Table of Contents

ToggleMutual Fund Sahi Hai — 2 Steps to Know How Mutual Funds Work

We’ve all heard it: “Mutual Fund Sahi Hai.” But for many teachers, it still sounds like financial jargon — something bankers talk about in hushed tones while we’re busy correcting answer sheets.

Let’s change that today. No long lectures, no confusing terms — just two steps. Understand these, and you’ll “get” mutual funds for life.

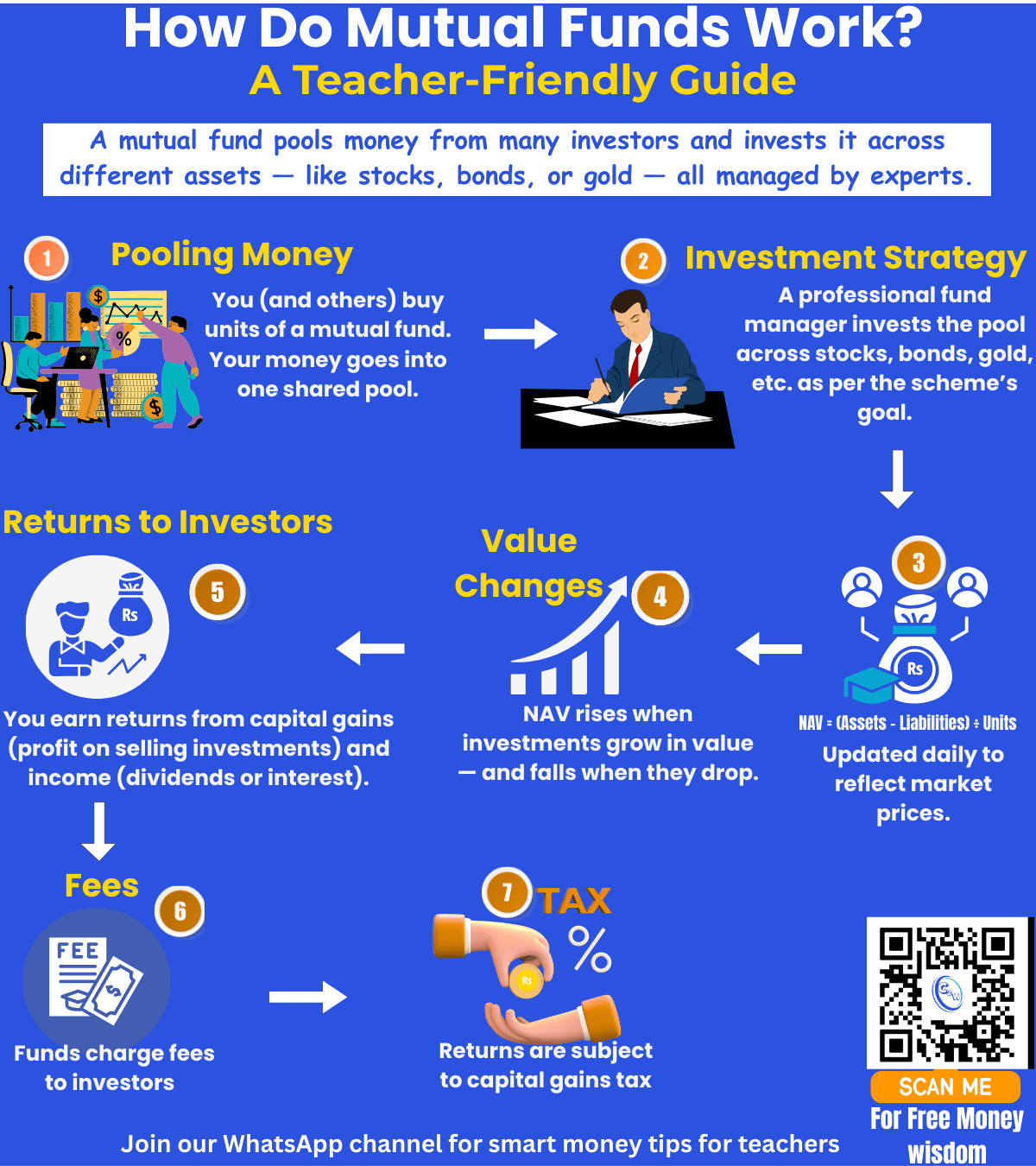

👉 To make it even simpler, here are 2 quick resources that every teacher can grasp at a glance:

With these, you don’t just hear “Sahi Hai” — you’ll know why it’s sahi.

Step 1 – Mutual Fund Sahi Hai Means Pooling Money Like a School Picnic Fund

Think back to your last school picnic.

- Every student contributed ₹200.

- That money was collected into one big pool.

- A teacher in charge (picnic coordinator) used that money to arrange the bus, food, games, and entry tickets.

Mutual funds are just like that picnic fund — except instead of buying sandwiches and cricket bats, the money is invested in stocks, bonds,gold, or other assets.

Here’s what happens:

- You (and thousands of others) buy “units” of the mutual fund.

- Your money joins a shared pool.

- A professional fund manager decides where to invest, based on the scheme’s goal (growth, income, or both).

Pooling money gives power — even if you start with just ₹500 or ₹1,000 a month, you still enjoy the benefits of large-scale investing and professional management.

And that’s one reason people say Mutual Fund Sahi Hai — it gives small investors big opportunities.

Step 2 – How NAV, Value Changes & Returns Work

Once the picnic bus starts moving, the real fun begins. In mutual funds, that “fun” is your investment growth — and it’s tracked through something called NAV (Net Asset Value).

Think of NAV as the ‘price’ of one unit of your fund.

NAV = (Assets – Liabilities) ÷ Number of Units

- If the investments in the fund grow in value (stocks go up, bonds give interest), NAV rises.

- If markets fall, NAV drops.

Just like you’d check attendance daily, NAV is updated daily to reflect market changes.

How You Make Money

You earn in two ways:

- Capital Gains – You buy at a low NAV and sell at a higher NAV. That difference is your profit.

- Income – Some funds pay dividends or interest from the returns they generate.

It’s like returning from the picnic and finding out there’s money left over — the teacher divides it equally among all students who contributed.

The Part Teachers Often Miss — Fees & Taxes

- Expense Ratio – The AMC charges a small annual fee to manage your investment, like paying the picnic coordinator for organising everything smoothly.

- Capital Gains Tax – The government charges tax on your profits, depending on how long you held the fund (short-term or long-term).

These costs don’t make mutual funds bad — they’re simply part of the system, just like school bus charges are part of the picnic.

Why Teachers Should Consider Mutual Funds

Teachers have unique financial challenges:

- Steady but Limited Income – Salaries may not leave much room for big investments.

- Time Constraints – Lesson planning, exams, and extra duties leave little time to track markets.

Mutual funds help in both cases:

- Low Entry Point – Start with as little as ₹500 via SIP (Systematic Investment Plan).

- No Market Tracking Needed – Professionals handle it for you.

- Diversification – Your money is spread across different assets, reducing risk.

- Better Long-Term Returns – Equity mutual funds have historically beaten FDs and savings accounts over time.

Golden Rule — Time is Your Best Friend

Mutual funds reward patience.

Invest for 5, 10, or 20 years, and compounding works its magic — just like how a student improves over years of guidance, not overnight.

So, next time someone asks you, you can say:

“It’s easy. Mutual Fund Sahi Hai — Step 1: Pool your money, Step 2: Let it grow.”

Teacher’s Tip:

Don’t jump in blindly. Choose funds that match your goals, start with SIPs, and stick to them. And remember — avoid panic-selling when markets dip.

Want more teacher-friendly money tips? Join our WhatsApp channel — scan the QR in the infographic above!