Table of Contents

ToggleHow a School Leader and a Mother Built More Than Just a House

🏡Home Loan Protection Plan — The Powerful Decision That Saved My Family from a ₹70 Lakh EMI Stress

How a School Leader and a Mother Built More Than Just a House — With a Home Loan Protection Plan

🪵 A Love Story Built on Bricks and Belief — Jagan & Usha’s Dream

In the quiet hills of Himachal, amidst the rhythm of school bells and morning prayers, a young couple — Jagan and Usha Charak — held on to a shared dream.

Not of luxury. Not of fame.

But of something far more meaningful — a home full of laughter, learning, and love. A home built with hope, sacrifice… and eventually, secured with a Home Loan Protection Plan.

It was 2010 when we first stepped onto that empty plot of land — hand in hand, hope in our eyes, and very little in our pockets.

We didn’t see soil and stones. We saw rooms where our children would grow, walls that would witness our prayers, and a kitchen that would serve not just food — but memories.

By December 2011, that dream stood tall — our first home.

Modest, but full of soul.

But the story didn’t end there.

Driven by Usha’s deep passion for early childhood education — and my own calling as a school leader — we felt the urge to give back to the community.

And so, from within those same walls of love and effort, a new idea was born.

On 26th February 2012, we opened the doors of our very own preschool — lovingly named “Rising Star Play School.”

A place where tiny hands would first hold pencils…

Where hesitant first steps would turn into confident leaps…

Where every child was seen not just as a student, but as a rising star — ready to shine.

🧱 2014 – A Second Story, and a Storm in My Mind

By May 2014, our dreams had grown — and so had our home.

We built a second floor to accommodate not just more rooms, but more aspirations. The laughter of children echoed through the Rising Star Play School. Our family felt more rooted, more fulfilled. But with every brick added above, a quiet weight pressed deeper within me. Our total loan had now climbed to ₹70 lakh — a number that didn’t just reflect construction cost, but the sum total of my life’s risks.

One evening, after a long day of school inspections and fee follow-ups, I sat alone in the balcony, gazing at the starlit sky.

A thought, dark and uninvited, crept in:

“What if something happens to me tomorrow?”

“Would Usha be able to manage this huge EMI?”

“Would my children be forced to give up their home — their safe space?”

I had built walls strong enough to hold our laughter… But not strong enough to protect my family from life’s uncertainties.

That night, I barely slept. Because for the first time, I realised —

That night, I barely slept. Because for the first time, I realised —

I had built a home… but I had forgotten to protect it with something as essential as a home loan protection plan — not just for the bricks, but for the people inside.

🛡️ The Turning Point: One Decision That Gave Me Peace

The next morning, I left for school with my usual briefcase in hand — but my heart felt heavier than ever.

Usha stayed back to run Rising Star Play School, just like every other day — welcoming new parents, calming little ones, and mentoring her team with quiet strength.

To the world, we looked like a well-oiled machine. But inside me, a storm was brewing.

“What if I never return from duty one day?”

“Would Usha have to manage not just the school… but also a ₹70 lakh home loan — alone?”

That haunting thought stayed with me through the assembly, the roll calls, even while explaining chapters I’d taught a hundred times.

And that evening, I knew I couldn’t ignore it anymore. No more postponing. No more pretending.

I sat down — not as a school leader, but as a husband and father — and began searching for the one thing that could protect my family’s future if life took an unexpected turn:

A home loan protection plan.

The Harsh Truth: A Loan Can Uplift or Destroy — It Depends on One Thing

A ₹70 lakh home loan in 2014 was not just a number —

It was a massive responsibility, especially for middle-class government school teachers like us living on a fixed monthly salary.

Back then, it felt like we were walking on the edge of a sword.

On one side, that loan promised us a dream home — space for our children, pride in our work, and a better life.

But on the other side, we knew the truth no one talks about:

If something went wrong — even once — it wouldn’t just shake our finances. It could collapse our entire future.

And that’s not a dramatic thought — that’s the harsh reality for most Indian salaried families.

If the main earner dies unexpectedly without a Home Loan Protection Plan, the family doesn’t just lose a person —

They risk losing the very roof over their heads.

Imagine your child waking up not in your lovingly built home… but in a rented flat, confused and scared.

Imagine your spouse forced to shut down a school, a dream, a future — just to keep up with EMIs.

It’s terrifying — but it’s also avoidable.

All it takes is one timely and thoughtful step:

✅ Protect your loan with Term Insurance

✅ Add a Critical Illness Rider

✅ Choose a reliable Home Loan Protection Plan tailored for your income.

Because the best time to prepare… is before life tests you.

🛡️ The Masterstroke No One Saw — But My Family Will Thank Me For

People saw me building a two-story home.

Some admired the design. Some estimated the cost. Some even whispered with envy.

But no one noticed the most important construction — the one you can’t see from outside.

I wasn’t just building a house. I was quietly building a safety net.

While bricks went up and paint dried on walls, something else was happening behind closed doors — a silent, serious decision most people ignore… until it’s too late.

I didn’t post about it.

Didn’t mention it at family dinners.

But I told myself one thing:

“This house may stand tall because of my effort —

But it must remain standing, even if I’m not here to protect it.”

🔑 That’s when I made what I now call the smartest move of my financial life:

I bought a Term Insurance Policy from ICICI Prudential —

and added a Critical Illness Rider —

because death isn’t the only thing that can shake a family.

📋 What Did I Really Buy?

| 🧱 On Paper | 🛡️ In Reality |

|---|---|

| ₹70 lakh Term Cover | A future where my family never fears EMIs |

| Critical Illness Rider | A shield even while I’m alive but struggling |

| ₹2,375 Monthly Premium | Less than what I once spent on weekend outings |

A quiet promise saying —

“You can test me, life —

but you will not crush the people I love.”

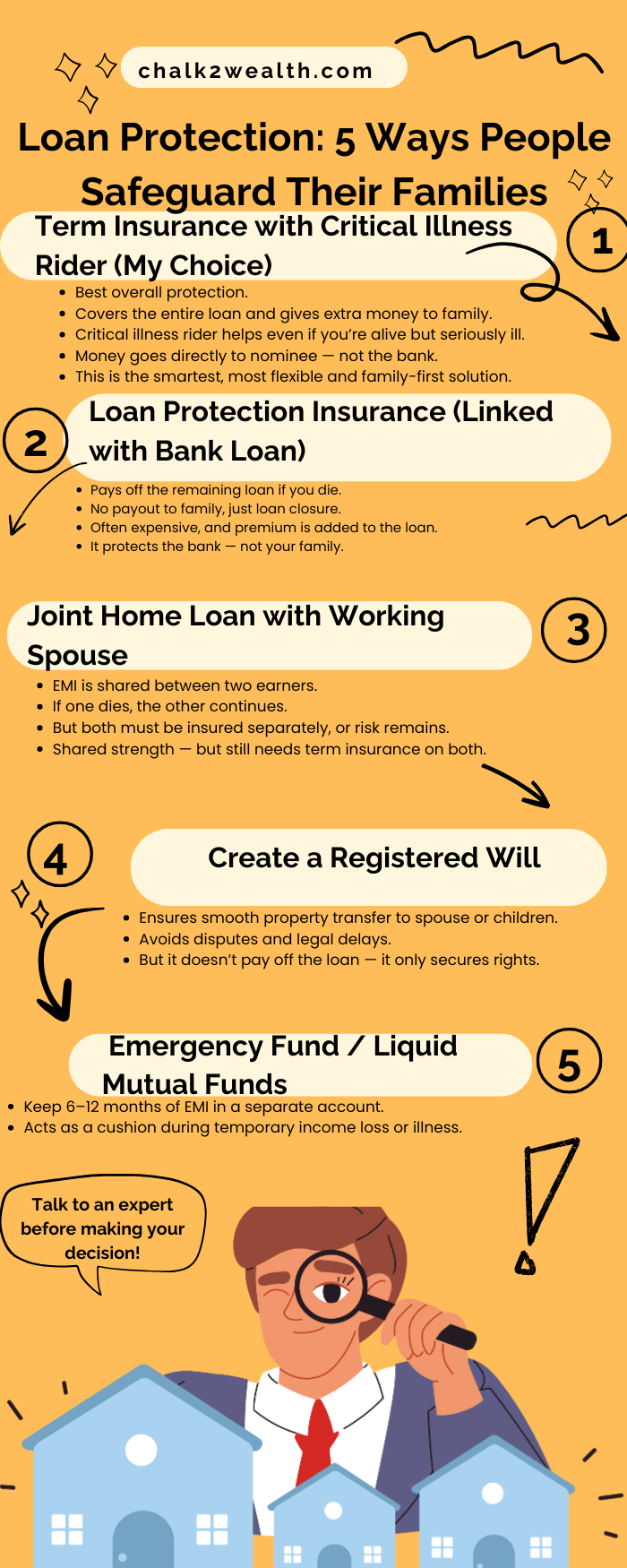

🛡️ Loan Protection: 5 Ways People Safeguard Their Families

Once I understood that my loan wasn’t just a financial number — it was a potential risk to my family’s peace, I began exploring how others manage this fear. And what I found was this:

Most people protect their car, their phone, even their water filter… But they forget to protect the biggest financial responsibility — their home loan.

Here are the 5 ways I discovered that people use to safeguard their families — only one of which truly gave me peace:

✅ 1. Term Insurance with Critical Illness Rider (My Choice)

Best overall protection.

-

Covers the entire loan and gives extra money to the family.

-

Critical illness rider helps even if you’re alive but seriously ill.

-

Money goes directly to nominee — not the bank.

🏦 2. Loan Protection Insurance (Linked with Bank Loan)

-

Pays off the remaining loan if you die.

-

No payout to family, just loan closure.

-

Often expensive, and premium is added to the loan.

👨👩👦 3. Joint Home Loan with Working Spouse

-

Pays off the remaining loan if you die.

-

No payout to family, just loan closure.

-

Often expensive, and premium is added to the loan.

📜 4. Create a Registered Will

-

Ensures smooth property transfer to spouse or children.

-

Avoids disputes and legal delays.

-

But it doesn’t pay off the loan — it only secures rights.

💼 5. Emergency Fund / Liquid Mutual Funds

-

Keep 6–12 months of EMI in a separate account.

-

Acts as a cushion during temporary income loss or illness.

-

Doesn’t solve the problem of death or total disability.

🔚 What I Learnt:

🔥 A loan is not a problem. But an unprotected loan is a silent danger.” Only term insurance gave me full control — over debt, dignity, and peace of mind..

And now, if life throws the worst… My family doesn’t lose a home. They keep the home — and gain a cushion to move forward.

🔥 TERM INSURANCE IS NOT OPTIONAL. IT'S A NON-NEGOTIABLE.

Let me say this without sugarcoating it:

Because the day something happens to you, your family won’t be asking:

“Which mutual fund should we redeem?” They’ll be asking: “How do we pay the next EMI?”

The Reality — Laid Bare:

The Reality — Laid Bare:

Without Term Insurance Without Term Insurance |

With Term Insurance With Term Insurance |

|---|---|

| Loan becomes a curse | Loan gets paid off |

| Family forced to sell home | Family keeps the home |

| Emotional trauma + financial stress | Only grief, no money worries |

| Dreams destroyed | Dreams protected and continued |

🧠 The Cost of Protection is Less Than the Cost of Ignorance

Most people casually spend more on:

-

Netflix subscriptions

-

Monthly pizza nights

-

Shopping app discounts

…than they would on a term insurance premium that could literally save their family from financial collapse. It’s not a question of affordability — It’s a question of awareness and priorities.

So please —

📢 Final Words: This Is Bigger Than You

You may be a teacher, a principal, a school leader, a parent… But above all, you are someone’s everything. So ask yourself:

“If I’m not around tomorrow, will my family survive — or suffer?”

Term insurance is not a luxury. It’s a duty. A simple, affordable, unselfish act of love. Buy it before life gives you no time to buy anything at all.

✍️ If This Story Made You Pause… Don’t Just Nod. Act.

Here’s what you can do right now:

Your home was built with love. Now protect it with wisdom.