Table of Contents

ToggleInvest Money Where: 7 Rules to Win the Investing Marathon

Investing isn’t a sprint – it’s a marathon. Yet many middle-class savers in India wonder “invest money where?” and end up treating it like a quick dash, panicking on every market hiccup. In reality, wealth grows slowly over time.

In the definitive guide, Safe Investments in India with High Returns – Where to Put Your Money in 2026, I explored the safest wealth-building paths for Indian families. Another must-read, Where to Invest Money in India 2026: Smart Ways to Beat Inflation, uncovers why traditional saving habits no longer protect purchasing power. This article takes those insights forward and distills them into 7 timeless rules for winning the investing marathon.

In a Money Control article As veteran investor Raamdeo Agrawal points out, “every five years, your money will double” if you stay the course. That’s compounding in action. Right now, inflation is around 4.6% on average, so a 5–6% bank FD barely preserves purchasing power. Winning the investing marathon means knowing where to invest money to beat inflation without taking reckless risks.

The good news: by following a few simple rules – staying disciplined, diversified and long-term focused – even cautious investors can build wealth steadily. Here are 7 rules to guide you across the finish line:

Wealth grows slowly, but surely. Run your financial marathon with Chalk2Wealth.

Disclaimer: This content is for educational purposes only. Chalk2Wealth does not provide personalized financial advice. Please consult a SEBI-registered financial advisor before making investment decisions.

1. Invest Money Where It Matters: Start Early and Leverage Compounding

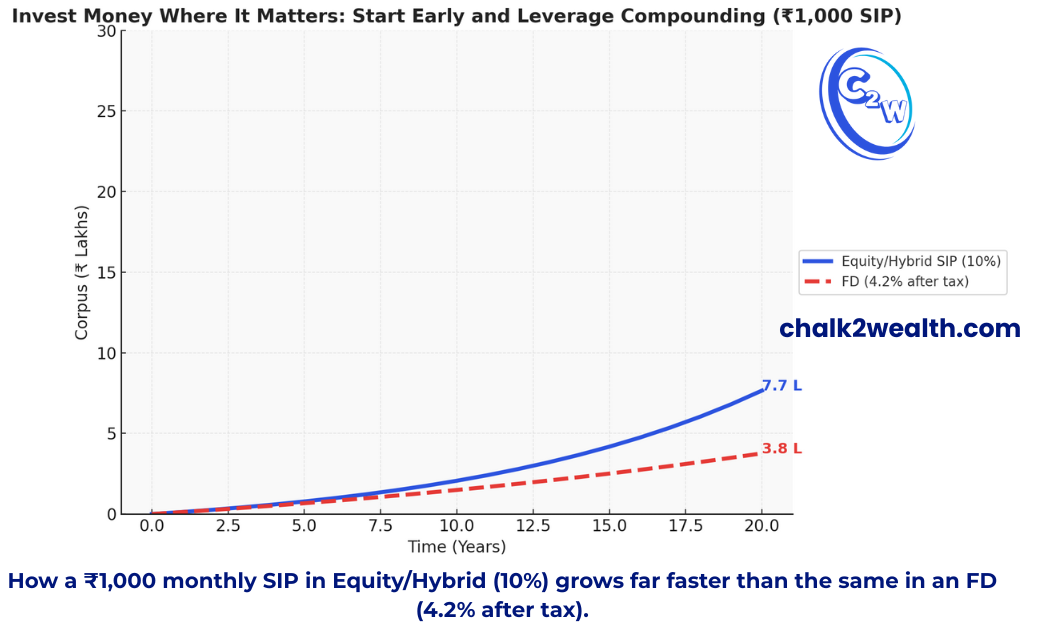

The most powerful factor in wealth creation is time. Every rupee you decide to invest Money where it can grow has years to multiply. The longer your horizon, the more compounding works in your favor. For example, Agrawal’s “rule of 72” shows that at 15% annual returns your money doubles every 5 years . Even at a modest 8–10% in equity or hybrid funds, a small SIP regularly grows into a large corpus over 10–15 years.

By contrast, starting late means shorter compounding and much higher monthly contributions needed. So rule #1 is: begin now, however small the amount. Even a ₹1,000 monthly SIP in a good fund, started today, can become ₹20–30 lakhs in two decades (while ₹1,000 on deposit would barely keep up with inflation). Remember, when you think about invest money where to begin, the sooner you start, the steeper your wealth curve becomes.

A ₹1,000 SIP can grow into lakhs — while an FD struggles to beat inflation. Invest money where compounding works for you, as explained in Safe Investments in India with High Returns – Where to Put Your Money in 2025 and further illustrated in Where to Invest Money in India 2026: Smart Ways to Beat Inflation.

Disclaimer: Returns shown are illustrative and not guaranteed.

Chalk2Wealth Case Study: Rajesh Sir’s ₹2500 SIP

Mr. Rajesh, a Chemistry teacher in Himachal, started a ₹2500 SIP in 2012.

SIP Value Today (2025): ~₹10.75 lakh

FD Value Today (2025): ~₹5.9 lakh

Same ₹2,000 every month. Same 13 years. But SIP doubled the wealth compared to FD. That’s the power of starting early and compounding.

Curious to see how your own SIP can grow? Try our free Chalk2Wealth SIP Calculator and check your future wealth in seconds.

Quick Takeaway

Starting early with SIPs doubles wealth compared to FDs, as Rajesh Sir’s case shows.

2. Invest Money Where Discipline Wins: Use SIPs Regularly

The secret of marathoners is pacing, not bursts of speed. Similarly, regular investing – ideally via Systematic Investment Plans (SIPs) – keeps you disciplined through market ups and downs. SIPs automate saving: you invest a fixed sum each month, rain or shine. This rupee-cost averaging buys more shares when prices are low and fewer when high, smoothing out volatility. Moneycontrol notes that SIPs “encourage disciplined investing” and let you build wealth steadily without trying to time the market

In practice, if you are wondering invest money where to stay consistent, the answer is simple: putting aside 5–10% of salary each month into a good equity or hybrid fund (via SIP) does wonders. It forces you to stay invested, avoids market-timing mistakes, and lets compound interest work its magic on each installment over the long run. This regularity shows exactly where to invest money for discipline — it beats lump-sum leaps and panics.

Quick Takeaway

Invest money where discipline counts. Regular SIPs beat lump sums and panic exits. Discipline is the real secret of wealth creation.

3. Build and Safeguard an Emergency Fund

No marathoner runs without training wheels. In investing, that safety net is your emergency fund. Aim to keep 6–12 months of essential expenses in liquid, ultra-safe forms (savings account, short-term FDs or liquid funds). This “rainy day” fund lets you cover urgent needs (medical, job loss, home repairs) without selling other investments at a loss. Think of it as your financial shock absorber. Only after this cushion is in place should the rest go into longer-term plans. This step ensures you never have to pull out of your SIPs or break a PPF early, which would otherwise derail compounding.

Invest Money Where for Safety? Start with an Emergency Fund

An image of a piggy bank symbolizes Rule 3: every marathon needs a support system. Reserve money in truly safe, liquid instruments. This way, even if a sudden expense pops up, your long-term investments stay intact.

Quick Takeaway

Keep 6–12 months’ expenses safe. It protects your long-term investments from sudden shocks.

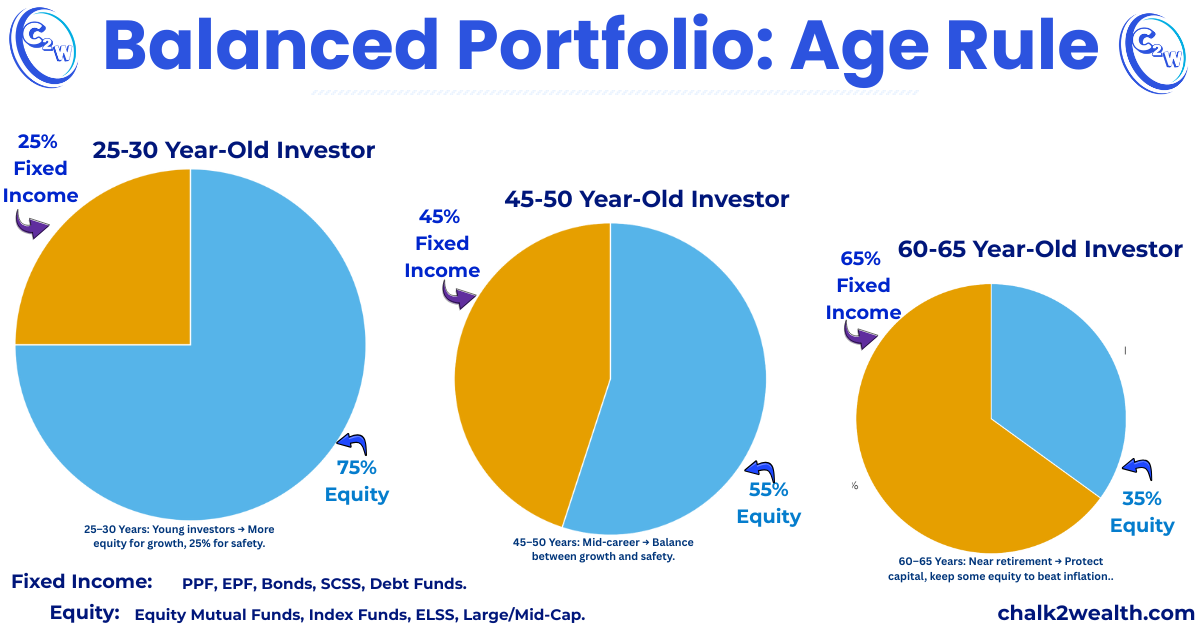

4. Diversify: Blend Safety and Growth

As a rule, don’t put all your eggs in one basket. Spread your investments across asset classes. A simple diversified mix might include government-backed fixed-income (like PPF, NSC, EPF), equity exposure (via mutual funds or index funds), and some gold or real estate/REIT for hedge.

Government schemes offer safety with decent returns – for example, Sukanya Samriddhi (8.2%), PPF (7.1%), NSC (7.7%) – far above most bank FDs. Keeping a portion in such guaranteed instruments locks in a baseline return. Meanwhile, even a moderate slice in equities or balanced funds boosts overall returns. In fact, according to Value Research Online balanced (hybrid) mutual funds combining debt and equity have delivered roughly 12% annualized over five years versus only ~4–7% from fixed deposits

Diversification reduces volatility: if stocks dip, your debt/gold cushions the fall. So when you ask “invest money where for both safety and growth?” the answer lies in diversification. As explained in Safe Investments in India with High Returns – Where to Put Your Money in 2026, safe government-backed schemes build your financial foundation, while insights from Where to Invest Money in India 2026: Smart Ways to Beat Inflation show why adding equity exposure is critical to truly beat rising prices.

Rule 4: Allocate safely (PPF, EPF, small savings) and allow some reasonable equity exposure. This mix lets you beat inflation while staying largely protected.

Quick Takeaway

Mix safe schemes (PPF, EPF, SSY) with equity funds. Balance reduces risk and still beats inflation.

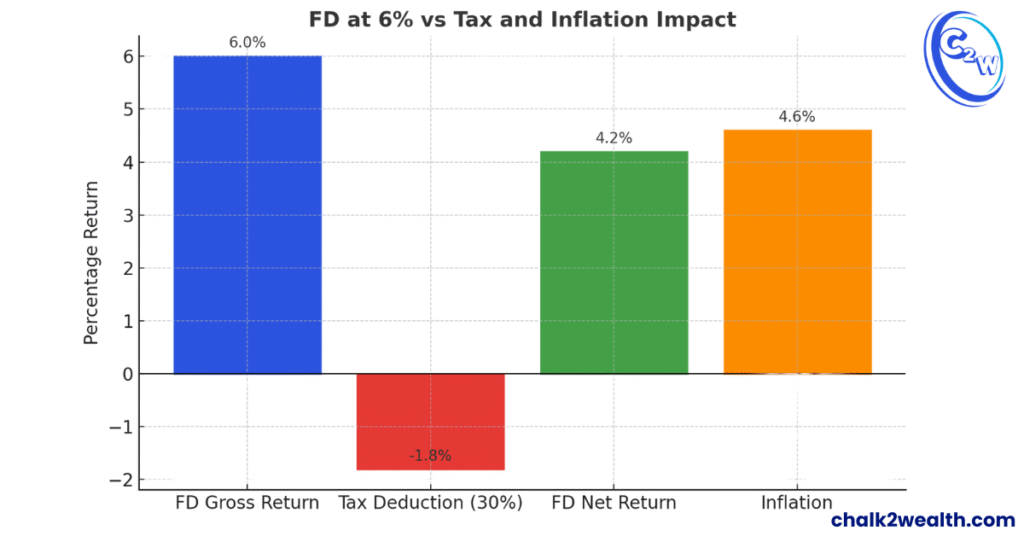

5.Invest Money Where Costs, Taxes and Inflation Don’t Eat Returns

Winning requires considering real (after-tax) returns. High returns on paper can be eroded by taxes, fees and rising prices. For example, a 6% FD yield becomes much less once taxed, barely above today’s ~4.6% inflation. Always compare net gains: an FD at 6% with 30% tax is effectively ~4.2%.

In contrast, interest from PPF/SSY is tax-free, and equity fund gains over one year can get 10–15% LTCG exemption. Similarly, choose funds with low expense ratios. Over decades, even a 1% annual fee can significantly eat into returns.

So when you think “invest money where it truly grows?” the answer is clear: Rule 5 is to focus on post-tax, inflation-adjusted returns. Prefer tax-efficient vehicles (PPF, SSY, index funds) and keep an eye on charges. This ensures you actually win the race ahead of inflation, not just on paper.

A 6% FD looks safe, but after 30% tax it drops to just 4.2% — below the 4.6% inflation line. This means your real wealth isn’t growing, only eroding. To truly win the investing marathon, you must look beyond FDs and choose smarter, tax-efficient options.

Quick Takeaway

A 6% FD becomes only ~4% after tax—below inflation. Always look at post-tax, real returns.

6. Stay Patient and Long-Term Focused

Marathoners don’t stop to check their speed every kilometer. Likewise, don’t get rattled by short-term market swings or headlines. The stock market may wobble year to year, but historically it rises over longer cycles. As Agrawal warns, markets will have storms, but disciplined investors “who stick with it will emerge as the biggest winners.”

In fact, staying invested through down periods often secures the real gains. For instance, even after a few bad years, many equity funds deliver 10–15% returns over 10+ year periods. So when you think “invest money where for long-term success?” the answer is clear: Rule 6 says don’t panic or try to time exits. Keep your horizon at least 5–10 years for equity/hybrids. Review your portfolio annually, but resist reacting to every news headline. Trust the process: steady, compounding growth wins out in the end.

A finish-line scene reminds us of Rule 6. Even if the market “race” speeds up or slows down, a steady approach takes you across the line. Staying the course is how long-term goals are ultimately reached.

Quick Takeaway

Invest money where patience pays. Markets wobble short term, but compounding works over years. Patience is your biggest profit tool.

7. Keep Learning and Adapt

Finally, treat investing like a skill that you sharpen over time. Educate yourself about different options (read Value Research, Moneycontrol, RBI reports, etc.) and avoid common traps. For example, traditional insurance-cum-investment plans usually yield only ~5–6% – poor compared to other routes – so do not confuse them with true investments. Instead, allocate to what works (balanced funds, index funds, safe bonds) and be wary of “too good to be true” schemes.

Also rebalance annually: if equities have run up, take some profit to add to safety, or vice versa. Rule 7: Be an active learner. The more you know (and the more you stick to these rules), the smoother your run. And when you ask yourself “invest money where to learn and grow wisely?” the answer is in knowledge, discipline, and regular practice.

As explained in Safe Investments in India with High Returns – Where to Put Your Money in 2026, safe government-backed schemes provide a strong foundation, while Where to Invest Money in India 2026: Smart Ways to Beat Inflation shows why measured equity exposure is essential. A modest, cautious investor can easily achieve 8–10% average returns by combining government-guaranteed 7–8% schemes with a measured equity allocation (hybrid funds in the teens). That beats inflation comfortably and grows your real wealth.

Quick Takeaway

Avoid traps like low-return insurance plans. Rebalance yearly and stay updated to grow steadily.

Invest Money Where? Your FAQ on Winning the Investing Marathon

How to invest 500 rupees per month?

Start a Systematic Investment Plan (SIP) in mutual funds. Many direct plans allow a minimum ₹500 SIP. Over 10–15 years, even this small amount grows significantly with compounding.

Where to invest 5 lakh??

You can split your ₹5 lakh into government-backed schemes like PPF, NSC, and fixed deposits to invest safely. If you want growth with controlled risk, consider a balanced mix of equity mutual funds (40–50%) and safe debt instruments (50–60%). This ensures steady returns and inflation protection.

where to invest 50 lakhs to get monthly income

You can invest ₹50 lakh across safe income-generating options like Post Office Monthly Income Scheme (7.4%), Senior Citizen Savings Scheme (8.2% if eligible), RBI Floating Rate Bonds (8.05%), and bank FDs with Monthly payout. For slightly higher yields, a portion can go into REITs or debt mutual fund SWPs. A balanced mix of these can give you ₹30,000–35,000 per month (pre-tax) while keeping capital largely safe.

Where to invest 5 lakhs for monthly income?

You can put ₹5 lakh in Post Office Monthly Income Scheme, Senior Citizen Savings Scheme (if eligible), or bank FDs with monthly payout. These options provide steady income of about ₹3,000–3,500 per month (pre-tax).

can I invest 500 rupees in share market ?

Yes, with modern discount brokers, you can invest in stocks with as little as ₹500. However, picking individual shares carries higher risk. Beginners are better off starting with mutual funds (SIP), where your ₹500 is spread across multiple companies. This reduces risk and still gives exposure to equity growth.

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms. And before you leave—drop a comment below: which investment option do you trust the most in 2025? Your experience can guide other Teachers too.