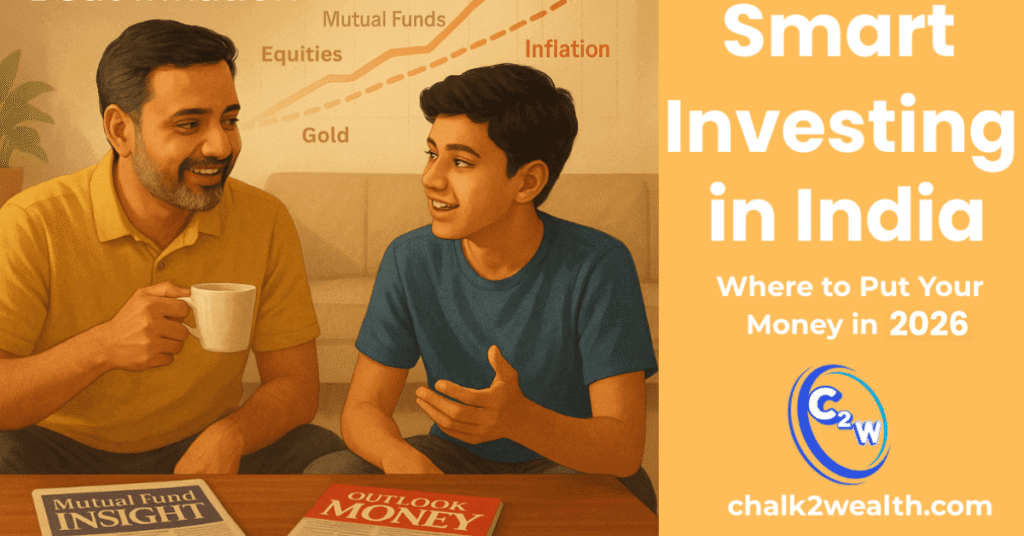

Invest Money Where: 7 Rules to Win the Investing Marathon

Invest Money Where — that’s the question every middle-class saver in India struggles with. Should you stick to fixed deposits, try SIPs, or balance between safety and growth? The truth is, investing isn’t a sprint; it’s a marathon. This guide distills 7 timeless rules — from starting early, building an emergency fund, to staying disciplined with SIPs — that show you exactly where to invest money to beat inflation and build steady long-term wealth.