Table of Contents

ToggleSafe Investments in India: How to Secure Your Savings from 2026 onwards

Last week in the staffroom, Mrs. Neelam, a senior teacher, shared a familiar concern. She had just received a double increment after years of service and asked quietly, “Sir, ab yeh extra paisa kahan lagaoon—safe bhi rahe aur tension bhi na ho?” (Sir, where should I invest this extra money so that it remains safe and worry-free?) She wasn’t looking for quick profits. She was worried about making a wrong decision.

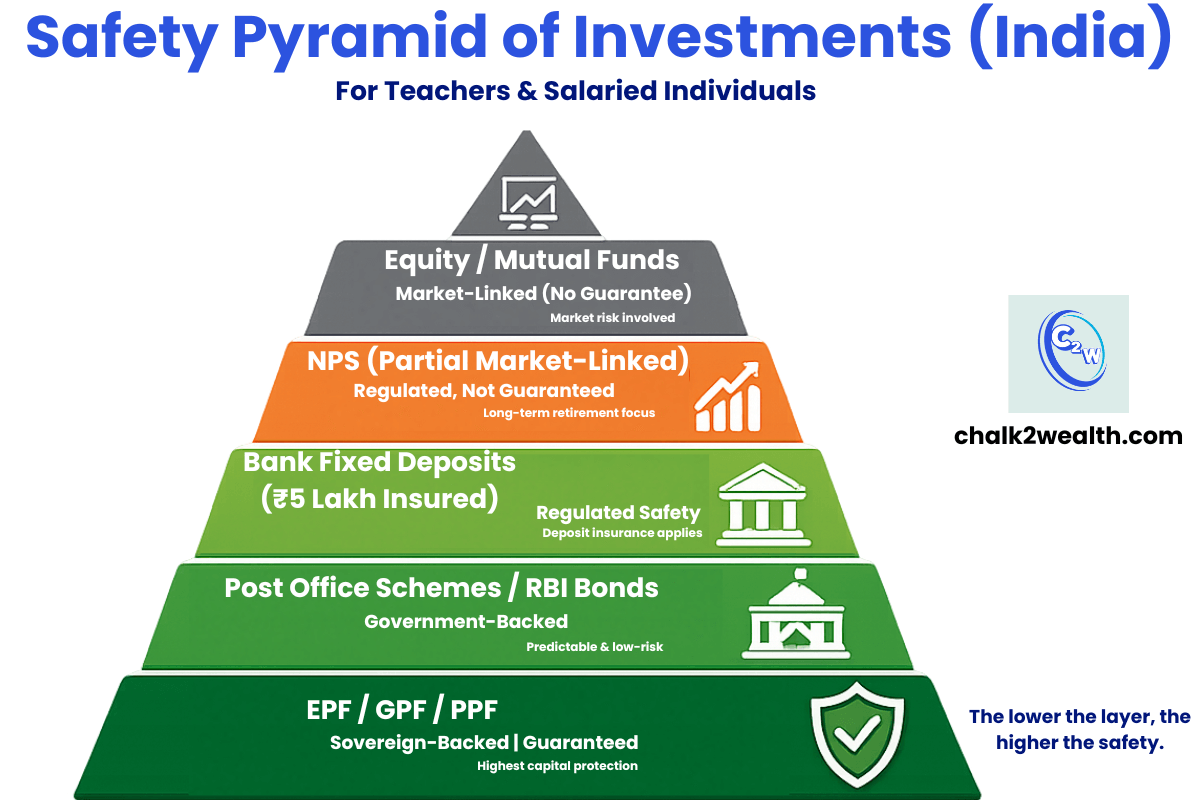

For Indian teachers and salaried persons, investing has never been about chasing high returns. It has always been about safety, stability, and peace of mind. In an environment of rising inflation, market volatility, and constant financial noise, choosing the right Safe Investments matters more than ever. Before comparing returns or schemes, every teacher must first understand what truly makes an investment safe.

This guide is built on a safety-first framework. Instead of jumping straight into products, it helps you learn how to identify genuinely safe investments in India. Once that foundation is clear, you can confidently explore specific options through our detailed pillar guide on [Best Safe Investment Options for Teachers in India], designed especially for conservative educators and salaried families.

If an investment fails more than one point in this checklist, it doesn’t belong in a teacher’s portfolio.

Why Safe Investments Matter for Teachers and Salaried Individuals

When we talk about safe investments, we generally mean investments that carry a very low risk of losing your principal—the money you put in. For teachers and salaried individuals, safety is not a vague idea; it rests on a few clear pillars.

- Principal protection and guaranteed outcomes: Some safe investments offer assured returns or principal protection, meaning your original amount (along with a fixed return) is protected regardless of market conditions. For example, bank fixed deposits are insured up to ₹5 lakh under the deposit insurance framework overseen by the Reserve Bank of India. Even if a bank faces financial trouble, deposits within this limit remain protected. Similarly, many government-backed savings schemes carry an implicit sovereign guarantee, meaning the Government of India stands behind your money.

- Trust and backing of reputable institutions: A product is considered safe if it is backed by a government or regulated authority that has a strong track record. Examples are schemes offered by the Government of India (like Public Provident Fund or National Savings Certificates) which enjoy the government’s trust factor. Knowing that an institution like the RBI, EPFO, or India Post is involved can greatly increase confidence.

- Simple structure and transparency: Safe investments tend to be simple to understand – you know how long your money will be locked in, what interest you’ll earn, and how to withdraw when needed. There are no complicated formulas or volatile stock prices. This transparency means there are fewer unknowns to worry about. For instance, a fixed deposit or a provident fund has straightforward rules and predictable outcomes, unlike equity investments which can swing up and down.

In essence, “safe” means predictability and protection. You might not get sky-high returns, but you can be reasonably sure about what you will get. For conservative savers like teachers, that certainty is worth more than the chance of higher (but uncertain) gains.

Built-In Safety Nets: EPF, GPF, and Pension Funds

One major advantage for teachers and salaried individuals is that some safe investments are already working in their favour by default. Whether you teach in a government or private school, a portion of your salary is usually directed toward long-term, low-risk retirement savings—often without requiring any active decision from you.

Employees’ Provident Fund (EPF): For most private school teachers and salaried employees, EPF is a compulsory savings mechanism. Every month, a fixed portion of your salary is contributed to your EPF account, along with a matching contribution from your employer. This fund is managed by the Employees’ Provident Fund Organisation and is invested only in approved, conservative instruments. The government declares the EPF interest rate each year, and the credited interest steadily compounds over time. EPF functions as a government-mandated safe investment that builds a retirement corpus automatically. Withdrawals are restricted to retirement or specific life needs, which protects the money from impulsive spending. Because both the principal and the interest are governed by statutory rules, the risk of capital loss is extremely low.

General Provident Fund (GPF): Government school teachers, especially those who joined service earlier, may be covered under the GPF system. Like EPF, a portion of salary is set aside every month, but the fund is directly managed by the government. Interest rates are notified periodically, and the fund carries a full sovereign guarantee. GPF is among the safest investments available to teachers—essentially a promise by the government to return your money with interest. Over time, it accumulates into a reliable lump sum that can be accessed at retirement or during permitted situations, providing long-term financial certainty.

Pension Schemes (EPS / NPS)

Many private employees enrolled in EPF are also covered under the Employees’ Pension Scheme (EPS), which provides pension benefits based on years of service and salary history. Younger government teachers, especially those appointed after 2004, are typically enrolled in the National Pension System (NPS). While NPS invests in a regulated mix of bonds and equities, it remains a structured and well-monitored retirement investment. It is regulated by the Pension Fund Regulatory and Development Authority and operates under strict transparency and trust-based safeguards. Limited withdrawal rules and long-term lock-in help ensure discipline and stability, making NPS a relatively safe option for building retirement income.

Why these safety nets matter

For teachers, knowing that EPF, GPF, or NPS is steadily building a protected retirement corpus significantly reduces financial stress. These built-in safe investments form the foundation of long-term financial planning. They allow educators to focus on their profession and family life without constantly worrying about market movements or investment decisions. To make the most of these safety nets, regularly review your PF or pension statements and avoid unnecessary withdrawals. Treated with discipline, these instruments serve exactly what they are meant to be—reliable, long-term safe investments that protect your future.

Trusted Government Schemes for Worry-Free Returns

Beyond provident funds, India offers several safe investments designed for conservative savers like teachers and salaried individuals. These options prioritise capital protection over aggressive returns and are mostly offered by the Government of India, nationalised banks, or trusted institutions such as India Post. Their biggest strength lies in government backing and regulatory oversight.

Small Savings Schemes (Post Office Savings): Post Office schemes are among the most trusted safe investments in India. These include PPF, NSC, KVP, SCSS, Sukanya Samriddhi Yojana, and Post Office Fixed or Recurring Deposits. All National Savings products carry a sovereign guarantee, meaning both principal and declared interest are backed by the Government of India.

Bank Fixed Deposits and RBI Bonds: Bank Fixed Deposits remain a popular choice among teachers due to their simplicity and accessibility. Deposits in scheduled banks are insured up to ₹5 lakh per bank, which makes them a reasonably safe investment, especially when spread across banks. While interest is taxable and returns may be modest, the safety trade-off is acceptable for many conservative investors.

For those seeking higher safety with better returns, RBI Floating Rate Savings Bonds stand out. Issued on behalf of the Government of India, these bonds offer periodic interest resets and carry a complete sovereign guarantee on principal and interest. They suit teachers who want stability without exposure to market volatility.

Public Provident Fund (PPF): Worth special mention (even though it’s a small savings scheme) because many teachers swear by PPF. It’s a 15-year account, interest ~7% (tax-free), and you can extend it in blocks of 5 years. PPF is practically a default safe investment for anyone – it has tax benefits, can’t be touched by creditors, and is sovereign-backed. The long lock-in actually helps instill discipline. Many salaried folks treat PPF as a second retirement fund. For example, Anita, a 30-year-old tutor, puts a bit of her surplus each year into PPF knowing it’s for her post-retirement life. She doesn’t mind that it’s locked in, because that money is truly for the long haul. The fact that even in 15 years, she’s guaranteed to get all her money plus accumulated interest (compounded annually) from the government gives her confidence. It’s like planting a tree for the future – slow growing, but one day it provides a lot of shade!

National Pension System (NPS) – for additional retirement savings: Apart from mandatory NPS for government employees, even private teachers and individuals can voluntarily invest in NPS. While not “guaranteed” (because it invests in markets), it is highly regulated and has the benefit of government oversight and low costs. The NPS Trust, under PFRDA, manages the funds transparently and your account is accessible online. Many consider NPS safe from a regulatory standpoint – your money can only go where it’s allowed by guidelines, mainly in government bonds, corporate bonds, and some equity (if you choose). There’s no swindling of funds. This gives a sense of security that even if markets fluctuate, the system is not a scam; plus at retirement, it converts into a pension (annuity) which can feel like a secure income stream. If you’re a teacher thinking of long-term planning, NPS can be a supplement to your PF – but keep in mind the value can fluctuate in the short term. It’s safe in terms of governance, but not risk-free in terms of market ups and downs.

Bottom line: India offers a suite of trusted, low-risk investment schemes ideally suited for conservative savers. They might have various names and purposes, but all share the theme of capital safety. Whether it’s a Post Office scheme, a provident fund, or a government bond, these instruments let you grow your money with minimal anxiety. As an educator, you can focus on your teaching and family, while these investments quietly work in the background, securing your future.

Before choosing any option, always run it through the safety checklist above — because for teachers, peace of mind is the real return.

Jagan Singh is a school leader and financial literacy educator who writes for teachers and salaried Indians. He has completed the Financial Literacy Course for Bharat conducted by NISM (National Institute of Securities Markets), a capacity-building initiative of SEBI (Securities and Exchange Board of India), and focuses on clarity, risk awareness, and long-term financial thinking.

Disclaimer: The content shared on Chalk2Wealth is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to consult qualified professionals before making financial decisions.