Table of Contents

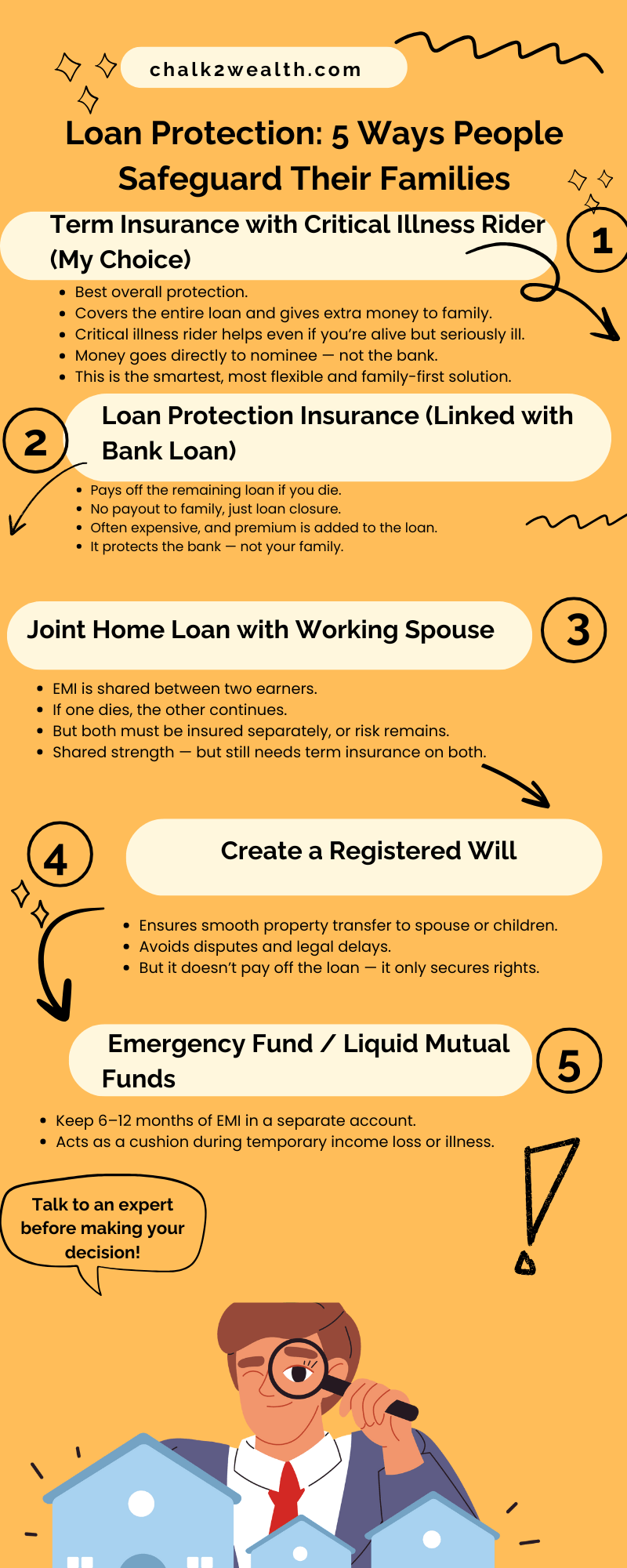

ToggleLoan Protection Infographic: The Essential Visual Guide to Safeguard Your EMI

Loan Protection Isn’t Optional — It’s the Safety Net Your Family Deserves

When you sign up for a home loan, you’re not just buying a house — you’re committing your family to years of EMIs. But what if something unexpected happens?

In schools, we often teach planning. But when it comes to our own lives, we leave too much to chance. A sudden illness, income loss, or worse — and your loved ones could be left dealing with both grief and unpaid debt.

This infographic breaks down 5 powerful ways Indian families protect their home loans — from term insurance with critical illness riders to emergency funds and even joint loans. It’s simple, visual, and exactly what every teacher, parent, or salaried professional should review before taking or managing a big loan.

You’ve worked hard for your home. Let’s make sure it doesn’t become a burden for your family

Loan Protection Isn’t About Fear — It’s About Responsibility

When we insure our phones and bikes, why leave the biggest liability—our home loan—unprotected?

Whether you’re a teacher, a parent, or a salaried professional, your family depends on your financial choices. And while we can’t control the future, we can prepare for it. From term insurance with a critical illness rider to building an emergency fund, each step in this infographic is not just a financial tip — it’s a lifeline.

Because one day, this protection won’t be for you — it will be for those who count on you the most. And what if You Don’t have the insurance

| Myth | Reality |

|---|---|

| “The bank loan insurance is enough.” | It only pays the bank — not your family. |

| “Joint loans remove all risk.” | Only if both are insured separately. |

| “Will takes care of everything.” | A will is for rights, not repayments. |

Myth vs Reality

Before you decide how to protect your home loan, here’s a quick side-by-side comparison of all five options from our infographic. This table helps you understand what each option covers, how much security it provides for your family, and what extra benefits you might get.

Use it to pick what works best for your situation — whether you’re a teacher, a salaried professional, or managing a family loan.

| Option | Covers Loan? | Protects Family? | Extra Benefit |

|---|---|---|---|

| Term Insurance + Critical Illness | ✅ | ✅ | Best Flexibility |

| Bank-Linked Loan Insurance | ✅ | ❌ | Auto closure only |

| Joint Loan with Spouse | ⚠️ | ⚠️ | Shared EMI, needs backup |

| Registered Will | ❌ | ✅ (Legal Rights) | Prevents disputes |

| Emergency Fund | ✅ (Temporary) | ✅ | Useful for illness/jo |