Table of Contents

ToggleWhat Is NSC? 5 Smart Benefits Every Teacher Should Know

Last year, during the SLDP Training at DIET Saru Chamba, a simple tea-break conversation among our staff turned into a powerful discussion on secure and stress-free investments. Many teachers shared the same concern:

“How do we protect our hard-earned savings without taking unnecessary risks?”

As we explored different safe investments in India with high returns, one option kept coming up again and again—National Savings Certificate (NSC).

If you’re someone who has ever wondered “What Is NSC, and is it really as safe as people say?”, this post will clear every doubt. In this easy-to-read guide, we’ll break down What Is NSC, explain why it has become a favourite among teachers and salaried professionals, and highlight five key benefits that make it a strong, reliable addition to your financial plan.

What is a National Savings Certificate (NSC)?

“A government-backed savings bond designed for teachers who want safe, steady growth over 5 years.”

An NSC (National Savings Certificate) is a government-backed savings scheme offered through post offices, designed to promote disciplined, long-term saving among individuals. If you’ve ever wondered What Is NSC, think of it as a fixed-income savings bond with a five-year lock-in period, where your money stays invested for 5 years and grows safely.

Since the NSC is backed by the Government of India, it comes with a sovereign guarantee, making it one of the most reliable options under the category of Safe Investments in India with High Returns. This means there is virtually no risk of default, and your returns are assured at maturity.

The interest rate for NSC is fixed for each issue and reviewed quarterly by the government. Currently, the NSC interest rate is around 7.7% per annum (2024), and the interest is compounded annually but paid out only at maturity—allowing your investment to grow steadily over the five-year period.

NSCs can be purchased in electronic or passbook form, either individually or jointly (up to two adults), and can even be opened on behalf of a minor. For any teacher or salaried professional researching What Is NSC or exploring Safe Investments in India with High Returns, NSC stands out as a low-risk, tax-saving, government-secured choice that offers guaranteed returns without the volatility of the market.

In short, What Is NSC? It is one of the simplest, safest, and most dependable ways to grow your savings while also reducing tax liability—perfect for conservative investors looking for stability and long-term assurance.

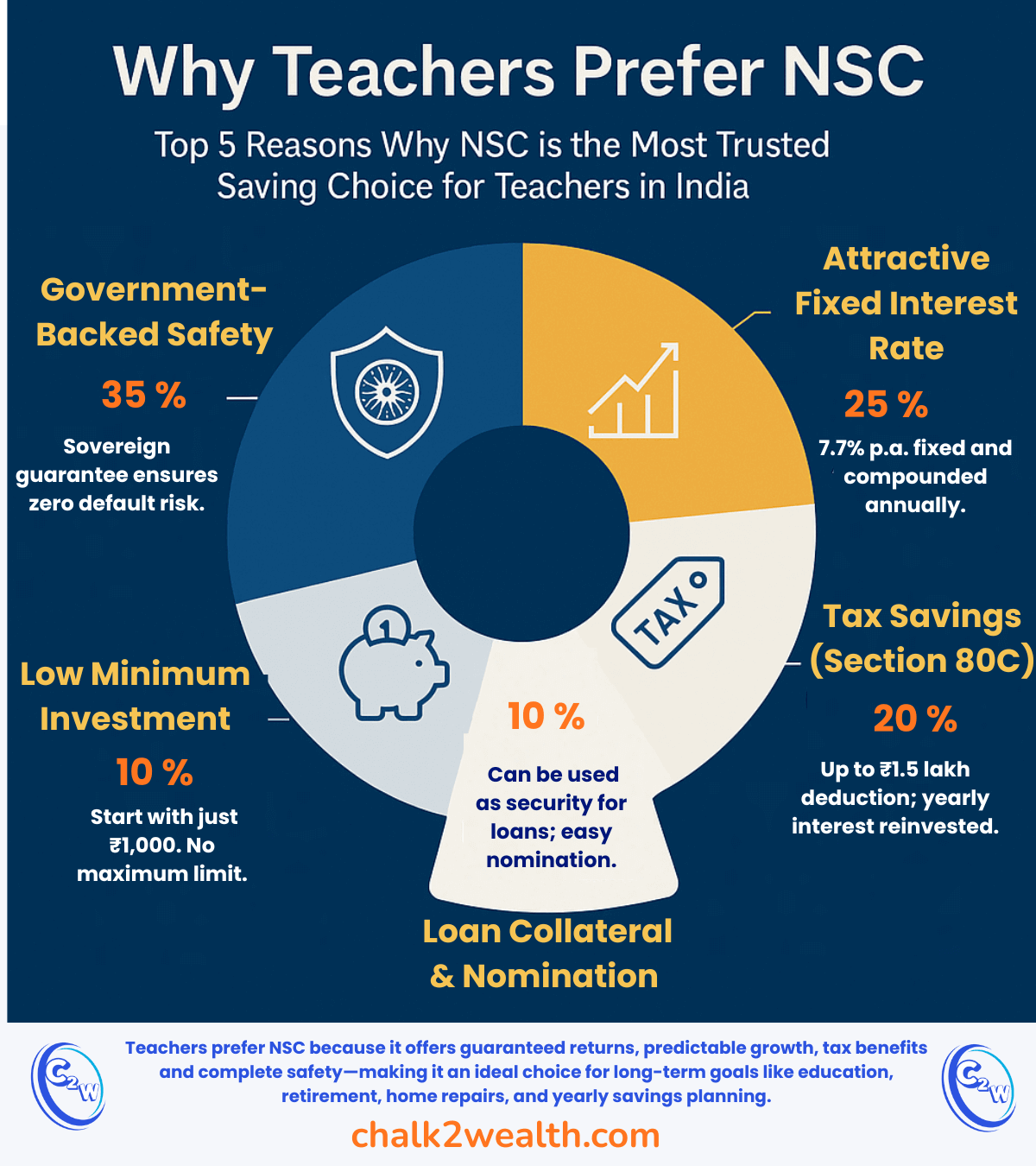

5 Smart Benefits of Investing in NSCs

Investing in National Savings Certificates offers several advantages for small and medium investors—especially teachers looking for Safe Investments in India with High Returns. If you already know What Is NSC and are exploring whether it fits your financial goals, these five benefits will give you complete clarity. Here are the key advantages that make NSC a favourite among teachers, staff, and conservative savers.

1. Guaranteed, Safe Returns (Backed by Government of India)

NSC is one of the safest investment options because it is fully backed by the Government of India. That means both your principal and interest are completely guaranteed, giving you absolute peace of mind.

The sovereign guarantee ensures that the risk of default is almost zero, making NSC a trusted choice for school staff and conservative savers who want stability more than high volatility.

During our SLDP Training at DIET Saru Chamba, one senior teacher shared how NSC helped her save safely for her daughter’s B.Ed admission fees. Instead of worrying about market risks, she simply invested small amounts every year, and the assured maturity amount came exactly when she needed it. That reliability is what makes NSC a favourite among teachers.

And if you’re comparing long-term retirement options, you may also like to read: National Pension Scheme Exposed: Are You Really Saving Enough for Retirement? — it helps teachers understand whether their current NPS contributions are truly sufficient for a stress-free retirement.

2. Attractive Fixed Interest Rate (Compounded Annually)

One major reason people search What Is NSC is its attractive interest rate. NSCs typically offer a higher return than regular savings accounts and many fixed deposits of similar tenure.

- Current NSC interest rate: Around 7.7% per annum (2025)

- Interest is compounded annually, which significantly boosts your maturity amount

Example: If you invest ₹1,00,000 in NSC at 7.7% interest, it grows to around ₹1,44,900 in 5 years due to annual compounding. That’s nearly 45% growth with guaranteed returns and zero market risk.

This makes NSC a powerful option within the category of Safe Investments in India with High Returns, especially when the market is unpredictable or interest rates fluctuate.

3. Strong Tax Benefits Under Section 80C

NSC is extremely popular among teachers and salaried employees due to its tax advantages.

Here’s why:

- You can claim up to ₹1.5 lakh under Section 80C for NSC investments

- Interest earned is not subject to TDS during the tenure

The interest that accrues each year (except the final year) is automatically reinvested and also qualifies for 80C deduction.

This combination of tax savings + tax-deferred growth makes NSC a smart planning tool. Understanding this alone answers a big part of What Is NSC and why it is preferred by conservative investors.

For those who like balancing safe products with assets like gold, you may also find this helpful: Gold Investment: How Much Gold Should Be in a Smart Investor’s Portfolio? — a practical guide for teachers building a disciplined long-term portfolio.

4. Low Minimum Investment (with No Upper Limit)

Another huge benefit is accessibility:

- Minimum investment: ₹1,000

- No maximum limit

This makes NSC suitable for:

- Teachers investing small amounts monthly

- Staff members saving for a goal

- Families wanting to safely park a bigger amount

You can even open multiple NSC accounts without any restriction. This flexibility allows you to personalise your investment strategy based on your comfort and long-term objectives.

For teachers planning their long-term future, you may also like this comparison: PPF vs NPS: Which Is Better for Long-Term Retirement Savings for Teachers? — a simple guide to choosing the best retirement pillar alongside NSC.

5. Can Be Used as Loan Collateral (Plus Nomination & Transfer Flexibility)

NSC also helps during emergencies without forcing you to break your investment. Banks and financial institutions accept NSC certificates as collateral for loans, which means:

- You get the money you need

- Your NSC continues to earn interest

- Your long-term plan stays intact

Additionally:

- You can nominate a family member to receive the amount.

- You can transfer the NSC from one post office to another or even change ownership.

These extra facilities make NSC not just a safe investment but also a flexible financial tool.

If you are a teacher looking for guaranteed, worry-free returns, NSC can be a solid pillar in your long-term plan.

What Is NSC? Common Questions Answered

What Is NSC Scheme?

The NSC Scheme (National Savings Certificate Scheme) is a government-backed savings program offered through post offices that provides guaranteed returns over a fixed 5-year period. It is designed for safe, low-risk investing, making it ideal for teachers and salaried individuals who want stable growth with tax benefits under Section 80C.

Can NSC Be Closed Prematurely?

Yes, NSC can be closed prematurely only in three special cases:

- Death of the certificate holder

- Court order directing premature closure

- Forfeiture by a pledgee (for example, if NSC was pledged to a bank and they take action)

Can NSC Be Withdrawn Before Maturity?

NSC cannot be withdrawn before maturity in normal situations. Early withdrawal is allowed only under specific conditions, such as:

- Death of the investor

- A court order

- Forfeiture by a pledgee (when NSC is pledged and the pledgee takes action)

Otherwise, you must wait for the full 5-year maturity to withdraw the amount.

What Is the NSC Maximum Limit?

The NSC maximum limit does not exist—there is no upper cap on how much you can invest. You can start with a minimum of ₹1,000 and invest any amount in multiples of ₹100.

What Is the Maximum Limit of NSC in Post Office?

There is no maximum limit for NSC in the post office. You can invest unlimited amounts, starting from the minimum ₹1,000 and then in multiples of ₹100.