Table of Contents

TogglePPF vs NPS: Which Is Better for Long-Term Retirement Savings for Teachers?

If you’re a salaried professional or a teacher in India, you’ve surely heard colleagues debate PPF vs NPS for retirement planning. Both are trusted, government-backed options, but they work very differently. In this quick, friendly guide, we’ll compare PPF vs NPS on returns, tax benefits, lock-in, flexibility, and risk to help you choose what fits your long-term goals.

What actually pushed me to write this was a challenge from a friend who didn’t know I’ve been reading personal finance magazines since 2009 — back from the time when I was posted as BRC in Education Block Chowari, Chamba. That conversation reminded me why I create financial content for teachers.

For deeper learning, you can also explore my main guide “Safe Investments in India with High Returns”, where I’ve explained how government-backed and low-risk options fit into a teacher’s financial plan.

And if you’re just getting started with PPF, don’t miss my detailed checklist post: “Investing in PPF: 8 Smart Things to Know Before You Start.”

Returns: PPF vs NPS — Guaranteed vs. Market-Linked

One major difference in PPF vs NPS is how each scheme generates returns:

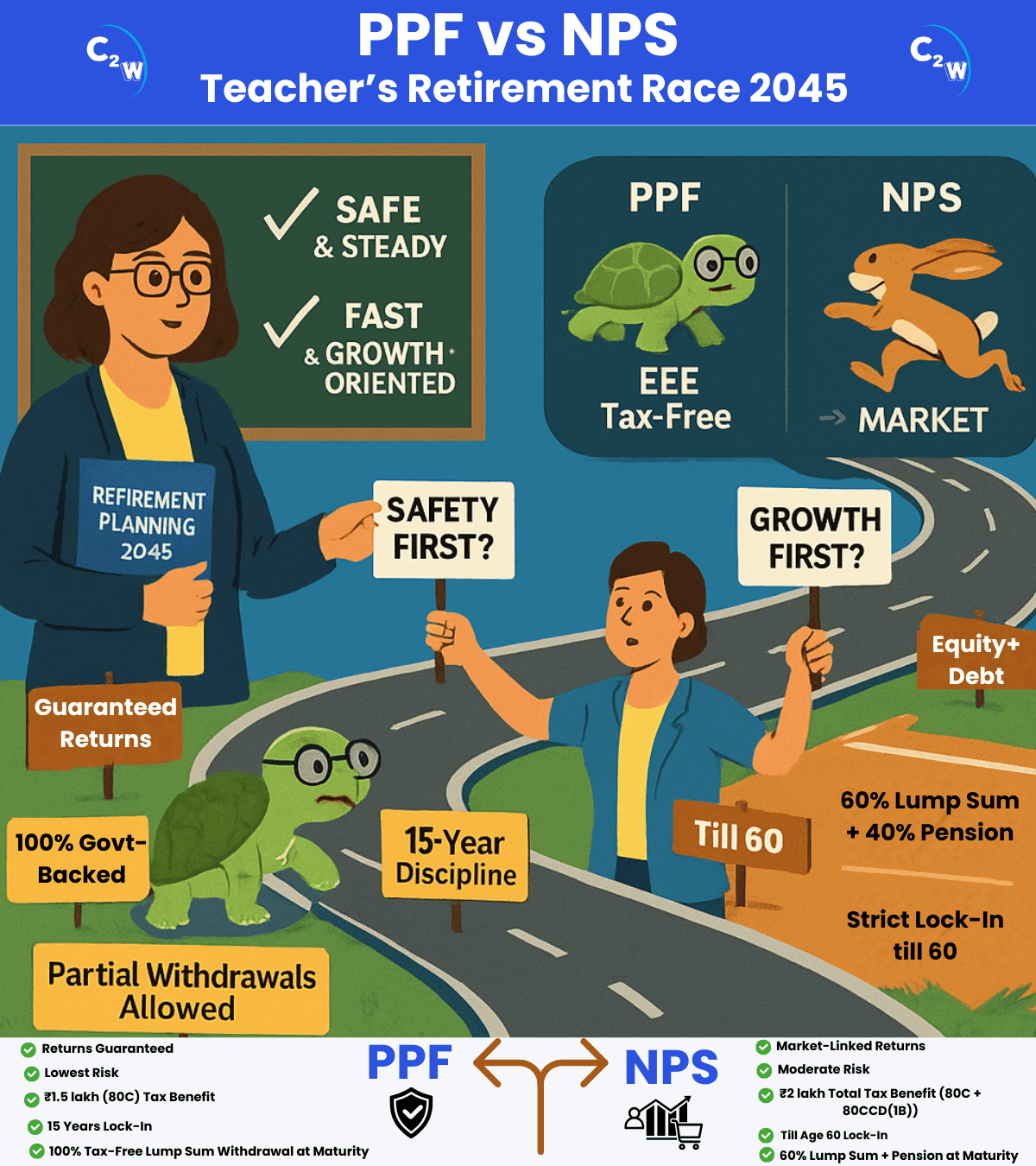

PPF: Offers a fixed, government-declared interest rate. Currently, PPF provides around 7.1% per annum, reviewed quarterly by the government. The returns are secure, predictable, and completely insulated from market ups and downs. However, because PPF’s rate is moderate and revised periodically, it may only slightly beat inflation in certain years.

NPS: NPS delivers market-linked returns. Your investment goes into a mix of equities, corporate bonds, and government securities based on your chosen allocation. This means returns can rise or fall with market performance. But historically, NPS has generated higher long-term returns — often 10–12% annually for portfolios with more equity exposure. The trade-off is that NPS doesn’t offer a guaranteed rate; some years may outperform PPF significantly, while others may be lower. For a deeper dive into how NPS works and whether you’re really saving enough, see [National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?].

Tax Benefits in PPF vs NPS: Section 80C and 80CCD(1B)

Both schemes offer strong tax-saving incentives under the old tax regime, but when you look at PPF vs NPS, NPS provides one additional advantage for taxpayers trying to maximize deductions.

PPF Tax Benefits: PPF is an EEE (Exempt-Exempt-Exempt) investment. Your contribution (up to ₹1.5 lakh) qualifies for Section 80C deduction, the interest earned is tax-free, and the full maturity amount is also tax-free. So in PPF, all three stages — contribution, growth, and withdrawal — remain completely exempt from tax.

NPS Tax Benefits: NPS also offers Section 80C deduction up to ₹1.5 lakh, but the big edge in PPF vs NPS comes from the extra ₹50,000 deduction under Section 80CCD(1B). This allows a salaried person to claim deductions of up to ₹2 lakh per year. This additional tax break is a major reason many investors choose NPS, especially those in higher tax brackets.

At retirement, NPS allows 60% tax-free withdrawal, while the remaining 40% is used to purchase an annuity, which provides monthly pension and is taxable as per your slab. (In very small corpus cases, full withdrawal is allowed, but typically the 60/40 rule applies.)

Bottom line on taxes: If your goal is to maximize deductions, NPS clearly has the advantage due to the additional ₹50,000 benefit. But if you want completely tax-free income at maturity, PPF stands stronger in the PPF vs NPS comparison, because its entire lump sum is tax-free, while NPS’s pension portion is taxable.For teachers who want to understand NPS returns in detail, don’t miss my deeper guide: National Pension Scheme Interest Rates — What Smart Teachers Need to Know to Master Them.

Lock-In Period and Withdrawal Rules

When saving for retirement, it’s crucial to understand how long your money stays locked and how easily you can access it during emergencies. In the PPF vs NPS comparison, both schemes work very differently.

PPF Lock-In:

PPF has a 15-year lock-in from the date of account opening, with full withdrawal allowed only after 15 years. Still, PPF offers useful flexibility:

- Partial Withdrawals: Allowed from the 7th year onward (one withdrawal per year, within limits).

- Loans: You can take a loan against PPF between the 3rd and 6th year.

- Extension: After 15 years, you can extend your PPF in 5-year blocks with or without fresh contributions.

Once PPF matures, the entire amount is yours with no restrictions on usage. For a full guide on smart withdrawal strategies, see: PPF Rules for Withdrawal — How to Tap Its Power Responsibly

NPS Lock-In:

NPS is strictly a retirement pension product, so your money stays locked until age 60. For someone starting NPS in their 30s, the funds remain tied up for decades. NPS allows limited access:

- Partial Withdrawals: After 3 years, you may withdraw up to 25% of your own contributions for specific purposes like buying a house, children’s education/marriage, or medical needs (only up to 3 times).

- Premature Exit: Before 60, at least 80% of the corpus must be used to buy an annuity; only 20% can be withdrawn as a lump sum.

- At Retirement (60): You can withdraw 60% tax-free, and 40% must go into an annuity for monthly pension.

For a deeper explanation of these rules, check out: National Pension Scheme Withdrawal Rules: 3 Must-Know Facts for a Stress-Free Retirement In PPF vs NPS, PPF offers more mid-term flexibility — partial withdrawals, loans, and easier access during emergencies. NPS, on the other hand, enforces discipline with a tight lock-in until retirement, which is good if your goal is purely pension-focused and you don’t need early access.

Risk Levels in PPF vs NPS: Safety vs Growth Potential

PPF and NPS carry very different risk levels, and this often becomes a deciding factor in the PPF vs NPS choice.

PPF – Very Safe:

PPF comes with a sovereign guarantee from the Government of India. Both the principal and interest are 100% safe, no matter how the market behaves. You never lose money in PPF, and returns remain steady. This makes PPF perfect for conservative investors who prefer stability over market volatility.

The trade-off: PPF returns are capped by the government rate. During high inflation or fast-rising markets, PPF’s fixed rate may deliver lower real returns, even though your capital always remains safe. For more safe and stable options, you may also explore: 7 Safe Investments with High Returns in India for Teachers.

NPS – Moderate Risk, Higher Potential:

NPS invests in equities, corporate bonds, and government securities, so it carries moderate market risk. Your account value can move up or down in the short term — especially if your NPS portfolio has a high equity allocation. However, over the long term, diversified NPS portfolios (especially equity-heavy ones) have historically outperformed fixed-income options and can beat inflation more effectively. Risk is flexible because you can choose your asset allocation — conservative investors can keep more in government bonds, while aggressive investors can go up to 75% in equities. Still, NPS is not risk-free. A market downturn close to retirement can affect the maturity corpus unless equity exposure is adjusted with age (which NPS allows).

To understand how returns are generated inside NPS, you may refer to National Pension Scheme Interest Rates — What Smart Teachers Need to Know to Master Them.

In essence:

PPF offers guaranteed, low-risk, steady growth, while NPS provides higher growth potential with some market-linked risk — making the trade-off clear in the PPF vs NPS comparison.

Who Should Choose PPF, and Who Should Choose NPS?

Both schemes support long-term retirement planning, but they suit very different types of investors. In the PPF vs NPS comparison, your mindset and comfort with risk matter the most.

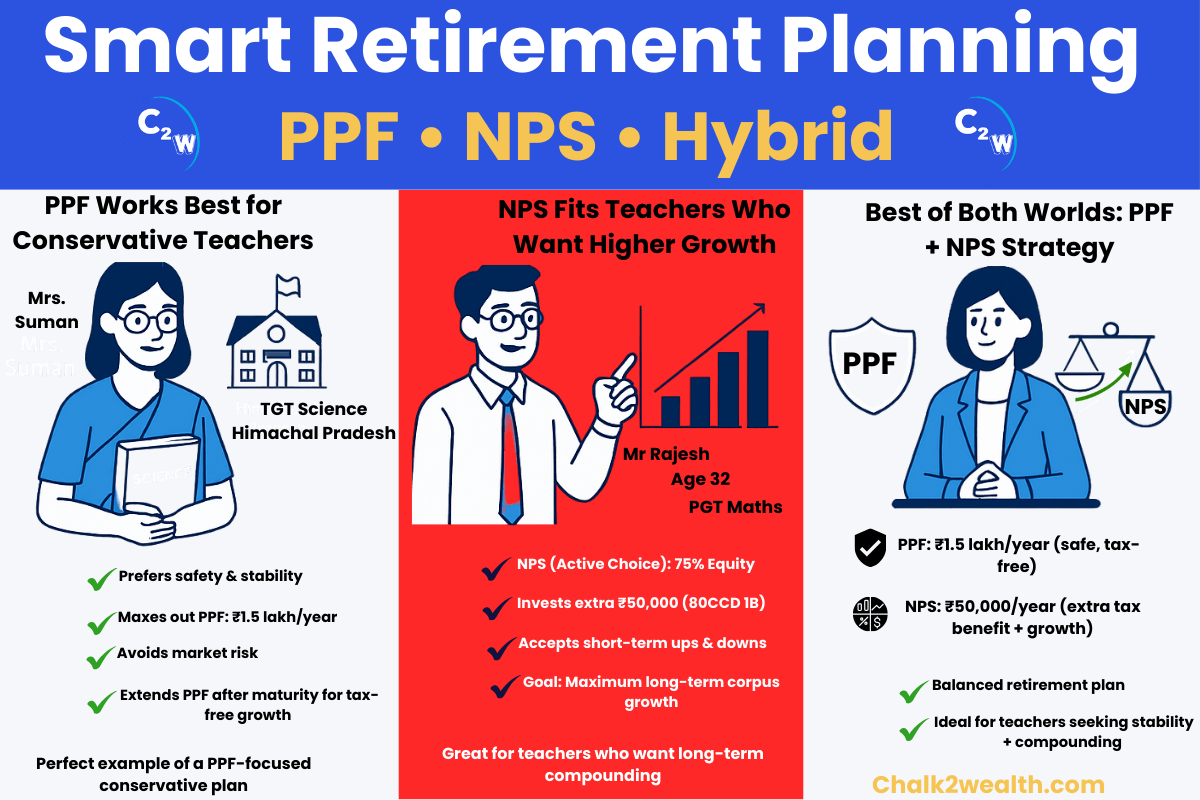

PPF Suits Conservative Savers:

If safety and certainty are your top priorities, PPF is the better choice. It’s ideal for conservative investors who prefer guaranteed, tax-free returns without market volatility. Many risk-averse teachers and salaried individuals choose PPF because they can “set it and forget it” for 15 years, knowing their savings are fully secure. PPF’s long lock-in encourages disciplined retirement saving, and the entire maturity amount is tax-free and fully accessible for any purpose.

NPS Suits Growth-Oriented (Market-Savvy) Investors:

If you’re comfortable with some market risk in exchange for higher long-term returns, NPS may be more suitable. Younger investors or those with a long working life ahead often prefer NPS because equity exposure over decades can significantly boost retirement wealth. NPS also appeals to higher-income earners due to the extra ₹50,000 tax deduction. But remember: at retirement, a portion of your corpus must be used to buy an annuity, meaning part of your wealth will become a monthly pension, not a full lump sum.

Why Not Both?

The good news is that PPF and NPS are not alternatives — you can invest in both. This balance gives you the best of both worlds:

- PPF for guaranteed, stable, tax-free growth

- NPS for higher potential returns and additional tax benefits

A smart strategy many investors use is to max out the ₹1.5 lakh 80C limit through PPF/EPF and then contribute to NPS for the additional ₹50,000 deduction and long-term growth. Together, this creates a retirement plan that is both safe and growth-oriented, making the PPF vs NPS combination a powerful approach.

Practical Suggestions for Choosing Between PPF vs NPS

Consider your own profile and comfort with risk. If you’re a middle-aged teacher or salaried person who prefers stability, prioritizing PPF (and EPF, if available) is a sensible choice for your core retirement savings. If you’re younger or comfortable with long-term equity exposure, NPS can help you build a larger retirement corpus. And if you want both safety and growth, splitting your investment between PPF and NPS gives you guaranteed savings plus the potential for higher returns. Align each scheme with your goals and risk appetite, and you’ll be able to save for retirement with confidence.

For broader guidance on balancing stability and growth, you may also refer to Safe Investments in India with High Returns — A Teacher’s Guide to Portfolio Rebalancing.

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future — whether teachers are choosing between PPF vs NPS, planning their child’s future, or securing retirement.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions, especially when comparing options like PPF vs NPS or other long-term instruments.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms. And before you leave — drop a comment below: which investment option do you trust the most in 2025? Your experience, whether with traditional schemes or modern choices like PPF vs NPS, can guide other teachers too.