Table of Contents

ToggleGold Investment: How Much Gold Should Be in a Smart Investor’s Portfolio?

As my wife and I chatted about the perfect anniversary gift—a delicate gold pendant—we found ourselves weighing the benefits of Gold Investment versus other savings. That discussion reminded me how gold isn’t just a romantic gesture; it’s also a smart hedge against volatility when you build a diversified portfolio. And if you’re planning to invest this year, here’s a helpful guide on how to invest in gold smartly in 2026 → How Can I Invest in Gold Smartly in 2026: 6 Best Options for a Strong Portfolio.

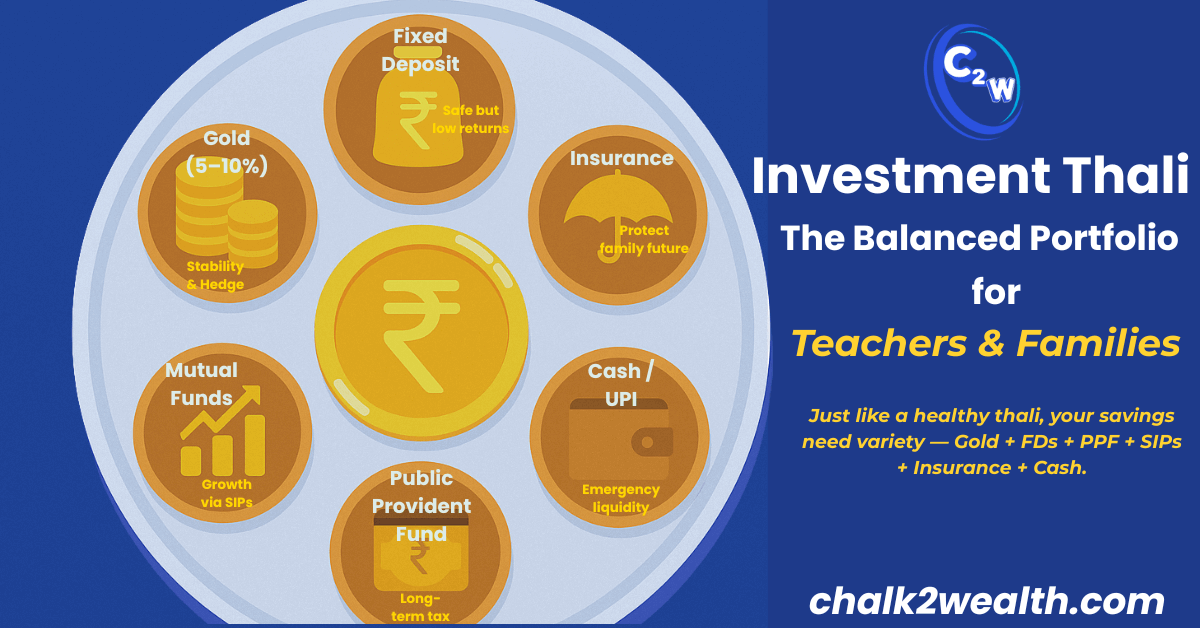

In our “Investment Thali,” a balanced plate of options just like a nutritious meal, Gold Investment deserves its 5–10% spot alongside fixed deposits, mutual funds, Public Provident Fund, insurance and cash. That’s when we sketched our own “Investment Thali” — a plate with different slots for each type of asset. Here’s what we learned:

Gold Investment: A Hedge, Not the Whole Meal (5–10% is Ideal)

Gold Investment has historically acted as a shield against inflation and market volatility. ET Money notes that gold has delivered average annual returns of ~9.6% over four decades — steady, reliable and shock-absorbing. Wealth advisors across India agree on one thing: Keep Gold Investment limited to 5–10% of your portfolio.

Why?

- It protects your portfolio during crises

- It balances equity-heavy investments

- It offers stability when markets swing

But if you go beyond 10–15%, your wealth stops growing at the pace equities can deliver. So gold is the papad of your thali — powerful, essential, but not the main course.

Public Provident Fund (PPF): Long-Term, Tax-Free Growth

With 7.1% returns, a 15-year lock-in and tax-free maturity, PPF stands out as a dependable long-term pillar in your financial plate.

Mutual Funds via SIP: Growth Engine of Your Thali

SIPs help you start small (₹500/month ) and grow consistently through:

- Rupee-cost averaging

- Compounding

- Disciplined investing

This is the sabzi + roti combination—nutritious, versatile, and essential for growth.

Insurance: Your Family’s Shield

PolicyBazaar explains that term insurance protects your family financially if the unexpected happens.

It’s not an investment — it’s security, your thali’s steel plate itself.

Emergency Fund: The Always-Ready Cushion

Value Research suggests keeping 3–6 months of expenses aside.

This prevents:

- Debt during emergencies

- Disturbing long-term investments

Think of this as the water + salad — always needed, always accessible.

Putting It All Together: Your Investment Thali with Gold Investment at Its Heart

A balanced portfolio works like a wholesome thali—each item has a purpose:

- Gold Investment (5–10%) for hedging

- Fixed Deposits for stability

- PPF for long-term, tax-free growth

- SIP-based Mutual Funds for wealth creation

- Insurance for protection

- Emergency Fund for liquidity

Together, they create the ideal mix of growth, safety and flexibility. And in this thali, Gold Investment is the flavour enhancer — small in portion, huge in impact.

To build this portion smartly, here’s a helpful guide:

→ How Can I Invest in Gold Smartly in 2026: 6 Best Options for a Strong Portfolio.