Table of Contents

ToggleInvestment vs Trading: What Smart Salaried Indians Should Choose Beyond 2026

While driving from Chamba to Chowari, I found myself caught in a lively debate between two co-travellers — Mr. Vikas Gupta, my ever-curious friend, and Mr. Baldev, who’s more like an elder brother than a friend. As the car snaked through the hills, Vikas boasted about how his cousin had doubled his money in a week through stock trading. Baldev ji smiled calmly and replied,

“That’s great — but my SIP investment has quietly doubled my savings too. It just took a few years longer.”

The conversation felt familiar. Back in the school staffroom, I hear the same debate almost every month — Mr. Rakesh swears by quick trading profits, while Mrs. Katoch proudly talks about her decade-long mutual fund journey. Both sound tempting, right? But when it comes to Investment vs Trading, which path truly suits an Indian schoolteacher’s family?

Although they’re often spoken of together, investment vs trading are as different as a marathon and a sprint. Trading demands speed, prediction, and emotional control. Investing, on the other hand, rewards patience and discipline. For example, a teacher who starts a modest Systematic Investment Plan (SIP) of just ₹2,000 a month can quietly build meaningful wealth over time — a reminder that patience often beats prediction.

(If you’re new to SIPs, you can read: What Are Systematic Investment Plans (SIPs) and How They Work to Build Wealth.)

And if you’re wondering where long-term investing actually fits into your overall plan, this pillar guide explains it clearly:

Where to Invest Money in India (2026): 5 Safe & Inflation-Proof Investment Options for Salaried People

As we move beyond 2026, teachers and salaried families often ask: “Where should I invest my money now?” Should one rely on disciplined investing through SIPs, or chase faster gains through trading? This Chalk2Wealth guide explains Investment vs Trading with Indian data and relatable teacher stories, helping you choose the approach that fits your goals, risk comfort, and life as an educator.

Investing vs Trading: The Fundamentals

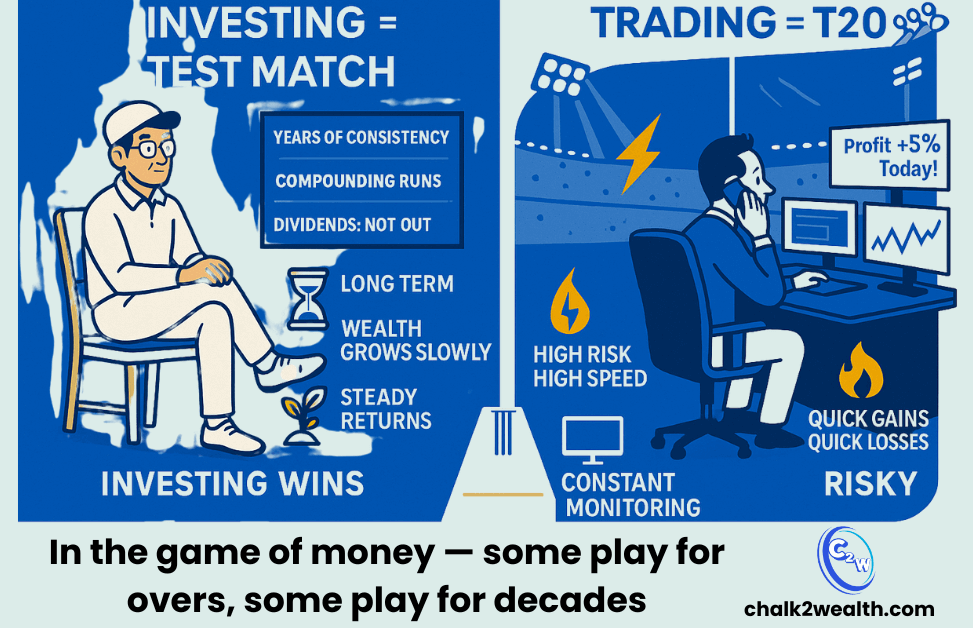

Investing is like a Test match—patient, strategic, and played for the long haul. In the debate of investment vs trading, investing means putting money into assets such as mutual funds or diversified equity investments and holding them for years, allowing compounding and long-term economic growth to do the work.

For example, a teacher who started a monthly SIP of ₹5,000 in a diversified equity mutual fund around 2010 would have seen their total investment grow 4–5 times by 2024, despite multiple market crashes—showing how patience often beats prediction. This long-term side of investment vs trading is explained in [Invest Money Where: 7 Rules to Win the Investing Marathon].

For most salaried Indians, especially teachers, investing works best when the focus is on safety and inflation protection rather than quick profits. A practical overview of such options is covered in [Where to Invest Money in India (2026): 5 Safe & Inflation-Proof Investment Options for Salaried People].

Trading, on the other hand, is like a T20 match—fast, exciting, and high-risk. In the context of investment vs trading, trading involves frequent buying and selling to capture short-term price movements, demanding constant attention, quick decisions, and strong emotional control. While trading can look attractive, it offers little stability for long-term goals such as retirement, where structured investing matters far more—as discussed in [National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?].

In short, investment vs trading comes down to this: investing rewards patience and consistency, while trading tests speed and nerves. Understanding this difference helps teachers choose a path that supports long-term financial peace, not daily stress.

Investment vs Trading — Side-by-Side Comparison

| Aspect | Investment | Trading |

|---|---|---|

| Time Horizon & Frequency | In the investment vs trading debate, investing is clearly long-term. Investors typically hold assets for years or even decades, making infrequent transactions and staying invested through full market cycles. | Trading is short-term. Traders may hold positions for minutes, days, or a few months, executing frequent buy–sell transactions to capture quick price movements. |

| Risk & Volatility | Investing generally involves lower short-term risk because investors ignore daily market noise. Over long periods, economic growth helps smooth volatility and reduce the impact of temporary downturns. | Trading involves higher risk and volatility. Since traders depend on short-term price swings, losses can be sudden and significant if the market moves against them. |

| Effort & Skill Required | In investment vs trading, investing demands less daily effort once the plan is set. Investors focus on discipline, diversification, and patience rather than constant monitoring. | Trading requires continuous attention. Traders must track charts, news, and technical signals daily and make fast decisions under pressure. |

| Returns Strategy | Investors aim for steady wealth creation. Compounding plays a major role—reinvesting returns over time can multiply wealth gradually and sustainably. | Traders chase quick profits, sometimes using leverage. While gains can be fast, outcomes are uncertain and losses can be equally rapid. |

| Objective & Mindset | Investing is goal-driven. The focus is on long-term objectives such as retirement, children’s education, or financial security—Prioritising stability over excitement. | Trading is transaction-driven. The mindset is opportunistic, aiming to outperform the market repeatedly in the short run, often at the cost of peace of mind. |

In investment vs trading, investing rewards patience and discipline over time, while trading tests speed, timing, and emotional control every day.

Reality Check – What SEBI Data Says

When the debate of investment vs trading comes up, opinions are plenty—but SEBI’s data tells the real story.

Futures & Options (F&O): A Harsh Reality

According to a SEBI-backed study covering FY22 to FY24, retail participation in the Futures & Options (F&O) segment has proved overwhelmingly loss-making. Of the over 1.1 crore individual F&O traders analysed, nearly 93% incurred losses during these three years. The average loss per trader was around ₹2 lakh, while only about 7% managed to make any profit at all. More strikingly, just 1% of traders earned more than ₹1 lakh after accounting for trading costs.

In total, retail F&O traders lost approximately ₹1.8 lakh crore over these three years—clearly highlighting how unforgiving and high-risk this segment is for the average individual investor, as documented by SEBI.

Intraday Equity Trading: Odds Still Against Retail Traders

The picture is not very different in intraday stock trading. As highlighted in a SEBI study for FY2023, nearly 7 out of 10 individual intraday traders in the equity cash segment ended the year with losses. The risk increased sharply with frequent activity—among traders executing 500 or more trades in a year, close to 80% lost money. Younger participants were especially affected, with over three-fourths of traders below 30 years reporting losses. In the real-world comparison of investment vs trading, this data sends a clear message: frequent short-term trading significantly raises the chances of losing money, while long-term investing avoids this constant churn and stress.

How Traders Compare to Simple Alternatives

Perhaps the most eye-opening insight in the investment vs trading debate comes from industry-wide analysis over multiple years: less than 1% of active traders earn more than a simple bank fixed deposit over three years. In practical terms, this means that nearly 99% of traders would have been financially better off choosing a low-risk fixed deposit instead of actively trading. This reality—highlighted by senior leaders in India’s brokerage industry—underscores how rare consistent trading success truly is, a conclusion further reinforced by recent SEBI studies.

What This Means for Teachers

Taken together, SEBI’s findings paint a consistent picture. While trading is often glamorised on social media and in casual conversations, the odds are firmly stacked against retail traders, especially after considering transaction costs, taxes, and emotional stress. In contrast, long-term investing—though slower and less exciting—offers a far more reliable path for salaried professionals who value stability and peace of mind. In the real-world comparison of investment vs trading, data—not stories—clearly favours patience over prediction.

Final Verdict: Investment vs Trading — The Smarter Choice for Salaried Indians

When all the stories are told and all the data is laid bare, the investment vs trading debate becomes far less confusing than it first appears.

Trading may look exciting in WhatsApp groups and social media reels, but SEBI’s numbers reveal a hard truth: for most salaried Indians, trading is not a wealth-building tool—it is a wealth-draining distraction. The stress, time commitment, and emotional swings it demands simply don’t align with the realities of a teacher’s life or a salaried family’s responsibilities.

Investing, on the other hand, rarely makes headlines—but it quietly changes lives. Month after month, a disciplined SIP, supported by patience and consistency, compounds not just money but confidence. It allows you to focus on your classroom, your family, and your peace of mind—without checking stock prices between periods or worrying about market noise every evening.

For teachers and salaried professionals, the real question is not “Can I make money quickly?”

It is “Can I build financial security without sacrificing my mental peace?”

In the long journey of investment vs trading, investing wins not because it is exciting—but because it is reliable, repeatable, and realistic.

Call to Action: Choose Peace Over Prediction in Investment vs Trading

If you’re a teacher or salaried professional reading this, here’s a simple next step:

- Start or strengthen your SIP today, even if it’s a small amount.

- Review your financial foundation—emergency fund, insurance, and retirement planning.

- Treat trading, if at all, as learning money, not as your family’s future.

Unsure where to begin? Read this next:

Where to Invest Money in India (2026): 5 Safe & Inflation-Proof Investment Options for Salaried People

Already investing but worried about retirement?

National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?

Remember, wealth is not built by predicting tomorrow’s market—it’s built by showing up consistently for years. If this guide helped you think clearly about investment vs trading, share it with a colleague in your staffroom. One honest conversation today can protect a family’s financial future for decades.

Choose patience. Choose discipline. Choose investing.

Jagan Singh is a school leader and financial literacy educator who writes for teachers and salaried Indians. He has completed the Financial Literacy Course for Bharat conducted by NISM (National Institute of Securities Markets), a capacity-building initiative of SEBI (Securities and Exchange Board of India), and focuses on clarity, risk awareness, and long-term financial thinking.

Disclaimer: The content shared on Chalk2Wealth is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to consult qualified professionals before making financial decisions.