Table of Contents

ToggleMutual Fund What It Means — Know 1 Basic Step to Master It

Imagine your school’s staffroom deciding to start a library. Each teacher contributes a small amount every month. That pooled money is handed to a librarian, who chooses the best books — novels, reference guides, story collections — based on everyone’s needs.

At the end of the year, everyone enjoys the library without worrying about which book cost more or which author is trending.

Mutual fund what they do for your money works in much the same way — except here, the “books” are stocks, bonds, gold, and other investments. And the “librarian” is a professional fund manager who selects and manages these assets to benefit every investor in the fund.

Prefer just the visual?

Download or share the infographic here →Visual Guide to share or download

What is a Mutual Fund?

A mutual fund is an investment vehicle that pools money from multiple investors and invests it across a variety of assets according to a set investment objective.

Here’s what that means for you:

- You buy units of the mutual fund, representing your share.

- The fund manager invests that pooled money in different assets.

- Returns or losses are shared among all investors, in proportion to the number of units each one holds.

For teachers, mutual funds are a low-effort way to grow savings while focusing on your real passion — teaching.

How Do Mutual Funds Work? (Step-by-Step)

Download or share the infographic here →Visual Guide to share or download

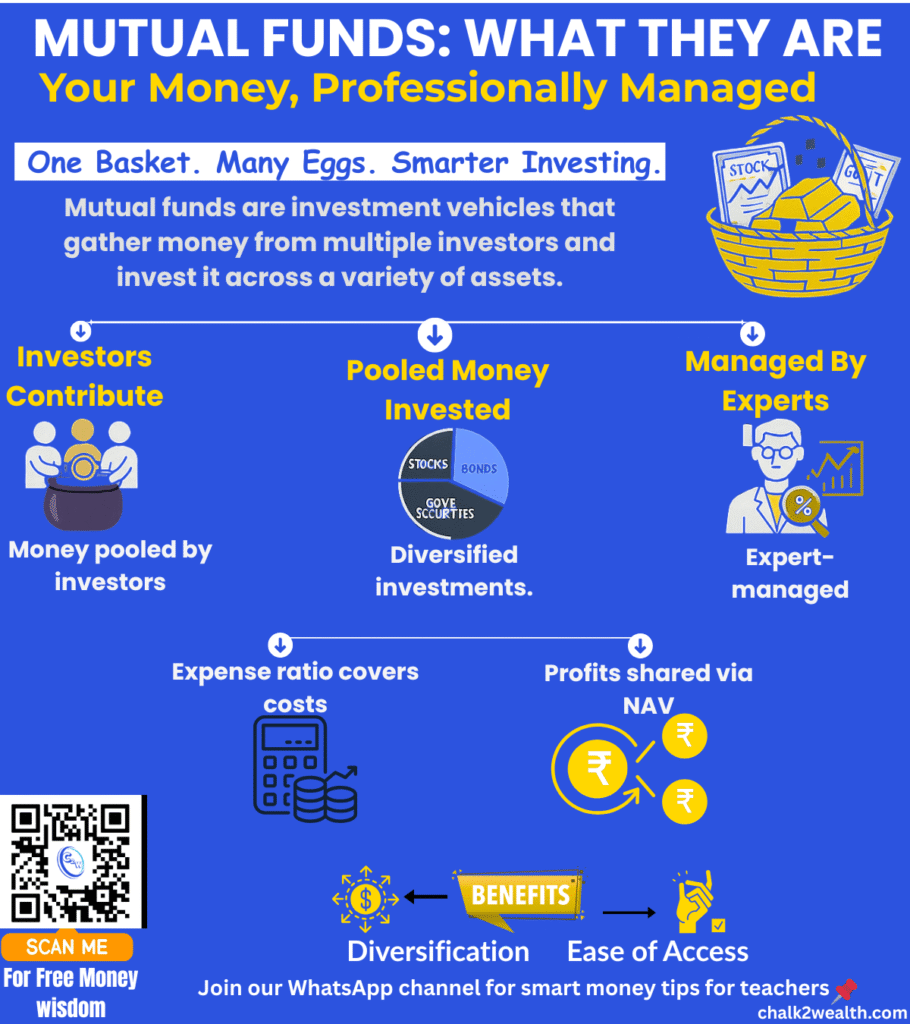

This infographic already shows this visually. Here’s the process in plain words:

- Investors Contribute – Many people pool their money together (just like the Library fund).

- Pooled Money Invested – The fund manager invests it in a diversified mix like stocks, bonds, gold, or government securities.

- Managed by Experts – Professionals decide what to buy, hold, or sell.

- Expense Ratio – A small fee is charged to cover the fund’s management costs.

- Profits Shared via NAV – Everyone benefits equally in proportion to their units, just like everyone enjoys the picnic equally.

Why Should Teachers Care?

In the rush of lesson plans, parent meetings, and exam duties, investing often takes a backseat. But mutual fund what they can do for your money is something every teacher should understand. With the power of compounding, even a small monthly SIP can quietly grow into a substantial fund over the years — enough to secure your children’s education, plan a comfortable retirement, or achieve personal dreams. Unlike savings accounts that barely beat inflation, mutual funds offer a chance to make your money work as hard as you do in the classroom.

- Low Entry Point — Start with as little as ₹500/month through SIPs.

- No Need to Track Markets Daily — Experts do the heavy lifting.

- Better Than Savings Account Returns — Long-term compounding can turn small amounts into big goals.

- Goal-Based Investing — Build funds for children’s education, retirement, or home purchase.

for example If you invest ₹2,000/month in an equity mutual fund with an average return of 12% per year:

- 10 Years: ~ ₹4,48,072 (₹2,40,000 invested across 10 years)

- 20 Years: ~ ₹18,39,715 (₹4,80,000 invested across 20 years)

- 30 Years: ~ ₹61,61,946(₹7,20,000 invested across 30 years)

(Figures are illustrative; actual returns vary.)

Mutual fund what they are-Money Lesson

Entertainment ends in a few hours, and monthly salaries seem to disappear faster than we expect — bills, groceries, and daily expenses quietly eat them away. But mutual fund what they do for your money is far more lasting. A mutual fund investment keeps working for you long after the month is over. Just like a staffroom library that grows richer with every new book added, your mutual fund portfolio becomes stronger with every contribution. The more consistently you add to your mutual fund, the more valuable and diverse your “wealth library” becomes, ready to serve you for years, not just moments.

Next in the Series → [Mutual Funds: How They Work — Step-by-Step Like in Class]

This is Part 2 of our Teacher’s Mutual Fund Series. Read it now to see exactly how your money grows in a mutual fund.

Well

It was very informative for me

A huge mutual fund knowledge is imparted in this topic

Thank you so much, Vikas ji! 🙏 I’m glad you found the post on “Mutual Fund What It Means — Know 1 Basic Step to Master It” informative. My aim with Chalk2Wealth is to simplify mutual funds so every teacher, family, and beginner can understand them easily. Do explore my new infographic post — Mutual Fund Sahi Hai Infographic: Quick 1Minute How It Works — I think you’ll find it equally useful.

Nice article.

Thank you, Surjeet ji 🙏. Glad you found it useful! Mutual funds often look complicated, but with 1 simple step teachers and families can master the basics. Keep following Chalk2Wealth — more teacher-friendly guides are on the way.”