Table of Contents

ToggleHow Much Term Insurance Do I Need as a Teacher in 2026?

The bell had barely rung when Mrs. Pooja — mathematics teacher, mother of two, and the quiet backbone of her family — slid into the staffroom, eyes fixed on the month-end ledger on her phone.

“I can manage the school fees and the loan EMI,” she whispered, “but if something happened to me, what happens to them?”

It’s a question most educators ask in private and postpone in public. In 2026, with salaries, loans, and children’s education costs pulling at the same paycheck, the real ask is simple: How Much Term Insurance Do I Need as a Teacher in 2026? Let’s answer it cleanly — teacher to teacher — with a practical way to calculate your number.

As Mrs. Pooja’s worry shows, every teacher eventually faces the same uncomfortable question: How Much Term Insurance Do I Need as a Teacher in 2026? The answer isn’t guesswork — it comes from understanding your income, EMIs, children’s future needs, and how long your family depends on you.

If you want a deeper, teacher-friendly explanation of coverage, premiums, riders, and practical examples, read the full guide here: Term Life Insurance for Teachers in India 2026: Honest Guide.

The Salary Reality: How Much Term Insurance Do I Need as a Teacher in 2026?

Across India, pay varies by board, city, and tenure. Government teachers enjoy steadier scales and allowances, while private teachers usually start lower and rise with experience and school reputation. That’s why the answer to How Much Term Insurance Do I Need as a school teacher in 2026 cannot be a fixed one-size slab like “₹50 lakh for everyone.”

Teachers often compare term insurance with their existing savings plans such as PPF, NSC, FD, or GPF. If you already invest in these, you can explore safe investment options for teachers or even compare PPF vs NSC for teachers to understand how your savings strategy influences the term cover you choose.

Ultimately, when you ask yourself How Much Term Insurance Do I Need, the real purpose is simple:

Your family should be able to maintain the same quality of life and continue your plans even if you’re not around.

A well-calculated term cover ensures exactly that.

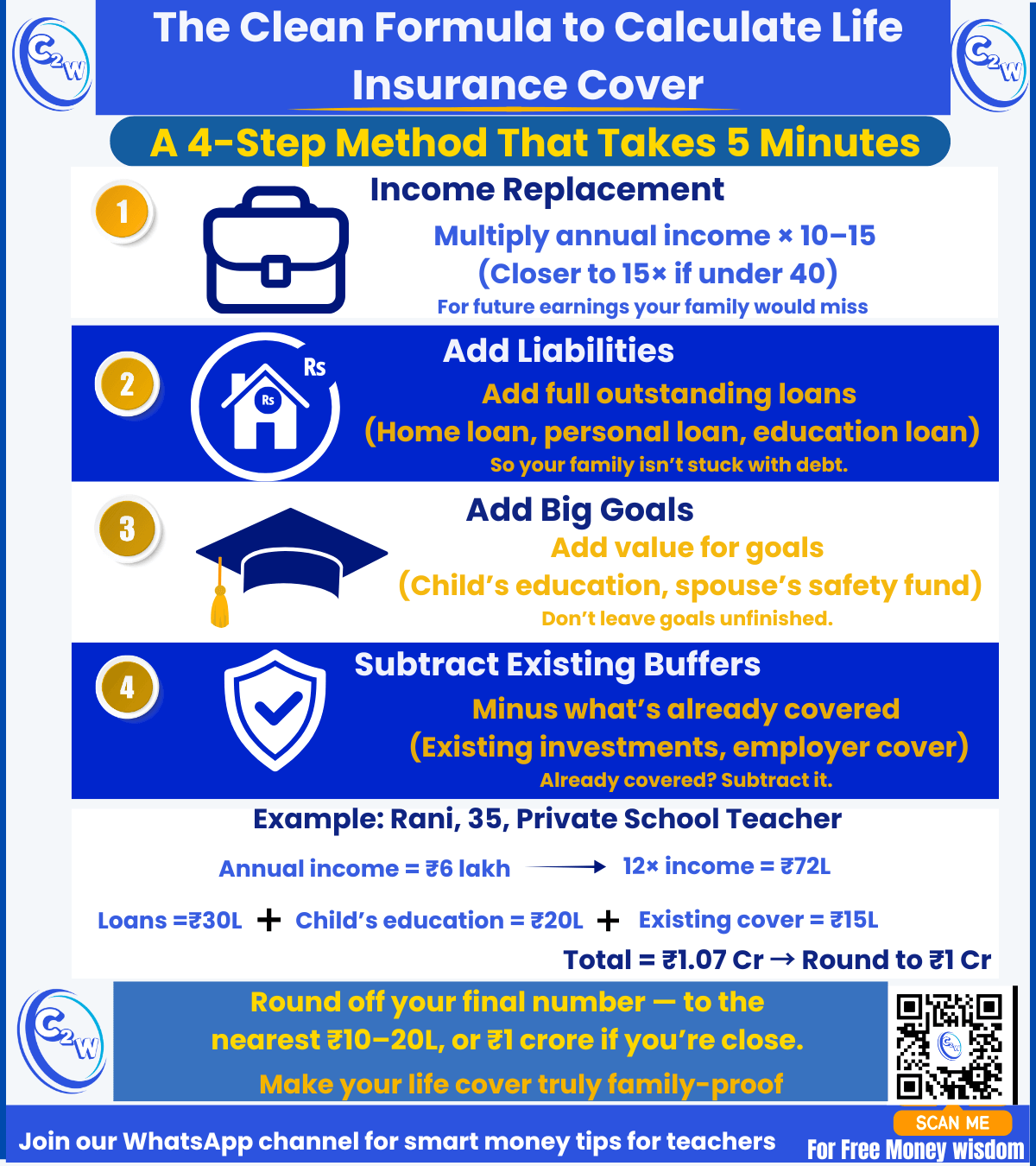

The Clean Formula to Calculate Life Cover for Teachers

Skip the jargon. Use this income replacement insurance method — a simple four-step, five-minute formula:

- Income replacement → 10–15× annual income (closer to 15× if under 40).

- Add liabilities → home, education, personal loans.

- Add big goals → children’s higher education, spouse’s cushion.

- Subtract today’s buffers → existing investments, GPF/EPF, employer life cover.

👉 That’s your realistic, family-proof Sum Assured.

Example (Rani, 35, private school teacher, ₹6L income):

12× income = ₹72L + loans ₹30L + child’s future ₹20L – buffers ₹15L = ₹1.07 Cr ≈ ₹1 Cr term insurance cover.

If you want the full playbook on why pure term beats mix-and-match products, read:

Age & Stage: How Much Term Insurance Do I Need as a Teacher in India in 2026?

Think in seasons, not just sums. Your life stage decides not only your premium, but also how much term insurance do I need to keep your family financially steady if something happens to you.

25–35: Foundation Years

Career and family are just beginning. Salaries may be modest, but future earning potential is high. Most teachers need ₹50 lakh–₹1 crore cover at this stage. If you’re asking how much term insurance do I need now, remember this: premiums are lowest in your 20s and early 30s, so opting for ₹1 crore early often makes long-term sense.

35–45: Peak Responsibility

This is the pressure phase — school fees, home EMIs, and aging parents overlap. Teachers typically require ₹75 lakh–₹1.2 crore (around 12–15× annual income). A salary jump or new loan means revisiting how much term insurance do I need, as yesterday’s cover may no longer be enough.

45–60: Nearing Retirement

Loans reduce, children become independent, and PF/savings grow. Required cover usually tapers to ₹50 lakh–₹1 crore (about 6–10× income). Beyond retirement, most debt-free teachers with pension or a solid corpus no longer need term insurance.

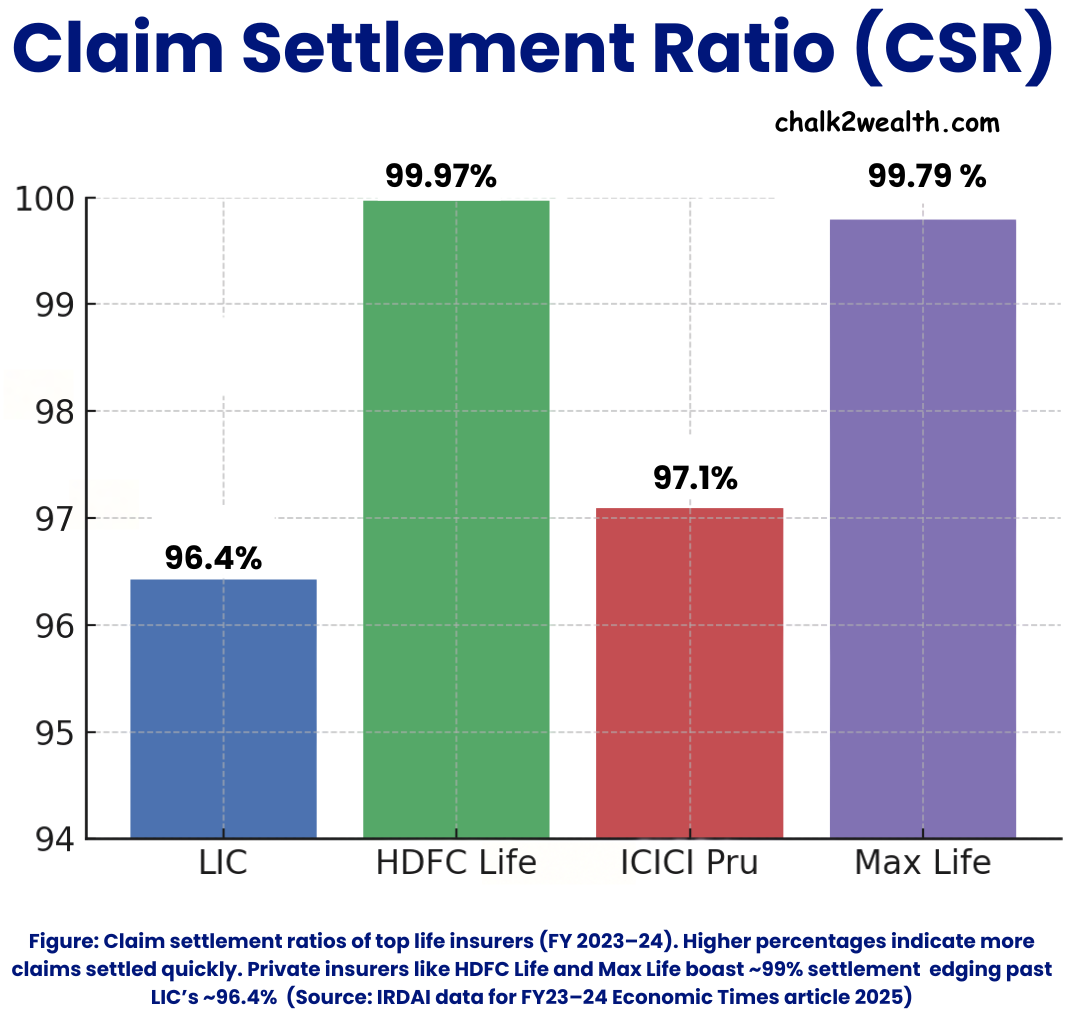

Choosing the Right Term Plan in 2026: LIC vs HDFC vs ICICI vs Max Life

After you’ve worked out how much term insurance do I need, the next step is choosing a reliable insurer to deliver that promise to your family. Indian teachers usually shortlist both public- and private-sector insurers, and four names consistently stand out: LIC, HDFC Life, ICICI Prudential, and Max Life.

All four are regulated by IRDAI and financially sound. Instead of obsessing over minor premium differences, focus on three practical factors:

- Claim Settlement Ratio (CSR): shows how consistently an insurer honors genuine claims

- Policy features: useful riders, payout options, and flexibility

- Service quality: ease of claim and long-term reliability

Recent IRDAI data (FY 2023–24) indicates that all four insurers maintain strong claim-settlement records, generally above 95%. Private players like HDFC Life and Max Life report very high CSRs, while LIC continues to command unmatched trust due to its scale, reach, and government backing.

Source: IRDAI data for 2023-24 article by Economic Times as on march 08, 2025

Recent IRDAI data (FY 2023–24) indicates that all four insurers maintain strong claim-settlement records, generally above 95%. Private players like HDFC Life and Max Life report very high CSRs, while LIC continues to command unmatched trust due to its scale, reach, and government backing.

In simple terms:

- LIC: legacy trust, fewer add-ons

- HDFC Life: flexible and feature-rich

- ICICI Prudential: balanced option

- Max Life: strong value with excellent service metrics

The core point is this: once you understand how much term insurance do I need, insurer choice becomes a matter of preference — trust vs features vs value — not confusion.

A detailed insurer comparison with premiums and riders is covered separately on Term Life Insurance for Teachers in India 2026: Honest Guide

Actionable Insights & Tips for Teachers

Finally, let’s break it down into clear, actionable tips so every teacher can confidently plan how much term insurance they need in India in 2026:

- Do the math, don’t guess: Use income × 10–15 + loans + kids’ future – savings = your cover. For most teachers, this means ₹50L–₹1Cr, not just ₹20L.

- Start early, save big: A 25-year-old teacher pays a third of what a 45-year-old pays for the same cover. Lock it before age and health raise the cost.

- Match to retirement: Keep cover until 58–60 or till kids are independent. Don’t waste money beyond your responsibility years.

- Update at milestones: Marriage, child, or a home loan = re-check your cover. Add a top-up if life’s math has changed.

- Pick riders wisely: A critical illness rider can help with treatment costs. Don’t add extras you don’t understand—stick to what protects your family.

- Check claims & service: Aim for insurers with >95% settlement ratio and easy claim process. Ensure your spouse/nominee knows where the papers are.

- Avoid being under-insured: Don’t shrink cover just to save a few hundred rupees. Better to skip a rider than leave your family short.

- Don’t depend only on school cover: State or private school policies are small and tied to your job. Always keep your own personal term policy.

- Be truthful: Declare health and habits honestly. Misstatements can mean claim rejection later.

3 Relatable Stories From a Teacher’s Life

These stories show that answering how much term insurance do I need isn’t a one-time calculation. Like lesson plans, coverage must evolve as a teacher’s life and responsibilities change.

1. The Early Starter – Arun, 27 (Government School)

Arun earns about ₹5.5 lakh a year, with no children yet and only a modest car loan. At 27, he locks in a ₹1 crore term cover till age 60, paying just a few thousand rupees annually. Five years later, life changes — marriage, a home loan, and a daughter. Instead of starting from scratch and paying higher premiums, he simply adds a ₹50 lakh top-up. His cover grows to ₹1.5 crore, matching his new responsibilities without straining his budget.

Arun’s case shows the advantage of answering how much term insurance do I need early — when premiums are lowest.

2. The Late Optimizer – Meena, 41 (Private School)

Meena earns ₹9 lakh annually and has two school-going children along with a ₹32 lakh home loan. She suddenly realizes that her old ₹50 lakh term cover, taken when she was single, is no longer enough. She recalculates using the income-multiple method (12× income + loans + children’s future costs – investments). The result: about ₹1.2 crore of required cover. By upgrading once, she closes a decade-long protection gap and gains peace of mind.

Her story reflects a crucial lesson: when income or responsibilities rise, it’s time to revisit how much term insurance do I need.

The teacher’s checklist (print, tape near your desk)

- Focused question to answer: How Much Term Insurance Do Teachers Need in India in 2026?

- My multiple chosen: ____ × annual income (10–15× if <40; 6–10× if 50+)

- Add liabilities: Home ₹____ + Edu ₹____ + Others ₹____ = ₹____

- Add big goals: College ₹____ + Spouse cushion ₹____ = ₹____

- Subtract buffers: Investments ₹____ + Employer cover ₹____ = ₹____

- My ideal cover now: ₹________________ (round to nearest ₹10–20L)

- Term ends in year: ____ (retirement/youngest independent)

- Riders I actually understand & need: __________

- Nominee informed + documents in one folder:

Before you finalize, give yourself 20 minutes with this article too:

Why Term Insurance Claims Get Rejected and How Teachers Can Avoid It

Follow those claim-proofing steps on day one—so your family never has to chase paperwork on their hardest day.

Bottom line (and a gentle nudge)

Teachers don’t buy term insurance for themselves; they buy time and dignity for the people who love them. If you remember just one line from today, let it be this: Pick a cover that comfortably replaces your income, clears your loans, and funds your children’s future—then lock it for the years your family depends on you.

If you want the deeper dive or to sanity-check your number, these are your next reads:

- Term Life Insurance for Teachers in India 2026: Honest Guide

- 7 Costly Term Insurance Mistakes Teachers Still Make in 2026 (Don’t Be #8!)

- Term Insurance vs Endowment Plan: Why Term Is No. 1 in Financial Planning for Teachers

- Why Term Insurance Claims Get Rejected and How Teachers Can Avoid It

The bell will ring again in a minute. Before it does, write your number on a sticky note. Then act. Your class—and your family—are counting on you.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.