Table of Contents

ToggleGood Life Insurance in India:1 Powerful Tip to Choose Wisely

Good Life Insurance in India — What You Actually Need and How to Buy It Right

Let’s clear the air: Insurance is not an investment. It’s protection — plain and simple. Yet many teachers, parents, and salaried professionals are sold life insurance as a “saving plan.”

“₹25 lakh milega — tax free!” “Investment bhi hai, protection bhi.”

But what they don’t tell you is:

- How much your family really gets if something happens to you

- And how little it’s worth if you survive

Last time, I exposed this bitter truth in my article:

Insurance Frauds in India — How Banks Make Profits, Not Promises

It showed how mis-selling is costing honest, middle-class families lakhs of rupees — in the name of “investment”. That’s why in this article, I’m going deeper.Because good life insurance isn’t about returns — it’s about responsibility.

If you want true peace of mind, you need to understand:

- Why Term Is No. 1 in Financial Planning for Teachers

- Health Insurance Benefits: 5 Essential Features to Consider for Teachers

This post is your simple guide to choosing the right life insurance in India — without falling into emotional traps, complex charts, or sweet promises. Let’s start with the basics — what makes good life insurance truly good?

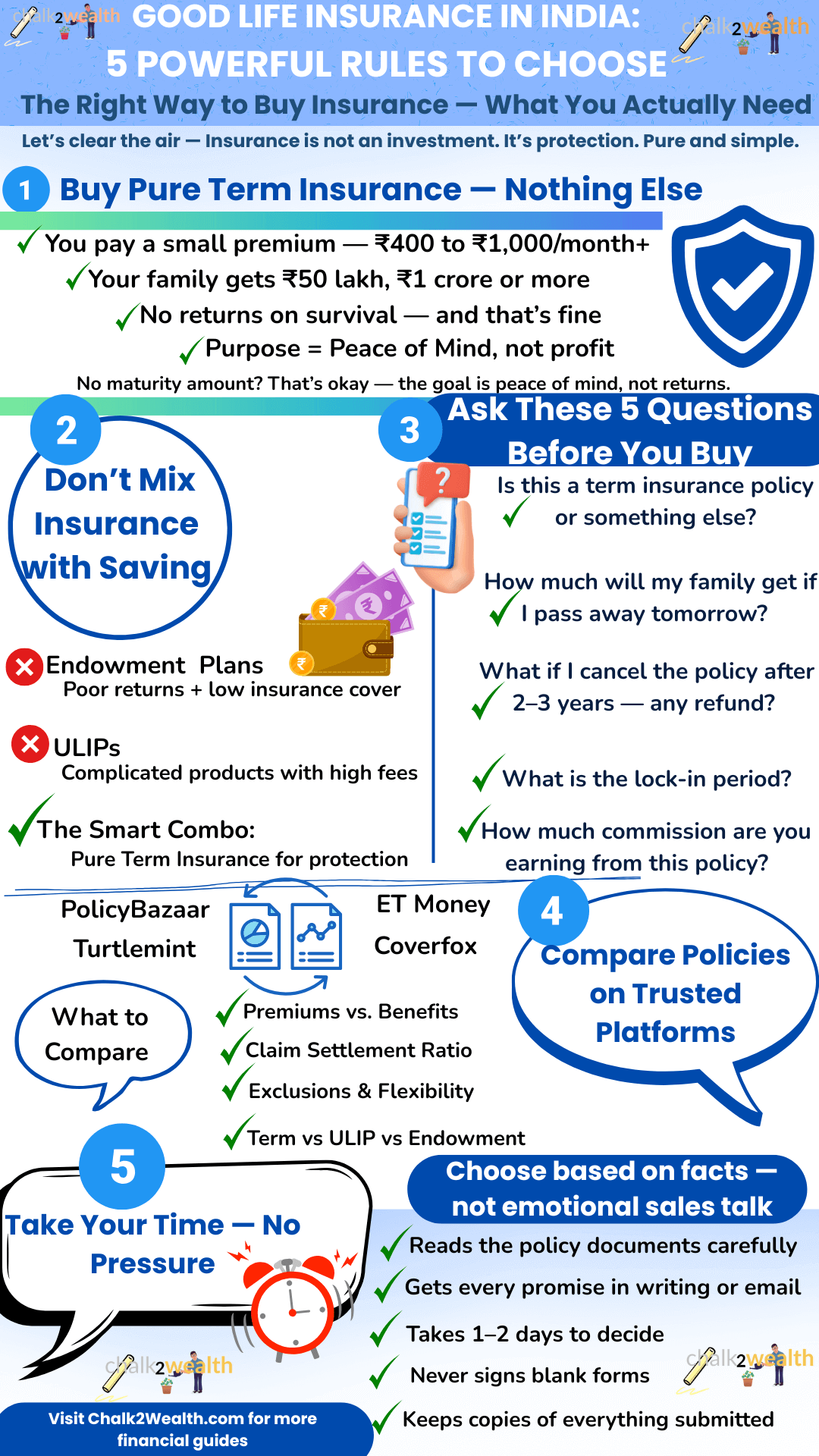

Good Life Insurance in India Starts with Pure Term Insurance — Not Endowment Plans

When it comes to good life insurance in India, term insurance stands above all other options — and for a good reason. Term plans are designed with only one purpose: to protect your loved ones financially if you’re no longer around. They don’t promise returns, bonuses, or savings. But they do promise peace of mind.

- You pay a small premium — as low as ₹400 to ₹1,000 per month

- In return, your family gets a large sum — ₹50 lakh, ₹1 crore, or more

- If you survive the policy term, there’s no payout — and that’s absolutely fine

Because the point is not to get something back — it’s to ensure your family never struggles in your absence.

“Term insurance protects your family. That’s its only job — and it does it well.”

Mixing Savings with Good Life Insurance in India? Think Again

Many people end up buying endowment plans or ULIPs thinking they’re getting the best of both worlds — insurance + returns. But here’s the truth:

- Endowment = Poor returns + low insurance cover

- ULIPs = Complicated products with high fees and no clarity

These hybrid plans confuse protection with profit. The result? You end up with insufficient coverage and disappointing returns — a double loss.

The smart path?

- Take pure term insurance for full protection

- Invest separately in SIPs, PPF, mutual funds, or NPS for real growth

This combo gives you the best of both worlds: security and wealth creation.

Keep it simple: Term Plan + SIP/PPF = Safety + Growth

3. Buying Good Life Insurance in India? Ask These 5 Questions First

Before you trust any agent, bank manager, or online offer — pause and ask these 5 essential questions:

- Is this a term insurance policy or something else?

- How much will my family get if I pass away tomorrow?

- What if I cancel the policy after 2–3 years — any refund?

- What is the lock-in period?

- How much commission are you earning from this policy?

If you get vague, defensive, or confusing answers — that’s your signal to stop.

“A good life insurance policy in India should come with honest answers — not hidden clauses.”

4. Compare Policies on Trusted Platforms

Don’t fall for emotional appeals like:

“Sir, this plan is perfect for your children’s future.” “This is LIC’s most popular policy — sab le rahe hain!” Instead, take a step back and compare real data yourself using trusted digital platforms like:

Look at:

✅ Premiums vs. benefits ✅ Claim settlement ratio ✅ Exclusions, terms, and flexibility ✅ Type of policy (Term vs ULIP vs Endowment)

This approach helps you choose a good life insurance policy in India based on facts — not sales talk.

5. Take Your Time — No Pressure

The biggest red flag?

“Sir, yeh offer sirf aaj ke liye hai. Sign kar lijiye!”

No good insurance product ever comes with pressure tactics.

A responsible buyer:

✅ Reads the policy documents carefully ✅ Gets every promise in writing or email ✅ Takes 1–2 days to decide ✅ Never signs blank forms ✅ Keeps copies of everything submitted

Buying life insurance is a major financial decision — treat it like one. Because what you’re really signing is your family’s safety net.

“A good life insurance policy in India gives clarity, not confusion.”

Still Confused? Here Are Some Common Questions

1.Why is good life insurance important in India?

A: It protects your family financially if something happens to you — with high coverage at low cost. It’s peace of mind, not a profit plan.

2. How to choose life insurance?

A: Choose pure term insurance for maximum protection at low cost.

- Check coverage (10–15× your annual income)

- Compare plans on trusted platforms

- Avoid mixing investment with insurance

3. Can I withdraw money from my life insurance?

A: Only if it’s a savings-based policy like endowment or ULIP.

You cannot withdraw from pure term insurance, as it offers no maturity or withdrawal benefit — it’s for protection only.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.