Table of Contents

ToggleHow Can I Invest in Gold Online in India (Beginner Guide)

Investing in gold has become easier than ever with online platforms. Gold is valued as a long-term portfolio stabilizer—often rising when other assets fall. Naturally, many beginners today want to know how can I invest in gold online in India safely and at low cost. (If you’re also planning broader investments beyond gold, our guide on where to invest money in India in 2026 to beat inflation explores other smart, long-term options.)

If you’re looking to buy gold online right now, it’s important to choose the right method and understand the steps, charges, and risks involved—especially if you’re wondering how can I invest in gold online in a safe and regulated way. (If you want a broader 2026-focused strategy covering all gold options and portfolio allocation, you can also read our detailed guide: How Can I Invest in Gold Smartly in 2026: 6 Best Options for a Strong Portfolio.)

Below, we break down the trusted online gold investment options in India, how to invest in each, and what you should know before you tap “Buy.”

How Can I Invest in Gold Online in India Safely?

When buying gold digitally—and especially when you’re wondering how can I invest in gold online safely—prioritize government-backed or regulated avenues for maximum safety.

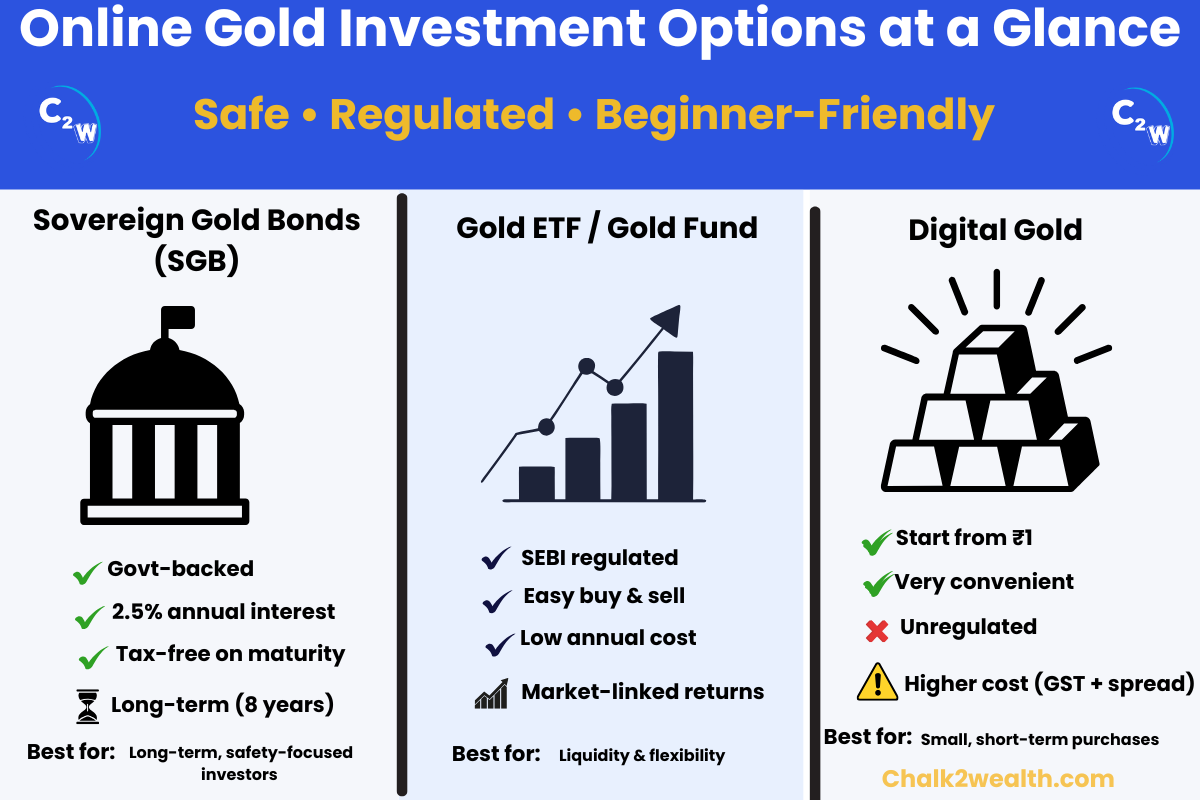

Sovereign Gold Bonds (SGBs) – Government-Backed Gold

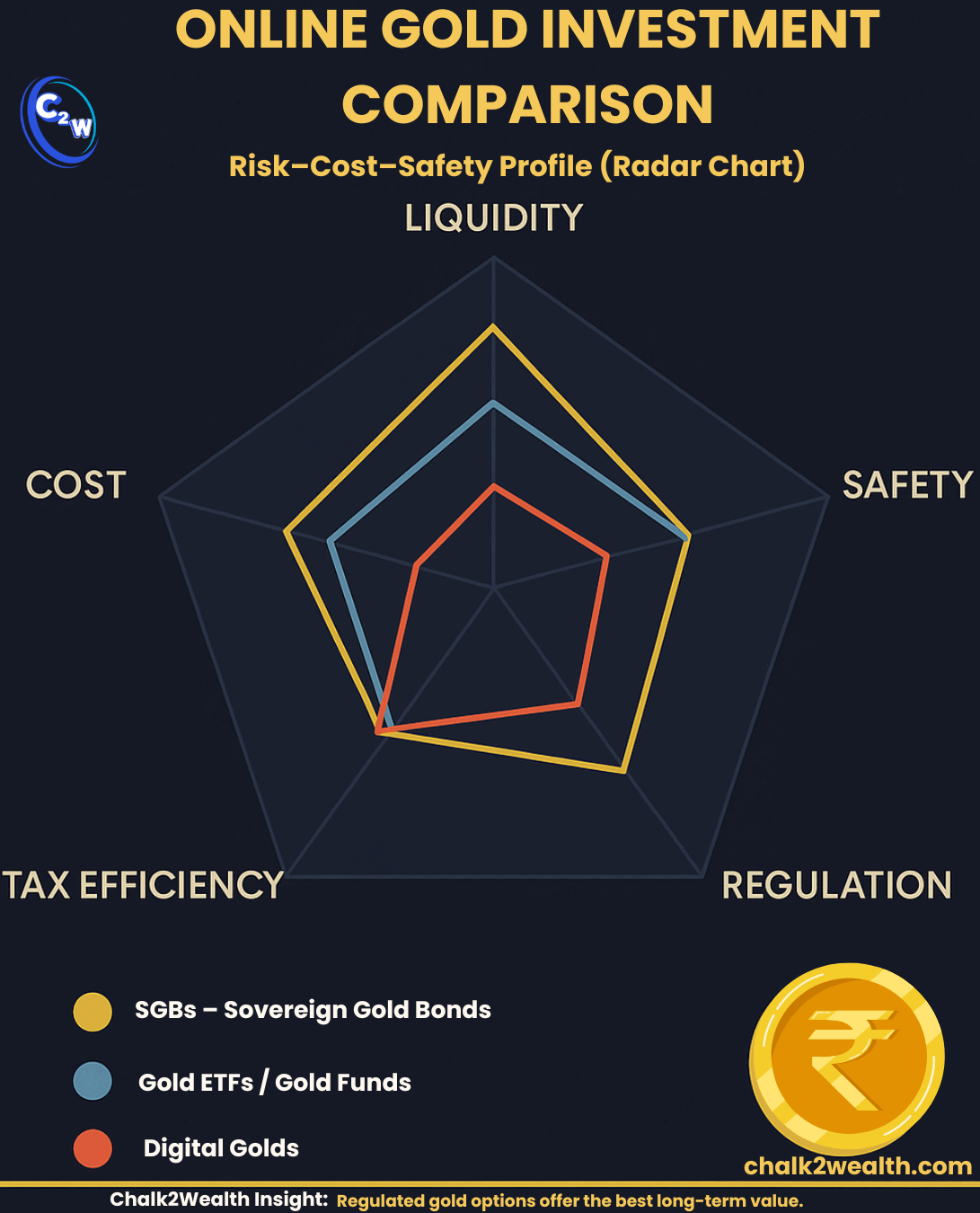

If you’re asking how can I invest in gold online with maximum safety, Sovereign Gold Bonds (SGBs) are one of the strongest options available. SGBs are government-issued bonds that track gold prices and also pay interest. Each bond represents 1 gram of gold and currently earns 2.5% annual interest, paid semi-annually- value research online. If held till maturity (8 years), any capital gain is tax-free, making SGBs especially attractive for long-term investors. According to RBI they also eliminate making charges and storage costs that come with physical gold.

How to invest in SGBs online:

You can buy new SGBs during issuance periods through your bank’s net-banking portal or investment apps. Many banks even offer a ₹50 per gram discount for online applications. If no fresh issue is open, you can still invest online by purchasing existing SGBs on the NSE or BSE through broker apps like Zerodha or Groww, though prices may carry a small premium and liquidity can be limited. SGBs have an 8-year tenure, with early redemption allowed after 5 years on interest payout dates. Backed by the Government of India, they remain one of the safest ways to invest in gold online.

Gold ETFs and Gold Funds – SEBI-Regulated Online Gold Investment

For investors wondering how can I invest in gold online with flexibility and liquidity, Gold ETFs and Gold Mutual Funds are popular regulated choices. Gold ETFs are exchange-traded funds backed by physical gold and held in your demat account. They are fully regulated by SEBI and offer transparent pricing with no GST, purity worries, or storage hassles. The main cost involved is a low annual expense ratio (often around 0.5%) plus minimal brokerage.

Gold Mutual Funds (also called gold ETF feeder funds) invest in Gold ETFs on your behalf and do not require a demat account. While their expense ratios may be slightly higher, they remain SEBI-regulated and accessible to small investors.

How to invest in Gold ETFs or Gold Funds online:

Open an account with a trusted brokerage or investment platform such as Zerodha or Groww and complete KYC. For ETFs, buy units on the stock exchange just like shares—most ETFs represent approximately 1 gram of gold per unit. For Gold Funds, use a direct mutual fund platform, search for a gold fund, and invest starting from about ₹100. These options offer easy buying and selling, low long-term costs, and no lock-in, making them suitable for long-term gold allocation.

Recommended Read:

Gold Investment: How Much Gold Should Be in a Smart Investor’s Portfolio?

Understand the ideal gold allocation to avoid over-investing or under-investing in this asset class.

Digital Gold on Fintech Apps – Convenient but Unregulated

Many people today ask how can I invest in gold online in small amounts, and digital gold offers a very easy answer. Popular apps like Paytm, PhonePe, and Google Pay allow you to buy 24K digital gold starting from as little as ₹1. The gold is stored in insured vaults by partners such as MMTC-PAMP or SafeGold, and you can sell it at any time or convert it into physical coins.

However, digital gold operates in a regulatory grey area. It is not regulated by SEBI or RBI, and there is no formal investor protection if something goes wrong. SEBI has officially cautioned investors about the risks involved in dealing in digital gold, including counterparty and storage risks.

How to buy digital gold online:

After completing KYC on a trusted app, go to the gold section, choose an amount or weight, and pay via UPI or net banking. The gold balance is credited instantly and stored in a vault. While this method is extremely convenient, always choose platforms tied to reputed vault partners like MMTC-PAMP, and carefully read the fine print regarding storage fees, spreads, or delivery charges.

Online Gold Investment: Charges, Taxes & Key Risks Explained

Sovereign Gold Bonds (SGBs): Low Cost, Government-Backed

- Costs: No upfront fees or GST. Prices are based on prevailing gold rates, with a small online discount when issued.

- Returns & Tax: You earn 2.5% annual interest, but this interest is taxable as income. If held till the 8-year maturity, capital gains are completely tax-free. Selling earlier (after 5 years or on the exchange) may attract capital gains tax.

- Risks: Gold prices can fluctuate in the short term, affecting bond value. Liquidity on stock exchanges can also be limited before maturity.

Bottom line: SGBs are one of the most reliable answers for anyone asking how can I invest in gold online in India safely for the long term.

Gold ETFs & Gold Funds: Transparent and Liquid

“If you are exploring how can I invest in gold online in India with liquidity, Gold ETFs are one of the simplest options.”

- Costs: Small brokerage per transaction (often ~₹20) and an annual expense ratio, typically 0.1–1%, reflected in NAV. No GST on transactions.

- Safety: The gold is audited, high-purity, and securely stored by the fund—so no purity or storage worries.

- Risks: Minor tracking error can occur, and prices can be volatile in the short term. You also need a demat account and can transact only during market hours.

Bottom line: : A regulated, cost-effective, and liquid way for anyone wondering how can I invest in gold online through safe, SEBI-regulated options.

Digital Gold (Fintech Apps): Easy but Expensive & Unregulated

- Costs: 3% GST on every purchase plus a 2–3% buy-sell spread, meaning you may pay around 5% more than the actual gold value upfront. Additional charges may apply for storage or physical delivery.

- Liquidity: Most platforms allow selling back instantly, but prices may be less favourable than market rates.

- Key Risk: Digital gold is not regulated by RBI or SEBI. If the platform or vault provider fails, there is no government guarantee or investor grievance mechanism.

Bottom line: Convenient for small, short-term purchases, but unsuitable for large or long-term gold holdings.

“Understanding how can I invest in gold online in India helps you choose the right option—SGBs, ETFs, or digital gold—based on safety and long-term goals.”

Choosing the Right Online Gold Investment Strategy

If you’re deciding how can I invest in gold online today, prioritize safety and long-term costs over convenience. Sovereign Gold Bonds (SGBs) and Gold ETFs emerge as the most reliable online options. SGBs are backed by the Government of India, pay annual interest, and offer tax-free gains on maturity—making them ideal for patient, long-term investors. Gold ETFs (and gold mutual funds) provide a regulated, liquid way to buy gold at live market prices with minimal fees through trusted platforms like Zerodha or Groww.

Digital gold apps such as Paytm or PhonePe make investing easy and allow very small purchases, but they come with higher costs and regulatory uncertainty. These are better suited for short-term or small-value buys rather than core gold holdings.

Bottom line: Start with regulated platforms—check for an open SGB issue or buy a gold ETF via a reputable broker. Use digital gold sparingly and with full awareness of fees and risks. By choosing wisely, you can add gold to your portfolio in a way that protects value over the long run.

Recommended Reads (for building a full investment strategy beyond gold):

1. Where to Invest Money in India in 2026 to Beat Inflation

Helps you choose safe, long-term allocations when planning your broader investment strategy.

2. Invest Money Where — 7 Rules to Win the Investing Marathon

A simple framework to avoid common mistakes and build a disciplined, inflation-proof portfolio.

Frequently Asked Questions – How Can I Invest in Gold Online in India?

How Can I Purchase Gold Online in India?

You can purchase gold online in India through three trusted methods: Sovereign Gold Bonds (SGBs), Gold ETFs/Gold Mutual Funds, and digital gold on fintech apps. The safest, government-backed option is Sovereign Gold Bonds, which you can buy directly through your bank’s net-banking portal or broker apps when a new issue is open. If you prefer liquidity, you can buy Gold ETFs via your demat account on platforms like Zerodha or Groww—these track real gold prices and are fully regulated by SEBI. Beginners who want to start small can buy digital gold through apps like Paytm or PhonePe, but this option is not regulated by RBI or SEBI and may involve higher charges. Always compare safety, costs, liquidity, and taxes before choosing your online gold method.

How to Invest in Digital Gold Online?

You can invest in digital gold online through popular fintech apps like Paytm, PhonePe, Google Pay, and speciality platforms partnered with MMTC-PAMP, SafeGold, or Augmont. After completing basic KYC, open the “Gold” section in the app, choose the amount or weight you want to buy (starting from as little as ₹1), and pay instantly via UPI, debit card, or net banking. The purchased gold is stored in insured vaults on your behalf, and you can sell it back anytime or convert it into physical coins. However, digital gold is not regulated by SEBI or RBI, and charges like 3% GST plus buy–sell spreads apply. Use this option only for small, short-term investments and choose reputed vault partners for maximum safety.

How to Order Gold Online?

You can order gold online in India through three routes: Sovereign Gold Bonds (SGBs), Gold ETFs/Gold Funds, and digital gold on trusted apps. To order SGBs, use your bank’s net-banking portal or a broker app during an open issue. To order Gold ETFs, open a demat account on platforms like Zerodha or Groww and buy units just like shares. If you prefer small, simple purchases, you can order digital gold on Paytm, PhonePe, or Google Pay, where 24K gold is stored in insured vaults and can be sold or converted into coins later. Always compare safety, charges, and regulation before ordering gold online.

Where to Buy Gold Online in India?

You can buy gold online in India from three reliable sources: banks and broker platforms for Sovereign Gold Bonds (SGBs), stock-market apps like Zerodha or Groww for Gold ETFs/Gold Funds, and trusted fintech apps such as Paytm, PhonePe, or Google Pay for digital gold. SGBs and Gold ETFs are the safest options because they are backed or regulated by the Government of India and SEBI. Digital gold is convenient for small purchases but is not formally regulated, so choose reputed vault partners like MMTC-PAMP or SafeGold.

Disclaimer:

This guide on how can I invest in gold online in India is for educational purposes only. Gold investments—including SGBs, Gold ETFs, and digital gold—carry market risks. Please verify latest rules and consult a qualified financial advisor before investing. Past performance is not a guarantee of future returns.