Table of Contents

ToggleWhat Money Is: 6 Smart Mantras Hidden in Karan Arjun’s Story

What if I told you that Karan Arjun isn’t just about reincarnation — it’s actually the perfect story to explain what money is and how it truly works for you? That iconic line — “Mere Karan Arjun aayenge…” — isn’t just a filmi dialogue. It’s a reminder that money, when invested wisely, always returns — maybe not instantly, but surely, with time and patience.

Just like a smart investor balances risk and reward through diversification, Durga Maa balanced her pain with faith. She didn’t know when or how her sons would return — but she trusted the process. That’s exactly how money behaves in your financial journey: it grows quietly when you stay disciplined, consistent, and diversified.

So, when you invest through SIPs, PPFs, or mutual funds — think of them as your Karan and Arjun. You might not see instant results, but if you give them time, they will come back stronger — multiplied and matured. That’s what money is — not something to chase, but something to nurture, invest, and believe in. Because in finance (just like in faith), patience and discipline always bring your Karan-Arjun back.

You already know the story — Durga Maa, her two sons, and the ruthless Thakur. He didn’t just take her land — he took away her dignity, her support system, her very existence. She was left with nothing — no home, no help, no hope. But there was one thing she never lost — her faith.

People mocked her:

“She’s lost her mind! Who comes back after death?” “Sister, stop dreaming now…” But Durga Maa kept believing. Every single day, she looked up and declared:

“Mere Karan-Arjun aayenge…”

Now pause for a second and think — isn’t that exactly how money works? When you invest through SIPs — ₹5000, ₹6000, or ₹7000 every month — it may seem small, slow, or even invisible. But this is what money is: faith in action. Quietly growing, silently compounding, steadily working behind the scenes — just like Durga Maa’s belief. For instance:

If you invest ₹6000 per month for 20 years at 12% annual returns, you build about ₹59 lakh (from just ₹14.4 lakh invested). Stretch that to 25 years, and it becomes ₹1.02 crore.

Raise your SIP to ₹7000, and it could reach ₹69 lakh in 20 years or ₹1.30 crore in 25 years.

That’s what money is — a loyal force that rewards patience, belief, and consistency. You won’t always see how or when it’s working. Markets may rise, fall, or stand still. But if your investments are diversified and long-term, your financial Karan and Arjun — your goals — will surely return.

That dream home you visualize… That peaceful retirement you wish for… Your child’s education, your family’s security… They’ll all come back — not through luck, but through faith and discipline.

Because what money truly is — is trust, time, and thoughtful action working together. Just like Durga Maa’s belief brought her sons back, your belief in long-term investing will bring your wealth back — stronger and multiplied.

“Mere Karan-Arjun aayenge…” — isn’t just a dialogue anymore. It’s the essence of what money is — patient, powerful, and always returning when you believe.

Lesson 2: What Money Is — How Silent, Diversified SIPs Create Visible Wealth Over Time

Years went by… until one day, the dust rose, the drums rolled, and a voice echoed —

“Mother, we’re back!”

Karan and Arjun had returned — not as helpless boys, but as stronger, wiser warriors ready to reclaim everything they had lost. That’s exactly what money is when you allow it to grow silently through long-term, diversified investments.

In the beginning, your ₹6,000 or ₹7,000 SIPs might look insignificant — almost invisible.

People may laugh or ask:

“Will that really make a difference?”

“Who waits decades to see results?”

But just like Durga Maa’s unwavering faith, your money too needs time to reveal its strength. Month after month, your small contributions quietly build roots beneath the surface — earning returns on returns, gaining power through consistency and patience.

Then one day, almost unnoticed, the numbers start to speak. Your portfolio blossoms — not because of luck, but because you stayed when others quit. That’s what money is — silent progress that compounds with time, faith, and discipline.

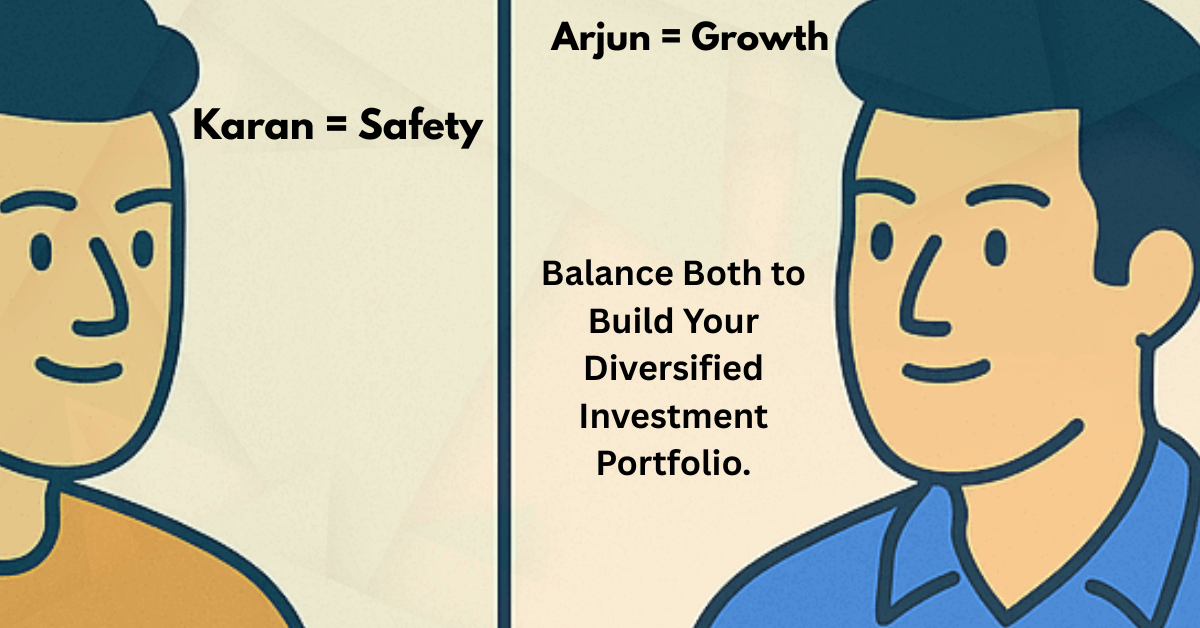

Lesson 3: What Money Is — Balancing Safety and Growth Like Karan and Arjun

Karan fought with power. Arjun fought with strategy. Alone, they were brave — but together, they were unstoppable.

Now think about your money.

If you put everything in FDs, real estate, or GPF — your Karan — you may stay safe, but your growth will crawl. If you pour everything into SIPs, mutual funds, or stocks — your Arjun — your wealth can grow faster, but so can your risks.

The smart move? Diversify.

Just like both brothers were needed to defeat Thakur, your diversified portfolio needs both Karan and Arjun working side by side.

- Karan = Stability → FDs, Real Estate, GPF, and other low-risk investments

- Arjun = Growth → SIPs, Mutual Funds, Equity, and wealth-building assets

Balance builds wealth. Let Karan protect your foundation. and Arjun expand your future.

A wise teacher-investor knows the truth:

It’s never about choosing safety or growth — it’s about blending both.

Because that’s what money is — a perfect balance of strength and strategy, faith and compounding.

Lesson 4: What Money Is — Spot the Real Villain Called Inflation

In the Karan Arjun story, Thakur wasn’t just a man — he was a quiet destroyer of lives, dreams, and dignity.

In your financial story, that same silent villain exists — and his name is Inflation.

You rarely see him. You rarely feel him. But every single year, he quietly steals from you. Your savings may look the same on paper, yet what they can buy keeps shrinking — bit by bit, month after month.

If all your money sits in low-interest options like FDs, GPF, or a savings account, you’re unknowingly letting this Thakur win. It feels safe today, but your money is losing power every year.

The only way to fight this financial Thakur is through smart, diversified investing — a portfolio that grows faster than inflation. Systematic Investment Plans (SIPs), mutual funds, and growth-focused assets are your Arjun — they help you fight back, protect your future, and reclaim your financial dignity.

Remember:

- Saving alone won’t protect you — investing wisely will.

- Inflation is the silent Thakur of personal finance.

To defeat him, you need a strong, growth-driven strategy that keeps your money ahead of time.

Because what money is — isn’t just what you earn or save, it’s how well you defend it from the forces that quietly steal its worth.

Lesson 5: What Money Is — Having a Plan, Not Panic, Like Karan and Arjun

Karan and Arjun didn’t charge into Thakur’s haveli blindly. They watched. They waited. They studied his weaknesses. And when the moment was right, they struck — not with panic, but with precision.

That’s exactly how smart investors handle their financial battles.

When markets fall, many people panic.

They stop their SIPs. They withdraw their investments. They react to headlines instead of strategy. But the wise investor — like Karan and Arjun — trusts the process. They understand that what money is cannot be built through emotion; it’s built through patience, planning, and discipline.

They know:

- Markets will rise and fall — but strategy must stand firm.

- Wealth doesn’t come from reacting; it comes from staying invested.

- Faith and planning beat fear and impulse every single time.

Remember:

Jumping without a plan is financial suicide. Building wealth is not about timing the market — it’s about time in the market. Because what money is, at its core, is a plan in motion — powered by patience, protected by discipline, and rewarded by time.

Lesson 6: What Money Is — Real Wealth Isn’t Crores, It’s Peace, Freedom, and Control

Durga Maa never asked for gold, luxury, or a grand palace. All she wanted was the return of her sons — her peace, her strength, her dignity. In your financial life, real wealth isn’t about chasing crores. It’s about reaching that quiet place where:

- You don’t fear emergencies.

- You don’t panic about the next school fee, hospital bill, or sudden expense.

- You don’t need to borrow, beg, or worry when life takes an unexpected turn.

That’s true freedom. That’s real wealth. Crores in your account mean nothing if you still live in fear. Peace is the highest return — and a diversified, long-term investment portfolio gives you that peace.

Remember:

- Wealth isn’t just about numbers; it’s about sleeping peacefully at night.

- Financial security is when you control your money, not when money controls you.

Because what money is, at its core, isn’t luxury or status — it’s freedom, dignity, and peace of mind that comes from discipline, patience, and balance. Your Karan and Arjun may come to you in the form of crores — but their real gift is returning your confidence, calm, and control over your own life.

Start Building Your Karan-Arjun Portfolio Today!

“Mere Financial Karan-Arjun aayenge…” — but only if you begin your journey today. Don’t let your dreams wait. Don’t let inflation win. Don’t let life catch you unprepared.

Start your SIP. Diversify your investments. Build your peace. Stay consistent. Trust the process. Your Karan and Arjun will return.

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions