Table of Contents

ToggleNational Pension Scheme Exposed: Are You Really Saving Enough for Retirement?

Last Sunday evening, my brother and I were discussing retirement over tea.

He looked a bit skeptical and said,

“Bhai, this NPS thing — the National Pension Scheme — isn’t really that good. The returns aren’t guaranteed like PPF, and there are too many rules!”

I smiled and replied,

“You’re right that it’s market-linked, but that’s also its strength. The national pension scheme isn’t about quick returns — it’s about building a disciplined, inflation-beating retirement fund over 25–30 years. Even teachers and salaried employees who start early can create a solid pension corpus with small, regular investments.”

The National Pension Scheme (NPS) is a government-backed retirement savings plan regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It’s a defined-contribution plan where you invest during your working years to build a retirement corpus.

What makes it special is the flexibility to choose your own asset mix — equities, corporate bonds, and government securities — managed by professional fund managers. In just over a decade, the national pension scheme has become one of the most trusted long-term investments for retirement planning, especially among teachers and salaried professionals. Its tax incentives and market-linked growth make it a practical way to secure your financial future.

If you’ve also been comparing NPS with safer options like the PPF Rules –How to Tap Its Power Responsibly beyond 2026 or want to understand how timing affects your PPF returns, don’t miss PPF Interest 2025: The 5th April Trick Every Teacher Must Know.

And if financial conversations still feel awkward or “too serious,” my honest take Financial Literacy, Charak SAHAB? Are You Foolish — Talking Money to the Nation’s Smartest? might change the way you see money altogether.

Is the National Pension Scheme (NPS) a Good Investment for Retirement?

The National Pension Scheme (NPS) is generally considered a strong long-term investment for retirement — especially if you have decades to invest. Its biggest strengths are professional fund management, low fees, and a balanced mix of equity and debt, which together can deliver higher returns than most fixed-income schemes. (If you’re still learning how to build wealth patiently, our guide on where to invest money: 7 rules to win the investing marathon will help you understand long-term compounding in practice.)

For instance, national pension scheme funds have historically generated annualized returns around 10% or more, comfortably beating the 7–8% returns of PPF or bank FDs. This means your savings grow faster and stand a better chance of outpacing inflation. Because it’s market-linked, the national pension scheme offers higher growth potential (thanks to equity exposure) while still being relatively safer than pure stock investing, thanks to its diversified structure and PFRDA’s regulatory oversight.(To see how NPS fits into a larger financial plan, explore retirement planning: 6 key steps to financial freedom.)

However, the national pension scheme does come with certain drawbacks. The Tier I account is quite illiquid — you generally cannot withdraw your money until age 60, except under specific conditions. Partial withdrawals (up to 25% of your contributions) are allowed only after 3 years and only for specific reasons like serious illness, children’s education or marriage, or purchasing a house.

At retirement, 40% of your NPS corpus must be used to buy an annuity, which provides a steady monthly pension — but these annuity payouts are taxed as income. So, if you prefer easy access to your funds or dislike market risk, the national pension scheme may feel somewhat restrictive.

Is it right for you? If you value disciplined long-term savings, professional fund management, and equity participation, the national pension scheme can be an excellent choice. For both government and private employees, it complements other retirement tools beautifully. But if you’re risk-averse or prefer fixed returns, options like PPF or other guaranteed instruments may suit you better. (Teachers looking to diversify beyond GPF can also read top investment options: 7 strategies for teachers beyond GPF for additional ideas.)

In short: the national pension scheme (NPS) is one of the best retirement options for those who want growth and long-term security — even if it comes with limited liquidity.

Is the National Pension Scheme (NPS) Really Tax-Free? Let’s Break It Down.

The National Pension Scheme (NPS) offers significant tax advantages, making it one of the most tax-efficient retirement investments in India — though not entirely tax-free.

Under the old tax regime, your own contributions to the national pension scheme are eligible for deductions:

- Up to ₹1.5 lakh under Section 80C, and

- An additional ₹50,000 under Section 80CCD(1B) (giving a total deduction of up to ₹2 lakh).

In addition, employer contributions to your NPS account (up to 10–14% of your salary) qualify for a separate deduction under Section 80CCD(2).

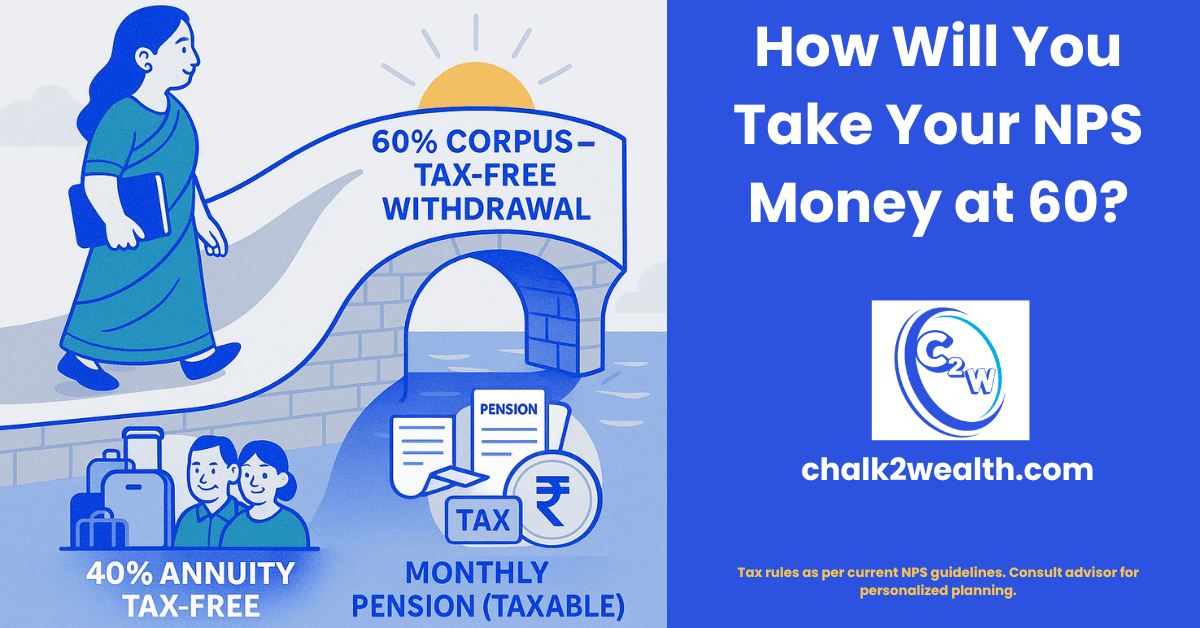

However, under the new tax regime (2023 onwards), only the employer’s contribution to the national pension scheme is deductible (up to 14% of basic salary). Your own contributions do not qualify for extra deductions unless you opt to remain in the old regime. At the time of retirement, you can withdraw 60% of your NPS corpus as a lump sum — completely tax-free. (Earlier, only 40% was exempt, but since FY 2020–21, the full 60% withdrawal is tax-exempt.) The remaining 40% must be used to buy an annuity, which provides a steady pension income. The annuity purchase amount itself is not taxed at the time of buying, but the pension payments you later receive are taxable as regular income.

In summary:

- Your investments in the national pension scheme get tax deductions up to ₹2 lakh under the old regime.

- 60% of the maturity amount is tax-free on withdrawal.

- The pension income from the annuity is taxable.

By contrast, PPF enjoys EEE (Exempt-Exempt-Exempt) status — it’s fully tax-free. Even so, the national pension scheme remains one of the most tax-efficient retirement options available today, especially for teachers, salaried employees, and long-term investors.

National Pension Scheme Withdrawal Rules: How NPS Maturity and Exit Work

The National Pension Scheme (NPS) has clear rules on withdrawals, maturity, and exits, designed to ensure long-term retirement security while still offering some flexibility for genuine needs.

At Retirement (Age 60 or Superannuation): When you reach 60 years of age or retire, you can withdraw up to 60% of your accumulated Tier-I corpus as a lump sum — completely tax-free. The remaining 40% must be used to purchase an annuity, which provides you with a monthly pension for life. If your total NPS corpus is ₹5 lakh or less, you’re allowed to withdraw 100% as a lump sum without buying an annuity — a useful relaxation for small investors and low-salaried employees.

Premature Exit (Before 60): If you exit the national pension scheme before age 60 — for example, due to a job change or personal choice — at least 80% of your corpus must be used to buy an annuity, and only 20% can be withdrawn as a lump sum. However, if your total corpus is ₹2.5 lakh or less, you may withdraw the entire amount as a lump sum instead of opting for an annuity.

In Case of Death of the Subscriber: If the NPS subscriber passes away, the entire corpus (100%) is paid to the nominee or legal heir. The nominee can choose to withdraw the full amount as a lump sum (subject to tax rules) or use it to buy an annuity in their own name.

Partial Withdrawals: The Tier-I account allows limited partial withdrawals for specific purposes — such as children’s education, medical emergencies, or housing. You can withdraw up to 25% of your own contributions after completing 3 years of joining the national pension scheme.

The Tier-II account, on the other hand, has no lock-in period and can be withdrawn anytime, but Tier-II contributions do not qualify for tax deductions (except in certain cases for government employees).

Related Read: If you also invest in PPF, don’t miss our guide — PPF Rules for Withdrawal & Common Mistakes: Smart Investing Guide 2026 — to understand how to time your withdrawals smartly and avoid losing interest benefits.

National Pension Scheme Interest Rate: How NPS Returns Grow Over Time

Unlike fixed-return schemes, the National Pension Scheme (NPS) does not offer a guaranteed “interest rate.” Your returns depend entirely on your asset allocation and market performance. For the latest fund performance data and trends, you can check the official weekly snapshot on the NPS Trust site here.

According to the NPS Trust, over the years, Tier-I pension funds have delivered annualized returns in the range of 11–20%, depending on the chosen fund and investment period. In practice, a balanced NPS portfolio typically averages around 9–12% per year, which is generally higher than fixed-income instruments like bank FDs or PPF.

Since the national pension scheme is market-linked, its actual yield fluctuates — strong equity market years can boost returns, while market downturns can temporarily reduce them. However, historically, NPS has consistently outperformed most small-savings schemes.

To dive deeper into how NPS returns are calculated and what affects them, check out this guide — National Pension Scheme Interest Rates — What Smart Teachers Need to Know to Master Them. It breaks down real-world examples and growth projections that every teacher-investor should understand.

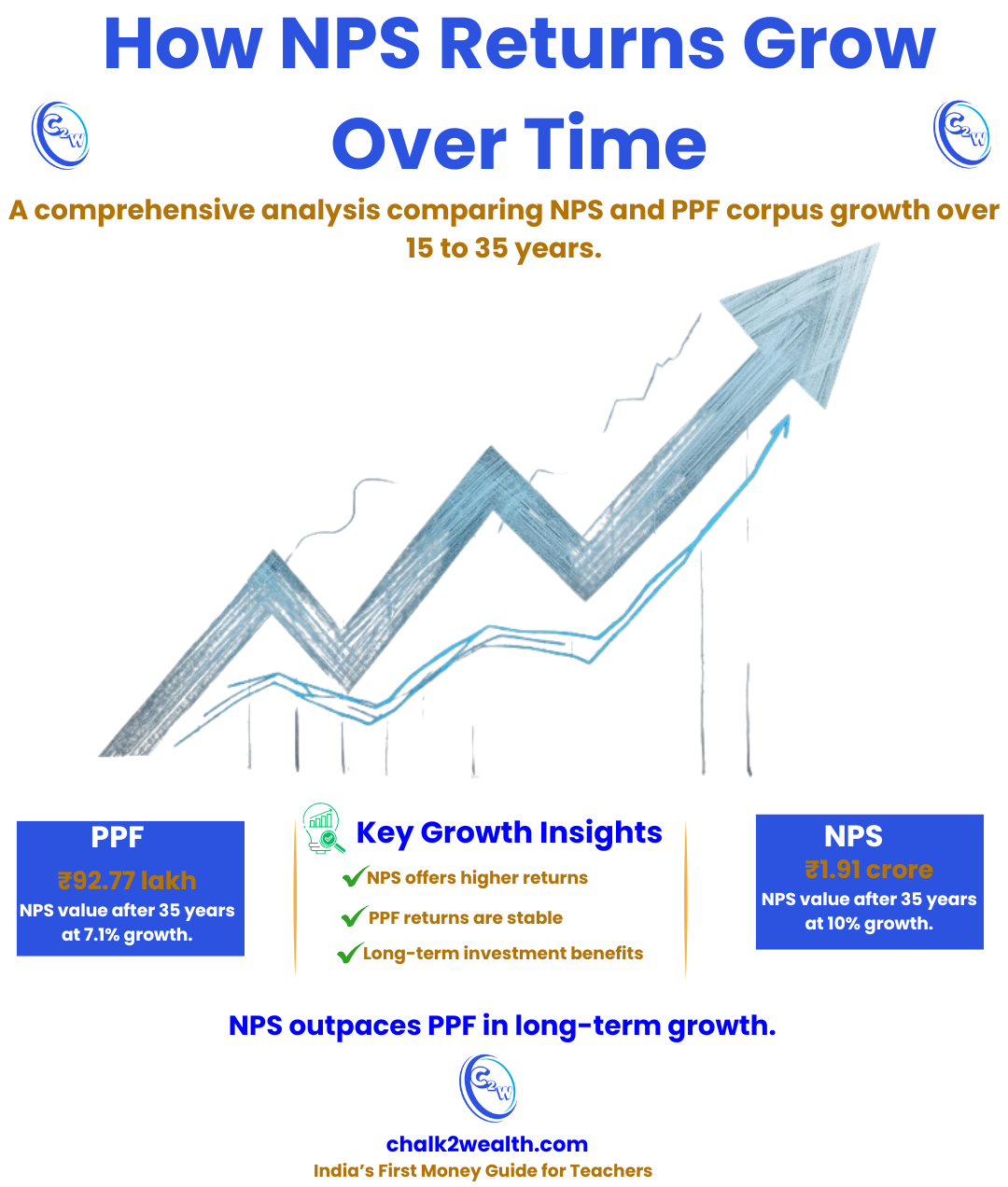

For comparison, the Public Provident Fund (PPF) currently offers a fixed 7.1% per annum for FY 2025–26. In contrast, the national pension scheme offers higher long-term growth potential, though it also carries moderate market risk.

Related Insight: If you already invest in PPF, make sure you understand the timing trick that maximizes your yearly interest — PPF Interest 2025: The 5th April Trick Every Teacher Must Know. It’s a tiny detail that can add up to thousands in extra returns over time.

In short, your final retirement corpus under the national pension scheme will depend on:

- How early you start,

- Your equity allocation, and

- How long you stay invested.

NPS rewards patience and long-term consistency — helping disciplined investors build inflation-beating retirement wealth.

How Much Should You Invest in the National Pension Scheme (NPS) Every Month?

There’s no fixed amount that everyone should invest in the National Pension Scheme (NPS) — it truly depends on your age, income, goals, and risk profile.

As a basic rule of thumb, you should invest at least ₹10,000 per year to take advantage of the extra ₹50,000 tax deduction under Section 80CCD(1B). However, if you can, it’s wise to contribute more to build a larger retirement corpus through the power of compounding.

For example, according to an illustration from UTI Mutual Fund, if a 25-year-old starts investing ₹5,000 per month in the national pension scheme and continues for 35 years at an assumed 10% annual return, the retirement corpus could grow to around ₹1.61 crore.

At retirement:

- 60% (≈ ₹96.5 lakh) can be withdrawn tax-free as a lump sum, and

- 40% (≈ ₹64.3 lakh) must be used to buy an annuity, which could provide a monthly pension of roughly ₹30,800.

Even smaller contributions can make a meaningful difference. For instance, investing just ₹2,000 per month (₹24,000 yearly) from age 25, assuming 9–10% returns, could still accumulate tens of lakhs by age 60.

The national pension scheme website and several online NPS calculators allow you to input your age, expected return, and monthly SIP amount to project your future corpus and pension.

Let’s take a relatable example:

Ramesh, a 25-year-old teacher, invests ₹5,000 every month in the National Pension Scheme for 35 years at 10% returns.

By age 60, his corpus grows to about ₹1.61 crore. Of this, ₹96.5 lakh can be withdrawn at retirement, while the remaining ₹64.3 lakh goes into an annuity that yields around ₹31,000 per month.

This clearly shows how long-term compounding can transform small monthly SIPs into a secure pension income.

In practice, try to save as much as you comfortably can, ideally up to the tax-benefit limits. Even a few thousand rupees per month invested consistently in the national pension scheme can make a huge difference to your financial independence at retirement.

How to Open a National Pension Scheme (NPS) Account

Opening a National Pension Scheme (NPS) account is simple and can be done online or offline, depending on your convenience. If you want a quick visual guide, check our infographic here: How to Open NPS Account Online in 10 Minutes (Infographic Guide)

Here’s how:

1. Online via eNPS

Visit the official eNPS portal — enps.nsdl.com. Click “Register” and select your account type (Individual or Corporate).

- Enter your Aadhaar or PAN details (if Aadhaar OTP is not used, KYC will be verified through your bank).

- Fill in your personal information and nominee details.

- Upload scanned copies of your KYC documents (identity proof, address proof) and your signature.

- Make the minimum contribution online — ₹500 for Tier I or ₹1,000 for Tier II.

- Finally, eSign using your Aadhaar OTP or submit a physical form if required.

Within a few days, you’ll receive your PRAN (Permanent Retirement Account Number) — your unique NPS ID.

2. Through a Bank (Netbanking or Mobile App)

Many banks let you open a National Pension Scheme account directly through their net banking or mobile app.

- Log in to your account, go to the NPS section, and follow the on-screen instructions.

- The bank handles most of the KYC verification automatically.

- Ensure your PAN is linked to your bank account if you’re registering without Aadhaar.

3. Offline via Point of Presence (PoP)

You can also open an NPS account offline by visiting an authorized Point of Presence (PoP) — such as banks, post offices, or financial service centers.

- Fill out the NPS application form and attach your KYC documents (PAN, Aadhaar, address proof, photo, and a cancelled cheque).

- Deposit the initial contribution (₹500 or more).

- The PoP will process your form and send your PRAN by post.

No matter which method you choose, keep a copy of your PRAN and login credentials safely. Once your National Pension Scheme account is active, you can easily log in online to:

- Track and manage your investments

- Make additional contributions

- Update nominee or personal details

NPS vs PPF: A Side-by-Side Comparison

Many savers compare National Pension Scheme (NPS) with the Public Provident Fund (PPF). Both are tax-advantaged retirement vehicles, but they have key differences. The table below summarizes the main contrasts:

| Feature | NPS (Tier-I) | PPF |

|---|---|---|

| Type of Instrument | Market-linked national pension scheme (invests in equities, corporate bonds, govt. securities). Returns vary by fund performance. | Government-backed savings scheme with fixed interest. Current rate is 7.1% p.a. (FY2025–26). |

| Returns | Market-driven. No fixed rate; historical annualized returns have been ~9–12% (often double-digit) depending on allocation. | Guaranteed fixed return (7.1% now). |

| Lock-in Period | Locked until age 60 (no full withdrawal before 60). Partial withdrawals (up to 25% of contributions) allowed after 3 years under specific conditions. | 15-year lock-in (can extend in 5-year blocks). Partial withdrawals allowed from 7th year onwards. |

| Minimum/Maximum | Min. ₹500 per contribution (₹1,000/year). No upper limit. | Min. ₹500/year, max. ₹1.5 lakh/year. |

| Contributions & Tax | Contributions deductible: up to ₹1.5L under 80C + additional ₹50k under 80CCD(1B) (old regime). Employer’s contribution deductible up to 14% salary. | Contributions deductible up to ₹1.5L under 80C. (No extra allowance beyond 80C.) |

| Withdrawals at Maturity | 60% corpus withdrawn tax-free, 40% used to buy annuity (pension, later taxed). | Entire corpus withdrawn tax-free (EEE) at maturity. |

| Partial Withdrawals | Yes, limited (after 3 yrs, up to 25% for education, medical, etc.). | Yes, after 5–6 years (subject to conditions). |

| Loans | No loan facility against NPS. | Loans allowed against PPF balance between 3rd–6th year (up to 25% of balance). |

| Annuity Requirement | Mandatory 40% annuitization at retirement to secure pension. | No annuity requirement; full lump sum withdrawal is allowed. |

| Risk/Return Profile | Higher growth potential with market risk. May outperform inflation. | Low risk; government-guaranteed returns. Capital is protected. |

The bottom line: National Pension Scheme can potentially build a larger retirement fund (thanks to equity exposure and higher returns) but comes with market risk and complex withdrawal rules. PPF is the safer, fixed-return option with complete tax-exemption on returns. NPS locks your money until 60 and forces an annuity, whereas PPF offers full lump-sum access at maturity. A balanced retirement plan often uses both: PPF’s stability and NPS’s growth potential.

Example Scenario: Retirement Corpus Calculation

To illustrate NPS, consider this scenario using a standard national pension scheme NPS corpus calculator:

Age 25, Monthly Investment = ₹5,000, Expected Return = 10%, Years = 35.

After 35 years of compounding, the total corpus is about ₹1.91 crore approximately . You can withdraw 60 percent ≈ ₹1.14 crore as a lump sum (tax-free) at age 60 . The remaining 40 percent ≈ ₹76.4 lakh is used to purchase an annuity. At a modest annuity rate (~5.75 percent), this could yield a pension of around ₹38,213 per month.

Total invested capital over 35 years was only ₹21 lakh. Strong market-linked growth helps beat inflation, making retirement comfortable. This example shows how consistent contributions grow into a large fund over time.

Of course, real results may vary. A person who starts later or contributes less will accumulate a smaller corpus. Even modest monthly investments, such as a few thousand rupees, can create significant wealth given long investment horizons.

To estimate your personalized retirement amount, you can adjust the inputs (age, SIP amount, return rate) using any reliable NPS corpus calculator to match your specific financial goals.

Summary

national pension scheme (NPS) is a market-linked retirement scheme that offers higher growth potential and tax benefits, but requires patience (lock-in) and annuitization. It suits salaried and self-employed people who want professional management and equity exposure for their pension fund. You open an NPS account online (via eNPS or your bank) with basic KYC documents, contribute regularly, and adjust investments over time.

You may also like reading on Chalk2Wealth:

What National Pension Scheme means in India?

What National Pension Scheme (NPS) means is a government-backed retirement plan that helps individuals save regularly for a secure post-retirement income. It is a market-linked scheme where your money is invested in equity, corporate bonds, and government securities to build a strong pension corpus over time.

How to open National Pension Scheme account?

You can open your National Pension Scheme (NPS) account online or offline, both options are simple and teacher-friendly.

Online Method (Most Popular)

- Visit the official portal — eNPS .

- Click “National Pension System – Join NPS”.

- Select your registration option – using Aadhaar or PAN.

- Complete KYC verification through your bank or POP (Point of Presence).

- Fill in basic details – name, DOB, nominee, and choose your fund manager and investment type (Active or Auto choice).

- Upload documents and make your first contribution (minimum ₹500).

- After submission, you’ll get a Permanent Retirement Account Number (PRAN).

Your account is now live! You can start contributing monthly or yearly to build your retirement corpus.

Offline Method

Visit any bank branch or post office that acts as an NPS Point of Presence (POP). Fill the subscriber form (CS-S1), attach KYC documents, and make your first deposit. You’ll receive your PRAN card by post.

What is the National Pension Scheme interest rate?

The National Pension Scheme (NPS) interest rate is not fixed like in PPF or FD because NPS is a market-linked retirement plan. Your returns depend on how your contributions are invested across equity, government bonds, and corporate debt.

Over the long term, NPS has delivered average annual returns of 8%–10% for most investors.

- Equity funds (E): 9%–12% average

- Corporate debt (C): 7%–9%

- Government bonds (G): 6%–8%

Your overall return depends on your chosen asset mix and fund manager.

What are the National Pension Scheme withdrawal rules?

Under the National Pension Scheme (NPS):

- At retirement (60 years) – You can withdraw 60% tax-free; the rest 40% must buy an annuity for monthly pension.

- Before 60 years – Only 20% can be withdrawn, and 80% goes into an annuity.

- Partial withdrawal – Up to 25% of your own contribution allowed after 3 years for needs like education, home, or medical treatment.

- On death of the subscriber, the entire corpus is paid to the nominee.

NPS vs PPF – Which is better?

Both NPS (National Pension Scheme) and PPF (Public Provident Fund) are popular retirement options, but they differ in returns and flexibility:

| Feature | NPS | PPF |

|---|---|---|

| Type | Market-linked | Fixed return |

| Average Returns | 8–10% | 7.1% (as of 2025) |

| Lock-in | Till age 60 | 15 years |

| Tax Benefit | Up to ₹2 lakh (80CCD) | Up to ₹1.5 lakh (80C) |

| Withdrawal | Partial & annuity-linked | Partial after 7 years |

| Risk | Moderate (market-based) | Very low |

✅ Verdict:

Choose NPS if you want higher growth and pension income.

Choose PPF if you prefer safe, fixed, and tax-free returns.

What is the NPS corpus calculator?

The “corpus calculator” for National Pension Scheme (NPS) is an online tool that helps you estimate how much retirement savings you will have by a given age — based on your monthly contribution, investment horizon, and expected rate of return. For example, the official NPS calculator on the Pension Fund Regulatory and Development Authority (PFRDA) site lets you enter your current age, monthly or annual contribution, expected return and annuity portion — then projects your total corpus at retirement and an approximate monthly pension.

You can use this to answer questions like: “If I invest ₹3,000/month now until age 60, what might my corpus be?” or “How much should I contribute monthly to target a corpus of ₹1 crore?”

Is NPS tax free?

The National Pension Scheme (NPS) offers multiple tax benefits, but it’s not completely tax-free.

- During investment: You can claim deductions up to ₹1.5 lakh under Section 80CCD(1) and an additional ₹50,000 under Section 80CCD(1B) — giving you ₹2 lakh total tax savings each year in old tax regime.

- At maturity (age 60): 60% of your corpus is tax-free, while the remaining 40% must be used to buy an annuity, which gives you monthly pension.

- Pension income from the annuity is taxable as per your income-tax slab.

Is NPS a good investment?

Yes, the National Pension Scheme (NPS) is a good long-term investment, especially for teachers, salaried employees, and self-employed individuals who want a secure retirement corpus with tax benefits.

- High growth potential: NPS invests in a mix of equity, corporate bonds, and government securities, giving 8–10% average annual returns.

- Tax benefits: Save up to ₹2 lakh per year under the old tax regime (Sections 80CCD(1) + 80CCD(1B)).

- Professional fund management: Your money is managed by PFRDA-regulated experts.

- Lock-in till 60 years: It’s best for those who can stay invested long-term.

In short: NPS is a smart and disciplined retirement plan — ideal if you want steady growth, tax savings, and lifelong pension income.

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms. And before you leave—drop a comment below: which investment option do you trust the most in 2025? Your experience can guide other teachers too