Table of Contents

ToggleCompound Interest Infographics: Early Bird vs Bigger Saver for Teachers

A Simple Question in the Staffroom

One afternoon in our school staffroom, I asked two colleagues a simple question: “If you had ₹10,000 every month, would you start investing today or wait until you earn more?”

Two Teachers, Two Different Choices

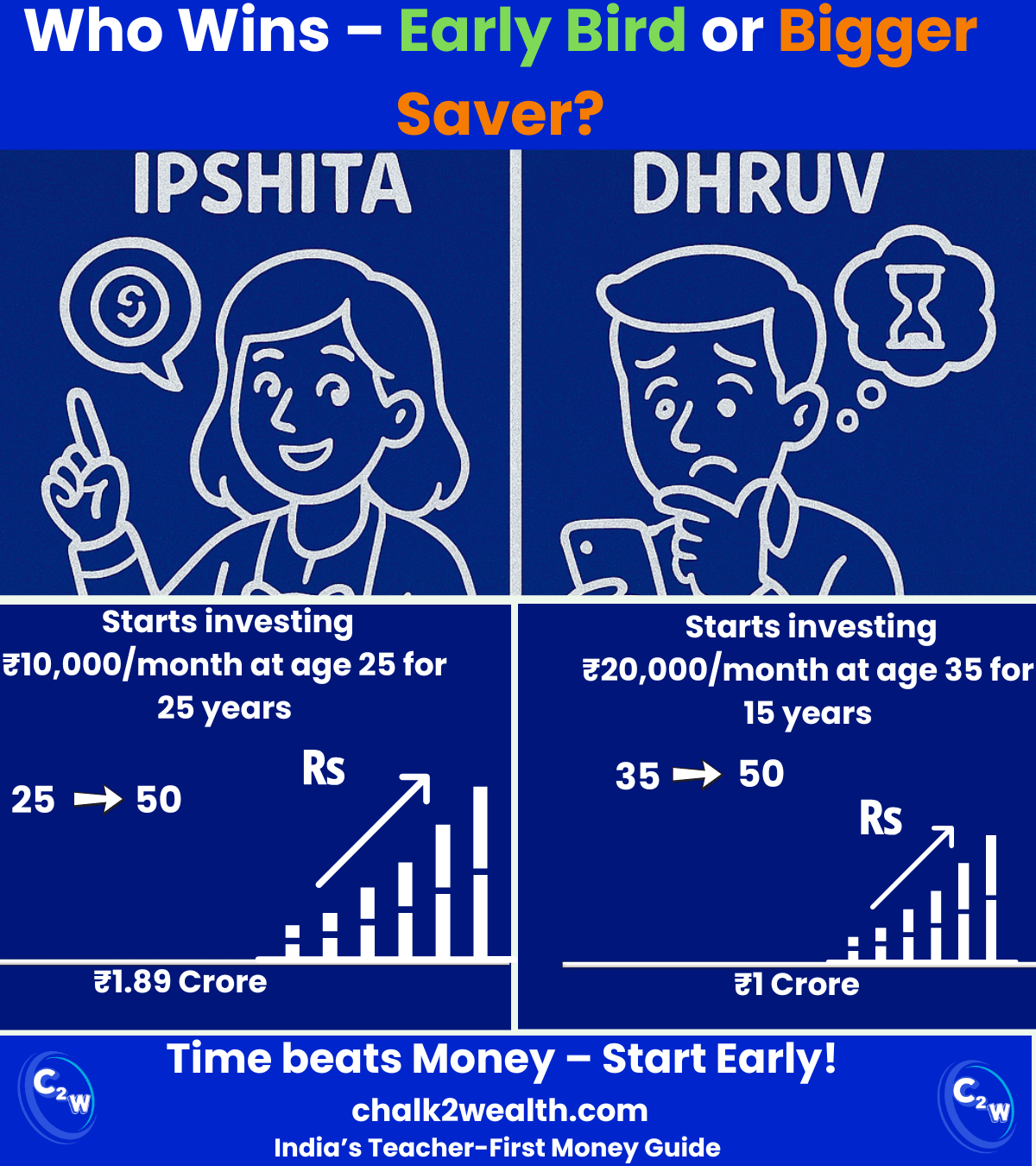

Mrs. Ipshita, a young science teacher, smiled and said: “I’ll start now, even if it’s small. ₹10,000 is manageable.”

But Mr. Dhruv, a senior teacher, replied: “I’ll wait till my salary increases. Then I’ll invest ₹20,000 at once.”

What Happened After 20 Years

Fast forward two decades:

- Ipshita’s early start turned her consistent ₹10,000 monthly SIP into nearly ₹1.9 crore.

- Dhruv, despite investing double the amount later, could only reach around ₹1 crore.

Early Bird vs Bigger Saver: Numbers at a Glance

| Teacher | Start Age | Monthly SIP | Investment Period | Total Invested | Final Corpus (12% p.a.) |

|---|---|---|---|---|---|

| Ipshita (Early Bird) | 25 yrs | ₹10,000 | 25 years | ₹30 lakh | ₹1.9 crore |

| Dhruv (Bigger Saver) | 35 yrs | ₹20,000 | 15 years | ₹36 lakh | ₹1.0 crore |

Even though Dhruv invested more money each month and more total amount (₹36 lakh vs ₹30 lakh), Ipshita still won because she gave her money more time. That’s the power of compound interest. The Staffroom Lesson for Every Teacher

That day, the staffroom lesson was clear: In investing, compound interest infographics show that time beats money. For teachers, the early bird vs bigger saver example proves you must start early, even with less.

Why Did Ipshita Win?

The power of compound interest rewarded Ipshita because she gave her money more time to grow. Dhruv’s bigger savings couldn’t catch up with her head start.

Want to understand the full maths behind this case study?

Read my detailed post here: : Compound Interest: Can a Class 8 Lesson Really Make You Rich in 2025?

Discover More Compound Interest Infographics for Teachers

At Chalk2Wealth, we make compound interest infographics that bring financial lessons alive for teachers. From Early Bird vs Bigger Saver to Why Rate of Return Matters, our visuals show why time is the most powerful tool in investing.

So dear teachers, don’t wait for a bigger salary, let compound interest be your bonus today

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.