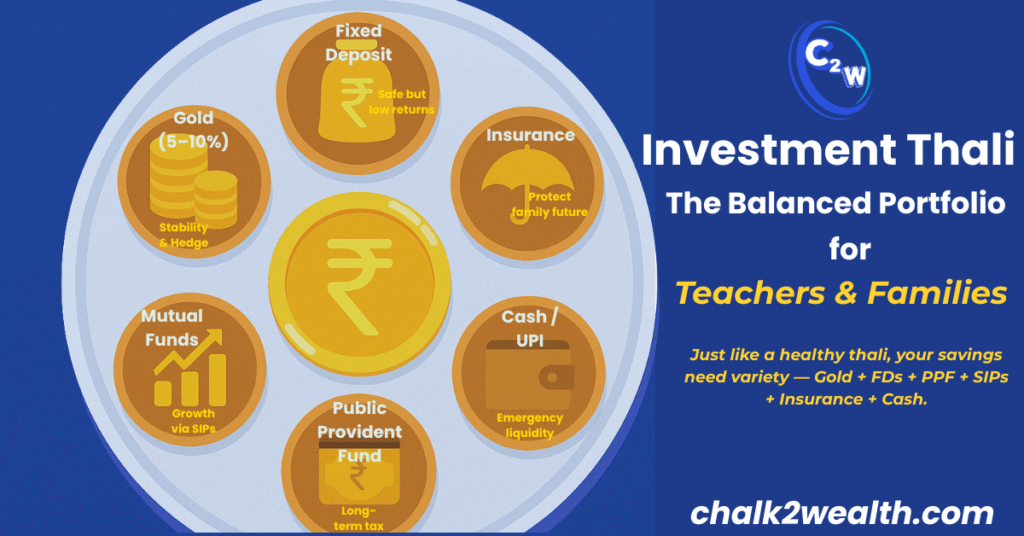

Gold Investment: How Much Gold Should Be in a Smart Investor’s Portfolio?

Gold isn’t just jewellery—it’s the stabiliser of your investment thali. A smart portfolio keeps only 5–10% in gold for balance, safety and inflation protection. Here’s how teachers can build a perfect “Investment Thali” with gold, SIPs, PPF, insurance and emergency funds.