It was a humid Tuesday afternoon. The staffroom fan squeaked in rhythm as familiar voices filled the air — casual complaints about rising school fees, delayed DA, and quiet discussions about how some manage to earn extra through coaching — while government rules tightly restricted most of us.

Back then, I was posted as a TGT Non-Medical at GMS Khadet. That day, I had just returned after visiting a respected elder lady from our community who had fallen seriously ill and had been rushed to a private hospital the night before. The entire village was worried. Even the school corridors carried the weight of that tension.

I had barely set my bag down in the staffroom when Archana Ma’am, a TGT Arts teacher, broke the silence. In a calm but serious voice, she said, “We often talk about everything, but never the financial planning tips that could actually prepare us for days like these.”

The room fell silent. Her words struck a chord.

Because deep down, we all knew the truth — most of us wouldn’t be financially ready if a real emergency knocked on our door. And it wasn’t because we weren’t hardworking. It was simply because we had never discussed or followed even the most basic financial planning tips that could have prepared us.

That one staffroom conversation — so raw, so honest — stayed with me long after. It made me realize something powerful: Financial planning tips aren’t just for the wealthy. They’re for us — teachers, school staff, school leaders — because emergencies don’t wait for your salary cycle or savings to catch up.

That day planted a seed in me. When I eventually became a School Head, I made it a priority that our staff meetings would cover more than just timetables and inspection reports — they would always include practical financial planning tips that could genuinely help us all build safer, stronger futures.

1. Know Where You Stand: Your Personal Balance Sheet

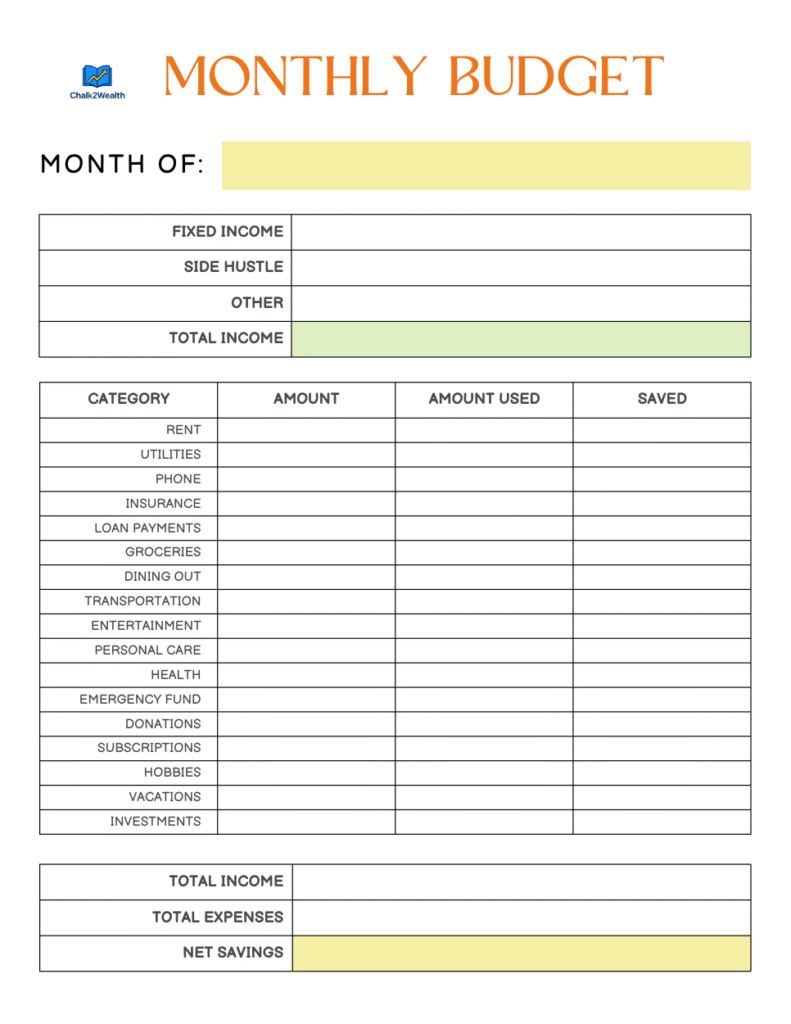

Our first meeting started simple. I picked up a whiteboard marker and shared two basic financial planning tips that many of us often overlook:

Income – Expenses = Surplus (or Deficit)

Assets – Liabilities = Net Worth

We asked everyone to calculate their own figures on a sheet.

That day, Neelam Ma’am was shocked to realise she was spending more than she earned — a classic case of EMI stacking. Mohinder Sir, on the other hand, discovered he had ₹5 lakh lying idle in his savings account for over three years — a powerful reminder that even simple financial planning tips can unlock hidden opportunities.

📌 Moral: If you can manage a classroom, you can manage your monthly budget too. Most financial planning tips start with one small habit — just start writing it down.

2. Emergency Fund: The ‘First Aid Kit’ of Your Finances

After our first meeting, where we focused on knowing our financial position, the next logical step in our financial planning tips journey was building a safety net.

In our second meeting, we shared personal stories that brought the need for an emergency fund to life. Usha Ma’am opened up about her daughter’s appendix surgery last year that cost her ₹70,000. She had no savings buffer back then and had to swipe her credit card to manage it — a debt she was still paying off.

That day, we pledged as a staff: every teacher would start building an emergency fund — even if it meant saving just ₹1,000 a month. Whether in liquid mutual funds or a separate bank account, this financial planning tip became non-negotiable. Our goal was simple: to build a fund that could cover at least 3–6 months of basic expenses.

📌 Lesson: Your peace of mind doesn’t come from your monthly salary — it comes from the savings buffer you build through small, consistent financial planning tips.

3. Financial Planning Tips Aren’t Boring — They’re Your Path to Freedom

A few weeks after our emergency fund discussion, we introduced another simple but powerful financial planning tip in our staffroom — a 30-Day Budgeting Challenge.

During the morning meeting, I casually suggested,

“For the next 30 days, let’s all track every single rupee we spend — whether it’s on chai, petrol, or that extra samosa from the school canteen.”

Some teachers downloaded budgeting apps like Walnut and Money Manager, while others preferred the old-school method — a diary tucked safely inside their handbags.

It wasn’t about complicated formulas — it was about building daily financial awareness, one of the most practical financial planning tips we could apply immediately.

The “Chalk & Slate” Budgeting Method for Teachers

During one of our monthly budgeting discussions, we realised we needed something simple, relatable, and tailor-made for teachers. That’s when we created our own easy-to-remember system — inspired by the simplicity we use every day in our classrooms.

We proudly called it the “Chalk & Slate” method, and it soon became one of our most effective financial planning tips for teachers.

🟩 CHALK = Fixed Essentials (60%)

Just like chalk marks that stay visible until you intentionally wipe them off, these expenses are your fixed, non-negotiable commitments.

They include:

- House rent or home loan EMIs

- School fees

- Grocery and electricity bills

- Transportation and daily essentials

This is the portion you must always budget first — it keeps your life stable. Prioritising these fixed essentials is a basic but crucial financial planning tip.

🟦 SLATE = Flexible Priorities (25%)

Just like a slate can be wiped clean and written again, these are your flexible, month-to-month expenses.

They include:

- Eating out, gifts, and shopping

- Weekend trips, streaming subscriptions

- Beauty parlour visits, small home repairs, leisure spending

Managing this part wisely is a smart financial planning tip because it keeps your lifestyle enjoyable without overstepping your budget.

🟨 DUSTER = Wipe-Off for Savings (15%)

This is the most powerful part of the method — the money you intentionally “wipe off” from your spending and move into savings.

This is where it should go:

- Mutual fund SIPs

- Term or life insurance premiums

- Emergency fund

- Child’s Sukanya Samriddhi Account or PPF

- Retirement savings like NPS

The Chalk & Slate method quickly became our staffroom’s favourite because it made budgeting and financial planning tips simple, visual, and achievable — just like teaching on a classroom blackboard.

4. Insurance: The Topic We Avoided — Until We Couldn’t

Some lessons in life come the hard way.

I still remember the time I had to undergo a major operation in Chandigarh. The total bill came close to ₹3 lakh. I had some savings, but the sudden expense hit me hard — not just financially, but emotionally. It forced me to face a truth I had long ignored.

That day, I truly understood one of the most critical financial planning tips — don’t wait for a ₹3 lakh hospital bill to realize the value of insurance. Plan now — for peace, for dignity, for control.

📌 Lesson: Medical emergencies don’t send invitations, but the right financial planning can prepare us for them.

That experience stayed with me. So, in our next staffroom session, I didn’t bring PowerPoint slides or fancy charts. I simply stood up and shared my story — not as a financial expert, but as someone who had survived the emotional and financial stress of an unexpected medical emergency.

I explained:

- Why term insurance is the most affordable and effective way to protect your family.

- Why health insurance should go beyond just the basic school or government policy.

- Why accident and critical illness covers are essential shields to protect your savings from being wiped out overnight.

That day, the staffroom didn’t just listen — they connected. They didn’t see a lecture; they saw a lived experience. It was another reminder that the most valuable financial planning tips often come from real stories, real people, and real struggles.

5. Financial Planning Tips for Retirement — It’s Closer Than You Think

A friend’s elder brother is set to retire in February 2026. Over a casual cup of chai one evening, he said something that stayed with me long after the steam from our cups had disappeared:

“Retirement ke baad paison ka kya karna? Bas khana-peena hi toh hai.”

But behind that easy smile was a harder reality. After decades of government service, his total savings came to just around ₹20 lakhs. No SIPs. No mutual funds. Only a GPF account and a couple of FDs — that’s it.

I didn’t challenge him that day, but a quiet alarm went off inside me. If ₹20 lakhs need to support someone for 20 years of retirement, that’s barely ₹8,000 a month — in today’s value. Even with a small pension, how would that cover medical emergencies, rising inflation, or even a life of basic dignity?

That simple staffroom-style conversation shook me to the core. It taught me that financial planning tips for retirement aren’t optional — they’re urgent. Retirement doesn’t mean the end of expenses — it means you finally deserve peace, not pressure.

So I chose a different path. I started small but steady:

- ✅ Began a monthly SIP — a core financial planning tip for future growth

- ✅ Opened an NPS account for long-term pension security

- ✅ Continued regular PPF contributions to strengthen my retirement safety net

📌 Lesson: Retirement isn’t far away. And it doesn’t bring freedom automatically — it brings the expenses you’ve always had, with fewer income sources to cover them. That’s why these financial planning tips aren’t just smart — they’re essential.

6. Tax Planning: Start in April, Not in a Panic

February used to look the same every year — a staffroom full of stress, last-minute paperwork, and the same question echoing in every corner:

“Kya 80C bhar gaya?”

I saw teachers scrambling for receipts, rushing to buy LIC policies they didn’t even understand — simply to save tax at the last minute. That’s when we realised we needed to approach this differently.

So, starting that April, we made a new rule in our staff meetings — one of the most practical financial planning tips we ever adopted:

- Plan your ₹1.5 lakh under Section 80C from the start of the financial year — spread it wisely across PPF, ELSS, or your existing LIC.

- Buy health insurance early in the year — not just to claim 80D, but to genuinely protect your peace of mind.

- Understand HRA, standard deductions, and explore NPS contributions if you’re salaried and eligible — don’t just sign forms, know what they mean.

📌 New Staffroom Rule: Plan your taxes like you plan your syllabus — don’t wait till the exam week. Tax planning isn’t a seasonal rush — it’s one of those financial planning tips that can save you from panic, poor decisions, and missed opportunities if you start early and stay consistent.

7. Financial Literacy Belongs in the Staffroom

“Paisa toh har mahine milta hai, par kaise sambhalein, yeh koi nahi batata.”

I still remember Archana Ma’am saying this during a staff meeting at GMS Khadet, sometime around 2015 or 2016. Her words struck me hard — because they were true.

Back then, I had just started exploring the world of personal finance. And in that moment, I realised something powerful — we, the very people shaping young minds, were never taught how to manage our own money.We knew how to manage classrooms, but no one had shared even the most basic financial planning tips with us.

That’s when I decided to take the first step.

Every month, I began sharing one simple, practical financial planning tip with our team — something easy, relatable, and designed especially for teachers.

- I’d circulate PDFs, blog links, and visuals — some of which now live right here on Chalk2Wealth.

- Our casual chai breaks slowly transformed into “chai-time money wisdom” sessions.

- Bit by bit, conversations about savings, budgeting, SIPs, insurance, and emergency funds started flowing naturally in our staffroom.

What began as a small staffroom experiment in 2015…

has today grown into a full-fledged mission — Chalk2Wealth — a place built to empower educators with smart money habits and easy-to-follow financial planning tips. Because when teachers start talking about money, they don’t just improve their own lives — they inspire each other to grow. They build a culture where financial wisdom travels faster than gossip.

📌 Staffroom Tip:

Start small. Share one financial planning tip every month with your colleagues. It could be as simple as tracking expenses, starting a SIP, or building an emergency fund.Small tips, shared regularly, can build a big community of financially confident teachers.

What School Leaders Can Do

As school leaders, we often focus on nurturing academic growth, discipline, and performance. But real leadership also means nurturing financial awareness within our teams.We can create safe spaces where teachers can openly talk about money — not with fear, but with curiosity and confidence.

Start by:

- Encouraging monthly money talks in staff meetings

- Sharing simple financial planning tips regularly

- Inviting experts for occasional sessions on savings, SIPs, insurance, and tax planning

- Leading by example — show how you plan, save, and invest

📌 Leadership is about nurturing growth — financial growth too.

When school leaders start financial conversations, they don’t just change numbers — they change mindsets.

Final Word: We Educate India — Let’s Empower Ourselves Too

You discuss timetables, syllabus, inspections, and events in staff meetings — But what about your future, your savings, your security?

✅ Start with just one financial tip at your next meeting

✅ Share this post with a fellow teacher who needs to hear it

✅ Subscribe to Chalk2Wealth for practical, teacher-first money insights.

Wow….. everyone should think in this way about their money nd salary ……..

Thank you so much! 🙏

Yes, once we start looking at our salary not just as income but as a tool for dreams, everything changes. It’s not about how much we earn — it’s about how aware we are of where it goes. I hope more educators join this mindset shift! 🌱