Table of Contents

ToggleHealth Insurance Benefits: 5 Essential Features to Consider for Teachers

Health Insurance Benefits: A Teacher’s True Story from the Corona Crisis

I always thought I was financially prepared. I had built my savings carefully, I had a plan, and I believed that was enough. But March 2020 proved me wrong.

That was the month when life, and the world, changed overnight. I still remember sitting on the cold hospital bench at PGI Chandigarh, tightly holding Usha’s hand. Fear gripped us both as we stared at the medical reports — the kind of reports that don’t ask how much you’ve saved. They only ask: Are you ready? Can you afford this?

At the same time, my close friend — who was much better off financially than I was — was going through his own battle in a Delhi hospital. He had enough money. His savings were solid. But even he told me over the phone, “Yaar, ye health expenses kisi ki planning nahi sunti. Savings kam pad jaati hain. Karodon me kharcha nikal jaata hai kabhi kabhi.”

(“These health expenses don’t care about your plans. Sometimes even crores are not enough.”)

That’s when I finally understood the bitter truth: savings, no matter how big, can’t always save you. What every teacher truly needs is a health insurance shield.

I learned this the hard way. Sitting there at PGI, watching the bills pile up faster than I could think, I realized health insurance benefits for teachers aren’t optional. They are the real safety net — the silent protectors standing between hope and helplessness.

Usha was by my side through every moment — from the panic to the paperwork, from the silent prayers to the harsh medical realities. And that’s why, today, whenever I speak to fellow teachers, I share this story with one request: please don’t wait until life teaches you this lesson the hard way.

“Sir, It’s Cancer.” — The Call That Made Both of Us Realize the True Value of Health Insurance Benefits After Our Own Battles

“Sir, it’s Cancer.”

These three words shattered the peace in my friend’s home.

A respected teacher, a loving father, a dear friend — he had spent his entire life giving to his students, his colleagues, and his family. And then, out of nowhere, came the diagnosis: cancer.

It happened in the middle of the first lockdown — March 2020. He had to be rushed to Delhi for urgent treatment. The roads were silent, but inside the hospital, life was in a race against time. One operation… then chemotherapy… then ICU care, complications, and months of painful recovery.

The cost? More than ₹40 lakh. Even though his finances were strong, the storm was too big, too sudden. His savings couldn’t handle it alone.

That’s when both of us realized a harsh truth: it’s not just about savings. It’s about having the right health insurance benefits that actually protect you when life hits hardest.Without proper health insurance, even the strongest financial plans can crumble. My friend learned this with ₹40 lakh of bills. And at the same time, I was fighting my own battle — on a hospital bed in PGI Chandigarh.

My Battle at PGI Chandigarh — The Day Savings Trembled

While my friend was in Delhi fighting cancer, I was fighting my own battle — on a hospital bed in PGI Chandigarh. A sudden health emergency struck me. I was rushed into surgery. The hospital lights, the sound of beeping machines, Usha sitting beside me — all of it is still fresh in my memory.

In those tense days, I couldn’t even visit my friend. I was recovering, managing bills, and managing emotions — while the expenses climbed rapidly, crossing ₹3 lakh before I could catch my breath.

Yes, I had savings. Yes, I had my “Achanak Zarurat” fund — my emergency cushion. But even that started trembling. That’s when I truly realized: savings alone can’t fight medical emergencies. You need health insurance benefits that stand strong when everything else starts shaking.

That experience changed how I looked at financial planning — not just for myself, but for every teacher I meet.

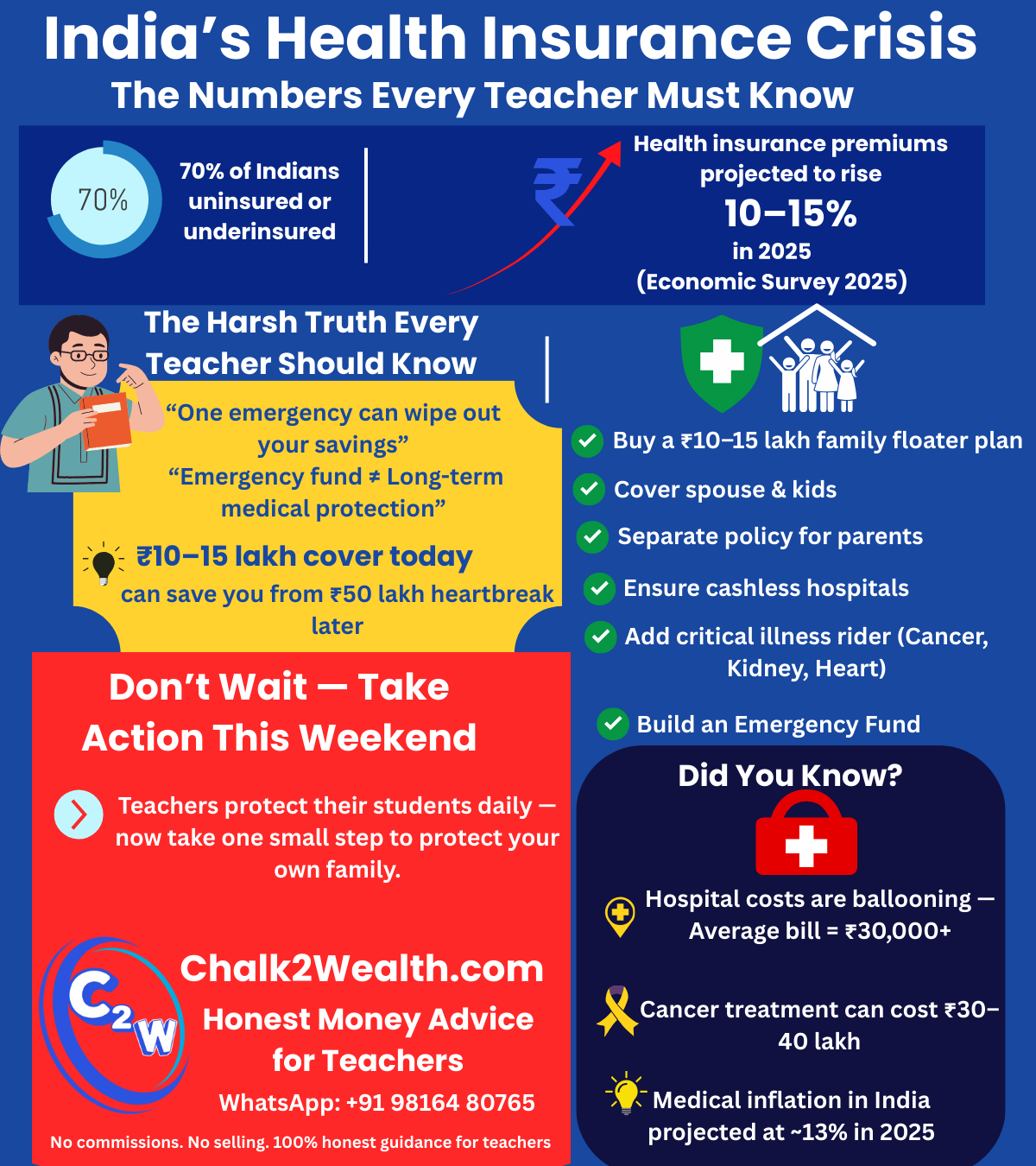

India’s Health Insurance Crisis — The Numbers Every Teacher Must Know

Eye-Opening Fact:

According to a 2025 Forbes India report, around 70% of Indians are now estimated to be “covered” by some form of health insurance. But here’s the bitter truth: the majority are underinsured, with tiny covers that collapse against real hospital bills. Other national health surveys show a similar warning: most Indian families still remain financially vulnerable — especially in rural areas and private jobs.

On top of that, health insurance premiums are projected to rise 10–15% in 2025 due to medical inflation and higher claims (Economic Survey 2025).

Bottom line: Whether you call it “underinsured” or “uninsured,” the reality is the same — millions of families are still just one illness away from financial ruin.

The Harsh Truth Teachers Can’t Ignore

One medical emergency can destroy years of savings in weeks.

Yes, emergency funds matter — but they can’t handle costs of cancer, critical illness, or long-term care.

- Medical inflation is real and rising.

- Health insurance is not optional.

- A ₹10–15 lakh cover today can save you from a ₹50 lakh heartbreak tomorrow.

Quick Tip: Protect Your Family Smartly

- Buy a ₹10–15 lakh family floater plan (costs less than eating out monthly).

- Cover your spouse and kids.

- Take separate cover for aging parents.

- Ensure cashless network hospitals.

- Add a critical illness rider (cancer, heart disease, kidney failure).

Emergency fund protects peace. Health insurance protects savings.

My Papa’s Story — The Hardest Lesson of All

Years ago, I lost my father to cancer. There was no health insurance. No safety net. My family came terrifyingly close to collapse — saved only because my elder brother had a government job. That pain taught me: health insurance isn’t financial advice — it’s survival wisdom.

Final Takeaway — Don’t Wait Until It’s Too Late

Dear Teachers, we make timetables, lesson plans, and meetings for our students. But we forget to plan for ourselves. Hope is not a health strategy. Health insurance is.

If you’re still thinking “abhi to sab theek hai…”, remember: that’s what everyone thinks until life’s toughest test arrives unannounced.

Act now — not later. Do it for your family.

Your Next Step Starts Today

- Build an Emergency Fund — even ₹500/month makes a difference.

- Buy Health Insurance — cheaper than a pizza night, but can save your life savings.

Subscribe to Chalk2Wealth.com for more teacher-focused financial guides. Or WhatsApp me at +91 98164 80765 for free resources and personal updates. If you haven’t bought health insurance yet, let this be your wake-up call. The cost of waiting is not just financial — it’s emotional, and sometimes, irreversible.

Dear Teacher,

You spend your life protecting others — your students, your family, your staff. Now it’s time to protect yourself.

Start with two small steps that create a big safety net:

- Build an Emergency Fund – even ₹500/month can make a difference.

- Buy Health Insurance – it’s cheaper than a pizza night, but it can save your life savings.

Don’t wait for a diagnosis to realize what you should’ve done. Take action this weekend — get quotes, ask questions, make your plan.

I think insurance is a scam. If someone has health insurance, hospitals often diagnose them for operations and other surgeries that are not actually required.

Surjeet ji, I fully agree with your concern. Hospitals and agents sometimes misuse insurance — unnecessary tests, inflated bills, even surgeries that may not be needed. Ye ek kaduwa sach hai.

But here’s the other side. Imagine the same hospital without insurance — a teacher family walking in with ₹5 lakh savings, facing a sudden ₹12 lakh medical bill. Savings khatam, loans shuru. Insurance at least shifts that financial risk to the insurer.

Yes, we must fight against malpractice — always demand a second opinion, prefer reputed hospitals, and check every bill. Lekin bina insurance, the financial shock can wipe out years of savings.

That’s why I keep repeating: Health insurance is not perfect, but it is protection. Without it, we teachers are standing in the battlefield without a shield.”