Getting into debt is easy. Getting out takes intention.

Table of Contents

ToggleDebt Trap: 5 Warning Signs Teachers Can’t Ignore in 2025

The Debt Trap Is a Silent Stressor — But You Can Escape It

One EMI after another. A phone on EMI. A credit card bill that never goes away. A BNPL purchase you barely remember making.

Sounds familiar?

For many teachers, parents, and salaried individuals, this is how the debt trap begins — not with a giant loan, but with small, manageable payments that slowly pile up. Month by month, your income starts feeling hijacked. You’re earning just to pay EMIs, interest charges, and minimum dues. There’s no room left for peace of mind, let alone savings.

I know this feeling personally.

In 2014, I had just finished building the second floor of our dream home in Himachal. ₹70 lakh — that was the home loan on my name. And one night, as I looked up at the ceiling I had built with pride, a chilling thought crossed my mind:

“If I’m not here tomorrow… would my wife and children be able to handle this EMI?”

That night, I didn’t sleep well. Because that’s when I realised — debt doesn’t shout. It silently steals your peace.

But that moment also triggered my escape.

And if you’re also struggling with no emergency fund, don’t miss this companion story: How My Parents’ Sandook System Taught Me the Real Meaning of an Emergency Fund

The Good News? Escaping the Debt Trap Doesn’t Need a Miracle

It just takes a plan. A clear, step-by-step approach. Small changes that stack up over time.

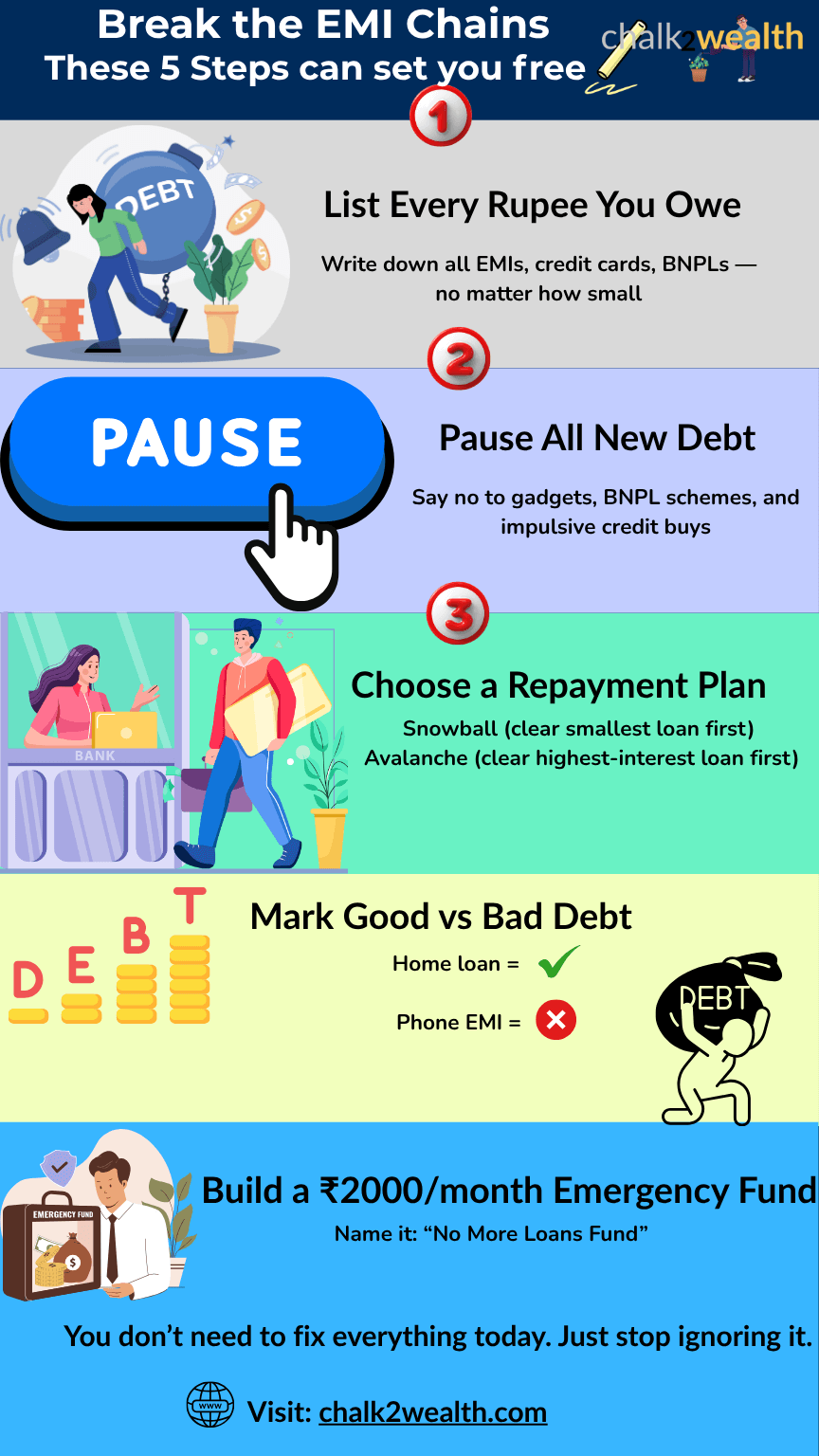

Refer to the visual guide below — it outlines exactly how to begin your journey out of the EMI cycle.

Here’s what it shows:

- Build your first ₹500/month emergency buffer

- Identify and list every debt — even the ones you’re avoiding

- Learn which loans to clear first for the biggest relief

- Say no to new debt for 30 days (it’s more powerful than it sounds)

- Reclaim your financial peace, one win at a time

If the debt trap has quietly taken over your life, this guide might just be your way out — gentle, practical, and doable. One decision at a time. Scroll down to view the infographic and take your first step.

And if you’re also struggling with Debt trap fund, don’t miss to check: Debt trap escape infographic showing 5 steps to break free from EMI burden including emergency fund, bad debt traps teachers, repayment plan, and spending pause.

Frequently Asked Questions About Debt Traps

Q1: How can a person fall into a debt trap?

A debt trap often begins quietly — with small EMIs or short-term credit offers. It might start with:

- A mobile phone on EMI

- A credit card purchase you plan to clear “next month”

- A Buy Now Pay Later (BNPL) scheme from an online sale

At first, these seem affordable. But when multiple EMIs start adding up — and you’re using new loans or credit cards to pay old ones — that’s when the trap sets in. Your income starts going mostly toward interest and repayments, leaving little room for savings or emergencies.

Many salaried people, including teachers and parents, fall into the trap without realizing it. It’s not the loan itself that’s harmful — it’s the lack of a repayment plan and the build-up of multiple loans over time that creates the real pressure.

Q2: How to recover from a debt trap?

Many teachers don’t even realize they’re in a debt trap until it’s too late. Here’s a simple checklist to help you spot the warning signs:

Recovering from a debt trap isn’t about big sacrifices — it’s about small, smart steps repeated consistently:

List Every Debt — Write down all loans, EMIs, credit card balances, and BNPL dues.

Choose a Strategy — Use either:

- Debt Snowball (clear the smallest loan first)

- Debt Avalanche (clear the highest-interest loan first)

Pause New EMIs — Avoid new debt for at least 30–60 days.

Build a Buffer — Start a ₹500/month emergency fund to reduce future borrowing.

Track Your Spending — See where your money leaks, and plug those gaps.

You don’t need to solve everything overnight — just take the next right step.

Q3: Is EMI a trap?

Not always. An EMI (Equated Monthly Installment) is just a tool — it becomes a debt trap when it’s misused.

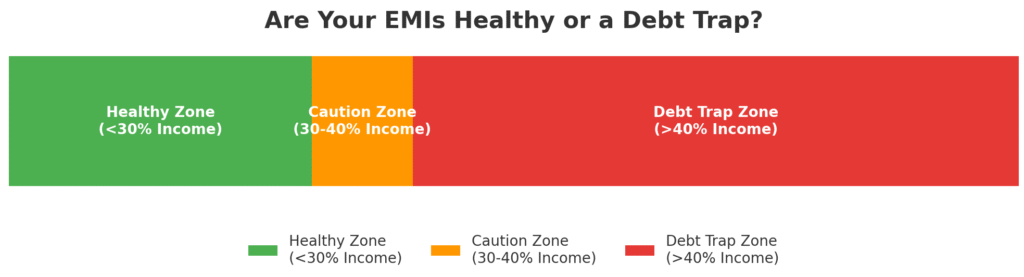

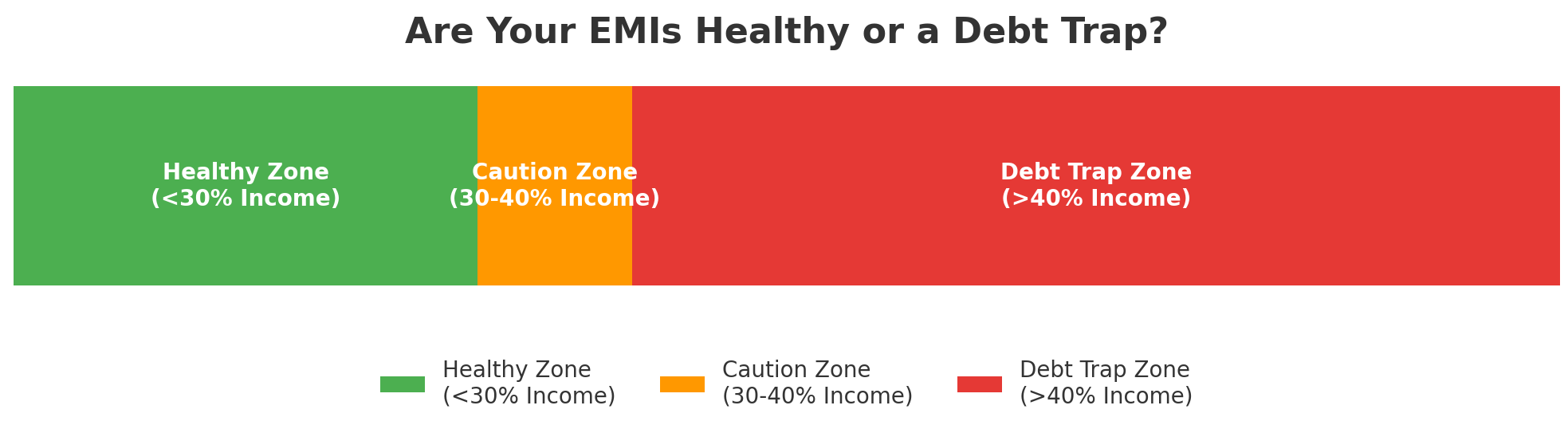

If your total EMIs are:

- More than 30–40% of your monthly income

- Spread across multiple loans (phone, vehicle, credit card, BNPL)

- Used for wants instead of needs

…then you may be on the path to a trap.

The key is planning. A well-managed EMI for a home or education can be useful. But unplanned EMIs, especially for lifestyle purchases, often turn into financial stress.

Debt Trap Is Real — But So Is Your Way Out

Debt trap recovery isn’t about perfection — it’s about taking the next small step. Whether it’s pausing new EMIs, listing every rupee you owe, or building your “No More Loans” fund, each action brings you closer to financial peace.

You don’t have to figure it all out today. Just stop ignoring it.

Start small. Stay consistent. You’ve got this.

Share Your Story & Join the Chalk2Wealth Community

Have you ever felt stuck in a debt trap — juggling EMIs with no savings left for yourself?

At Chalk2Wealth, we believe teachers, parents, and salaried families deserve real, simple financial solutions.

Drop your thoughts or story in the comments below — your experience could guide someone else.

And if you found this guide helpful, don’t miss our weekly tips, money habits, and financial stories crafted especially for educators.

👉 Subscribe to the Chalk2Wealth newsletter and take one step closer to peace of mind.

“Jagan ji, you are doing a wonderful job in field of Financial Literacy, 99% of people are unaware. Perhaps that’s why they remain troubled in life. If people are taught financial literacy from an early age, their lives can be much better. I truly feel that everyone should read your blogs.”

Thank you so much, Bhaiya, for your kind and encouraging words. Coming from a respected Navodayan senior like you, it truly means a lot. I completely agree—financial literacy is something most people miss out on, and it impacts their lives deeply. My goal is to simplify and spread this knowledge so that more people can make informed financial decisions early on.

Your support and blessings inspire me to keep going. Grateful to be part of the Navodaya family where we continue to uplift each other. 🙏

Warm regards,

Jagan