Table of Contents

ToggleHow Can I Invest in Gold Smartly in 2026: 6 Best Options for a Strong Portfolio

In the staffroom, Sunita Madam quietly shared her confusion:

“Pehle gold ka matlab sirf jewellery hota tha. Ab Digital Gold, Gold ETFs aur Sovereign Gold Bonds sunne ko milte hain. Par samajh nahi aata—how can I invest in gold safely without jewellery?”

This question isn’t just Sunita Madam’s—it reflects the thinking of thousands of Indian teachers in 2026. For teachers, gold has never been about speculation or quick profits. It has always meant safety, stability, and protection against rising inflation.

Earlier, investing in gold meant buying jewellery, paying heavy making charges, and worrying about purity and storage. Today, however, teachers hear about Digital Gold, Gold ETFs, and Sovereign Gold Bonds—but choosing the right option has become confusing. Naturally, many teachers are now asking a practical question: how can I invest in gold smartly in 2026 without buying jewellery or taking unnecessary risks?

Gold continues to play an important role in a teacher’s portfolio, but not all gold investment options are equally safe or suitable. Each option—Digital Gold, Gold ETFs, or Sovereign Gold Bonds—comes with different costs, risks, tax treatment, and long-term benefits. Teachers who want to build a balanced portfolio should also understand how gold complements other safe investment options for teachers rather than relying solely on gold.

In this guide, you’ll clearly understand how can I invest in gold as a teacher in 2026 and beyond, which gold option suits your goals, and how much gold is actually enough—so you invest with confidence, not confusion. This guide is written specifically for Indian teachers who want safe, low-stress gold investments, not risky shortcuts.

Gold prices change daily — check your bank, NSE, RBI, or jeweller app before buying.

How Can I Invest in Gold Smartly in 2026?

To understand how you can invest in gold in 2026, it’s important to separate tradition from efficiency. While jewellery is emotional, modern gold investments focus on low cost, safety, liquidity, and tax efficiency. According to Moneycontrol, gold continues to act as a hedge against inflation, currency volatility, and market uncertainty—making it relevant even in 2026.

But for the common investor asking: “How can I invest in gold?”—physical jewellery is costly and impractical. Thankfully, there are better ways now:

Main Options to Invest in Gold

- Physical gold (jewellery, coins, bars): Traditional but costly due to making charges and storage cost.

- Digital gold (online platforms): Buy small amounts via apps for as little as ₹1–10, with gold stored in vaults.

- Sovereign Gold Bonds (SGBs): Government-issued bonds in grams of gold, offering 2.5% annual interest and tax-free gains.

- Gold ETFs (Exchange-Traded Funds): Stock exchange funds that track gold prices, with each unit ~1 gram of gold.

- Gold Mutual Funds: Mutual funds that invest in gold ETFs on your behalf, often allowing small SIPs (₹500+).

- Gold savings schemes/plans: Banks and jewellers’ installment plans to accumulate gold over time.

Let’s understand each—clearly, honestly, and practically.

1.Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. Launched in 2015 by the RBI on behalf of the Indian Government, SGBs offer a way to “buy” gold without holding it physically. For anyone asking “how can I invest in gold without buying jewellery or coins?”—this is a trusted answer. Each bond’s unit equals 1 gram of gold (or a multiple of grams)- source (pib.gov.in)

Key Features (2026):

- Issuer: RBI on behalf of Government of India

- Interest: 2.5% per year (paid half-yearly)

- Tenure: 8 years (exit allowed after 5 years)

- Storage: No locker, no purity risk

- Tax: Capital gains on maturity are tax-free for individuals

On maturity, you receive the market value of gold in cash, not physical metal.

In summary: Sovereign Gold Bonds (SGBs) are government-backed gold investments that also pay 2.5% annual interest and offer tax-free gains on maturity. With no storage or purity risk and very low costs, Value Research online calls them the safest way to invest in gold. The only drawback is a 5-year minimum lock-in (though they are tradable on exchanges)

Sovereign Gold Bonds (SGBs) are government-backed gold investments that pay 2.5% annual interest, give tax-free maturity gains, and remove storage or purity worries—making them the safest, most efficient way to invest in gold long-term

2. Digital Gold (Online Gold Investment)

Digital gold is a modern, convenient way to buy real gold without visiting a jeweller. For anyone wondering “How can I invest in gold in small amounts?”—this is one of the simplest options available today.

You can buy digital gold through fintech and e-wallet platforms like Paytm, Google Pay, PhonePe, MMTC-PAMP, Augmont, and SafeGold, starting with as little as ₹1–₹10. Your purchase is credited in grams (or fractions) of gold, and the corresponding physical gold—usually 99.99% purity—is safely stored in an insured vault by the provider.

- How it works: You load cash into the app and buy gold at the current market rate. If you are asking “how can I invest in gold digitally?”—the provider claims 100% allocation, meaning they hold that much physical gold (usually 99.99% purity) in a secure vault. Paytm’s blog confirms you can start with just ₹1 of gold and it is allocated within secure vaults.

- Flexibility: You can hold the digital gold as an asset, sell it anytime on the platform, or convert it later to physical gold (coins or jewellery) by paying making charges. For teachers or beginners wondering “how can I invest in gold without buying jewellery?”—this option also allows you to get coins delivered to your home.

- Cautions: Since digital gold is not regulated by RBI, only deal with well-known platforms. Always check vault charges or commissions, as they may slightly add to the cost. Moneycontrol advises that investors “check out the reputation of the platform as well as the charges” before buying.

Overall: Digital gold is beginner-friendly—you can buy small amounts online, store it securely in vaults, and sell anytime with no lock-in. Returns move exactly with gold prices, so it’s flexible but market-linked.

Digital Gold lets you buy gold online in tiny amounts (₹1+) via apps like Paytm/Google Pay, stored safely in vaults and sellable anytime—easy and flexible, but not RBI-regulated.

3.Physical Gold: Jewellery, Coins & Bars

For most Indians, the first answer to “How can I invest in gold?” is jewellery or coins. You can buy 22K or 24K gold from jewellers, or gold bars/coins from banks and mints (e.g. MMTC-PAMP, NGC). Physical gold can be both ornamental and investment – it’s often passed down in families.

However, pure investment gold has some drawbacks:

- Making charges: Jewellery adds design and fabrication fees. These non-recoverable costs do not count towards your investment value. ValueResearch notes that “conventional buys like coins or jewellery still make great choices, [but they] bear hefty making charges”.

- Storage risk: You must safely store or insure physical gold. There’s the chance of theft or loss, and storage (locker) fees. As RBI explains, SGBs eliminate such costs; in contrast, with jewellery you bear storage risk and cost.

- Purity issues: You need to trust the seller’s gold purity. Fake or impure gold can be a risk.

If you still want physical gold as an investment, the best is bars or coins of high purity (99.9%). Many banks and jewellers sell stamped gold bars/coins with low spreads (no making charges). Buying these in bulk (e.g. 1 gm, 5 gm bars) at current market rates avoids some hidden costs. But remember GST on gold is 3% + 5% GST on making charges, so budget accordingly. Also, keep records of your purchases (bills, certificates) for any future sale or taxation issues.

Jewellery = Fashion, not investment. Prefer 24K coins/bars (99.9% purity) to avoid heavy making charges & purity doubts

4. Gold ETFs: Investing in Gold Through the Stock Market

Gold ETFs are exchange-traded funds that invest in physical gold. Each ETF unit roughly represents one gram of gold (minus small fund management fees)

. Popular examples include Nippon Gold ETF, HDFC Gold ETF, and SBI Gold ETF

How can I invest in gold through ETFs? You need a demat and trading account (like for stocks). You place buy/sell orders through your broker (Zerodha, ICICI Direct, Groww, etc.) just like buying any share. Gold ETFs trade on NSE/BSE during market hours at transparent prices.

Benefits: Gold ETFs give you direct exposure to the gold price without handling metal. You avoid purity and storage issues because the fund holds gold bars in vaults. Moreover, ETFs usually have low expense ratios (around 0.5–1% per year). ETFs allow you to invest in small quantities (even one unit) and you can enter/exit at prevailing prices

Cons: Since ETFs require a demat account, there is a small annual fee to maintain it. Also, you pay brokerage and Securities Transaction Tax (STT) on each buy/sell, though these costs are usually much lower than jewellery making charges. As a trade-off for liquidity and convenience, Gold ETF investors rely solely on price returns (no interest income).

In plain terms, think of a Gold ETF as buying digital gold through the stock market. If gold prices rise 10%, your ETF’s NAV should rise ~10% (minus small fees). If held over 3 years, gains qualify as long-term capital gains, taxed at 20% with indexation.

Gold ETFs let you buy gold through the stock market (1 unit ≈ 1 gram) via a demat account, offering safe, liquid, and low-cost exposure to gold prices—without purity or storage worries.

5. Gold Mutual Funds: Investing in Gold via SIPs

Gold mutual funds (or gold funds) work like any equity fund, except their portfolio is tied to gold-related assets. Most pure-play gold funds invest primarily in Gold ETFs. Some funds may also hold a small portion in stocks of gold mining companies. How can I invest in gold using mutual funds? A big plus is you can invest via a Systematic Investment Plan. You can start SIPs in gold mutual funds with as little as ₹500–₹1,000 per month.

A fund manager handles the buying and selling of ETF units (and mining stocks, if applicable) on your behalf. This adds convenience, especially for beginners. Gold funds are quite liquid – you can redeem units on any business day like other mutual funds. Keep in mind Gold funds charge an expense ratio (~0.5–1.5%), which may be slightly higher than ETFs. Gold mutual funds offer professional management and easy SIPs, but have a “slightly higher expense ratio compared to direct ETFs. There may also be exit loads for short-term holdings, so check the fund brochure.

Overall, gold mutual funds are a good choice if you want hands-off investing or want to invest very small sums periodically. Your returns will track the gold price closely (minus fund fees). The taxation is similar to ETFs: units held >3 years get long-term capital gains benefit.

Gold mutual funds allow you to invest in gold through small SIPs (₹500–₹1,000 per month) without needing a demat account, providing professional fund management and easy liquidity—though their expenses are slightly higher than ETFs.

6. Gold Savings Schemes: Investing for Future Jewellery Needs

For those who like a disciplined savings approach, many banks and jewellers run gold savings plans or schemes. Under these plans (often called “gold savings scheme” or “gold bond scheme” by Jewellers), you deposit a fixed amount of money each month or quarter. At the end of the tenure (typically 1–3 years), you receive an equivalent amount of gold (often in the form of Jewellery) or the cash equivalent.

How can I invest in gold through these schemes? Example: You might pay ₹5,000 every month for 10 months. At the end, the Jeweller gives you Jewellery worth the total deposits (minus some making charges). This enforces regular saving and averages out your purchase price of gold over time (rupee-cost averaging). It is popular for parents wanting to gift gold to children at ceremonies.

These plans include making charges on the jewellery you receive, which can be substantial. The scheme may also have a margin between deposit value and gold price. Hence, while they feel safe, their effective return can be lower than buying gold outright. Also, any gains are treated as a sale of jewellery, so normal tax rules on capital gains (jewellery is treated as 22K gold) apply if you sell later.

The Economic Times notes that banks and jewellers offer such systematic gold investment plans, where you deposit regularly and later get gold jewellery. Popular plans include SBI’s Gold Deposit Scheme, LIC’s gold savings plan, and shop-based plans like Malabar Gold’s MGS. These can make sense if you value the discipline and gifting aspect, but purely for investment it’s often cheaper to buy via ETF/SGB/digital gold.

Gold mutual funds let you invest in gold through SIPs (₹500–₹1,000/month) without a demat account, offering professional management and easy liquidity—though costs are slightly higher than ETFs

Quick Guidelines: How Can I Invest in Gold?

- Security & tax perks → Go for Sovereign Gold Bonds (SGBs). They pay interest, give tax-free maturity gains, and avoid storage issues (buy on exchange if new issues aren’t open).

- Flexibility & liquidity → Choose Gold ETFs or Gold Mutual Funds. Easy buy/sell with no lock-in.

- Small amounts → Start with Digital Gold (₹1–10) or Gold SIPs (₹500+). Even 1-gram coins (₹2,000) work.

- Physical ownership → Prefer coins/bars over jewellery to save on making charges. Buy during festive offers.

- Savings discipline → Bank/jeweller Gold Savings Plans help you save regularly for future jewellery or gifting.

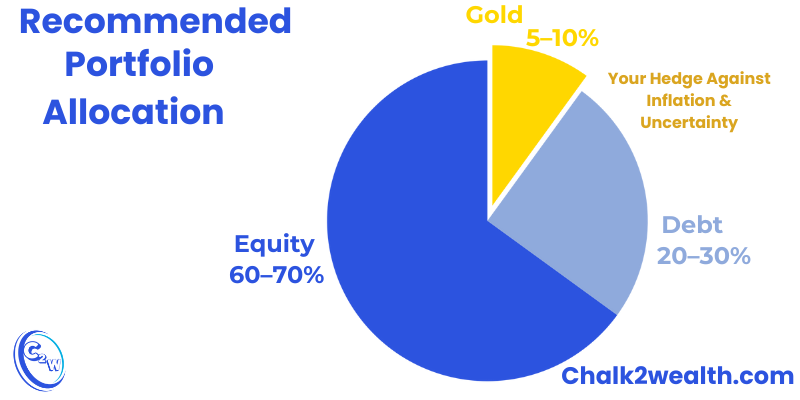

Pro tip: Never buy gold on credit. Keep gold only 5–10% of your total portfolio for balance.Investing works best when you follow clear rules, not emotions—if you often ask invest money where, these 7 rules to win the investing marathon can help you build long-term discipline beyond gold.

A little gold balances your portfolio — cushioning against inflation, market crashes, and currency swings.

Gold works best when combined with other safe investment options for teachers, not in isolation.

FAQs: How Can I Invest in Gold?

How can I invest in gold online

You have several online options. You can buy digital gold via popular apps: Paytm, PhonePe, Google Pay, or dedicated apps from companies like MMTC-PAMP or SafeGold. These let you buy gold starting from just ₹1–10, with the metal stored in secure vaults. You can also use your stock trading account or mutual fund app to purchase Gold ETFs or Gold Mutual Funds online. For example, in the broker’s platform (Zerodha, Groww, etc.), search for a gold ETF and buy as you would any share. Finally, the RBI’s Retail Direct portal and many banks’ websites allow you to subscribe to Sovereign Gold Bonds online during an issue period.

How can I invest in gold ETF?

To invest in a Gold ETF, you need a Demat and trading account (any stockbroker or bank providing trading). In your brokerage app or portal, select a Gold ETF (like Nippon India ETF, HDFC Gold ETF, etc.) and place an order for the desired quantity (units). One unit typically equals about 1 gram of gold. The order will execute at the market price on the stock exchange. You can also buy Gold ETF mutual funds (which invest in these ETFs) through mutual fund platforms. There are no purity or security issues with ETFs, but remember there are brokerage and a small annual fee.

How can I invest in gold in India?

There are many routes to invest in gold in India. Besides buying physical gold from jewellers or banks (coins/bars), you can use financial products: Sovereign Gold Bonds (SGBs) issued by the RBI/Govt; Gold ETFs on stock exchanges; Gold mutual funds; and digital gold through fintech apps. You can also use systematic gold savings schemes by banks or jewellers. Each of these methods is available in India and can be accessed through banks, stock brokers, post offices, or online platforms. For example, RBI’s press release notes that SGBs are sold through banks, post offices, and stock exchanges. In short, Indian investors have a wide menu of gold investment options beyond just jewellery.

Where can I invest in gold?

How can I invest in gold through legitimate channels? You can invest through licensed financial channels. Physical gold can be bought from RBI-authorized jewellers or banks. SGBs can be purchased from nationalized/private banks, SHCIL outlets, designated post offices and even through NSE/BSE brokers. Gold ETFs and mutual funds can be bought via any registered stock broker or mutual fund distributor. Digital gold is available on RBI-permitted payment apps and fintech platforms. In short, you can use banks, stock exchanges, mutual fund houses, or established online platforms – all are legitimate avenues for gold investment.

How can I invest in gold bonds?

“Sovereign Gold Bonds” are the main gold bonds in India. How can I invest in gold through SGBs? To invest, wait for a subscription window announced by the RBI (they are issued periodically). During that time, you can apply for SGBs by filling a form at an issuing bank, post office, or via your broker. You pay in cash (or online), and bonds are allotted in your name.

Once issued, SGBs can be held in paper certificate form or dematerialized in a Demat account. The bonds earn 2.5% interest per year. You can hold them till maturity (8 years) or sell them on stock exchanges after 5 years.

RBI’s FAQ and press releases confirm the process: for example, SGBs are “sold through Scheduled Commercial Banks… designated post offices, and recognised stock exchanges”. Always ensure you invest through authorized channels (banks, SHCIL, brokers) to buy genuine SGBs.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future. His recent articles often answer practical questions teachers ask—like “How can I invest in gold safely in 2026?”—making complex finance topics simple and relatable for everyday families.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms.

And before you leave—drop a comment below: Where to Invest Money in India 2026? what are the Best Safe Investment Options in India 2026?

Your experience can guide other teachers too.