Table of Contents

ToggleCompound Interest: How a Class 8 Lesson Can Shape Your Financial Future in 2026

During an orientation programme for maths teachers, I casually held up a dice and asked a simple question: “We all teach compound interest in Class 8—but tell me honestly, have you ever used it in real life?”

The room went silent. A few smiles. A few uncomfortable nods. That silence said everything.

Compound interest isn’t just a chapter in a textbook—it’s the very formula that can decide whether we, as teachers, retire with peace or struggle with debt. Yet most of us rely only on our GPF or pension, without realizing that the same concept we teach our students can quietly secure our own financial future through real investments (as we discussed earlier in The Real Cost of Debt for Teachers).

The real challenge, however, isn’t understanding the formula—it’s knowing where to apply it. Questions like where to invest money in India in 2026 or whether familiar options like PPF are still worth it in today’s inflationary environment often stop us from taking action.

In this post, let’s explore how the humble Class 8 compound interest lesson can shape your financial future in 2026 and beyond—not in theory, but in real life.

Compound Interest for Teachers in India: A Lesson That Can Secure Retirement

For teachers in India, compound interest isn’t just an abstract math problem—it can be a personal finance game-changer. Take the General Provident Fund (GPF), for example. As of 2025, it offers an annual interest rate of around 7.1%, compounded annually. It’s safe and guaranteed, and over decades of service, it has helped build a retirement corpus.

But 7.1% is only the starting point. With rising inflation and changing lifestyle needs, depending solely on GPF or pension may not be enough to ensure a truly comfortable retirement. The real power of compound interest reveals itself when it is applied beyond mandatory savings.

Most teachers understand the math—we teach it every year. What’s missing is application. By investing even small amounts outside GPF, compound interest can work for you, not just in your classroom examples.

Many of us stick to fixed deposits or provident funds and avoid markets altogether. That caution is understandable. Yet, well-diversified investments such as mutual funds have historically delivered 10–15% annual returns over the long term. The difference between compounding at 7% and 12% can decide whether retirement is merely secure—or truly stress-free.

Compound interest may be the only lesson where being a good student can literally pay off for a teacher.

Why Einstein Called Compound Interest the Eighth Wonder (and Why Teachers Should Care)

It’s often said that Albert Einstein referred to compound interest as the “eighth wonder of the world.” A popular quote attributed to him reads: “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it.”

Whether or not Einstein actually said these exact words, the wisdom behind them is undeniable. When you understand how compound interest works in your favor, wealth grows quietly and exponentially over time. This is exactly how long-term investments like Systematic Investment Plans (SIPs) harness compounding to build wealth steadily over years rather than months (explained in detail in What Are Systematic Investment Plans (SIPs) and How They Work to Build Wealth).

Why would someone like Einstein attach such importance to this idea? Because compounding rewards time and patience. Over long periods, even modest amounts can grow into substantial sums through the simple power of “interest on interest.”

For teachers, this isn’t just a clever quote—it’s a reminder that the concepts we teach in classrooms can directly shape our own financial security. Let’s break down exactly how and why compound interest deserves such high praise.

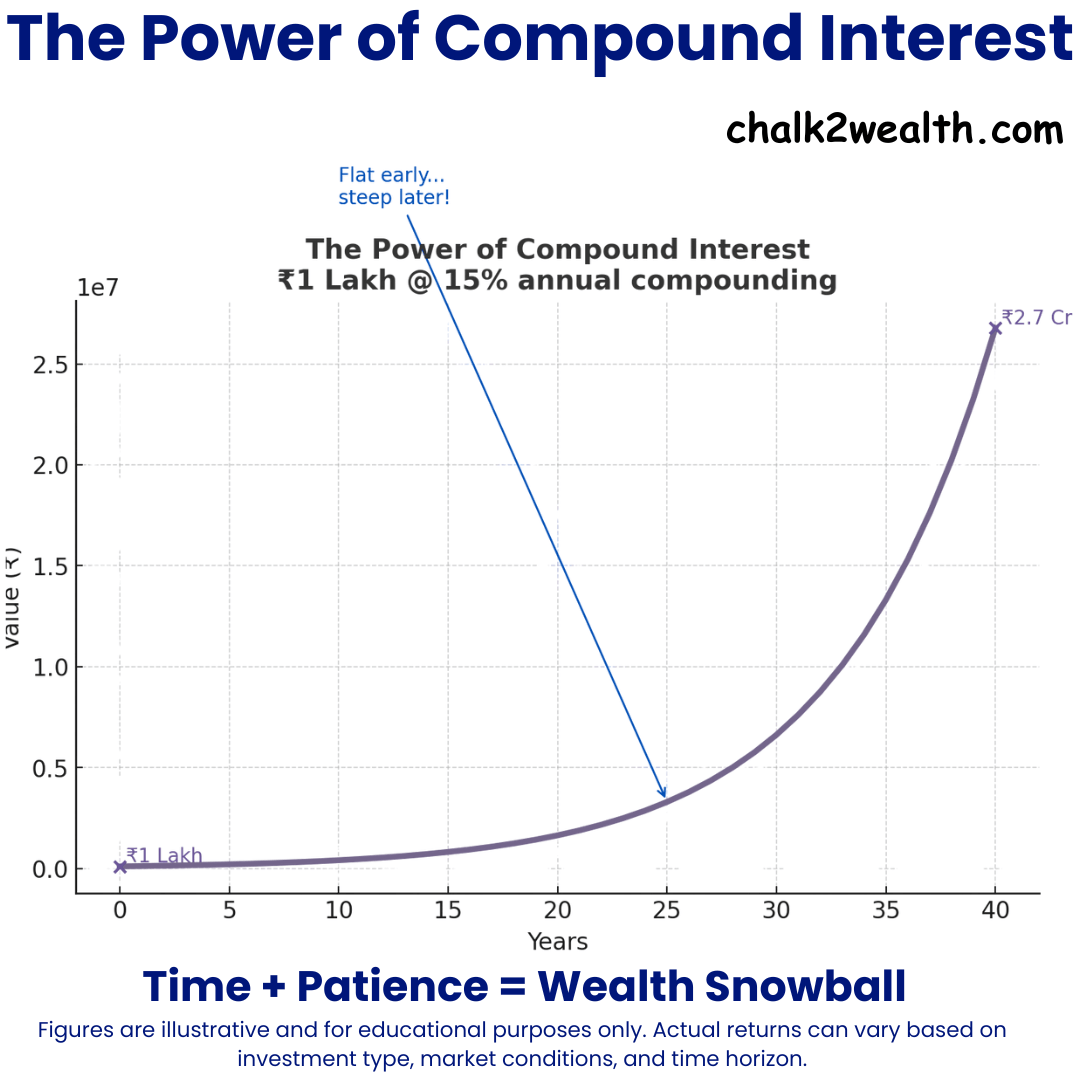

How Compound Interest Creates Exponential Growth Over Time

Compound interest works by generating “interest on interest,” causing your money to grow exponentially. Unlike simple interest, compounding adds interest to your principal each period, and that interest then earns more interest. This is the same principle that powers long-term investments like Systematic Investment Plans (SIPs), where regular contributions and time work together to accelerate wealth creation (explained in detail in What Are Systematic Investment Plans (SIPs) and How They Work to Build Wealth).

At first, growth feels slow, but with time it accelerates sharply. This delayed acceleration is why many investors give up too early—just before compounding really starts to work in their favor.

How Teachers Can Build a Rich Retirement Using Compound Interest

What does “retire rich” mean for a teacher? It doesn’t mean a flashy billionaire lifestyle—it means a comfortable, worry-free retirement where money isn’t a constant concern. Compound interest can help achieve that by growing your retirement corpus steadily and exponentially, provided you give it enough time.

The formula for success is surprisingly simple:

Start Early + Invest Regularly + Give it Time + Earn a Decent Return = Wealth through Compounding

Let’s break that down.

Starting Early:

The sooner you start investing, the more compounding periods you get. A teacher who begins investing at 25 will end up with a far larger corpus at 60 than someone who starts at 40—even if the latter invests more every month. The early years are the most precious when it comes to compounding power. Once lost, they can’t be recovered. We’ll see a clear example of this in the next section (spoiler: a 10-year head start can potentially double your ending wealth).

Invest Regularly (Consistency):

Make investing a habit, like a monthly “expense” you always pay—to yourself. Regular contributions, even small ones, act like adding wood to a growing fire. Through market ups and downs, consistency ensures you keep fueling compound growth.

For instance, contributing just ₹1,000 per month to an investment earning around 10% annually can grow to roughly ₹7.6 lakh in 20 years, from a total contribution of only ₹2.4 lakh. Small monthly SIPs, when sustained, can quietly build a meaningful corpus.

Give it Time (Patience):

Time is the secret ingredient that makes compounding magical. You need to leave your money invested and allow it to grow uninterrupted. The longer you let it snowball, the bigger it becomes—especially in the later years. Patience also means not panicking during market fluctuations and not interrupting compounding through premature withdrawals. As investing legend Charlie Munger puts it, “The big money is not in the buying or the selling, but in the waiting.” In other words, time in the market beats timing the market.

Earn a Decent Return (Rate of Return):

While you can’t control market returns, you can choose asset classes wisely. Even a small difference in annual return makes a huge impact over long periods. Historically, equities have outperformed fixed deposits and provident funds. A balanced portfolio for a young teacher might aim for ~10% or more by combining growth assets like equity with stabilizers such as debt and gold.

Gold, in particular, plays an important role—not as a return maximizer, but as a risk balancer during volatile periods. This is why many long-term investors include it strategically as part of their portfolio rather than treating it as speculation (explained in detail in How Can I Invest in Gold Smartly in 2026: 6 Best Options for a Strong Portfolio).

By following these principles, teachers really can retire as rupee millionaires—not by taking reckless risks, but by staying disciplined, patient, and consistent. Still skeptical? Let’s look at real scenarios and data-driven insights on time, rate, and consistency—the three core engines of compounding we’ve just outlined.

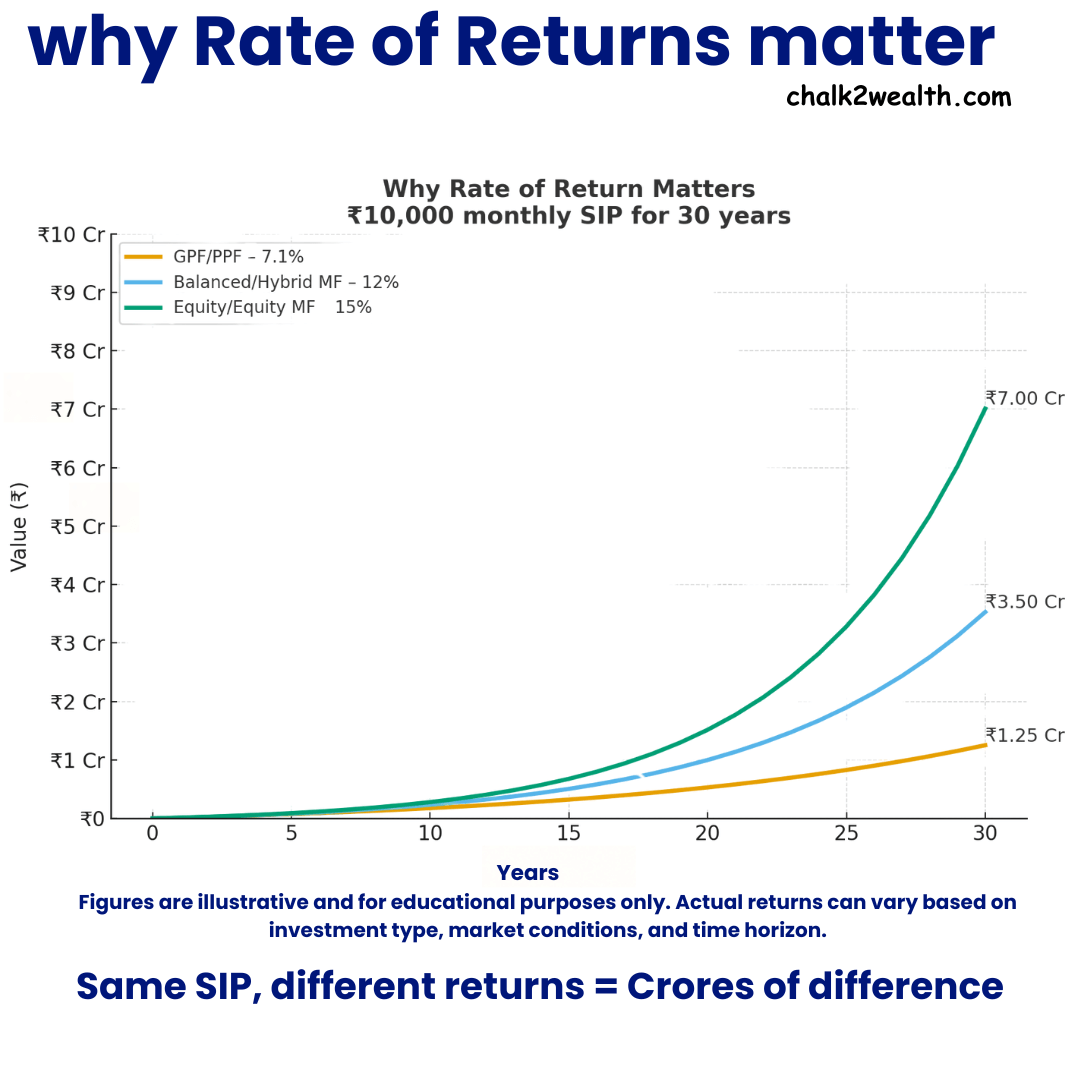

Why Rate of Return Matters More Than You Think

Even a small difference in the rate of return can create a huge gap in wealth over time. This happens because of the power of compounding—higher returns don’t just add money, they multiply it faster year after year.

For long-term investments like SIPs, the difference between earning 7%, 12%, or 15% annually may look small on paper. But over 25–30 years, this difference can completely change your financial future. That’s why understanding where you invest and what returns you can realistically expect is crucial for building long-term wealth.

What Compounding Actually Does (With Real Numbers)

| Investment Type | Assumed Annual Return | Final Corpus after 30 Years |

|---|---|---|

| GPF/PPF | 7.1% | ₹1.25 Crores |

| Balanced/Hybrid MF | 12% | ₹3.50 Crores |

| Equity/Equity MF | 15% | ₹7.00 Crores |

Compounding magnifies returns over time. The difference between 7.1% and 15% returns doesn’t just double your corpus—it multiplies it nearly 6 times.

This is why higher-return investment avenues like equity mutual funds, while more volatile, can significantly increase long-term wealth if invested with discipline and for a longer time horizon.

The Magic of Time and Patience

Time is the most powerful force in compounding—often more important than how much you invest, and sometimes even more than returns (to an extent). Starting early gives your money the longest runway to grow, and that advantage is incredibly hard to beat later.

Let’s understand this through a simple, teacher-friendly example.

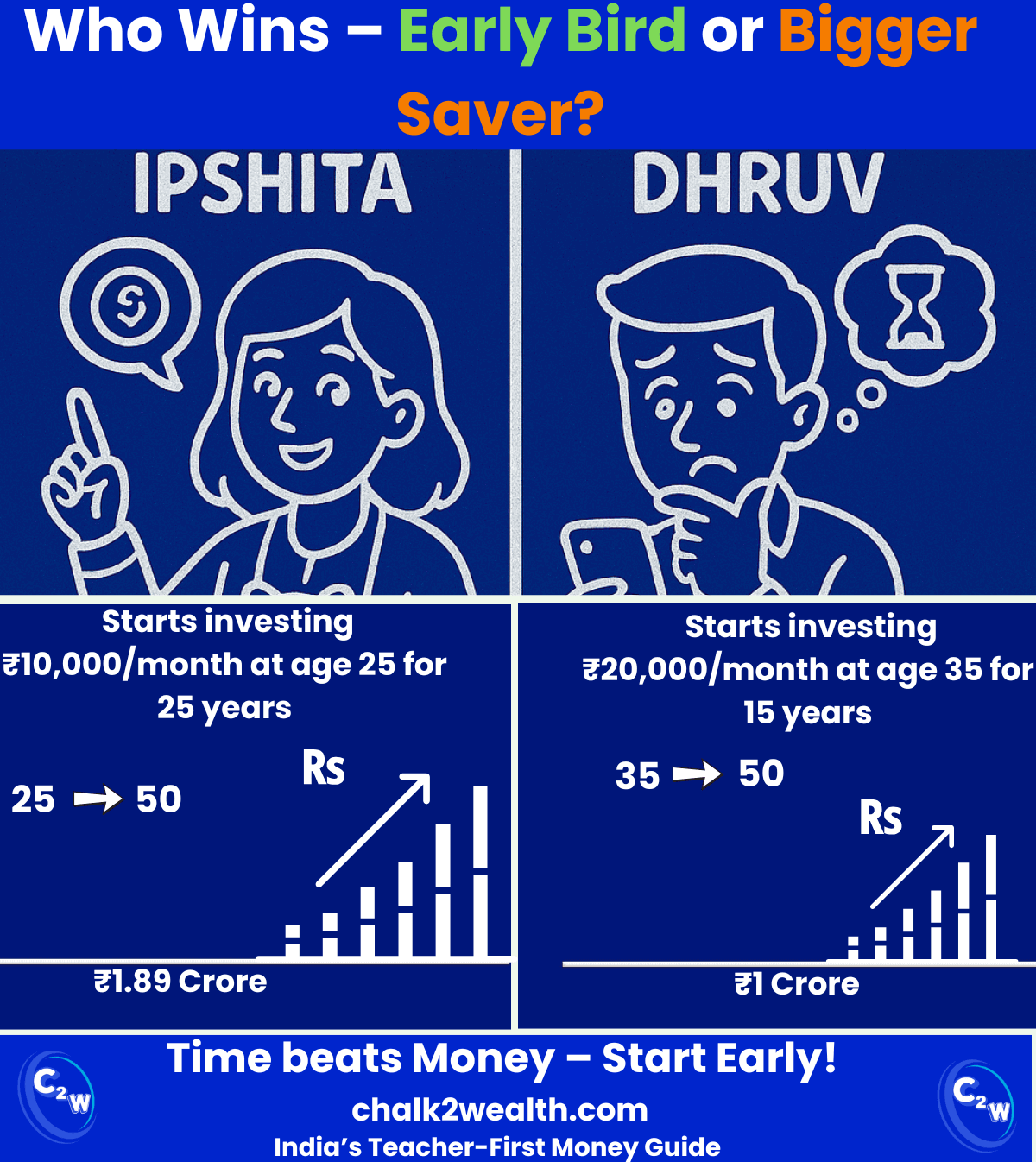

Ipshita vs Dhruv: A Lesson in Compounding

Time is one of the most powerful forces in compounding—often more powerful than investing more later, and sometimes even higher returns (to an extent). An early start gives your money the longest runway to grow, and that advantage is very hard to beat later.

Example:

Two teachers, same returns (12%), different start times.

- Ipshita starts at 25, invests ₹10,000/month for 25 years (till 50).

Total invested: ₹30 lakh → Corpus at 50: ~₹1.89 crore - Dhruv starts at 35, invests ₹20,000/month for 15 years.

Total invested: ₹36 lakh → Corpus at 50: ~₹1.0 crore

Despite investing more money, Dhruv ends up with barely half of Ipshita’s corpus.

Why?

Ipshita gave compounding a 10-year head start. Early years allow returns to generate returns, creating momentum that late investing cannot fully catch up with.Compounding accelerates with time. At high long-term equity returns, a large part of wealth creation happens in the later years. Staying invested longer matters as much as starting early.

Key lesson:

Lost time is lost wealth. Extra money cannot fully compensate for a late start. Even if you’re starting late, begin now. Every extra year of compounding adds value. As teachers, with stable income and long careers, starting small—but early—can still create meaningful wealth.

Bottom line:

Start early. Stay invested. Let time do the heavy lifting.

From Chalk to Wealth: A Teacher’s Final Lesson

So, can a Class 8 lesson really make you rich in 2025? By now, you know the answer—yes, if you understand it and actually apply it.

As teachers, we use chalk to shape our students’ futures every day. It’s time we use the same knowledge to shape our own financial future. Wealth is not built through lottery wins or overnight success. It is built through discipline, patience, and time—powered by the quiet force of compound interest.

The lesson is simple: start early, invest consistently, and stay invested.

What we teach in the classroom can become the foundation of our own financial freedom—if we choose to practice it.

Frequently Asked Questions on Compound Interest

How is compound interest calculated?

Compound interest is calculated by adding interest to the principal, and then calculating future interest on the total amount (principal + interest). In simple words, your money earns interest, and then that interest also starts earning interest.

The basic formula is:

A = P × (1 + r/n)^(n×t)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate

- n = Number of times interest is compounded in a year

- t = Time in years

Example:

If you invest ₹1,00,000 at 10% annually for 3 years, compounded yearly, the amount grows faster each year because interest is calculated on the growing balance—not just the original amount. That’s why compound interest is called the power of money growing on money.

What is a Compound Interest Calculator?

A compound interest calculator is an online tool that helps estimate how your money may grow over time when interest is added to both the principal and accumulated interest. It allows you to change the investment amount, expected return, and time period to understand the effect of compounding.

What is the Compound Interest Formula?

The compound interest formula is:

A = P × (1 + r/n)^(n×t)

Where:

- P = principal amount invested

- r = annual rate of return

- n = number of times interest is compounded in a year

- t = time in years

This formula shows how money grows faster when interest is calculated on both the original amount and the accumulated interest.

How Does Compound Interest Work?

Compound interest works by earning interest not only on the original investment but also on the interest earned earlier. Over time, this creates a snowball effect where money grows faster as the base amount increases. In the early years, growth looks slow. But as time passes, interest starts earning interest, and the growth accelerates—especially in long-term investments like SIPs, PPF, or mutual funds.

What Is the Best Investment for Compound Interest?

There is no single “best” investment for compound interest—it depends on time horizon, risk tolerance, and consistency. However, investments that stay invested for long periods and allow returns to compound regularly tend to benefit the most. For long-term goals, equity mutual funds through SIPs have historically shown strong compounding potential over time. For conservative investors, options like PPF or GPF offer steady compounding with safety, though at lower returns.

The key to benefiting from compound interest is not chasing the highest return, but starting early, investing regularly, and staying invested for the long term.

What is the magic of compound interest?

Magic of compound interest lies in the way money grows faster with time by earning returns on both the original investment and the accumulated returns. In the beginning, growth feels slow, but as years pass, the compounding effect accelerates sharply.

This is why starting early and staying invested for long periods can turn small, regular investments into a large corpus. Time, patience, and consistency together create the real magic.

Teachers, your chalk has shaped thousands of futures. Now let compound interest shape yours. Don’t wait for pension or luck — start a small SIP, let it grow, and watch how the “eighth wonder of the world” can turn today’s savings into tomorrow’s wealth.

👉 Use the Chalk2Wealth SIP Calculator now and see how your money can grow with compounding.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

Name tthe fumds in wbich one should invest

Thank you so much for your comment, Rajesh ji 🙏.

There is no “one-size-fits-all” fund — the right choice depends on 3 factors:

1. Your Goal – child’s education, retirement, or short-term needs.

2. Time Horizon – 10–20 years suits equity; short-term suits debt/hybrid.

3. Risk Comfort – some accept market ups and downs, others prefer stability.

👉 Once clear, the choice is simple: equity index funds for growth, hybrid for balance, debt/liquid for safety.

Just like we choose the right book by class level, funds depend on life stage. Start small, start early — that’s how compound interest creates wealth.