Table of Contents

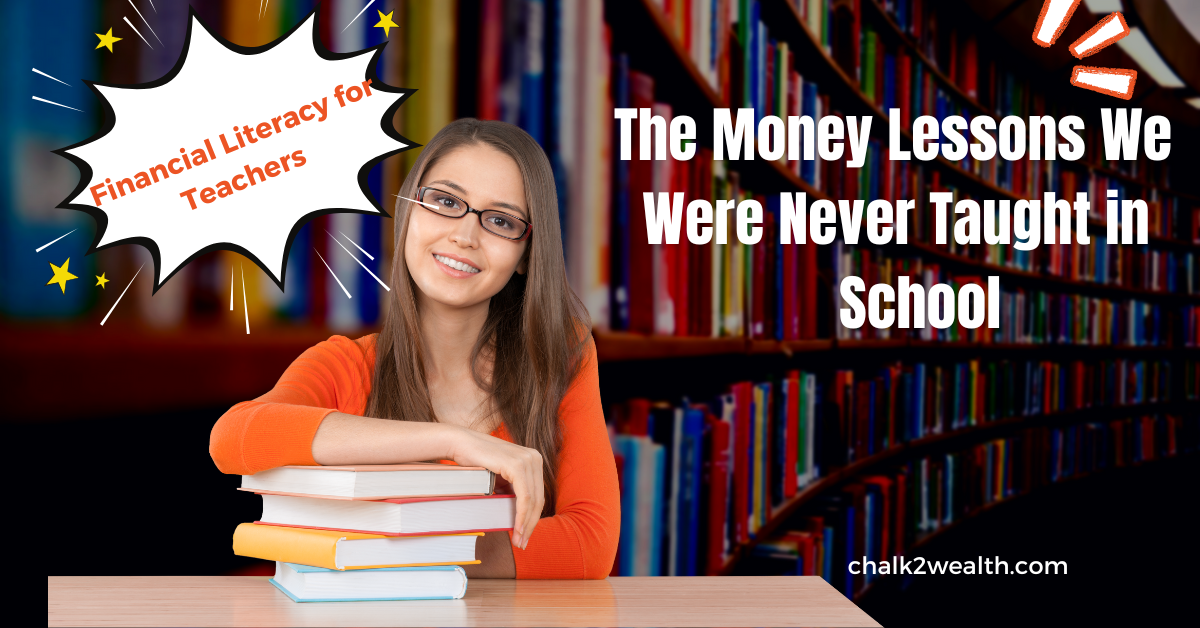

ToggleFinancial Literacy for Teachers: Powerful Lessons They Never Taught Us in School

We step into classrooms every day to shape young minds, guide futures, and build a better world. But there’s one lesson no one ever taught us — not in school, not in our training, not in our staff rooms.

The lesson of financial literacy.

We’ve mastered lesson plans, morning assemblies, and student results. But when it comes to our own money, many of us are quietly struggling — guessing, hoping, surviving.

This is the conversation we’ve missed for too long.

And it’s time to have it — for ourselves, for our families, and for the students who are watching us more closely than we think.”

1. The Harsh Truth: Why Financial Literacy for Teachers Is Often Ignored

Let me share something personal — I’m Jagan Charak, a school head, a father, and a lifelong learner.

But I wasn’t always a learner when it came to money. I quietly struggled, not because I was careless — but because no one ever taught me how to manage my own money.

I was busy shaping classrooms and guiding students, but deep inside, I was financially lost. Like many teachers, I believed my salary, yearly increments, and Provident Fund would be enough. But life taught me otherwise.

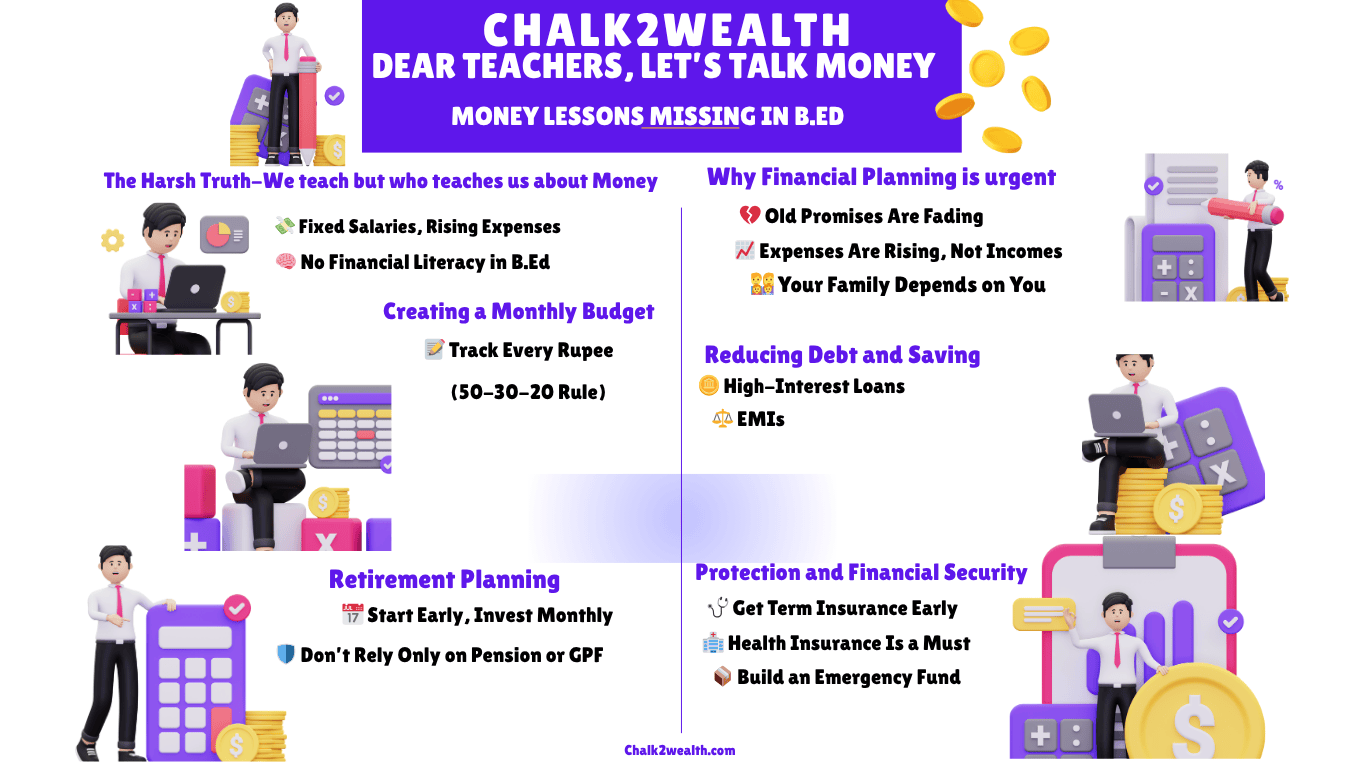

No one ever taught us basic money skills — not in school, not in B.Ed classes, not in staff meetings. Financial literacy for teachers? It was never on the timetable. We can explain algebra and history, but most of us — including me — were just guessing when it came to managing our own money.

For years, I worked hard but was financially unaware.

Then life happened — unexpected medical bills, rising school fees, and growing family needs.

That’s when I realised:

👉 Hard work alone is not a financial plan.

👉 Financial literacy for teachers is not optional. It’s essential.

When I finally started learning, I discovered:

✔️ I could start a SIP on a ₹15,000 salary.

✔️ I could build a small emergency fund.

✔️ I could plan for my family’s future with confidence.

That’s why I started Chalk2Wealth — so no teacher has to feel as unprepared as I once did.

Let’s begin this journey together. It’s time to learn for ourselves.

Why Even the Most Dedicated Teachers Struggle Financially

Let’s be honest — teachers are among the most dedicated people.

We guide students, manage schools, support families, and still show up with purpose. We work for the mission, not for money. But somewhere, we forgot to build our own financial future. That’s why many teachers silently struggle. We were told to study hard and get a stable job. But no one taught us about saving, investing, or planning for emergencies.

👉 We manage students, but no one taught us to manage money.

Most teachers rely on small, fixed salaries. Expenses rise. EMIs, school fees, and family needs pile up.

But financial literacy for teachers is missing — from our B.Ed, our meetings, and our system.

We believe: “My PF and pension will be enough.”

But life’s costs tell a different story. We work hard, yet live paycheck to paycheck, quietly stressed.

I’ve felt that stress. I’ve lived those months. Not because we failed — but because no one ever taught us.

But we can change this.

👉 By learning simple money skills.

👉 By starting small, but starting now.

Financial literacy for teachers is not a luxury — it’s our right.

Let’s build a stronger future — for our students and for ourselves.

For years, we’ve been told:

“Teaching is a noble profession. You don’t need to worry much about money.”

But life doesn’t work that way.

We also have families, responsibilities, and dreams that need financial planning.

Personal finance isn’t a luxury for us — it’s a necessity.

When I finally started learning about financial literacy for teachers, I realised that peace of mind is just as important as job satisfaction.

👉 Financial security isn’t extra. It’s essential for living with dignity.

We can’t just depend on small yearly increments or believe that PF and pension will cover everything.

Expenses are rising — school fees, medical bills, daily costs — but salaries often remain tight.

Financial literacy for teachers matters because it gives us the confidence to face life’s challenges without fear.

When we understand our finances,

✔️ We stop living paycheck to paycheck.

✔️ We start saving with purpose.

✔️ We build simple systems that create long-term security.

Financial literacy helps us live with freedom, not just obligation. It’s time to take that first step.

4. Our Children and Students Are Watching Us

We often think our students and children only listen to what we say — but they also watch how we live. If we constantly struggle with money, worry about expenses, and live without a plan, they notice.

👉 What we model, they inherit.

Financial Literacy for Teachers is not just for our peace of mind — it’s about setting the right example for the next generation. When we build smart money habits, they learn that money isn’t something to fear — it’s something to manage.

The way we handle our finances today quietly shapes their future mindset.

Let’s show them the lesson we were never taught.

5. Take Charge: Financial Literacy for Teachers Begins with Learning, Planning, and Action

For a long time, I believed that the system would prepare us.

Maybe through government workshops. Maybe through financial awareness sessions in our training classes. Maybe through the policies that promised us security.

But the truth is — no one is coming to teach us this. The system expects us to figure it out on our own.

It’s our responsibility now.

👉 To learn.

👉 To plan.

👉 To take action.

And this is exactly where Financial Literacy for Teachers truly begins.

It doesn’t require complex mathematics. It doesn’t require a financial background.

It starts with small, real steps:

✔️ Knowing where your money goes every month.

✔️ Starting a SIP, even with a small amount.

✔️ Building an emergency fund, no matter how little you can begin with.

✔️ Protecting your family with health insurance.

We already have the discipline to manage classrooms. We already have the patience to handle students. Now we just need the direction to handle our money.

Financial Literacy for Teachers isn’t about becoming rich — it’s about becoming ready.

Let’s not wait for a perfect time.

👉 The right time is now.

6. Who This Blog Supports: Financial Literacy for Teachers, Principals, and School Staff

This blog is not for financial experts. It’s not for stock market professionals. It’s not for people already building wealth.

This blog is for us — teachers, principals, and school staff — who are still figuring it out.

- Those who work hard, but still wonder where their salary disappears.

- Those who know how to manage a classroom but struggle to manage a monthly budget.

- Those who thought Provident Fund and pension were enough, until life showed otherwise.

Financial Literacy for Teachers is not about big money. It’s about small, smart steps for people like us who want:

✔️ To save taxes and increase in-hand salary.

✔️ To start SIPs and basic mutual fund investments.

✔️ To plan for children’s education and marriage.

✔️ To repay loans without suffocating the family budget.

✔️ To build side incomes or passive income without quitting teaching.

And most importantly — to live with peace of mind, not constant financial stress.

If you’ve ever thought:

“I wish someone had explained all this earlier.”

“I wish I knew where to start.”

“I wish I had better control over my money.”

👉 Then this is your space.

👉 Chalk2Wealth is your platform.

Because Financial Literacy for Teachers should be simple, relatable, and accessible. You don’t need complex advice. You need real stories from people who walk the same school corridors as you do.

You belong here. Let’s build this learning together.

I never thought I would talk about money. Like most teachers, I believed my salary, Provident Fund, and pension would be enough.

But life proved me wrong.

Unexpected expenses, rising school fees, and family responsibilities showed me I wasn’t financially prepared.

That’s when I realised — Financial Literacy for Teachers isn’t optional. It’s necessary.

I started learning, step by step:

✔️ Budgeting my salary

✔️ Starting small SIPs

✔️ Building an emergency fund

And now, through Chalk2Wealth, I want to share these simple, practical lessons with you — so you don’t have to figure it out alone.

Let’s walk this path together — from chalk to wealth.

So, where do we begin?

👉 We begin with budgeting.

In the next blog post, we’ll explore:

Money Saving Tips: 7 Budgeting Tips for Teachers I Learned from My Silent Staffroom Struggles

We’ll break down how teachers can:

✔️ Track their monthly income and expenses

✔️ Balance EMIs, savings, and daily needs

✔️ Build financial security — even on a limited salary

Financial Literacy for Teachers starts with knowing where your money goes.

You don’t need to earn more. You need to manage better. Let’s move forward together.

Your next step is waiting.

📣 Join the Chalk2Wealth Mission for Financially Empowered Educators

🎓 Are You a Teacher, School Leader, or Retired Educator?

Then this platform is made especially for you.

💌 Subscribe – and receive practical, real-life financial tips straight to your inbox.

📢 Share this blog – with fellow educators who rarely talk about money, but silently struggle.

💬 Comment below – What’s the one financial worry that keeps you up at night?

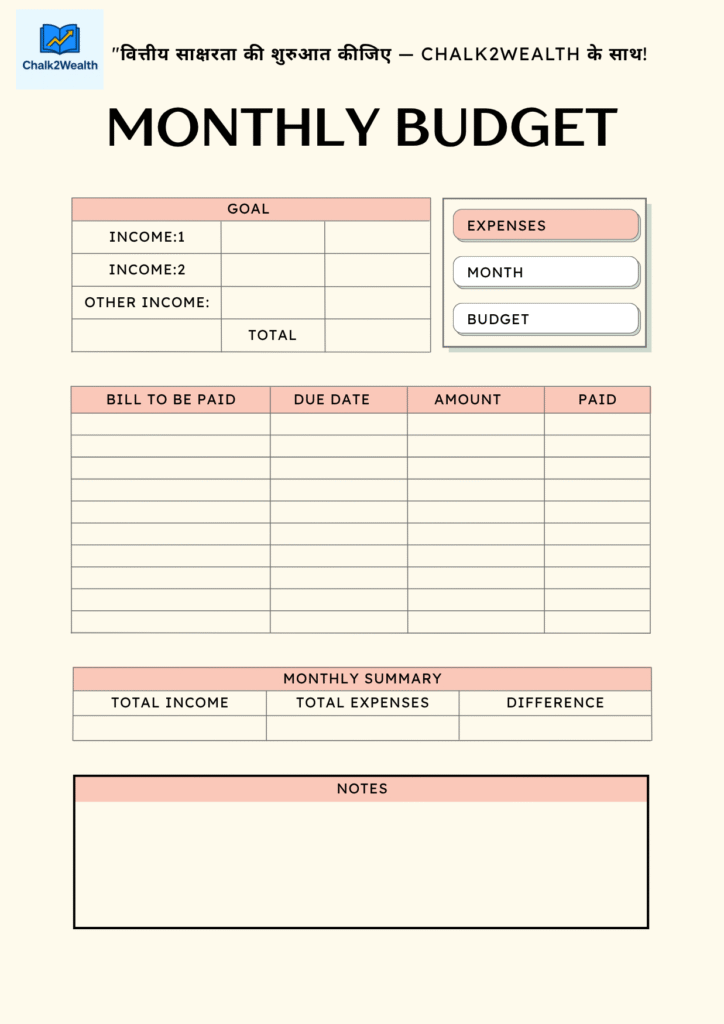

📌 Before you read the next post — take one small but powerful step.

👇 Download the worksheet below and begin your financial learning journey with Chalk2Wealth.

This worksheet is designed specifically for teachers — to help you understand your monthly income, expenses, and savings with clarity.

Let’s build a community where educators are not only respected — but also financially strong and secure. Because the stability and success we dream of for our students — we deserve that for ourselves, too.