EMI vs SIP — A Lesson from a Fellow Teacher’s Story

Last December, when I was at HIPA Shimla for a training session, I met my colleague Mohit after a long time. Over evening tea, as he now resides there, he leaned closer and shared something that struck me deeply.

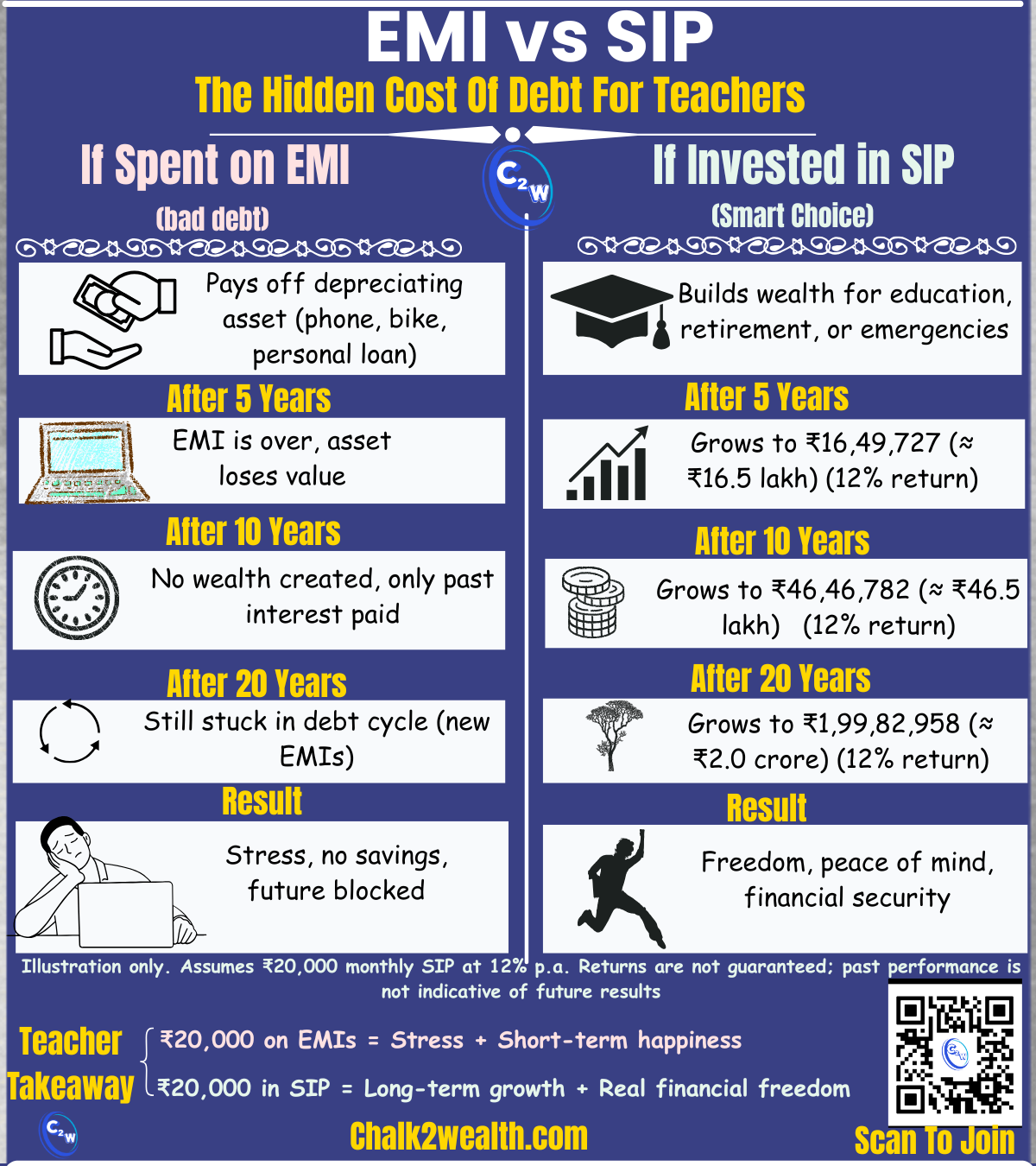

He sighed and said, ‘Every month, I pay nearly ₹20,000 in EMIs… and yet, after years, I have nothing to show for it.’

That night, I couldn’t stop thinking. What if the same ₹20,000 had gone into a SIP instead?

- After 20 years, it could grow into ₹2 Crore.

- The same amount spent on EMIs? Zero wealth, only stress.

This simple choice makes all the difference:

EMIs = Stress + Short-term assets

SIPs = Freedom + Long-term growth

I created this 1-minute visual inspired by Mohit’s struggle—because many teachers and families are in the same boat.

Are your ₹20,000 going toward EMIs or SIPs?

The answer decides whether you stay stuck in the cycle of debt or step into financial freedom.

Your future deserves the smarter choice.

EMI vs SIP — Key takeaway

Teacher Takeaway :

EMI = Stress | SIP = Freedom — Choose wisely.

Further Reading (teacher-first resources):

-

Build foundational financial habits in Financial Literacy for Teachers & Families

-

Bust myths that keep educators stuck, in 5 Money Myths Teachers Still Believe — & the Truth

-

Learn smart ways to stretch your salary in Budgeting for Teachers: Smart Strategies