For decades, teachers across India have dedicated themselves to shaping young minds, often sacrificing their own financial priorities. But when it comes to retirement planning, many still believe that the GPF or government pension is enough to carry them through their golden years.

Unfortunately, that belief can be risky. Whether you teach in a government school, a private institution, or a semi-government setup, retirement can either be your well-earned peace—or a period of silent financial anxiety.

Let’s break down what every Indian teacher must consider before retirement, backed by data and expert insight.

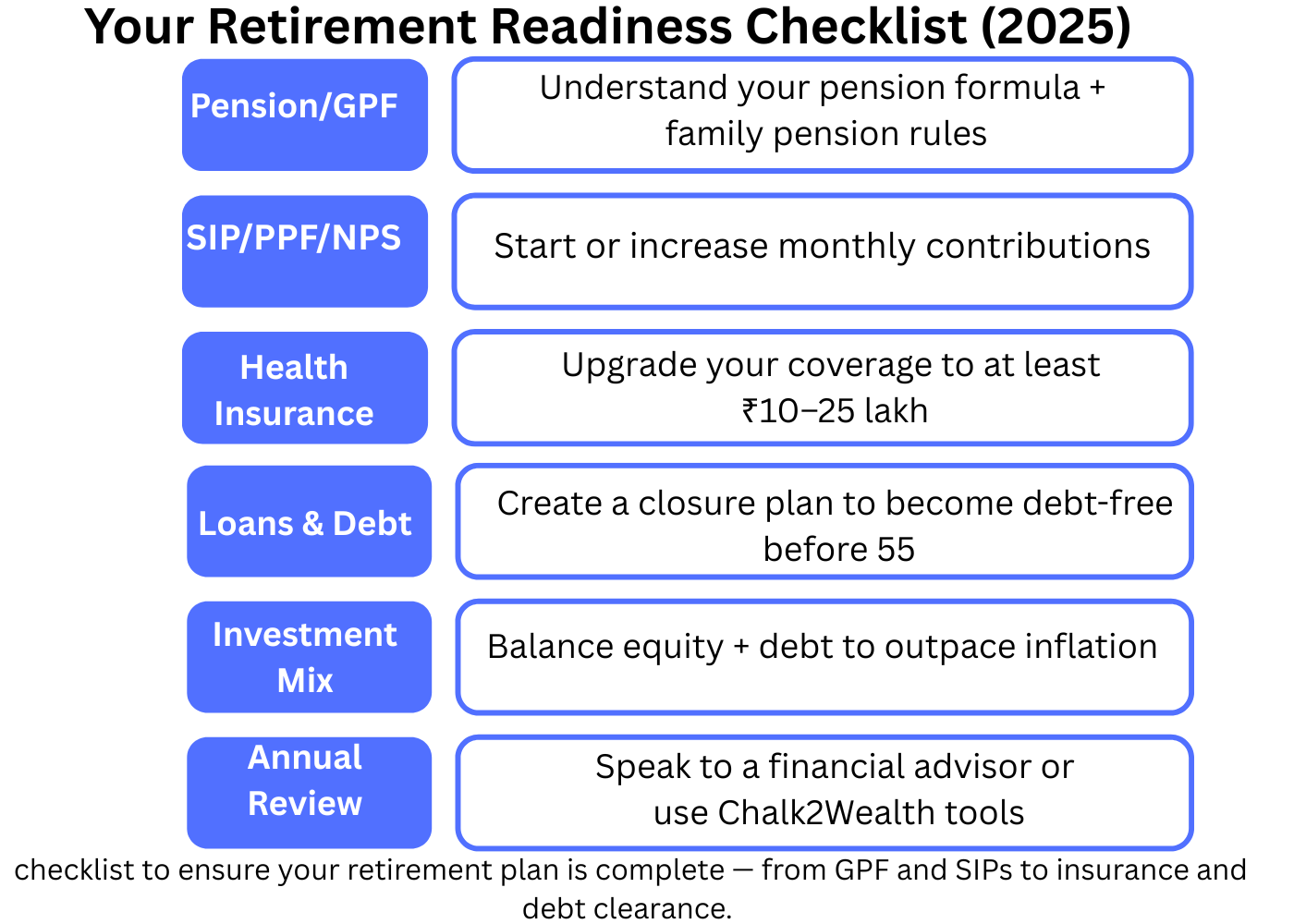

1. Retirement Planning Begins with Your Pension — But Shouldn’t End There

Most Indian teachers retire with a defined-benefit pension — typically from sources like GPF, gratuity, or family pension. This provides a stable income post-retirement and, for years, has been seen as the go-to security blanket.

But here’s the truth: Retirement planning has changed, and so has the cost of living.

A pension of ₹45,000–₹50,000/month may feel adequate now — covering groceries, electricity bills, and daily comfort. But will it still feel sufficient when medical emergencies arise? Or when inflation slowly chips away at your spending power?

The RBI’s Consumer Confidence Survey (Nov 2024) shows that Indian households now expect inflation to rise sharply, with one-year-ahead expectations touching 10.1%, mainly driven by essentials like food and housing.

🔗 Source: IAS Gyan – RBI Survey

That means your ₹50,000 pension today could lose nearly 40% of its value within a decade. What feels like comfort today could feel like compromise tomorrow.

And this is without even factoring in emergencies — a ₹5 lakh surgery, sudden home repairs, or support for your children’s education — all of which have become more common and more expensive.

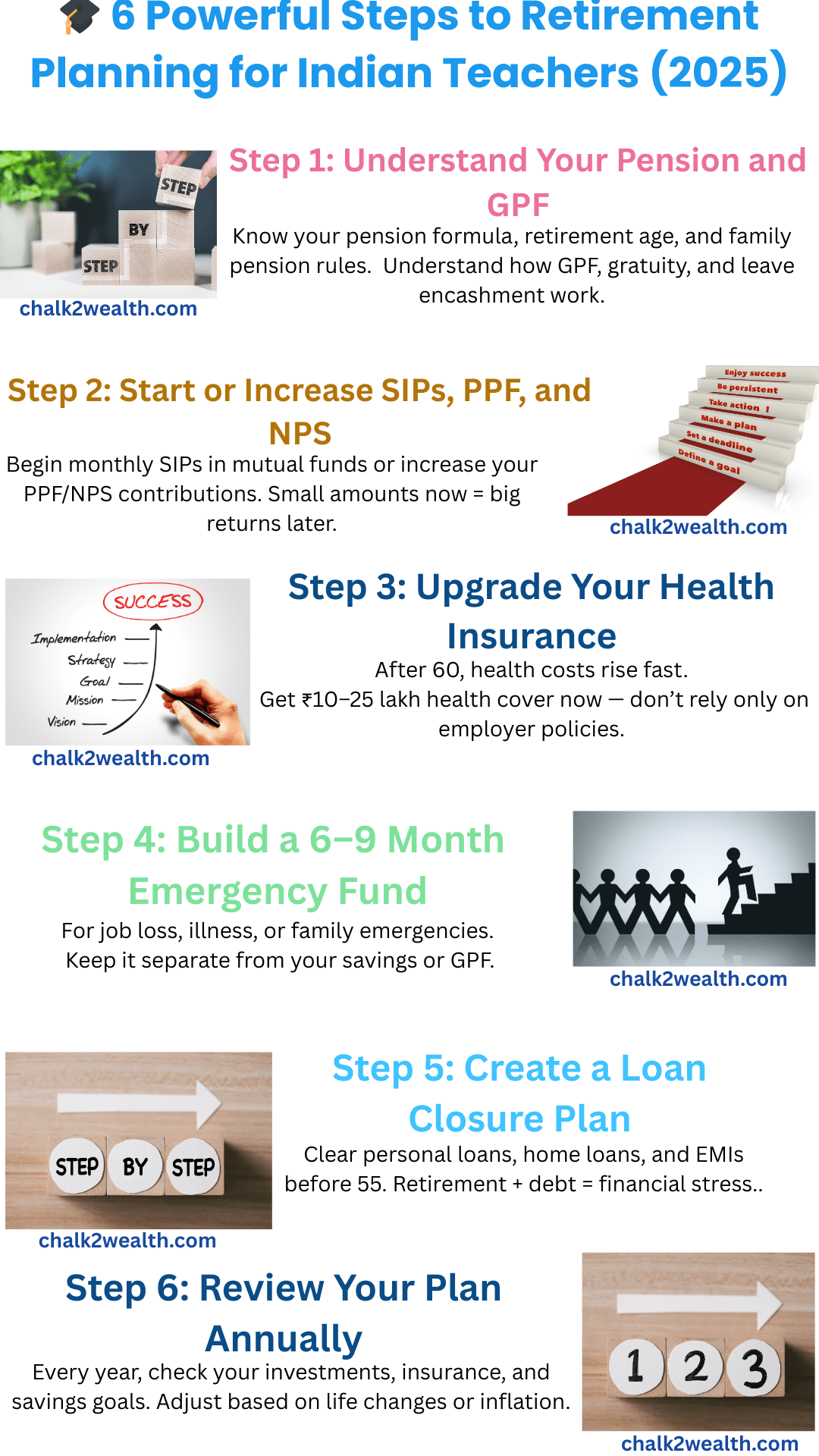

So, What Should Retirement Planning Look Like for Teachers?

Depending only on pension income is no longer safe. Modern retirement planning for Indian teachers must go beyond the GPF. It needs a multi-layered approach:

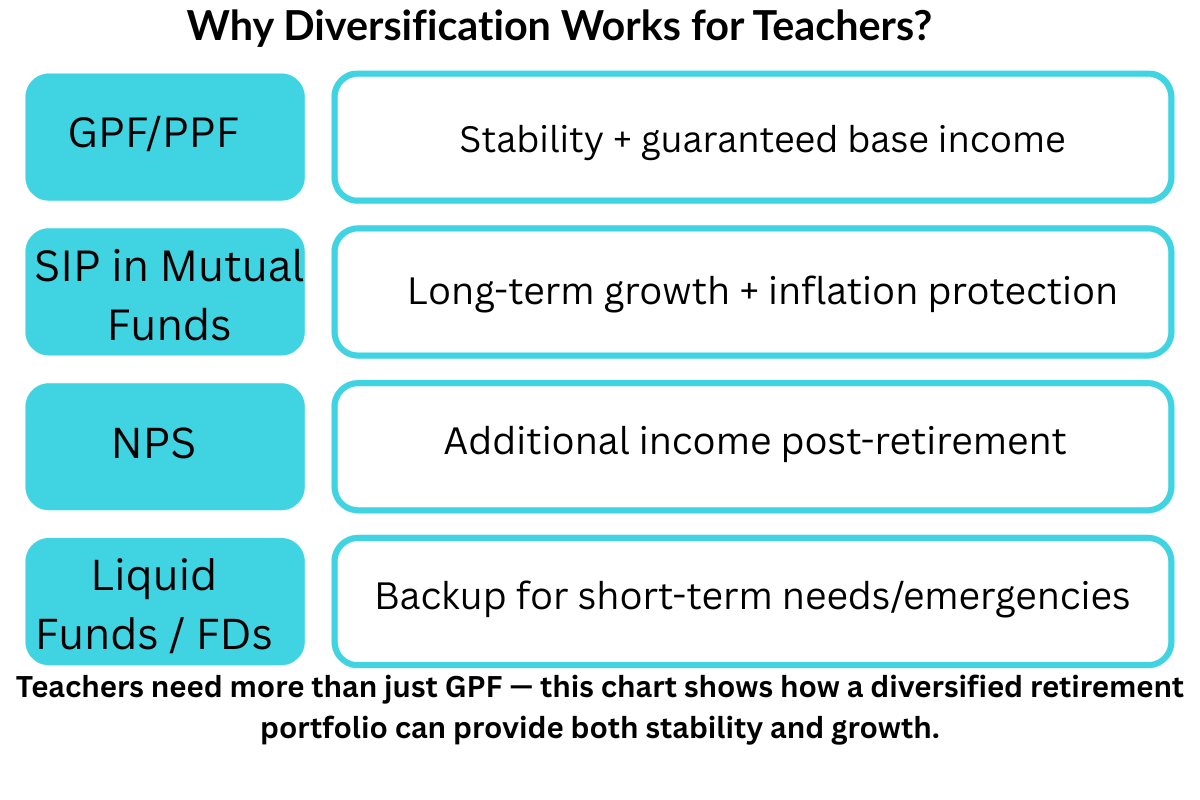

- SIPs in mutual funds for long-term wealth creation

- PPF for tax-free, guaranteed growth

- NPS for additional retirement income

These aren’t luxuries — they’re essentials for a financially stable and worry-free retired life.

Remember: A pension is the first chapter in your retirement story — not the final word. The real planning begins when you ask, “What if this isn’t enough?”

Let’s build that answer — step by step.

2. Supplemental Savings — The Backbone of Smart Retirement Planning

Many teachers stick to what they know—GPF, fixed deposits, LIC policies. But today’s financial climate demands a blend of safety and smart growth. If your money isn’t growing, it’s shrinking under inflation.

That’s why retirement planning for Indian teachers must include tools that work quietly in the background—compounding over time and building real wealth.

Smart Supplemental Tools You Can Start Today:

SIP in Mutual Funds

A SIP (Systematic Investment Plan) is simple, flexible, and designed for long-term growth.

Even a modest ₹5,000/month SIP for 25 years, assuming a 12% return, grows to: ₹94,88,175 (while you invest just ₹15,00,000) And if you double it to ₹10,000/month? You could build a retirement corpus of ₹1.9 crore — enough to beat inflation and cover medical, travel, or lifestyle needs.

PPF (Public Provident Fund)

Safe, government-backed, and currently offering 7.1% tax-free interest (as of July 2025). A good complement to your GPF.

NPS (National Pension System)

A low-cost, long-term option blending equity and debt — ideal for creating an additional pension stream in retirement.

Key Insight:

“You don’t build a retirement fund in a day. You build it ₹5,000 at a time — even if it means starting small and scaling up later.” The earlier you begin, the lighter your financial load will be in your 50s and beyond. Don’t wait until the final few working years to realize what could have been done sooner.

3. Diversification — Don’t Let Your Retirement Ride on a Single Track

Think of your retirement like a long-distance train journey. If you’re riding on just one track — say, a pension or a fixed deposit — any disruption can throw your entire journey off course.

That’s why retirement planning needs more than just predictability. It needs a well-laid network of tracks — each one serving a different purpose, working together to get you safely to your destination.

A review of traditional investment approaches shows that when portfolios exclude equity or growth-oriented assets, the average annual return hovers around 4%–7% — barely enough to maintain purchasing power after inflation.

Now consider this:

According to a 2024 report by Economic Times,

🔗 Source: Economic Times – Long-Term Equity Returns

That’s not speculation — that’s time-tested consistency.

By mixing safe instruments with growth-oriented ones, you spread your risk and increase your retirement fund’s ability to grow — just like teaching a mixed-ability class requires a variety of strategies.

A Teacher’s Perspective:

You wouldn’t teach your entire class using just a blackboard anymore, right?

Then why plan your retirement with only one kind of financial tool?

Diversification isn’t a gamble — it’s a shield against uncertainty and a lever for long-term growth. The more thoughtfully you build your mix, the stronger and more secure your retirement journey becomes.

4. Healthcare — The Most Underestimated Risk in Retirement Planning

As teachers, we’ve planned lessons down to the minute. But when it comes to retirement planning, many forget to plan for one of life’s most unpredictable chapters — healthcare. It’s a silent threat. You may retire with peace of mind, thinking your pension and savings are enough. But all it takes is one unexpected medical event to shake that confidence. Rising hospital bills, out-of-pocket surgeries, costly medicines — these aren’t distant risks anymore. For most Indian families, healthcare expenses are already one of the top three financial burdens, and they spike with age.

One Stat That Says It All:

As per a recent Business Standard report, India has a health protection gap of over 70%, leaving tens of crores without adequate health coverage — including salaried middle-class retirees.

🔗 Source: Business Standard – Health Insurance Access in India

If you think employer-provided health insurance will continue post-retirement — think again. Many such plans end with your job. And relying on savings alone is dangerous when surgeries today cost ₹3–7 lakh or more.

What Smart Retirement Planning Includes:

- Buy a comprehensive health insurance policy of ₹10–25 lakh before retirement.

Preferably by age 50–55 while premiums are lower and no critical illness has developed. - Include a top-up plan or super top-up that extends your coverage affordably.

- Create a dedicated Medical Emergency Fund of ₹1–2 lakh — not mixed with your regular savings.

- Review your family’s coverage — your spouse’s and dependent parents’ needs matter too.

A Teacher’s Lesson:

You’ve taught students to prepare for exams they don’t know the questions to. Isn’t your health after 60 the biggest unknown of all? A single hospital bill shouldn’t ruin decades of hard work. With the right retirement planning, it won’t.

5. Retirement Planning Fails When EMIs Don’t Retire with You

Retirement is supposed to be a time of rest, reflection, and reward — not repayments. But for many Indian teachers, that peaceful vision is clouded by ongoing EMIs: home loans, car finance, pending education loans, or credit card dues. These debts may have served a purpose once, but carrying them into retirement is like carrying schoolbags after class is over — unnecessary and exhausting.

The Reality in Indian Homes

A growing number of retirees are now walking into their 60s with loan obligations. And the result? A big chunk of their monthly pension or GPF withdrawals goes straight into repayments — leaving little room for medical expenses, travel, or even basic comfort.

Here’s an example:

A teacher retiring at 58 with a ₹10,000 EMI for 5 more years will pay ₹6 lakh post-retirement — money that could’ve gone toward health emergencies or family support. Now multiply that with rising inflation and shrinking income, and you’ll see how even a small loan can quietly derail your retirement planning.

Your Debt-Cleaning Checklist Before Retirement:

- Home Loan – Try to prepay or downsize by 55–58

- Education Loan – Wrap it up before your child graduates

- Credit Cards – Avoid rolling balances; clear them every month

- Personal Loans / Car Loans – Don’t carry them beyond your working years

- Avoid New Borrowings – After 50, focus on building assets, not liabilities

A Thought for Teachers:

You’ve cleared report cards for thousands of students.

Now it’s time to clear your financial report card, too.

Freedom from debt is freedom in the truest sense — and one of the most empowering gifts you can give yourself as you step into retirement.

6. Financial Guidance — Because Even Teachers Need a Mentor

As educators, we spend our lives guiding students — helping them understand subjects, make decisions, and build futures. But when it comes to retirement planning, we often forget that we, too, need guidance.

And why not? The financial world today is more complex than ever — filled with investment options, tax laws, insurance plans, and market noise. It’s easy to feel overwhelmed or unsure about what’s best for your unique situation.

Why Financial Advice Matters

According to a 2023 study by the Financial Planning Standards Board (FPSB India):

“91% of individuals who worked with a certified financial advisor felt confident that they had enough money to last through retirement.”

🔗 Source: Business Today – FPSB Retirement Confidence Study

Compare that to those who went solo — most admitted to feeling uncertain, underprepared, or unaware of critical financial risks. This tells us something simple but powerful:

You don’t need to figure everything out on your own.

What a Financial Guide Can Do for You:

- Help structure your pension, SIPs, and insurance into a working retirement plan

- Advise on tax-saving strategies before and after retirement

- Rebalance your investments as your risk appetite changes with age

- Plug blind spots — like rising medical costs or estate planning

- Keep your goals aligned with real-life timelines

Just like a principal ensures the whole school runs smoothly — not just one classroom — a good financial planner helps you see the big picture and make confident money decisions.

A Final Thought for Educators:

You’ve spent your life teaching others. Now it’s time to be open to learning — from someone who understands money the way you understand your subject. Guidance isn’t weakness. It’s wisdom.

Let a financial expert be the co-teacher in your retirement journey.

Would you like a “Signs You Need a Financial Planner” checklist or a quote graphic like:

“Even teachers need a guide — especially when the syllabus is retirement.”

Final Summary: Build Your Retirement Like You Build a Lesson Plan

You’ve dedicated your life to shaping students’ futures — now it’s time to shape your own. Retirement planning isn’t just about saving money. It’s about preparing for every chapter after your last working day — from healthcare to inflation, from dreams to daily expenses.

Here’s a quick recap of what a well-rounded retirement plan for Indian teachers must include:

Remember:

You wouldn’t enter a classroom without a lesson plan. Don’t enter retirement without one either. Let’s turn your years of service into years of financial peace, freedom, and purpose — one smart step at a time.

People Also Ask

#1. How to retire successfully?

- Start saving and investing early to build a strong financial foundation for retirement.

- Plan your lifestyle, healthcare, and activities to ensure fulfillment and security in your post-work years.

#2.What is the best rule for retirement?

The best rule for retirement is to save at least 15% of your income each year and aim to have 10 times your annual salary to maintain your lifestyle in retirement

#3. What is the 4 rule retirement in India?

The 4% rule is a widely used guideline in retirement planning. It suggests that you can safely withdraw 4% of your total retirement savings in the first year of retirement, and then increase this amount each year to keep up with inflation. The goal is to ensure your savings last for at least 30 years.

#4. When to do retirement planning?

Begin your retirement planning with your very first income—starting early gives your money more time to grow through compounding, making it easier to achieve your future financial goals and reducing stress as you get older

#5. How much money should I need to retire?

The amount of money you need to retire depends mainly on your expected monthly expenses, lifestyle, and how long you anticipate living after retirement. A common approach is to estimate your annual expenses in retirement and multiply that by 25 to 30; for example, if you need ₹1 lakh per month (₹12 lakh a year), you should aim for a retirement corpus of around ₹3–3.5 crore to maintain a comfortable lifestyle and cover inflation over 25–30 years. Adjust this figure higher if you want to account for unexpected costs or plan to retire early.