Table of Contents

ToggleSovereign Gold Bonds: How to Check If an SGB Is Expensive or Cheap Before You Buy

Sovereign Gold Bonds (SGBs) are unique gold-linked investments issued by the Government of India. Each bond represents 1 gram of gold and pays a fixed 2.5% annual interest on the initial issue price. At maturity (8 years), you get back the bond’s value equivalent to the prevailing gold price — and this redemption gain is tax-free for individuals.

But here’s where many investors go wrong: the price you pay for an SGB today may be higher or lower than the actual gold price. Buy blindly, and you could lock in a poor deal for years.

Given these perks, Sovereign Gold Bonds (SGBs) often trade at prices different from the current gold market price — sometimes at a premium, sometimes at a discount. If you’re thinking about how to invest in gold smartly in 2026 as part of a strong, balanced portfolio, understanding whether an SGB is expensive or cheap becomes critical. How do you check that before you buy? Let’s break it down.

Why Sovereign Gold Bonds (SGBs) Prices Don’t Match the Actual Gold Price

Issue Price vs Market Price

When Sovereign Gold Bonds are first issued, their price is fixed by the Government of India, in consultation with the Reserve Bank of India, based on the prevailing gold price at that time. The issue price is calculated using the average closing price of 999-purity gold published by the India Bullion and Jewellers Association for the preceding few days, as notified through official PIB releases.

For example, if gold is trading around ₹5,500 per gram during an issue, the Sovereign Gold Bonds (SGB’s) face value will also be close to ₹5,500 per gram (with an additional ₹50 per gram discount for online subscribers). Once issued, SGBs are listed on stock exchanges and can be freely bought or sold. From this point onward, their market price is no longer fixed and may differ from the live gold price due to several factors.

Key Reasons Sovereign Gold Bonds (SGB’s) Prices Differ from Gold Prices

- Gold Price Movements SGB prices broadly move in line with gold because their redemption value is linked to the prevailing gold price. When gold prices rise or fall, SGB prices usually follow the same direction.

- Accrued Interest Benefit: Unlike physical gold, SGBs pay 2.5% annual interest (paid semi-annually) on the bond’s face value. This makes an SGB effectively “gold plus interest.” Because of this extra return, investors are often willing to pay a small premium over the pure gold price.

- Tax Advantage at Maturity: For individual investors, capital gains on SGB redemption are completely tax-free. This powerful benefit increases the perceived value of SGBs. Many investors are comfortable paying a higher market price knowing that any appreciation in gold value will not be taxed at maturity.

- Demand, Supply, and Liquidity: SGB supply is limited to the tranches issued by the government. When fresh issuances are paused and investor demand remains strong, scarcity can push prices well above the spot gold price. In contrast, lower demand or poor liquidity can cause some SGBs to trade at a discount.

At times of strong demand and limited supply, investors have paid significant premiums over spot gold for certain SGBs, driven by the combined appeal of interest income and tax-free redemption. Such market dynamics can push SGB prices far above the current gold price.

Bottom Line

Sovereign Gold Bonds (SGBs) prices differ from the actual gold price because they offer more than just gold exposure. Interest income, tax benefits, and market demand–supply forces all add extra value. That is why an SGB may trade at a premium or discount compared to gold at any given time. Understanding these pricing differences is essential if you want to invest in gold smartly in 2026 as part of a strong portfolio, rather than buying gold-linked products blindly.

Next, let’s see how to evaluate whether a specific SGB is fairly priced or overpriced before you buy — and if you decide it makes sense, here’s a clear step-by-step guide on how to buy Sovereign Gold Bonds (SGBs) online in 2026.

How to Calculate the Fair Value of a Sovereign Gold Bond(SGB) (Step-by-Step)

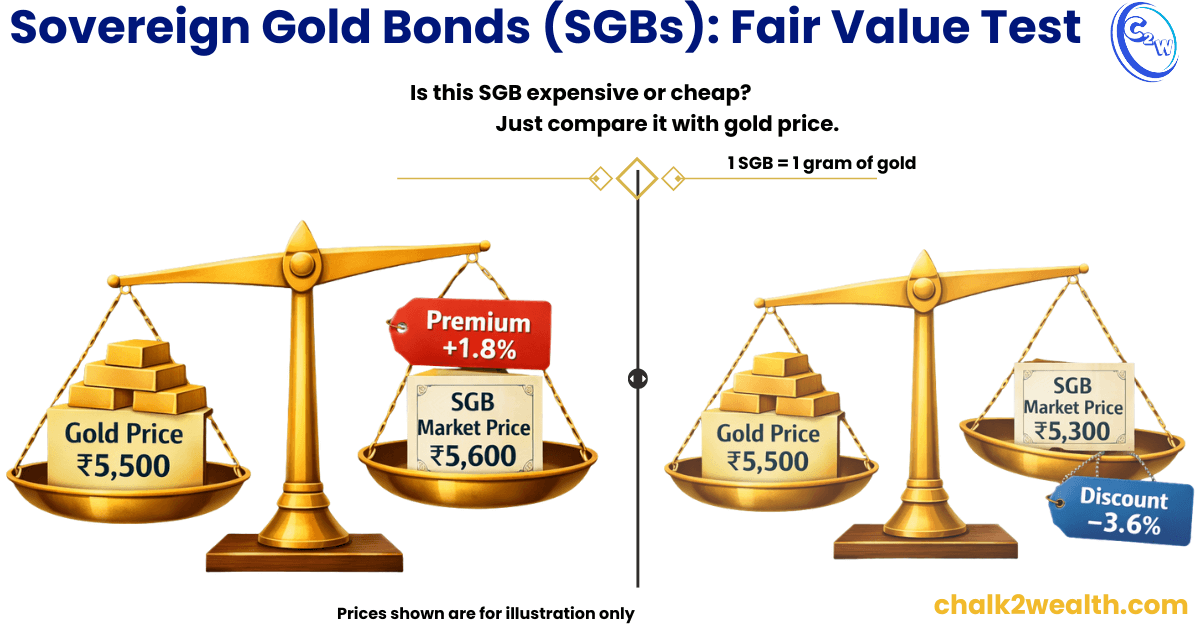

You don’t need complex formulas to judge whether Sovereign Gold Bonds(SGBs) are expensive or cheap. A simple comparison works.

Step 1: Check the current gold price (per gram)

Look up today’s 24k gold price per gram using a reliable source (RBI reference or IBJA rate).

Example: Gold is trading at ₹5,500 per gram.

Step 2: Check the Sovereign Gold Bond’s market price

Find the latest trading price of the specific Sovereign Gold Bond on the stock exchange (1 SGB = 1 gram).

Example: The Sovereign Gold Bond is trading at ₹5,600.

Step 3: Identify premium or discount

Compare the two prices.

- ₹5,600 vs ₹5,500 = ₹100 premium (~1.8%)

- ₹5,300 vs ₹5,500 = ₹200 discount (~–3.6%)

At times of high demand, some Sovereign Gold Bonds have traded 20–25% above gold prices, making this comparison crucial.

Step 4: Add remaining interest value

Sovereign Gold Bonds pay 2.5% annual interest on the original issue price, not on what you pay in the market.

Example:

- Issue price: ₹5,000

- Years left: 3

- Annual interest: ₹125

- Total remaining interest: ₹375

This interest is additional income on top of the gold value.

Step 5: Estimate fair value

A simple fair value estimate for Sovereign Gold Bonds is:

Current gold price + remaining interest value

Example:

₹5,500 (gold) + ₹375 (interest) = ₹5,875

- If a Sovereign Gold Bond trades below ₹5,875, it is relatively cheap

- If it trades well above this, it is expensive

Once you’ve checked that an SGB is fairly priced, the next step is execution — here’s a step-by-step guide on how to buy Sovereign Gold Bonds online so you can invest correctly.

Important note on yield:

If you buy Sovereign Gold Bonds at a premium, the effective return from the 2.5% interest falls.

Buying at a discount improves your effective yield.

When You Should Avoid Sovereign Gold Bonds (SGBs) Completely

Not every Sovereign Gold Bond is worth buying. Avoid Sovereign Gold Bonds (SGBs) in the following situations:

1. High Premium Over Fair Value: If an SGB is trading well above its fair value (current gold price + remaining interest), it’s a poor deal. Paying ₹1,000 or more extra when only limited interest remains makes recovery unlikely unless gold prices rise sharply.

2. Near Maturity but Still Overpriced: Sovereign Gold Bonds close to maturity should trade close to the gold price. If a high premium persists, the remaining interest may not compensate for the extra amount paid.

3. Low Liquidity or Market Hype: Illiquid SGBs or those driven by temporary demand can trap investors. When market enthusiasm fades, selling without a loss may become difficult.

4. Short Investment Horizon: If you may need funds within five years, Sovereign Gold Bonds are unsuitable. Early exit through exchanges may force you to sell at a discount, as liquidity can be limited. In such cases, Gold ETFs or other online gold options offer better flexibility. If you’re unsure which option fits your needs, this beginner guide on how to invest in gold online in India explains the alternatives step by step.

Bottom Line: Avoid Sovereign Gold Bonds that are significantly overpriced, especially near maturity or if you cannot hold them long term. Paying more today for lower returns later can lock in losses unless gold prices surge.

Final Decision Framework: Should You Buy This Sovereign Gold Bond (SGB)?

- Check the price: Compare the Sovereign Gold Bond’s market price with current gold price + remaining interest.

- Buy only if fair: If the Sovereign Gold Bond trades at or below this value, it’s reasonably priced.

- Avoid the hype: Skip Sovereign Gold Bonds with large premiums, especially those close to maturity.

- Think long term: Sovereign Gold Bonds reward patience—buy smart, hold till maturity, and let gold and tax-free returns work together.