Table of Contents

ToggleTeachers, What Is the Real Cost of Debt? 5 Heavy Prices You Pay

The Ride That Opened My Eyes

Last week, on my way home from school, a casual chat turned into a life lesson. One of my colleagues, earning ₹70,000 a month, quietly admitted:

“I have loans worth ₹30 lakh… car EMI, personal loan, credit card dues, even BNPL for a phone.”

I went silent.

And sadly, he isn’t alone. Many good, hardworking teachers are living under bad debt — EMIs that bring short-term comfort but quietly steal tomorrow’s peace. We spend hours planning lessons for our students. But how many of us plan our own financial life?

Teachers, What Is the Real Cost of Debt? 5 Heavy Prices You Pay

Before we dive in—if you’re a teacher trying to take charge of your money, you may also find these Chalk2Wealth guides useful:

📖 Budgeting for Teachers: 5 Smart Strategies to Save More & Stress Less

Financial Jungle Are you trapped in ? Many teachers, without realizing it, end up walking straight into hidden financial traps. I call this the Financial Jungle — a place full of EMIs, credit card monsters, and wrong investments.

At Chalk2Wealth.com, we believe every teacher deserves financial peace, not EMI stress. Let’s explore the hidden costs of debt that quietly chain our future.

What Exactly Is “Bad Debt”?

Bad debt isn’t just borrowing—it’s borrowing without a wealth-building purpose. It drains your present and blocks your future.

EMIs for a depreciating phone or two-wheeler

Credit card dues from online shopping

Personal loans for weddings, parties, or lifestyle upgrades

These start small and “manageable,” then quietly chain your future.

Why Do Teachers Still Fall into Debt Traps?

The answer lies in our emotions.

As Livemint reported, many borrow not from real need but from emotion:

- To feel better temporarily

- To match peers socially

- To satisfy short-term wants

What starts as a small loan for convenience becomes a lifelong EMI burden. This is the bad debt impact on teachers—emotional choices leading to long-term financial chains.

The Real Cost of Debt for Teachers — 5 Heavy Prices You Pay

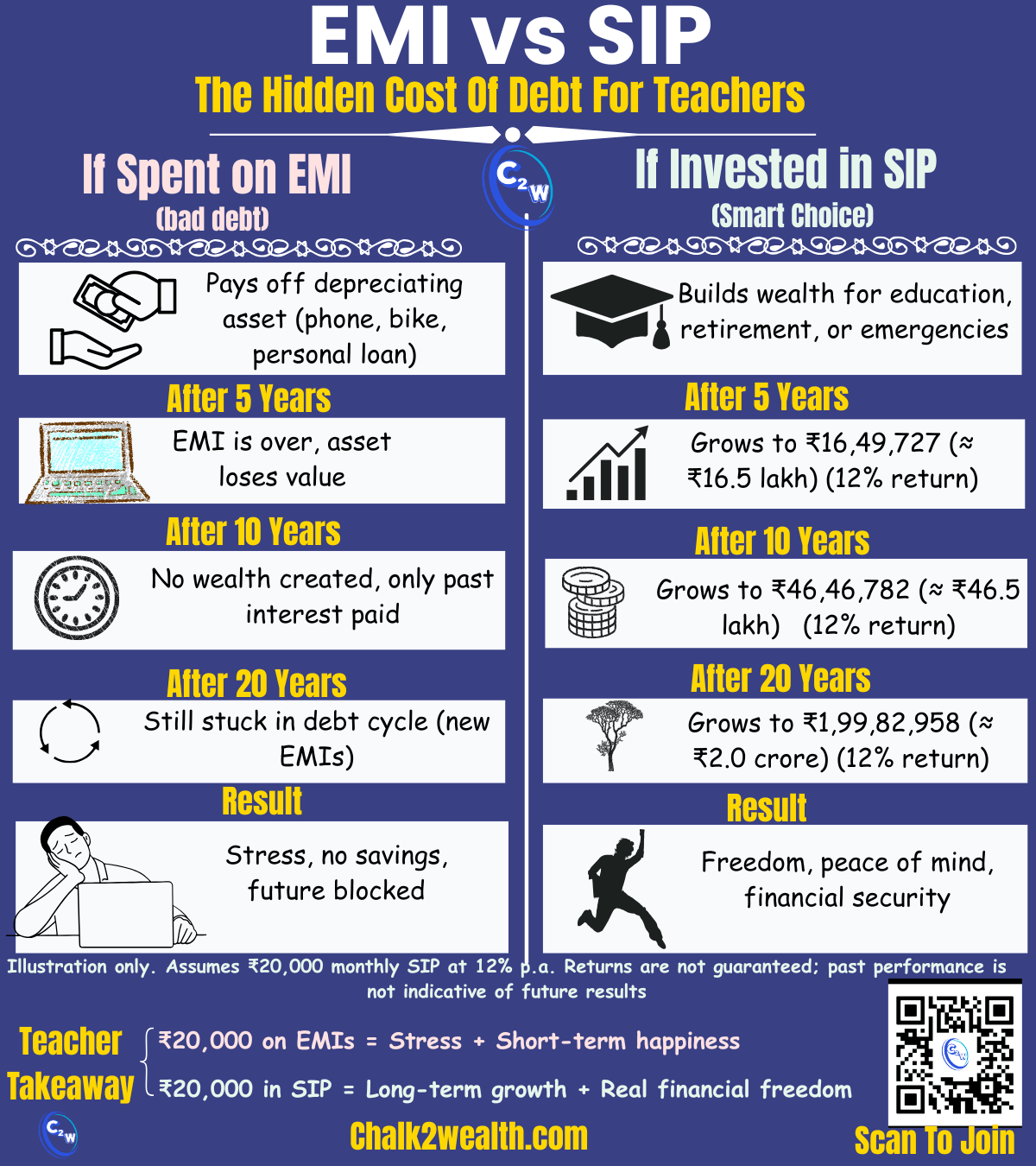

EMI vs SIP for Teachers

• Monthly amount compared: ₹20,000 (EMI vs SIP)

• SIP return assumption: 12% p.a. (illustrative, not guaranteed)

• Outcomes at this assumption:

– 5 years ≈ ₹16.5 lakh (₹16,49,727)

– 10 years ≈ ₹46.5 lakh (₹46,46,782)

– 20 years ≈ ₹2.0 crore (₹1,99,82,958)

• Figures are rounded and for education only; returns are not guaranteed.

1) Loss of Peace of Mind

Unknown calls create anxiety. Bank SMSs spike your heart rate. You earn well—but freedom feels far.

Teacher tip: If EMIs > 30% of your salary, stress compounds—cut it.

2) Blocked Future Goals

“Child’s education SIP? After this credit card bill.”

“Health insurance? After the bike EMI.”

Delay becomes years—and time stops compounding for you.

Teacher tip: Start a small, non-negotiable SIP—even ₹1,000—so compounding begins.

3) Strained Relationships

When every dinner talk is “due dates” and “minimum payments,” family joy shrinks.

- Spouses hide purchases

- Children sense the stress

- You avoid social gatherings out of shame

Teacher tip: Hold a 15-minute money check-in weekly—same day, same time.

4) Damaged Credit & Reputation

Late EMIs pull your credit score down, making borrowing harder when you truly need it. Among colleagues, unpaid loans cause embarrassment and lost trust.

Teacher tip: Automate payments; pay minimum due + extra on the smallest loan (see Snowball).

5) Stolen Growth & Dreams

The heaviest cost is invisible: dreams that never compound. Instead of building assets, you service EMIs. Instead of planning growth, you fight survival.

Teacher tip: Replace one lifestyle EMI with a goal-based SIP (child’s education, retirement, emergency fund).

EMI vs SIP — The Hidden Cost of Debt for Teachers

If you spend ₹20,000 monthly on EMIs, you end with nothing after 20 years. If you invest the same ₹20,000 in an SIP (12% assumed return):

- 5 years → ₹16.5 lakh

- 10 years → ₹46.5 lakh

- 20 years → ₹2 crore

👉 Debt steals dreams. Investing secures them.

FAQs on the Cost of Debt for Teachers

1. What is the cost of debt for teachers?

The cost of debt for teachers goes beyond EMIs and interest. It includes loss of peace, delayed savings, strained relationships, and limited financial freedom.

2. Why do teachers fall into debt traps?

Teachers often borrow emotionally—to match peers, manage family demands, or cover short-term wants. This emotional borrowing turns into long-term EMI burdens.

3. How can teachers avoid the impact of bad debt?

By building an emergency fund, budgeting monthly expenses, and avoiding loans for lifestyle or non-productive items, teachers can stay debt-free.

3 Quick Steps for Teachers to Break Free from Debt

List and Rank Your Loans

Write down every loan—personal, vehicle, credit card, BNPL. Start paying off the smallest one first (debt snowball method).Cut EMI Burden with Budgeting

Follow a simple 50-30-20 rule: 50% needs, 30% wants, 20% savings. Don’t let EMIs cross 30% of your salary.Replace Borrowing with Saving

Instead of EMIs for gadgets or weddings, start a small SIP or recurring deposit. Let your money work for you, not against you.

Final Bell: Teachers, Choose Freedom Over Debt

The true cost of debt for teachers isn’t just interest rates—it’s peace, dreams, and family well-being. Let’s teach ourselves what we teach our students: discipline and planning.

👉 Share this with a fellow teacher—you might save them from a lifetime of EMI chains.