Table of Contents

ToggleHow My Parents’ Sandook System Taught Me the Real Meaning of an Emergency Fund

Emergency Fund Planning — 5 Steps I Learned from My Mother’s SANDOOK Envelope System

I grew up in a quiet village called Fanar, nestled amidst the majestic hills of Bharmour, Himachal Pradesh. Life was simple, but every rupee in our home had a purpose — especially when it came to building our emergency fund, though we never called it that back then. My Papa was a thekedaar, working on local construction sites, and during apple season, he became an apple merchant, often travelling long, tough routes to sell produce. He even supplied goats to the Indian Army in Leh-Ladakh. He wore many hats, but he always had one mission — to create financial stability for our family.

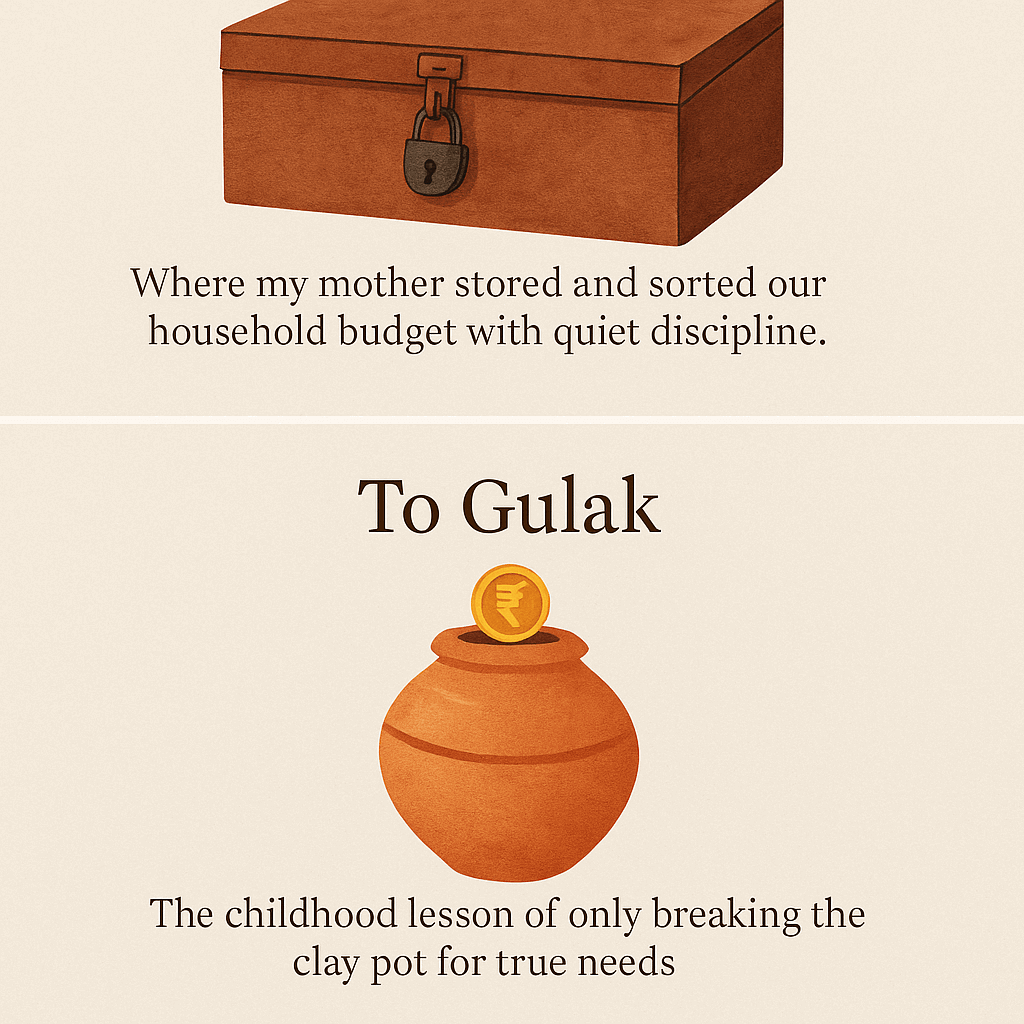

At home, my Mammy was the silent pillar — a full-time homemaker who managed our finances with wisdom, discipline, and her trusted tin box — our family’s Sandook. Every month, when Papa returned with cash from payments or the fruit mandi, Mammy would sit cross-legged on the floor, open the Sandook, and carefully sort the money into labelled envelopes:

- One for ration

- One for daily expenses

- And one special envelope marked: “Achanak Zarurat” — our emergency fund.

She would often remind me:

“Beta, paisa sirf kharchne ke liye nahi hota, sambhalne ke liye bhi hota hai.”

(Money isn’t just for spending — it’s for safeguarding your future.)

Papa, with his tired hands and calm eyes, maintained a thick hand-written register, noting every rupee earned and spent — building his own version of an emergency fund plan long before we had digital banks.

“Zindagi kabhi timetable se nahi chalti,” he once said.

“Kabhi chhutti ki jagah par pariksha aa jaati hai. Isliye har ghar mein ek emergency fund zaroori hai.”

(Life doesn’t always follow a timetable. Sometimes, a test arrives when you expected rest — that’s why every home needs an emergency fund.)

Back then, I didn’t realise they were not just teaching me how to manage money — they were teaching me how to build financial resilience and how to prepare for life’s unexpected moments through an emergency fund.

When I lost Papa in Class 7 at Navodaya Vidyalaya, it was heartbreaking. But the financial habits he and Mammy built — the envelopes, the Sandook, and the Achanak Zarurat fund — became my emotional anchor and financial compass.

Today, as a school leader, father, and financial storyteller, I feel responsible to pass these life-changing lessons forward. If you’re a teacher, a parent, or anyone striving for financial stability, this emergency fund story is for you.

What Is an Emergency Fund — And Why Every Indian Teacher Must Build One

An emergency fund is more than just money — it’s a quiet promise you make to your future self. It’s a financial safety net, a cushion that can soften life’s sudden blows — whether it’s a medical emergency, a salary delay, an unexpected job loss, or even a school closure that leaves you stranded in the middle of your commitments.

Why Every Indian Teacher Needs an Emergency Fund

Back in Fanar, my parents never used fancy financial terms like “emergency fund.” But they lived the principle, faithfully, through a simple envelope labelled “Achanak Zarurat.” That small envelope, tucked safely in my mother’s Sandook, protected us more times than I can count. When the roof leaked during a storm, when an urgent trip to Chamba hospital couldn’t wait, or when Papa’s payments from thekedari got delayed — we never had to borrow, beg, or panic. That one envelope held our peace of mind.

Today, many teachers — especially those working in private or rural schools — are walking the same tightrope my parents once did. Salary delays. Unplanned expenses. Seasonal financial gaps. Or worse, school closures like we saw during COVID that shook the stability of entire households. When your entire family is leaning on your salary, even a single missed payment can feel like a landslide.

That’s why, as educators, we can no longer afford to leave our financial security to chance. We must carry forward the same quiet wisdom our parents lived — but with today’s tools, whether it’s a digital envelope, a SIP, or an automated savings account. The world may have gone cashless, but the need for an emergency fund is timeless.

5 Simple Steps to Build Your Emergency Fund — Inspired by My Mother’s Sandook

(From the hills of Fanar to your wallet today)

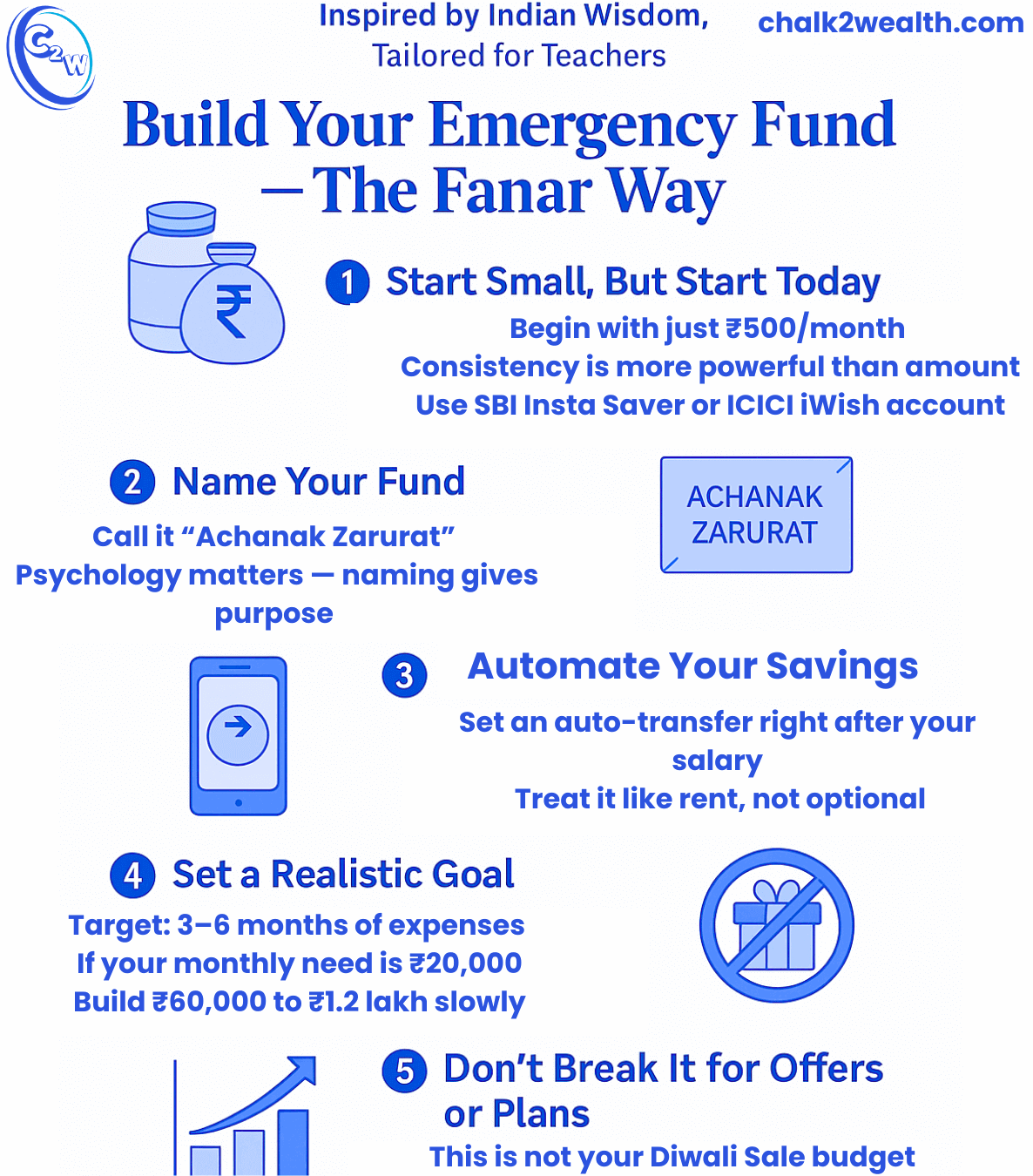

1. Start Small — But Start Now

Just like Mammy’s simple envelope system, you don’t need to wait for a big amount. Begin with whatever you can — even ₹500 per month is enough to start building your emergency fund. The secret is not in how much you save, but in showing up every month, consistently.

Think of it as your own digital Sandook — a quiet corner of your wallet that you don’t touch unless life truly demands it.

Tool Tip: Open a separate savings account dedicated to emergencies. You can explore options like SBI Insta Savings or ICICI iWish — easy to set up, easy to track.

2. Give Your Fund a Name — Just Like “Achanak Zarurat”

Don’t let your emergency fund stay nameless. Whether you write it in your diary, your phone, or on the savings account itself — name it with purpose.

When you label it clearly, your mind automatically respects its boundary.

In our home, that one envelope marked “Achanak Zarurat” was untouchable. It wasn’t just money — it was our family’s safety net. Giving your emergency fund a meaningful name keeps it emotionally protected, just like Mammy’s envelope was in our Sandook.

3. Automate Your Savings — Make It Non-Negotiable

Set up an auto-transfer to your emergency fund the moment your salary hits your account. Treat it like a compulsory expense — just like rent, school fees, or EMIs.

What automatically goes out, never tempts you to spend.

The less you see it, the more you’ll protect it.

Tool Tip: Use apps like SBI YONO, KFINKart, or goal-based saving options to make this process effortless and disciplined — just like Mammy’s fixed habit of setting aside the “Achanak Zarurat” envelope every month.

4. Aim to Cover 3 to 6 Months of Expenses

Take your time, but keep your target clear — your emergency fund should be strong enough to cover at least 3 to 6 months of your essential expenses.

Think about the basics: ration, children’s school fees, EMIs, health costs, travel needs — the non-negotiables.

For example, if your family needs ₹20,000 per month to survive comfortably, your emergency fund goal should be between ₹60,000 to ₹1.2 lakh.

This is your financial safety net — the cushion that lets you breathe easy even when life takes an unexpected turn.

5. Don’t Touch It for Sales or Travel Plans

Your emergency fund is not your festive sale fund. It’s not your trip-to-Manali budget either.

It’s your family’s safety net — to be used only when life truly demands it.

Be like Mammy — she never touched the SANDOOK’s Achanak Zarurat envelope unless there was no other way.

Hold that same discipline. Let this fund stay sealed until a real emergency knocks at your door.

The Biggest Mistake I Made About Emergency Funds — Don’t Repeat It

When I started earning, I thought exactly what most of us think: “I have GPF. I have a regular salary. Why should I worry about emergencies?” So, for years, I happily ignored the idea of building an emergency fund. But life doesn’t wait for you to get ready.

It taught me the hard way.

- Car breakdowns don’t check your salary date.

- Medical bills don’t care about your monthly budget.

- And the emotional stress? It hits the hardest when your bank balance isn’t ready to support you.

I realised too late that GPF and salary aren’t emergency shields — they’re just part of the system. Real protection comes from the emergency fund you create for yourself.

Those early days of struggle made me revisit the “Achanak Zarurat” envelope — this time through a SIP and digital fund.

How Much Emergency Fund Is Enough? Where to Keep It Safe — And How to Find Your Personal Number

When it comes to building an emergency fund, one-size-fits-all doesn’t work. Your emergency fund should fit your life — your home, your needs, your family.Some people chase random numbers they hear on YouTube. But the right amount is the one that can protect your family’s basic needs when life suddenly takes a sharp turn.

Here’s how to calculate your personal emergency fund:

Step 1: List Your Non-Negotiable Expenses

- Monthly groceries and ration

- Children’s school fees

- Home/car EMIs

- Utility bills (electricity, phone, gas, water)

- Basic health costs

- Daily travel or work expenses

Example: Your monthly essential expenses come to ₹22,000.

Step 2: Multiply By Your Comfort Zone

You can plan for 3 months minimum or 6 months for full safety.

Example: ₹22,000 × 6 months = ₹1,32,000

That’s your personal emergency fund target.

Where Should You Keep It?

Like Mammy kept her emergency fund safely in her Sandook, you should also keep yours where it’s safe but quickly accessible.

Best Places to Keep Your Emergency Fund:

- A separate bank savings account (not your daily expense account)

- A liquid mutual fund for slightly better returns but easy withdrawal

- A goal-based saving app like SBI YONO, KFINKart, or Groww

Don’t lock it in an FD. Emergency funds should not have exit barriers.

Final Tips for Teachers Starting Late

- Don’t feel guilty — feel grateful you’re starting now.

- Even if you’re 45+, a fund of ₹50,000 can save you from taking a ₹50,000 loan.

- Involve your spouse — and even your elder kids.

- Keep the spirit of Fanar alive — less about tools, more about mindset.

Frequently Asked Questions (FAQ)

1. How much money should I keep in an emergency fund?

You should aim for at least 3 to 6 months of your essential monthly expenses. Start with whatever is possible, even ₹500 per month, and build slowly.

2. Where should I keep my emergency fund for quick access?

The best places are:

A separate bank savings account

A liquid mutual fund

Goal-based saving apps like SBI YONO or Groww

Avoid FDs with long lock-in periods.

3. Can my GPF or PF act as my emergency fund?

No. GPF is not an emergency fund. GPF withdrawals take time and are meant for long-term savings. You need a fund that you can access instantly.

4. Can I invest my emergency fund in the stock market?

No. An emergency fund should never be invested in risky places like stocks or long-term mutual funds. It should always be in low-risk, easy-access options.

5. How soon should I start my emergency fund?

The best time is today. Even if you start small, starting now is better than waiting for a perfect time that may never come.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

Very true but thoughtful words

Every person have to maintain ACHANAK JAROORAT FUND

Thank you, Vikas bhai ji 🙏 You said it perfectly — every person must build an Achanak Zaroorat Fund. My mother’s Sandook envelope system taught me that small, disciplined savings can become a strong shield in emergencies. I’ll keep sharing more such practical money lessons to make financial planning simple for everyone.