Table of Contents

ToggleInsurance Frauds in India: Banks Earned ₹21,773 Cr from Our Regret — Are You the Next Victim?

Every day, insurance is sold to teachers, parents, government employees, and middle-class families with sweet, rehearsed promises:

“It’s an investment and insurance.” “Aapko ₹25 lakh milega — tax free.”

“Sir, policy band mat karna — maturity ke time bada amount milega!”

The words are comforting. The brochures? Glossy. And the agent? Often someone you trust — your banker, your cousin, or your school’s LIC “bhaiya”.

It usually starts with trust. And like so many teachers, parents, and salaried professionals, you say yes. But what you don’t see is what happens after.

Here’s the dark truth about Insurance Frauds in India — something nobody talks about:

- 43% of life insurance policies lapse before the 5th year.

- Banks and agents earn lakhs in upfront commission — even if you stop paying after a year.

- Salaried people like us — teachers, nurses, parents — lose their hard-earned money quietly, without filing a complaint.

And the worst part? We don’t even know we’ve been cheated.

you may also like

1.Debt Trap in India — 5 Steps to Escape the EMI Cycle

2.Bad Debt Is Easy to Enter — But Who Shows You the Exit?

We think we’re “investing.”

But in reality — we’re being sold dreams… wrapped in glossy brochures and packed inside complex paperwork. This is the silent epidemic of Insurance Frauds in India — where trust is traded for targets, and your savings become someone else’s commission bonus.

Let’s uncover how this fraud works, how to spot if you’re the next victim, and what you must do now — before your hard-earned savings become someone else’s payday.

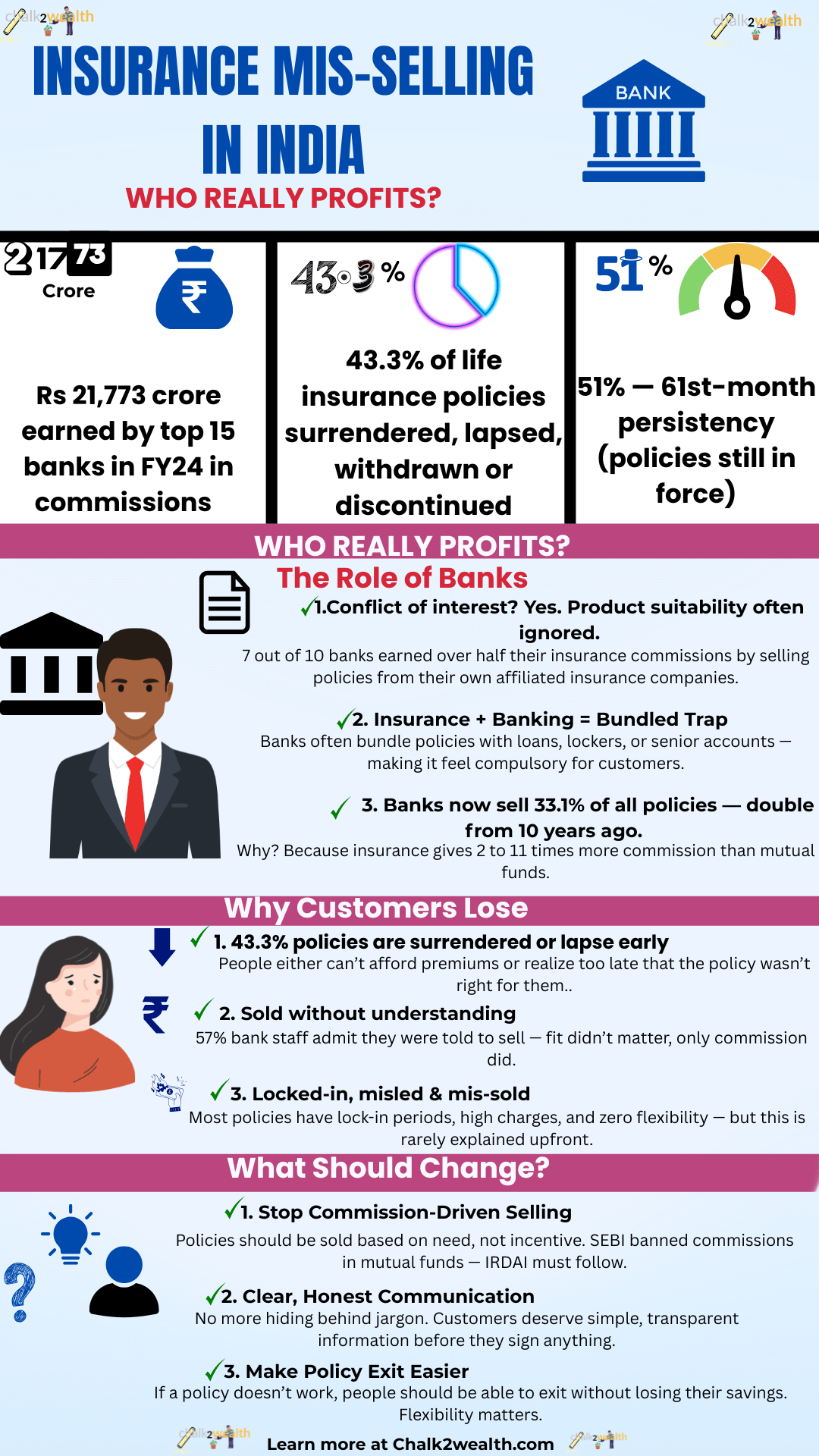

Shocking Statistics That Expose Insurance Frauds in India

(As per Moneycontrol article, June 10 2025, based on FY24 data)

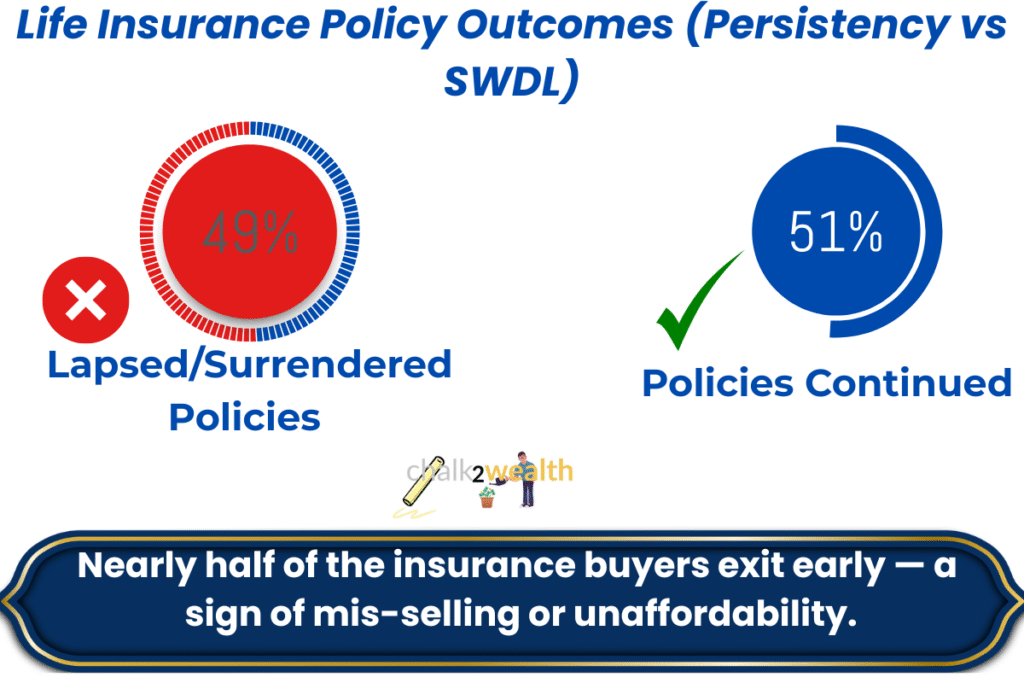

- 43.3% of benefit payouts by the top‑10 life insurers are tied to surrendered, withdrawn, discontinued or lapsed (SWDL) policies—highlighting widespread buyer regret or premium unaffordability

- 57% of relationship managers surveyed admit they were told to push insurance, regardless of product-to-customer fit

- Persistency over 61 months averages just 51% for bank-affiliated life insurers—meaning nearly half of policies lapse within five years

- IRDAI still allows distributors to earn up to 65% of the first‑year premium, and recover up to 80% of management expenses from it—fueling misaligned incentives

- Banks’ share of life‑insurance premiums has doubled over a decade—from 15.6% in FY14 to 33.1% in FY24—underscoring how bancassurance drives volume

Bottom line:

Insurance is being pushed like a product — not planned like protection. And most buyers don’t even realize what they’ve bought until it’s too late.

Imagine this: You bought a ₹50,000 annual premium policy thinking “I’ll get ₹10–15 lakhs in the future.”But after 3 years, you surrender it — and get back just ₹60,000 total. Meanwhile, the agent made ₹30,000+ in year one, your bank manager met their target…

…and you walked away with a loss.

Insurance Frauds in India Aren’t Rare Mistakes — They’re a Pattern.

It happens most to honest, innocent people — teachers, parents, government clerks, retirees. People who just wanted to save, protect, and do the right thing for their family.

You’re not careless. You’re trusting.

And trust without information is exactly what this industry feeds on.

Before You Sign Another Policy…

At Chalk2Wealth, we’ve met too many teachers, parents, and honest savers who thought they were “investing” — only to realise years later that they were locked into a plan that didn’t serve them. Insurance is not the villain. But how it’s sold often is.

So before you say yes to that next “investment + insurance” plan —

- Ask questions.

- Understand the lock-in.

- Check if it really fits your goals.

Because once your money is gone… the agent’s commission is paid. The policy may be permanent — but the regret will be too.

Let’s Build Financial Awareness Together

You’re not just a policyholder. You’re a teacher. A parent. A dreamer. A provider. And you deserve clarity — not confusion.

Share this with someone who needs to hear it.

Got a similar experience? Drop it in the comments or message us — your story could save someone else.

🔗 Stay updated with honest money advice — visit Chalk2Wealth.com

Let’s make financial trust smarter. Not costlier.

Articles That Helped Shape This Title

As we uncover the uncomfortable truths behind insurance frauds in India, here are some of the trusted sources and reports that informed this post and its title:

RBI Deputy Governor Flags Mis-Selling by Banks

Source: The Hindu business line (June 09, 2025)

Key Insight: RBI is examining the need for guidelines to prevent insurance mis-selling by banks.Report on Insurance Commissions & Lapse Rates by Top 10 Banks

Source: Moneycontrol (2024) (June 10, 2025)

Key Insight: ₹21,773 Cr earned by banks, 49% of policies lapsed or surrendered.RBI’s New Stand Against Mis-Selling

Source: Money life

Key Insight: As the issue of insurance mis-selling gains national attention, the Reserve Bank of India (RBI) has officially stepped in with stronger oversight and future regulatory plans. According to the RBI Annual Report 2024–25, the central bank is preparing new rules to protect consumers — especially the most vulnerable — from misleading financial sales practices.

Very well explained.

🙏 Thank you so much, Mr. Sanjeev Suri, for engaging with this post. It means a lot when experienced professionals like you acknowledge the issue.

We need more awareness around how financial products — especially insurance — are being mis-sold in the name of investments.

Would love to hear your perspective — especially on what steps we can take to protect the average family or salaried professional from such traps.