Table of Contents

TogglePower of Compounding: Why Time Matters More Than Salary for Indian Teachers

One quiet afternoon in the school staffroom, I asked two colleagues a deceptively simple question: “If you had ₹10,000 to invest every month, would you start today—or wait until your salary grows?”

Mrs. Ipshita, a young science teacher, answered without hesitation: “I’ll start now, even if the amount is small.” Mr. Dhruv, a senior teacher, thought differently. He smiled and said,

“I’ll wait for my next pay hike. Then I’ll invest ₹20,000 at one go.”

That short exchange captures the power of compounding better than any formula written on a blackboard. It shows that wealth is not built by waiting for a higher salary, but by giving money more time to grow. The same concept we teach in Class 8 mathematics quietly shapes our real financial futures.

If this idea feels familiar, it’s because the foundation is already in our textbooks. I’ve explained this concept in depth in my earlier post —

Compound Interest: How a Class 8 Lesson Can Shape Your Financial Future in 2026 — where classroom theory meets real-life money decisions.

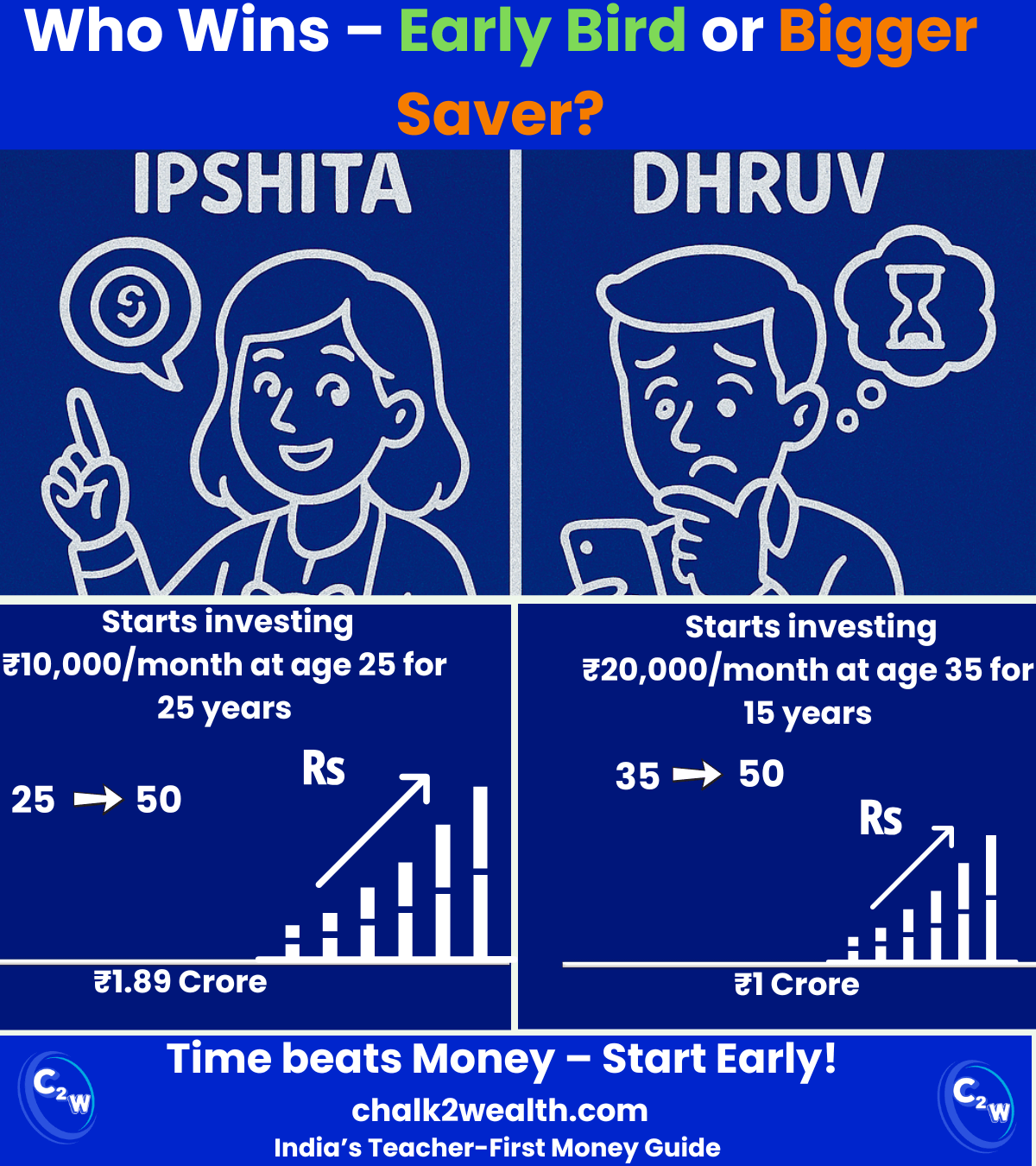

Early Bird vs Bigger Saver: How the Power of Compounding Played Out Over 20 Years

Fast forward two decades, and the results speak louder than any financial advice ever could.

Ipshita’s simple decision to start early transformed her disciplined ₹10,000 monthly SIP into a corpus of nearly ₹1.9 crore. Dhruv, despite investing double the amount every month later in his career, could accumulate only around ₹1.0 crore.

The difference wasn’t intelligence, effort, or income. It was time. The power of compounding rewarded Ipshita because her money stayed invested longer, allowing returns to generate further returns year after year. Dhruv’s higher monthly investment simply couldn’t make up for the lost decade.

Early Bird vs Bigger Saver: Numbers at a Glance

(Assuming a long-term average return of 12% per annum)

| Teacher | Start Age | Monthly Investment | Investment Period | Total Invested | Final Corpus |

|---|---|---|---|---|---|

| Ipshita (Early Bird) | 25 years | ₹10,000 | 25 years | ₹30 lakh | ~₹1.9 crore |

| Dhruv (Bigger Saver) | 35 years | ₹20,000 | 15 years | ₹36 lakh | ~₹1.0 crore |

Even though Dhruv invested ₹6 lakh more in total, Ipshita ended with almost double the wealth. This real-life comparison proves a fundamental truth every teacher should remember:

In investing, the power of compounding makes time more valuable than salary.

Why Time Beats Money: The Real Power of Compounding in Investing

The staffroom lesson was simple but powerful: starting early beats waiting for a bigger salary. In investing, time is your greatest ally. The longer your money remains invested, the more opportunities it gets to grow—and then grow on its own growth. That self-reinforcing cycle is the true power of compounding.

Compound interest works by earning returns not just on your original investment, but also on the returns accumulated over the years. This is why early investments often snowball into large sums, while late but larger investments struggle to catch up.

India’s financial regulators consistently reinforce this principle. The Securities and Exchange Board of India (SEBI) article on Importance of Investing Early highlights that compounding is one of the most effective tools for long-term wealth creation and clearly states that the longer money stays invested, the stronger the impact of compounding becomes.

Similarly, India’s pension regulator, PFRDA, encourages citizens to begin saving early in their careers so they can benefit from many years of compounded growth and build long-term financial security.

The Takeaway for Teachers

Don’t wait for a higher income to begin investing. Even modest amounts invested early can grow into substantial wealth over time, while larger sums invested later may never fully bridge the gap. As teachers, we constantly remind our students that small, consistent efforts lead to big results. The same rule applies to our finances. Start your SIP early. Let the power of compounding work quietly in the background—and allow time, not just salary, to shape your financial future.

About the Author

Jagan Singh is a school leader and financial literacy educator who writes for teachers and salaried Indians. He has completed the Financial Literacy Course for Bharat conducted by NISM (National Institute of Securities Markets), a capacity-building initiative of SEBI (Securities and Exchange Board of India), and focuses on clarity, risk awareness, and long-term financial thinking.

Disclaimer: The content shared on Chalk2Wealth is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to consult qualified professionals before making financial decisions.