Table of Contents

ToggleInvesting in PPF: 8 Smart Things to Know Before You Start

It was a calm morning at GHS Rang when Mrs. Sonia walked into the staffroom, a file in her hand and a question in her eyes.

“Sir, is it okay if I attend the BRC training next week?” she asked hesitantly.

I smiled, “Of course, it’s not just okay — it’s great! That training will help you grow as a teacher.”

As she nodded in relief, I noticed the same file she carried — her new PPF account form. “Sir, I’m also planning to open a PPF account this month,” she added.

In that moment, I realized how many teachers today are quietly searching for Safe Investments in India with High Returns — and investing in PPF naturally becomes one of the strongest and most dependable choices.

Just like BRC training shapes a teacher’s professional future, investing in PPF builds long-term financial confidence. And for teachers like Mrs. Sonia, beginning their journey by investing in PPF is not just a good step — it’s a smart one.

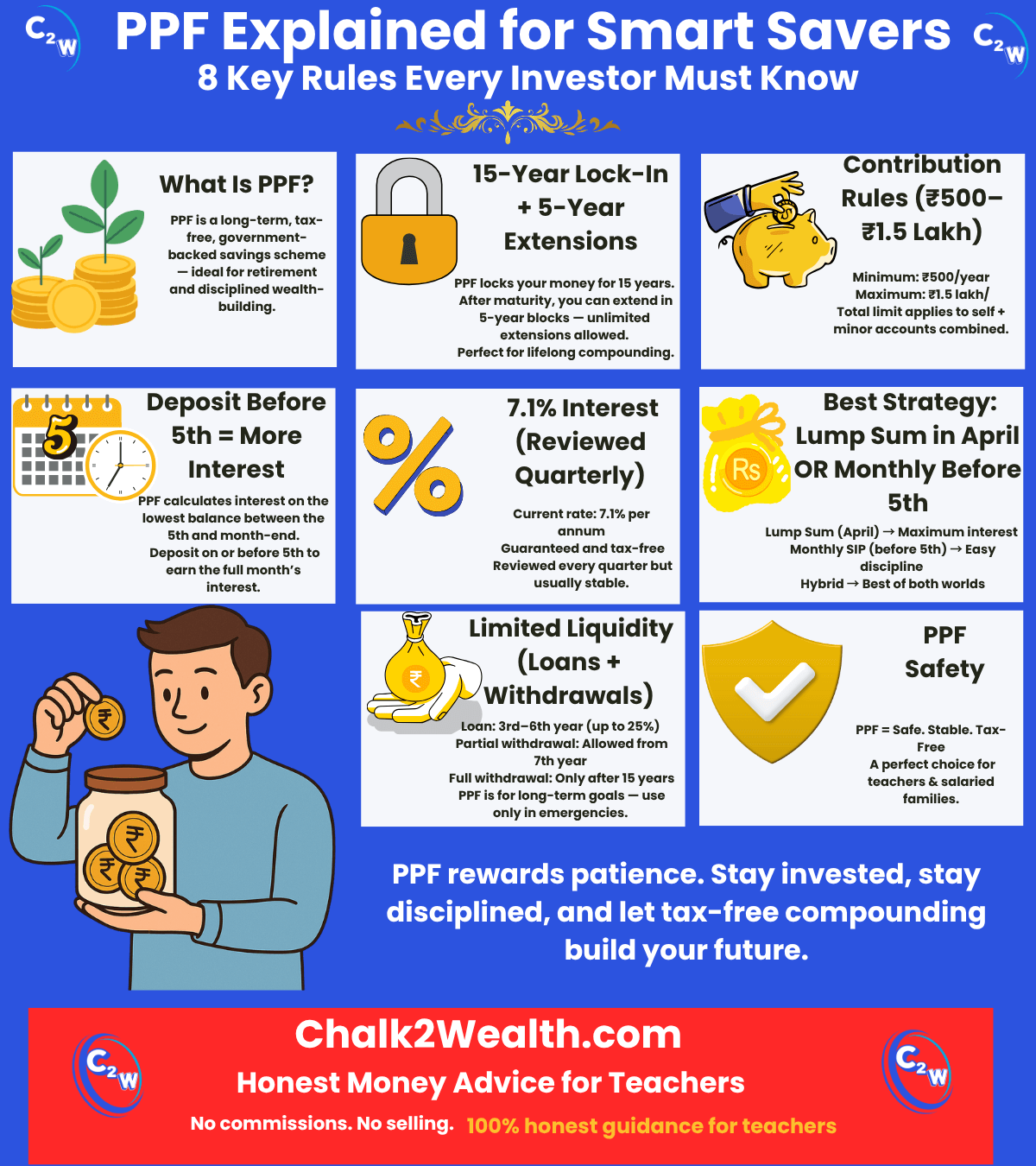

The Public Provident Fund (PPF) is one of India’s most trusted long-term investment options, known for safety, discipline, and tax-free returns.

But before you start depositing your hard-earned money, it’s important to understand how this scheme truly works — because a few smart moves can make a lifetime of difference.

Here are 8 key things to know (and do) before you begin investing in PPF, so you can maximize benefits and avoid common mistakes many investors overlook.

1. Sovereign Safety: 100% Government-Backed, Zero Worry (Investing in PPF)

When Mrs. Sonia asked if BRC training was safe to attend, I assured her — “It’s government-approved, you’re in good hands.” The same applies when you’re investing in PPF.

The Public Provident Fund (PPF) isn’t just safe — it’s sovereign safe. Backed by the Government of India, your money carries a guarantee as solid as the nation itself. There’s virtually zero risk of default, making it one of the most trusted choices for anyone investing in PPF for long-term stability.

Unlike market-linked instruments that fluctuate with the stock market, PPF returns remain steady and predictable — ensuring your savings grow without stress. If you value capital protection, steady returns, and peace of mind, investing in PPF gives you all three, backed by the full faith of the government.

2. Long-Term Commitment: 15-Year Lock-in (Extendable Further) — Investing in PPF

When Mrs. Sonia looked up and said, “Sir, 15 years is a long time, isn’t it?” I smiled, “That’s the beauty of investing in PPF — it rewards patience like nothing else.”

When you begin investing in PPF, your money stays locked in for 15 years, which builds discipline and allows compounding to work quietly in your favour. You cannot withdraw the full amount before maturity, so PPF is perfect for long-term goals but not ideal if you need quick liquidity.

As highlighted by Moneycontrol, the 15-year term isn’t a final boundary. After maturity, you can extend your PPF in 5-year blocks, again and again, with no limit. Many savers continue investing in PPF after 15 years so their balance keeps earning risk-free, tax-free interest for decades. It effectively becomes a lifelong, stable savings instrument.

In short: Investing in PPF is not about quick gains — it’s about committing to your future. The lock-in keeps you invested, and the extension option gives you complete flexibility to let your money grow as long as you choose.

3. Contribution Rules: Min ₹500, Max ₹1.5 Lakh Per Year

Before you start investing in PPF, it’s important to know how much you can (and should) contribute in a year. The rules are simple: you can invest between ₹500 and ₹1.5 lakh per financial year. You may deposit the amount in one lump sum or spread it across multiple installments. The limit is per person — even if you have two accounts (your own and your child’s), the total combined contribution cannot exceed ₹1.5 lakh in a year. There’s no requirement to invest every month; you just need to deposit at least ₹500 to keep the account active.

A key point to remember: ₹1.5 lakh is the maximum amount that earns interest. Anything you deposit beyond this limit won’t earn interest and won’t qualify for tax benefits. So, avoid over-contributing — it simply locks your money without returns. Earlier, PPF allowed only 12 deposits a year, but now you can make unlimited deposits, online or offline, as long as you stay within the ₹1.5 lakh cap.

Smart tip: If possible, try to invest as close to the ₹1.5 lakh limit as your budget allows. Consistently investing in PPF at the maximum amount helps build a stronger, compounding-based corpus. If ₹1.5 lakh feels high right now, start small and increase your contribution gradually every year. And whatever happens, don’t miss the minimum ₹500 — skipping it can make your account inactive, requiring a penalty and reactivation process. Set a reminder or auto-debit to ensure the account stays active and growing.

4. Tax Benefits: Enjoy Completely Tax-Free Returns (EEE)

PPF isn’t just safe – it’s incredibly tax-friendly too. In fact, when investing in PPF, you benefit from one of the rare “EEE” categories (Exempt-Exempt-Exempt). This means:

- Exempt 1: Your contributions (up to ₹1.5 lakh per year) are eligible for tax deduction under Section 80C of the Income Tax Act. So you save on taxes in the year you invest.

- Exempt 2: The interest you earn each year on your PPF balance is completely tax-free. It does not get added to your taxable income (unlike bank FD interest which is fully taxable).

- Exempt 3: The maturity amount you receive (principal + interest) at the end of 15 years is entirely tax-exempt as well.

This triple advantage is a major reason why so many long-term savers prefer investing in PPF. As Moneycontrol points out, the tax-free 7.1% PPF interest often beats taxable fixed deposits in effective returns. For someone in the 30% tax slab, an FD would need to offer over 10% to match PPF’s post-tax return — something unheard of today.

Simply put, every rupee of PPF interest is a full rupee in your pocket. Over 15+ years, this tax-free compounding can dramatically boost your final corpus. Just remember: to claim the 80C deduction, you must invest before March 31 each year.

If you want a Safe Investments in India with High Returns, disciplined, tax-efficient way to build long-term wealth, investing in PPF is one of the smartest choices you can make.

5. Stable Interest Rate: Currently 7.1% (Revised Quarterly) — Investing in PPF

One of the first questions people ask when investing in PPF is: “How much interest will my money earn?” The PPF interest rate is announced by the Ministry of Finance every quarter. As of 2025, it stands at 7.1% per annum, and interestingly, this rate has remained unchanged since April 2020, giving small savers a sense of stability even when other interest rates fluctuated.

In earlier years, PPF offered higher returns (8%–8.7% in the mid-2010s), but rates gradually declined along with the overall interest rate environment. During the COVID period, the government reduced the PPF rate to 7.1% — and it has stayed there for five continuous years. As Moneycontrol and other financial platforms note, the government often keeps PPF rates steady to manage interest payout burden and maintain stability for savers.

How is the rate decided? PPF rates are linked to government bond yields of similar maturity and are generally set about 0.25% above the 10-year G-sec yield. However, the government has flexibility and sometimes keeps rates unchanged even if the formula indicates a change. Rates are reviewed quarterly (March, June, September, December), but in practice they change infrequently — sometimes not for several quarters in a row.

For anyone investing in PPF, the current 7.1% tax-free return is actually quite attractive. Over 15 years, consistent investing can build a strong, predictable corpus. For example, if you invest ₹1.5 lakh every year at 7.1%, your PPF can grow to ₹40+ lakh at maturity.

One important detail: PPF interest is compounded annually and credited on March 31, but monthly balances determine how much interest you earn (details in the next section). So don’t expect monthly credits — the interest shows up once a year and then itself begins earning interest.

In short: when investing in PPF, assume a stable ~7% tax-free return. Any increase in future quarters is simply a bonus.

6. Interest Calculation Hack: Deposit Before the 5th of the Month

When investing in PPF, there’s a simple timing rule that can increase your returns without putting in even a rupee extra: make your deposits on or before the 5th of every month.

PPF interest is calculated on the lowest balance between the 5th and the last day of the month. So, if you deposit after the 5th, your money won’t earn interest for that month — it will start from the next month. But if you deposit on or before the 5th, that amount is counted for the entire month, and you earn a full month’s interest.

Example:

If you have ₹1,00,000 to deposit and you put it on June 4, it starts earning interest for July. If you wait and deposit on June 6, you lose interest for the entire month of June. Over 15 years, that missed month (every year) can reduce your total maturity value significantly.

So whether you invest monthly or occasionally, aim to deposit before the 5th. If you use standing instructions, set them for the 1st of the month. If you make lump-sum deposits, doing it early in the financial year is even better (more on that in the next point).

Bottom Line:

Mark the 5th on your calendar. It costs nothing extra — it’s just about being timely. That’s how you ensure you earn 12 full months of interest every year, not 11.

Also remember: Interest is calculated monthly but credited to your account annually (on March 31). To earn interest for a given month, the amount must remain in the account from before the 5th until month-end.

In short: When investing in PPF, timing is money.

7. Optimal Deposit Strategy: Early-Year Lump Sum vs Monthly SIP (When Investing in PPF)

When investing in PPF, you can choose how to contribute:

- One lump sum (like ₹1.5 lakh in April)

- Monthly SIP-style deposits (e.g., ₹12,500 every month)

- A hybrid of both

The key idea is simple: the earlier your money enters the PPF account, the more interest it earns. A lump-sum deposit in April earns interest for all 12 months. Monthly deposits earn interest only from the month they enter the account — so the total annual interest becomes slightly lower. That’s why financial planners say: April lump sum gives the highest return.

But not everyone has ₹1.5 lakh ready in April, and that’s completely fine. Treating PPF like a Monthly SIP is:

- Practical for salaried households

- Great for disciplined saving

- Easier on monthly cash flow

Just follow the golden rule: deposit before the 5th of every month to count for that month’s interest. If you stick to this, the difference between SIP and lump sum becomes very small.

Many savers use a simple hybrid method:

- Put whatever lump sum you can in April

- Then add monthly contributions for the rest of the year

This gives you early compounding + steady discipline.

Which method suits you?

- Already have savings or bonus → Lump sum in April

- Depend on monthly salary → SIP before the 5th

- Want maximum benefit → Hybrid approach

In the long run, consistency matters more than deposit style. Over 15 years, being regular vs irregular can completely change your maturity amount.

In short: When investing in PPF, try to invest as early in the financial year as possible. If that’s not feasible, set up a monthly auto-debit before the 5th. Give your money the maximum time to grow.

8. Limited Liquidity: Withdrawal and Loan Rules (Why You Should Avoid Early Exit)

When investing in PPF, go in with the mindset that this money is meant to stay untouched for a long time. This is a long-term retirement-focused instrument, and its real benefit comes from leaving your money invested for the full 15 years (or longer). Still, life happens — so here’s what you can access if needed, and when.

- Partial Withdrawal: Allowed only from the 7th year. You can withdraw up to 50% of the balance (whichever is lower between the 4th year’s balance or previous year’s balance). Use only for important needs.

- Loan Against PPF: From 3rd to 6th year, you can borrow up to 25% of your balance. Repay within 36 months with a small interest (about 1% above PPF rate). Helpful to avoid costly personal loans.

- No Full Withdrawal Before 15 Years: Except in rare cases like serious illness, higher education, or becoming an NRI. Even then, 1% interest penalty applies.

- PPF is Protected: Your PPF cannot be touched by creditors or courts, making it one of the safest long-term savings tools.

Treat PPF as your untouchable retirement fund. Access only if it’s a real emergency. Being one of the Safe Investments in India with High Returns, the longer you leave it untouched, the more powerfully it compounds.

Investment in PPF limit — can you invest more than ₹1.5 lakh?

No. You cannot exceed ₹1.5 lakh in a financial year. If you accidentally deposit more, the extra amount will be returned without interest.

Will PPF interest rate increase if GDP or economy improves?

A stronger economy does not always lead to higher PPF rates. The rates depend mainly on inflation, government borrowing costs, and G-Sec yields.

How to invest in PPF account for the first time?

To invest for the first time, open a PPF account through any bank or post office, submit KYC documents, choose nominees, and make your first deposit (minimum ₹500).

Monthly investment in PPF calculator — how much should I invest every month to reach my target amount?

A monthly investment in PPF calculator shows the exact amount you must deposit every month to reach your desired maturity value over 15 years. By entering your goal (₹10 lakh, ₹20 lakh, ₹30 lakh or more), the calculator instantly tells you:

- The required monthly deposit

- The total interest earned at 7.1%

- The final maturity amount

- How much faster you can reach your goal if you deposit before the 5th each month

It helps teachers and salaried families plan disciplined monthly PPF investments with accurate projections and zero guesswork.