost Me Everything

For years, I believed:

“I’m a teacher. I have PF. I’ll get a pension. That should be enough.” It was the same comfort I carried during my early budgeting days (as I shared in my previous post). Back then, I was busy clearing loans, raising children, and tracking expenses with my wife Usha — but I still hadn’t dared to ask: What happens when I stop earning altogether?

One evening, while helping my son Dhruv calculate compound interest for a class project, something clicked:

“Have I ever calculated how much I’ll actually need when I retire?”

Out of curiosity, I opened a retirement calculator. And what I saw shook me. Not because the number was too high — but because I had never even looked. The result exposed everything I had been avoiding:

-

How inflation could quietly eat away at my PF savings

-

How rising health expenses could bankrupt a family

-

How I might end up dependent — not by choice, but by lack of planning

In that moment, I remembered what I tell my students before an exam:

“If you don’t prepare now, panic will prepare you later.”

That was the night I turned the question inward:

“Jagan, you’ve planned timetables, school events, and your students’ futures… when will you start planning your own?”

That was the true wake-up call.

The Quiet Burdens I Carried – And How I Faced Them

Back in 2017, life felt like a constant balancing act. Our monthly income — nearly ₹98,000 combined from Usha and me — looked solid on paper. But in reality, it was always stretched. Between three home loans, a car EMI, ₹3,500 for Dhruv and Ipshita’s education, and a GPF contribution of ₹15,000 — we had little flexibility for long-term planning. For months, I kept telling myself:

“I’ll start proper saving later — once things settle.”

But that “later” never arrived. Despite already putting ₹15,000 into SIPs, I often doubted myself. I thought:

“How will this be enough? Am I even doing it right?”

I’d see others share financial tips on social media — NPS, term plans, calculators — and quietly scroll past, thinking:

“Maybe that’s not for people like me.” But I now realize — that ₹15,000 wasn’t just a figure. It was a foundation. I hadn’t waited for perfection. I had already started. What I needed was consistency, clarity, and confidence. From guilt to gratitude. From delay to direction. That ₹15,000 SIP every month became my quiet act of commitment — to my future self and to my family’s peace of mind.

🧠 The One Decision That Changed Everything

There wasn’t a big breakthrough moment. No windfall, no lottery, no sudden raise. Just one quiet decision — to start budgeting with full honesty and to back it up with a steady SIP.

I began to cut out expenses that added momentary pleasure but long-term pressure:

Weekly takeaways. Casual shopping. Unplanned weekend trips.

None of it was wrong — but all of it was stealing from my future. It was during those budgeting sessions — where Usha and I would sit down with a notebook and our numbers — that I began to see the pattern. Every rupee needed a reason.

As we tracked our income and outflows carefully, a major shift happened:

-

I stopped reacting to expenses

-

I started deciding where money should go

And that’s when the savings took shape. We had already been investing ₹15,000 in SIPs — but earlier it felt like a routine deduction. After budgeting, it felt like a powerful, conscious act of self-respect. Today, at the age of 48, that consistent SIP has grown to nearly ₹30 lakhs.

Not overnight. Not with shortcuts. But with patience, trust, and small acts of discipline — month after month. There were times I felt tempted to pause it — when finances were tight, or when others seemed to enjoy life more freely. But now, looking at that corpus, I feel something deeper than happiness — I feel safe. I feel proud.

The best advice I can give you, from one educator to another, is this:

“The small sacrifices you make today will become the biggest blessings of your tomorrow.”

How I Protected My Family Too

When I took a ₹50 lakh loan, a thought haunted me:

“If I’m gone, how will my family manage?”

So I did two things:

-

Took term insurance equal to my loan

-

Bought ₹65 lakh health insurance with critical illness cover for my family

These weren’t financial products. They were promises:

-

A promise of safety

-

A promise of dignity

-

A promise that my absence wouldn’t shatter my family’s future

Where I Stand Today

Recently, I opened my investment app. ₹30,12,764 in my SIP corpus.

For some, it’s not a big number. For me, it’s a symbol of progress:

-

I started late.

-

I had loans.

-

I had doubts.

But I still began.

My next goal? A ₹1 crore retirement corpus before December 2028.

Not by luck. Not by chance. By clarity, consistency, and quiet courage.

And that’s not all. I also have:

-

✔ Term insurance

-

✔ ₹65 lakh health insurance with critical illness rider

These aren’t luxuries. They’re acts of love.

Now It’s Your Turn — Not Tomorrow, But Today

If you’re still reading, maybe you’re like me: A teacher who spent years planning for others while postponing his own future.

But here’s the truth:

No one will plan our retirement for us. Not the government. Not the school. Not even time.

We must do it. For ourselves. For our peace of mind.

So take your first step today:

🔐 Open a SIP

💸 Review your PF

📖 Talk to an insurance advisor

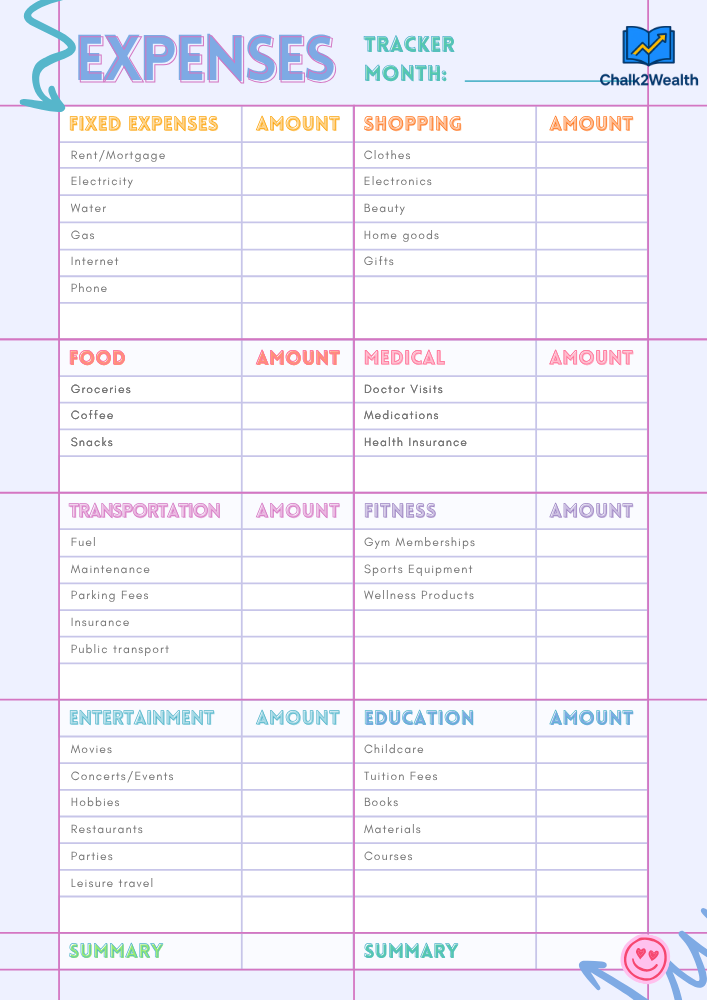

✏️ Write down your income, expenses, and goals

Even that is a beginning.

Chalk Tip — Straight From My Desk

“Retirement is not the end of the story. It’s the chapter where you finally get to live on your own terms. Write it well. Write it wisely.”

✍️ About the Author

Jagan Charak is a school Head, husband, and financial storyteller. Through Chalk2Wealth, he shares real stories to help Indian educators build a financially secure life — one chalk, one SIP at a time