Table of Contents

ToggleHow to Buy Sovereign Gold Bonds (SGBs) Online in 2026 – Step-by-Step Guide for Indian Investors

Sovereign Gold Bonds (SGBs) are a safe, government-backed way to invest in gold without holding physical metal—but buying them online isn’t always straightforward. They are not available every day, prices can vary, and many first-time investors are unsure whether to buy during an RBI issue or from the stock market.

If you’re searching for how to buy sovereign gold bonds online in 2026, this step-by-step guide focuses on exactly that—when you can buy SGBs, where to buy them online, and how to avoid common mistakes like overpaying or choosing the wrong route. For a broader perspective on gold as an asset, you may also find it useful to explore our guide on how to invest in gold smartly in 2026 and build a strong portfolio.

In this guide, you’ll learn what SGBs are, how RBI issue windows work, how to buy SGBs from the stock market when new issues are closed, and how to evaluate prices before placing an order. If you’re completely new to digital investing, our beginner guide on how to invest in gold online in India can help you get comfortable before you begin.

By the end, you should be able to open your net banking or trading app and confidently place an SGB order—knowing exactly what you’re buying and why.

Updated for 2026 | Based on RBI rules

What Are Sovereign Gold Bonds (SGBs) — and Why Buying Them Online Makes Sense

SGBs are government securities denominated in grams of gold, issued by the Reserve Bank of India on behalf of the Government. In simple terms, they are an alternative to holding physical gold, offering you the market value of gold at redemption plus periodic interest. Like other long-term, safety-oriented instruments such as PPF, where withdrawal rules and timelines matter, understanding how and when you can access your money is important—something we’ve explained in detail in our guide on PPF rules for withdrawal in 2026. Key features include:

| Feature | Details |

|---|---|

| Backed by Government | SGBs are government-issued bonds with a sovereign guarantee. Remember that you don’t hold physical gold—the value tracks gold prices. |

| Denomination | Issued in 1 gram units and multiples (minimum 1 gram). As part of how to buy sovereign gold bonds online, payment is made online and redemption is in cash, not physical gold. |

| 8-Year Tenure | SGBs have an 8-year maturity with premature redemption allowed after 5 years on interest dates for those who buy sovereign gold bonds online. |

| 2.5% Annual Interest | SGBs pay 2.50% annual interest, credited semi-annually, in addition to gold price appreciation. |

| No Storage or Purity Worries | Since there is no physical gold, investors avoid storage, theft, making charges, and purity issues—one reason many choose how to buy sovereign gold bonds online. |

| Tax-Free at Maturity | Capital gains at maturity (after 8 years) are tax-free for individuals, making sovereign gold bonds attractive for long-term investors. |

| Issued at Market Price of Gold | SGBs are issued at market-linked gold prices and redeemed at prevailing prices, ensuring full value for investors who buy sovereign gold bonds online. |

In summary, Sovereign Gold Bonds let you invest in gold in a digital, paper form with guaranteed gold pricing, periodic interest, and none of the drawbacks of physical gold like storage or purity issues. This combination of gold’s upside and fixed interest (plus a tax-free payoff) makes SGBs an attractive option for long-term investors looking for safety and returns. For official details and clarification, investors can also refer to the RBI’s Sovereign Gold Bond FAQs.

When Can You Buy Sovereign Gold Bonds Online?

One key thing to understand about how to buy sovereign gold bonds online is that new SGBs are not available all the time. The RBI issues SGBs only in limited tranches. When a tranche is announced, subscriptions remain open for a short window (usually about a week). During this period, you can apply online through banks or broker platforms. Once the window closes, no fresh SGBs are issued until the next tranche. However, you are not restricted to RBI issue periods only. Even when no new tranche is open, you can still buy SGBs online from the stock exchange (secondary market). Previously issued SGBs are listed on NSE and BSE and can be bought or sold anytime like shares.

Current situation : As of early 2026, no new SGB tranche has been announced, so investors looking at how to buy sovereign gold bonds online in 2026 will mainly use the stock exchange route unless fresh issuances resume.

In short: You can buy SGBs online either during RBI issue windows or anytime from the stock market, making them accessible throughout the year if you know the right route. SGBs are also considered among the safer investment options in India, especially for long-term investors focused on stability and inflation protection.

How to Buy Sovereign Gold Bonds Online in India (Step-by-Step) During an RBI Issue

When the RBI opens a fresh issue, how to buy sovereign gold bonds online becomes very simple. During the subscription window, you can apply through three main routes:

- Through Net Banking (SBI, HDFC, ICICI, Axis, etc.): Log in to your bank’s net-banking portal, go to the Sovereign Gold Bond section, enter the quantity (minimum 1 gram), add nominee details, and confirm payment. You can hold SGBs in demat or certificate form. A key benefit of buying SGBs online is the ₹50 per gram discount offered by RBI for digital payments.

Through RBI Retail Direct Portal: You can also buy SGBs directly from RBI by opening a Retail Direct (RDG) account. Once registered, select the open SGB issue, place your order, and pay online. This route also qualifies for the ₹50/gram online discount.

Through Broker Platforms (Zerodha, Groww, ICICI Direct, etc.): Most brokers allow you to apply for new SGB issues through their apps. Select the SGB issue, enter grams, and submit your bid. After allotment, the bonds are credited to your demat account—usually within 2–3 weeks.

Important to remember: No matter which method you use, allotment happens after the issue closes, not instantly. Interest starts accruing from the issue date and is paid every six months to your bank account.

In short: During an RBI issue window, how to buy sovereign gold bonds online is as easy as making an online payment—just don’t forget the ₹50/gram digital discount. If this is your first time applying through net banking or a broker, understanding the basics of investing in gold online in India can make the SGB buying process much easier and more confident.

How to Buy SGBs from the Stock Market (Secondary Market)

If no fresh RBI issue is open, how to buy sovereign gold bonds online becomes even more relevant through the stock market route. Once issued, SGBs are listed on NSE and BSE and can be bought anytime, just like shares.

What you need

- A demat + trading account with a broker (Zerodha, Groww, ICICI Direct, etc.)

- One unit = 1 gram of gold

Simple steps to buy

- Log in to your trading app.

- Search for “SGB” (you’ll see multiple series with different maturity years).

- Choose the series you want based on maturity.

- Place a buy order (market or limit).

- After T+2 days, the SGB appears in your demat account.

Key things to know

- Interest continues: If you buy from the exchange, you still receive the 2.5% interest going forward.

- Prices vary: Some SGBs trade at a discount or premium to gold price depending on demand and maturity.

- Liquidity matters: Use limit orders as some series have low trading volume.

- Exit anytime: You can sell SGBs on the exchange before maturity, or hold till maturity for RBI redemption. Like other long-term investments with defined withdrawal rules, SGBs work best when you are clear about your holding period and liquidity needs.

In short:

When no RBI issue is available, the stock exchange is the easiest way to buy SGBs online—just ensure you’re paying a fair price. While SGBs are a strong option for long-term investors, they are just one of the different ways to invest in gold, each suited to different goals and time horizons.

Conclusion: Take Action with Confidence

Updated for 2026 | Based on RBI rules

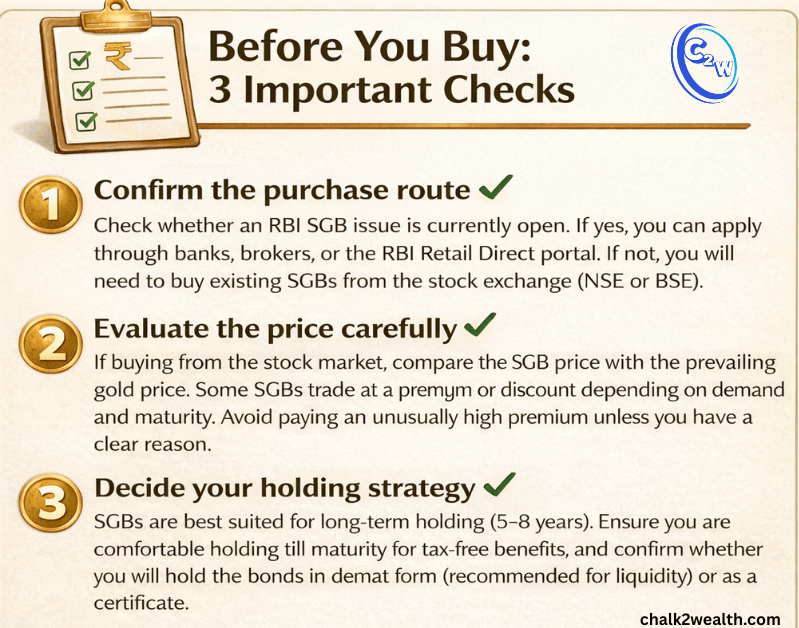

This was a money-action guide—so you now know exactly how to buy sovereign gold bonds online with clarity and confidence. To recap briefly: SGBs offer government-backed gold exposure, 2.5% annual interest, no storage or purity worries, and tax-free gains at maturity. You can buy them during RBI issue windows via net banking or brokers, or anytime from the stock market when fresh issues aren’t available.

Your next step is simple:

Decide why you’re investing (retirement, child’s education, long-term stability), allocate a sensible portion to gold (typically 5–15%), and start—even with 1 gram. Monitor RBI announcements, use the secondary market when needed, and aim to hold till maturity to maximize tax benefits.

If after reading this you can open your Zerodha app or Your net banking and confidently place an SGB order—knowing what you’re buying and why—then this guide has done its job.

Happy investing, and may your gold investments truly shine.

About The Author

Jagan Singh is a school leader and financial literacy educator who writes for teachers and salaried Indians. He has completed the Financial Literacy Course for Bharat conducted by NISM (National Institute of Securities Markets), a capacity-building initiative ofSEBI (Securities and Exchange Board of India), and focuses on clarity, risk awareness, and long-term financial thinking.

Disclaimer: The content shared on Chalk2Wealth is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to consult qualified professionals before making financial decisions.