Table of Contents

ToggleBudgeting for Teachers in 2025: Smart Moves vs Money Traps

Teaching is a noble profession — but noble doesn’t pay the rent.

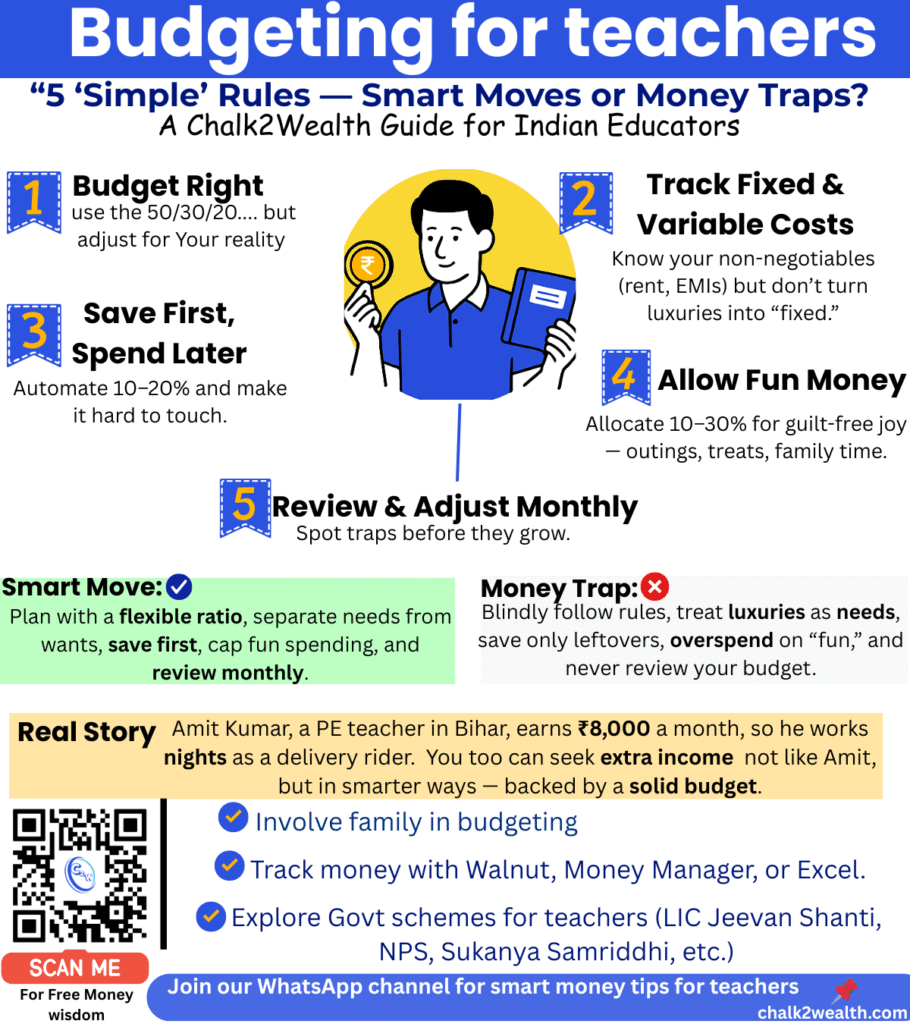

Just ask Amit Kumar, a physical education teacher in Bihar earning ₹8,000 a month. His evenings? Spent delivering food to make ends meet. “I never imagined I would be doing this,” he says. Sadly, Amit’s story isn’t rare. Across India, many private school teachers bring home ₹15,000–₹22,000 a month, and even government starters (~₹42,600) aren’t exactly lounging on financial cushions.

The bitter truth? Your income matters — but how you manage it matters more. And while budgeting is supposed to be the savior, some so-called “simple” rules can either make you financially stronger… or quietly push you into a money trap.

At Chalk2Wealth, we’ve seen this pattern again and again:

- In Financial Literacy, Charak SAHAB? Are You Foolish — Talking Money to the Nation’s Smartest?, we explored why even the most educated minds fall prey to money mistakes — and how to fix them.

- In 5 Money Myths That Keep Teachers Broke — And the Truths That Build Financial Freedom, we exposed the false beliefs that quietly drain your wallet.

- And in Good Life Insurance in India: 5 Powerful Rules to Choose, we showed how to pick a policy that protects your family — without wasting money.

Today, we’re playing financial detective. Are these 5 budgeting rules actually smart moves… or cleverly disguised money traps? Let’s find out.

Budgeting Rule #1: “Follow the 50:30:20 Rule” — Smart Structure or Lazy Shortcut?

The classic breakdown:

- 50% → Needs (rent, groceries, utilities, school supplies)

- 30% → Wants (dining out, movies)

- 20% → Savings or debt repayment

Smart Move: If you’ve never budgeted before, this framework gives you a quick, workable starting point. Example: On ₹30,000 take-home, that’s ₹15,000 for needs, ₹9,000 for wants, and ₹6,000 for savings/debt payoff.

Money Trap: Blindly sticking to this ratio without looking at your actual expenses can backfire. If your rent alone eats 40% of your pay, you’ll either overshoot the “needs” category or starve your savings.

Teacher Tip: Treat 50:30:20 as a guideline, not gospel. Adjust it for your real life.

Budgeting Rule #2: “List Your Fixed Expenses” — Smart Priority or Comfort Zone Trap?

Your fixed expenses are your non-negotiables: rent, fuel, EMIs, insurance, children’s school fees.

Smart Move: Listing them ensures you never miss essentials and gives a clear baseline for budgeting.

Money Trap: Declaring too many things as “fixed” locks your cash flow.

Example: If DTH subscription, multiple OTT apps, and premium gym memberships are all in your “fixed” list, you’re defending luxuries as necessities.

Teacher Tip: Challenge each “fixed” item. Ask: If my salary dropped tomorrow, would I still keep this?

Budgeting Rule #3: “Budget for Variable Costs” — Smart Planning or Sneaky Leak?

Groceries, power bills, commuting, mobile data — they fluctuate, but patterns exist.

Smart Move: Reviewing the last 2–3 months’ expenses helps you estimate realistically and avoid end-of-month panic.

Money Trap: If you base next month’s grocery budget only on the lowest spend month, you’ll overshoot and dip into savings.

Teacher Tip: Always budget slightly higher than your average for variables. Surplus? Roll it into savings.

Budgeting Rule #4: “Pay Yourself First” — Smart Habit or Illusion of Saving?

The golden advice: transfer 10–20% of income to savings or investments before spending.

Smart Move: Automation removes temptation. Mutual fund SIPs, recurring deposits, or goal-based accounts build wealth in the background.

Money Trap: If you “pay yourself first” but later pull that money out for mid-month expenses, you’re fooling yourself.

Teacher Tip: Keep savings in an account that’s slightly inconvenient to access — your future self will thank you.

Budgeting Rule #5: “Budget Fun Money” — Smart Sanity or Spending Spiral?

Allowing 10–30% of your income for joy — movies, dining out, hobbies — keeps life enjoyable.

Smart Move: Guilt-free fun money prevents burnout and helps you stick to the budget long-term.

Money Trap: Overshooting fun money, or treating every “want” as mental health spending, erodes savings fast.

Example: Sunita Ma’am discovered her “self-care” category was actually mostly snacks and impulse online shopping.

Teacher Tip: Cap it and track it. Missed a treat this month? Roll it over to the next — delayed joy tastes sweeter.

Budgeting Together: Team Sport or Solo Struggle?

A budget isn’t a punishment — it’s a roadmap. But like any class project, it works better when everyone is on the same page. Involve your spouse, explain to older children why certain expenses are cut, and set collective goals.

Budgeting FAQs for Teachers in 2025: Smart Moves vs Money Traps

Q1. What is the 50:30:20 rule?

- Smart Move: It’s a simple budgeting formula where 50% of your income goes to needs, 30% to wants, and 20% to savings. Great for beginners who need a quick framework.

- Money Trap: Teachers often have higher “needs” like rent, school fees, and EMIs. If these alone eat up 60–70% of income, blindly following 50:30:20 can leave you frustrated or under-saving.

Q2. What are the benefits of budgeting?

- Smart Move: Budgeting gives teachers control over money. It prevents mid-month borrowing, ensures fees and EMIs are paid on time, and builds savings for goals like children’s education. Most importantly, it reduces stress.

- Money Trap: Budgeting becomes a punishment if you treat it as rigid rules instead of flexible planning. Over-restricting yourself may cause burnout and overspending later.

Q3. What is the 70:20:10 (or 70:20:30) rule?

- Smart Move: This method allocates about 70% of income to daily living, 20% to savings, and 10% to giving/charity. For higher earners, it creates balance between personal needs and social responsibility.

- Money Trap: For a teacher earning ₹15–20k, putting 10% into charity before building an emergency fund may weaken financial stability. It works only when your basics and savings are already secure.

Q4. Which budgeting method is best for teachers in India?

- Smart Move: Teachers with fixed salaries do well with priority-based budgeting — first cover essentials (rent, school fees, EMIs), then automate savings (SIP, RD), and keep a small “fun money” allowance. This keeps life balanced and goals on track.

- Money Trap: Blindly copying Western formulas (like 50:30:20) or over-relying on short-term fixes (credit cards, advance salary apps) can leave teachers stuck in a debt cycle, especially during summer breaks or festival expenses.

Final Bell: The Verdict

Every budgeting rule can be a smart move or a money trap — the difference is awareness.

Don’t just follow rules. Test them against your reality. Adjust. Repeat.

Because in the classroom, you teach your students to think critically.

In your finances, you deserve the same.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.