Table of Contents

ToggleEMI Monster: How a ₹17,500 Car Loan Trapped My Cousin

Last month, my cousin — a teacher — found himself struggling while paying his ₹17,500 car EMI for his Maruti Grand Vitara.

He admitted, “Sirf gadi chal rahi hai… par khud ki savings ruk gayi hai.”

This is exactly how the Financial Jungle traps families. A shiny EMI looks easy at first, but when combined with school fees, gadgets, and daily expenses, it silently eats away savings and peace of mind. In fact, we’ve already shown in our EMI vs SIP battle infographic how every rupee locked in EMIs today could have grown into wealth through disciplined investing.

The problem doesn’t end there. What starts as one car EMI often expands into multiple loans — personal, education, even credit cards — until income is swallowed whole. That’s the classic debt trap we explained in our 5-step escape guide. Without a plan, teachers and middle-class families keep working hard but never feel financially free.

And when debt grows unchecked, it often turns into bad debt — borrowing for lifestyle wants instead of long-term needs. Bad debt not only drains salaries but also blocks the very savings that could build an emergency fund or fuel SIP investments.

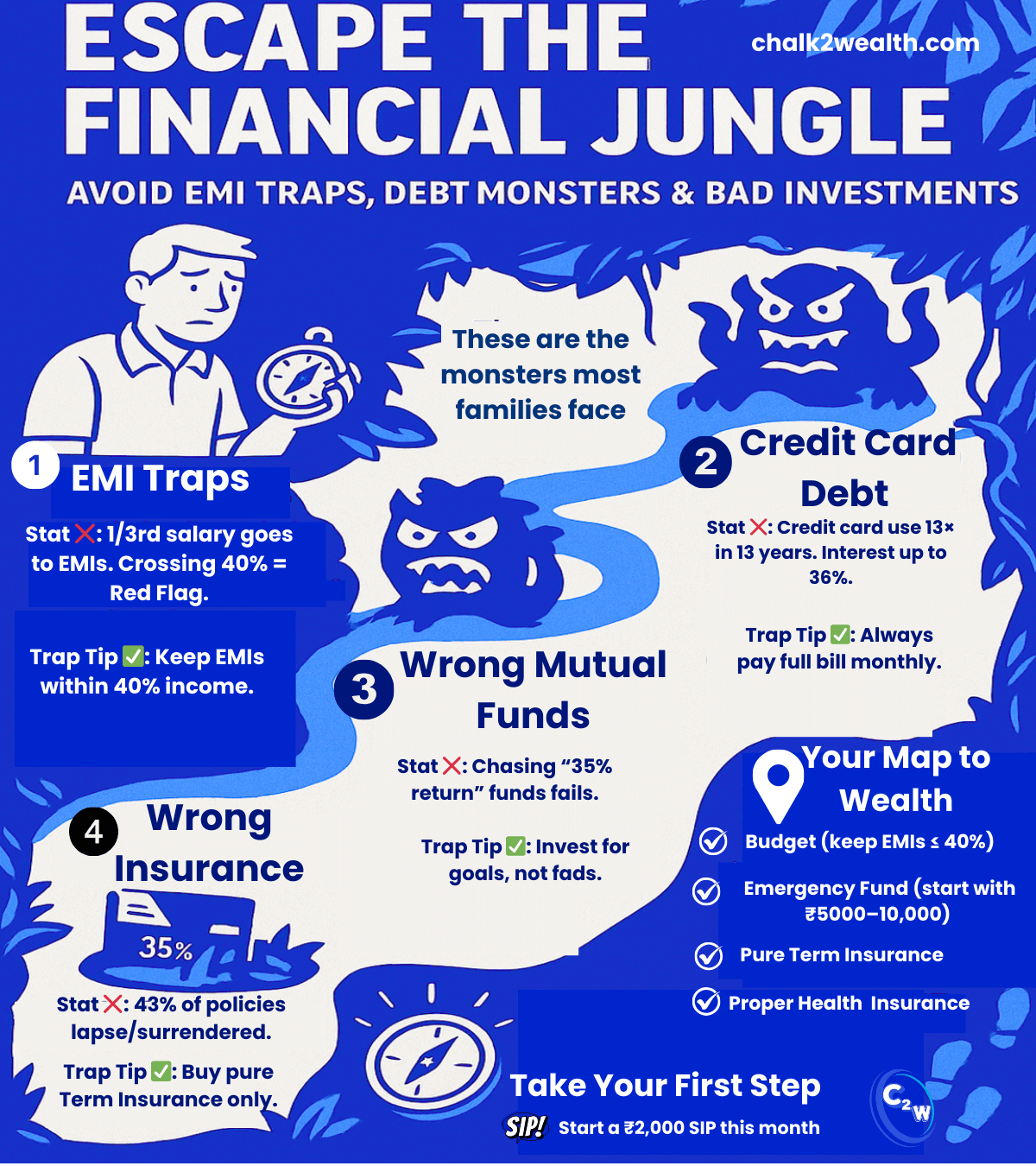

Our infographic below maps the four biggest money monsters teachers and families face:

- EMI Traps that swallow income

- Credit Card Debt that piles up with interest

- Wrong Mutual Funds chosen in haste

- Wrong Insurance that offers little cover

The safe path is simple but powerful:

- Keep EMIs ≤ 40% of income

- Build an emergency fund (₹5,000–₹10,000 to start)

- Start SIPs for future goals

- Always buy pure term insurance for real protection

👉 Teachers deserve financial freedom, not financial stress. Learn from my cousin’s struggle — and use this infographic as your map to escape the jungle.

Tame the EMI Monster Before It Eats Your Savings

Check your monthly EMIs today. If they are swallowing more than 40% of your income, the EMI Monster is already in control. Teachers, don’t let it chain your financial freedom — share this guide with a colleague before it’s too late.

Share Your EMI Monster Story

Have you faced your own EMI Monster — car loan, home loan, or credit card debt? Drop your story in the comments. Your experience could guide another teacher.