Table of Contents

ToggleNational Pension Scheme Interest Rates — What Smart Teachers Need to Know to Master Them

In the staffroom, the chatter never ends — “NPS is not that good,” sighed Mrs. Suman, “returns bhi fix nahi hote!” Heads nodded in agreement; most teachers felt the same. After all, the National Pension Scheme interest rate isn’t printed like the PPF’s 7.1%.

But here’s the twist no one talks about — while teachers were busy doubting it, NPS quietly turned into a retirement powerhouse. Its AUM shot up from ₹48,000 crore in FY2013-14 to a staggering ₹15,21,543.25 crore by March 2025 PFRDA Report and active subscribers nearly tripled to 1.9 crore.

Looks like the “not-so-good” NPS just proved everyone wrong.— and if you’re wondering how much you’re really saving for retirement, don’t miss this deep dive: National Pension Scheme Exposed: Are You Really Saving Enough for Retirement?

Fund-wise Returns under the National Pension Scheme Interest Rate

The National Pension Scheme interest rate isn’t fixed — NPS is fully market-linked. Over time, however, it has rewarded patient investors handsomely. Equity funds (Scheme E, Tier-I) have delivered around 15–19% per annum over 5 years and 12–14% per annum over 10 years(as per hdfcsec.com).

In comparison, Corporate Debt funds (Scheme C) have averaged about 6–7% per annum (5-year), while Government Securities (Scheme G) have generated 6–8% per annum over 5–10 years. Interestingly, top-performing pension fund managers have even surpassed these benchmarks — for instance, Kotak Pension’s Equity Fund has clocked nearly 20% per annum over 5 years.

Across all schemes, one principle remains constant: the longer you stay invested, the more compounding magnifies your retirement corpus.

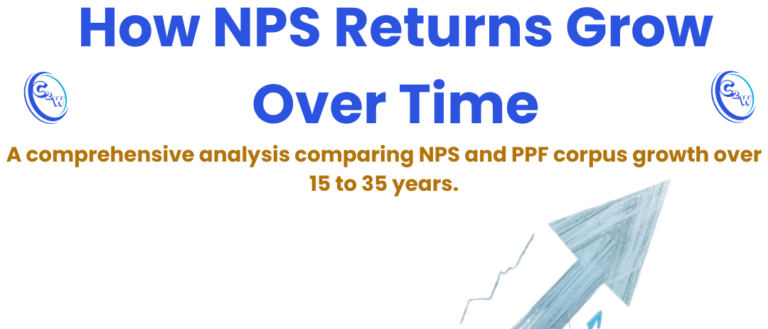

NPS vs PPF (Long-Term Growth & Returns Comparison)

Unlike the Public Provident Fund (PPF), which offers a fixed interest rate of around 7.1% per annum, the National Pension Scheme interest rate varies with market performance — and that’s exactly what gives it long-term power. With its equity tilt, NPS can potentially “supercharge” retirement returns.

Over a 25–30 year horizon, an NPS SIP compounding at ~9–12% p.a. can roughly double the corpus compared to a fixed 7.1% scheme. For instance, investing ₹5,000 per month for 30 years could grow to about ₹1.13 crore at 10% versus ₹62.5 lakhs at 7.1%.

Thanks to recent rule updates, NPS now allows up to 100% equity allocation for private subscribers , further widening the wealth gap over traditional options. In short, while PPF offers stability, the National Pension Scheme delivers growth — making it a more powerful tool for long-term wealth creation.

What Drives National Pension Scheme Interest Rate & Returns

The National Pension Scheme interest rate depends on a few key factors — primarily asset mix, fund manager skill, and time horizon .

- A higher equity allocation means higher risk but also higher long-term growth potential.

- A larger debt or government securities share brings more stability but lower returns .

- Your chosen Pension Fund Manager’s expertise plays a big role in performance consistency.

Most importantly, compounding rewards patience — even a small difference, like retiring at 60 instead of 55, can add lakhs to your final NPS corpus . Do note, however, that under current rules, 40% of your total NPS corpus must be used to purchase an annuity, which provides a steady monthly pension after retirement.

Teacher & Salaried Takeaways: Why the National Pension Scheme Interest Rate Works in Your Favour

For teachers and salaried professionals with decades before retirement, the National Pension Scheme interest rate offers a rare blend of growth and discipline. Even a modest SIP — say ₹5,000 per month — can compound into crores over time when invested through NPS’s equity-linked funds.

The beauty lies in its built-in discipline — automatic deductions and a long lock-in make NPS a true “set-and-forget” investment. Compare this: a ₹5,000 monthly SIP for 30 years at ~10% can create nearly double the corpus of a 7% PPF scheme.

By combining NPS for growth and PPF for stability, teachers can build a balanced, low-stress retirement plan. Remember — steady investing in the National Pension Scheme consistently outpaces fixed-return options in the long run.

For a complete breakdown of how it works, read our detailed guide on the National Pension Scheme (NPS): Is It a Good Investment for Teachers?.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.