Table of Contents

Toggle7 Safe Investments with High Returns in India for Teachers

Safe Investments with High Returns In India- Explained simply

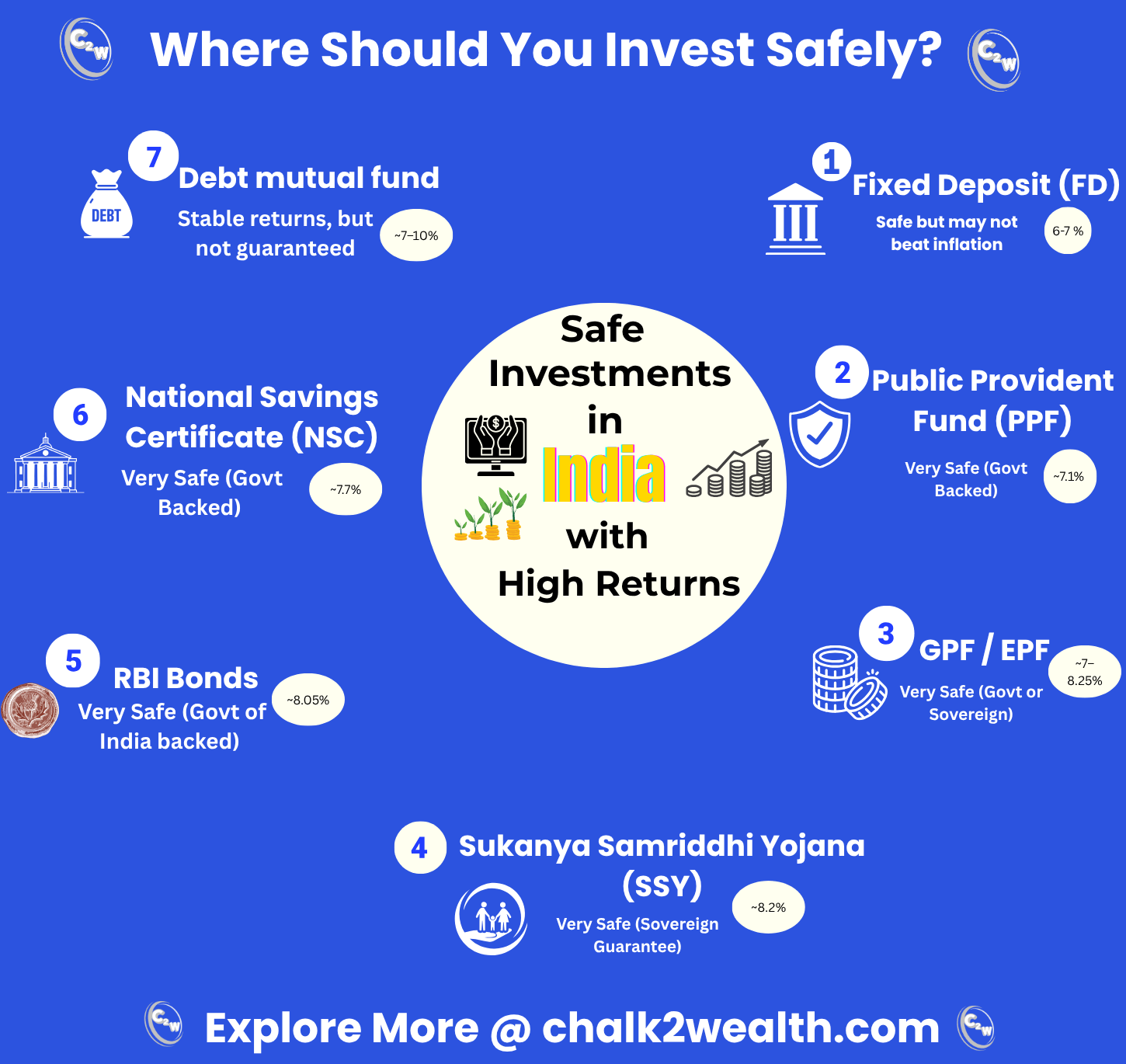

Teachers, salaried families, and government employees prefer stability over risk. Here’s a quick breakdown of India’s most reliable options. When you want safety + stable growth, these 7 options are your strongest choices. For the full guide, check: Safe Investments with High Returns in India (2026) — A Teacher’s Guide to Portfolio Rebalancing.

1. Fixed Deposit (FD)

Safety:

Returns: ~6–7%

Reliable for short-term goals and parking emergency funds. A classic safe investment with high returns in India for beginners.

2. Public Provident Fund (PPF)

Safety:

Returns: ~7.1%

100% secure, tax-free, and perfect for long-term retirement planning.

3. GPF / EPF

Safety:

Returns: ~7.1–8.25%

Salary-linked retirement corpus with guaranteed, disciplined growth.

4. Sukanya Samriddhi Yojana (SSY)

Safety:

Returns: ~8.2%

Best for girl-child future planning; high, safe, and tax-free.

5. RBI 7-Year Bonds

Safety:

Returns: ~8.05%

Government-backed, steady, tension-free long-term returns.

6. National Savings Certificate (NSC)

Safety:

Returns: ~7.7%

Low-risk, government-backed, and a smart 80C tax-saving tool.

7. Debt Mutual Funds

Safety:

Returns: ~6–9%

Better potential than FDs with low-to-moderate risk.

Quick Takeaway

If you prefer Safe Investments with High Returns in India, government-backed choices like PPF, SSY, NSC, EPF, and RBI Bonds are your strongest base.

For deeper clarity on mixing these into your portfolio, read:

Best Safe Investment Options for Teachers in India (2026–27 Complete Guide)