Table of Contents

ToggleIs PPF a Good Investment and Is It Worth It in 2026?

Last week, while we were sorting school files, my wife — the principal of Rising Star Public School, Chowari — looked at me and asked,

“PPF ka kya karein? Is PPF a good investment? Is it really worth it in 2026?”

Since I handle most of her investment planning, her question felt familiar. Most teachers live on a fixed monthly salary and quietly hope for just one thing—a tension-free retirement. Safety matters more than excitement. That’s why many teachers and salaried parents blindly invest in PPF, assuming it’s automatically the best and safest choice. But very few pause to ask an important question:

Does PPF still make sense in 2026, or are we investing out of habit?

Before opening their first account, many readers go through my detailed guide—Investing in PPF: 8 Smart Things to Know Before You Start—because clarity always brings confidence.

As an educator who studies safe investments deeply, I want to break this down clearly and honestly. Is PPF really safe? Is it truly tax-free? And most importantly—is it still worth it for teachers in 2026?

Let’s find out, step by step—while also understanding where PPF fits among other safe investment options for teachers in India:

PPF remains one of India’s most trusted savings schemes for its government-backed safety and tax-free returns. But as we move into 2026, it’s important to re-evaluate: Is PPF a good investment, and is it worth it compared to other options?

Readers who compare it with NSC often refer to National Savings Certificate (NSC): How Much Should You Have in Your Investment Portfolio? — because both instruments serve different financial purposes. And when teachers ask whether they should first repay debt or invest, I often direct them to Teachers, What Is the Real Cost of Debt? 5 Heavy Prices You Pay— because debt silently eats away returns, even from safe schemes like PPF. For those planning retirement, another common comparison is PPF vs NPS, and my guide PPF vs NPS: Which Is Better for Long-Term Retirement Savings for Teachers? helps them choose based on stability vs growth.

This guide now breaks down PPF’s features, current returns, new rules, and comparisons with NSC, FD, and ELSS — backed by the latest data from trusted financial sources.

Why PPF Is Attractive and Safe: Is PPF a Good Investment?

PPF remains highly attractive for risk-averse investors because it offers a 15-year government-backed lock-in, stable returns, and full tax exemptions. “It enjoys the rare Exempt-Exempt-Exempt (EEE) status — contributions up to ₹1.5 lakh qualify for Section 80C, the 7.1% interest is tax-free, and the entire maturity amount is tax-free. Moneycontrol also highlights that PPF’s tax-free nature significantly boosts its effective yield for investors.”

Safety is another major reason people ask, “Is PPF a good investment and is it worth it?” PPF is backed by the Government of India, meaning zero default risk. In comparison, bank FDs—though generally safe—are insured only up to ₹5 lakh per bank. With PPF, both your principal and interest carry full sovereign guarantee, providing unmatched peace of mind.

Current Interest Rate and Recent Performance

As of late 2025, the Public Provident Fund (PPF) continues to offer a 7.1% annual interest rate, according to the Times of India. Although the government reviews small savings rates every quarter, PPF’s rate has remained unchanged for several years. Other schemes like NSC (7.7%) and SCSS (8.2%) have also delivered stable returns through 2024–2025.

Historically, PPF rates were much higher — touching 12% in the 1980s–90s — but as interest rates in India declined, PPF has generally hovered around 7–8% in recent years. The last adjustment came in 2020, when the rate was fixed at 7.1%, and the government has retained it despite shifts in policy rates.

Entering 2026, 7.1% remains the assured return on PPF. While modest at first glance, its tax-free nature boosts the effective yield significantly. A taxable investment like a bank FD would require nearly 10% interest for a high-tax-slab investor to match PPF’s post-tax return.

New Rules in 2024–25: What’s Changed?

A few important updates were introduced to the Public Provident Fund (PPF) in 2024–25, and they directly affect how investors evaluate whether PPF is a good investment and whether PPF is worth it for long-term planning.

- Interest on Minor Accounts

Parents can open a PPF account in the name of a minor child, and it earns the same PPF interest rate (currently 7.1% p.a.). However, when deciding is PPF a good investment for children, it is important to remember that the combined contribution by the parent in their own PPF and the minor’s PPF cannot exceed ₹1.5 lakh per financial year under Section 80C — a common area of confusion for many new investors. - Earlier Partial Withdrawals

Some readers ask whether changes here affect whether PPF is worth it as a long-term savings tool. The rule remains the same: partial withdrawals are allowed only after 5 financial years from the end of the year of account opening, and only one withdrawal is permitted each year. - No Change in Core Rules

The annual contribution limit continues to be ₹1.5 lakh, and PPF still enjoys full tax exemption on interest and maturity proceeds. These unchanged core benefits are major reasons many conservative investors continue to feel that is PPF is a good investment and worth it for long-term, safe wealth building.

Conclusion: Is PPF a Good Investment in 2026?

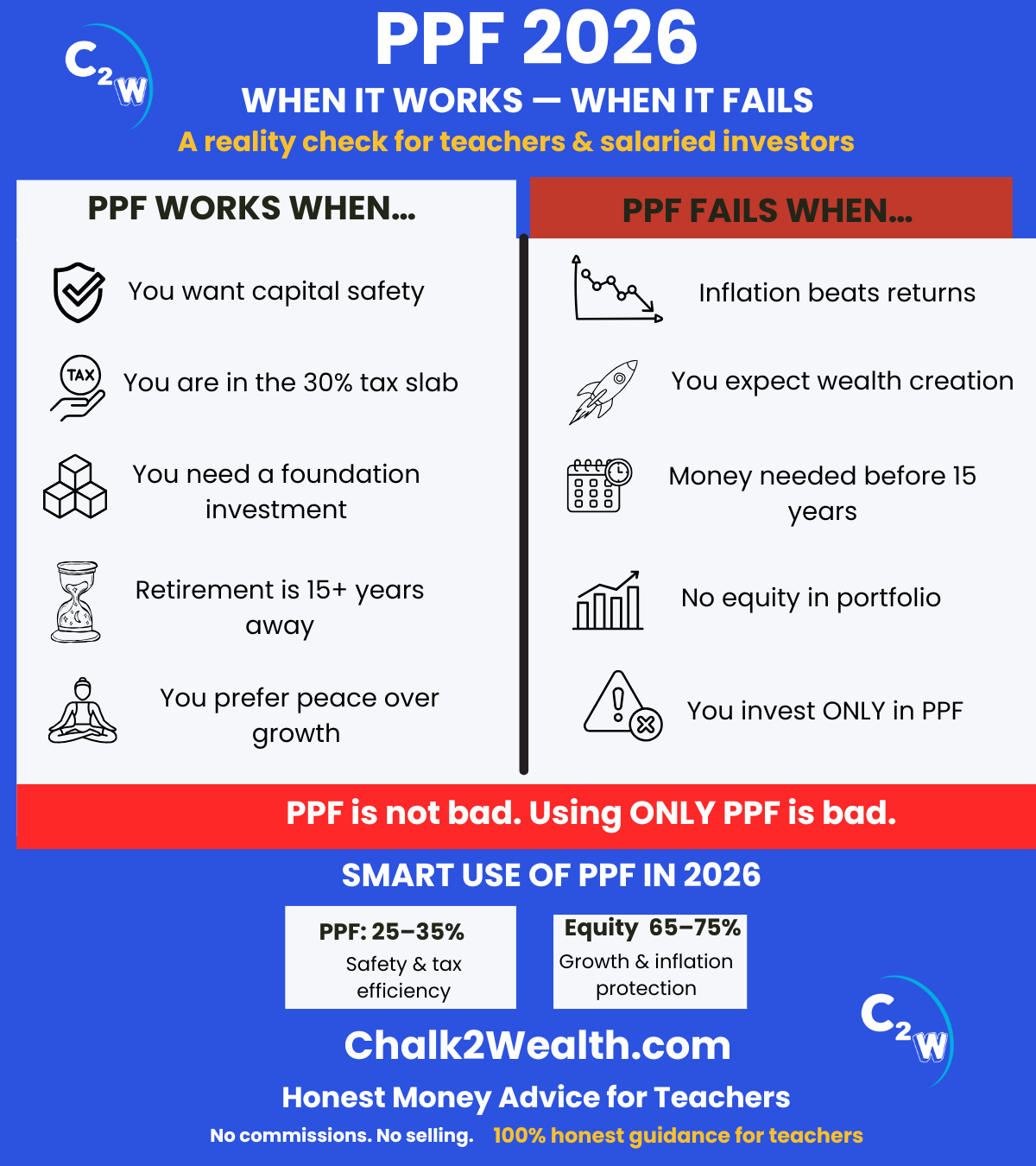

For risk-averse teachers, salaried investors, and long-term planners, PPF continues to be a reliable, tax-efficient, government-backed investment. While returns are modest, its safety, EEE tax status, and sovereign guarantee make it a strong foundation for stable wealth building. Whether PPF is worth it depends on your goals — and for long-term security, it remains a valuable tool even in 2026.

Is PPF a Good Investment in 2026? (FAQs)

PPF vs FD: Is it better to invest in PPF or FD for long-term wealth growth?

PPF is better than FD for long-term wealth growth because PPF offers tax-free returns (EEE) and higher real returns after tax, while FD interest is fully taxable every year. FD is suitable for short-term needs or emergency funds, but for long-term, stress-free wealth creation, PPF is the smarter choice.

PPF vs SIP: Which is Better?

PPF is better for safety, guaranteed returns, and tax-free income, making it ideal for conservative investors and teachers. SIP (Mutual Funds) is better for higher long-term growth if you can handle market ups and downs.

In short:

- Choose PPF for stability and peace of mind

- Choose SIP for faster wealth creation over the long term

- Best approach: PPF for safety + SIP for growth

PPF vs ELSS: Which Is Better for Long-Term Tax Saving?

For long-term tax saving, PPF is better for safety and certainty, while ELSS is better for higher growth if you can handle market risk.

- PPF offers guaranteed, tax-free returns (EEE) with government backing—ideal for conservative investors and teachers who want predictability.

- ELSS provides potentially higher returns through equity exposure and tax deduction under Section 80C, but returns are market-linked and volatile.

Bottom line:

- Choose PPF for risk-free, tax-free stability.

- Choose ELSS for higher long-term growth with risk.

- Best approach: Use both—PPF for security, ELSS for growth.

Disclaimer:

This article is for educational purposes only and does not constitute financial advice. The answer to “Is PPF a good investment?” depends on your personal financial situation and goals. Please consult a qualified financial advisor before making investment decisions