Table of Contents

TogglePPF Interest 2026: The 5th April Trick Every Teacher Must Know

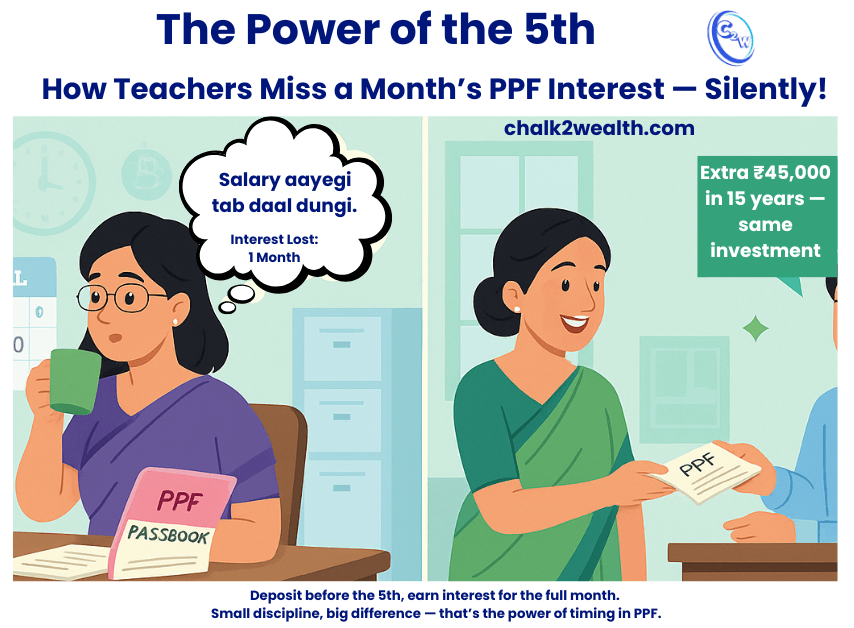

It was the first week of April — the new academic session had just begun at Rising Star Public School.

While most teachers were busy decorating notice boards, Mrs. Suman, the math teacher, sat in the staffroom sipping her chai and filling out her PPF deposit slip.

“Bas April 10 ko jama kara dungi,” she said casually to the clerk, “salary tab tak aa jaayegi.”

What she didn’t realize was that those five little days — from the 5th to the 10th — were quietly costing her a full month’s worth of PPF interest every single year.

A few months later, during a financial-literacy workshop, Rekha ma’am discovered a simple but powerful truth: “In PPF, even timing is money.”

Since then, she’s made it a ritual — her PPF cheque goes in before April 5 every year, without fail. And over 15 years, this tiny change will earn her almost ₹45,000 extra in tax-free PPF interest, without investing a single rupee more.(Approximate estimate assuming consistent early deposits and prevailing interest rates)

That’s the beauty of the Public Provident Fund (PPF) — small discipline, big difference.

“If you’re a teacher looking to explore safe and smarter choices beyond traditional savings, check out our detailed guide on Top Investment Options for Teachers Beyond GPF. The Public Provident Fund (PPF) is one of India’s most trusted long-term savings schemes.

The Public Provident Fund (PPF) is one of India’s most trusted long-term savings schemes, known for its sovereign guarantee and tax-free returns. It has a 15-year lock-in and allows annual investments up to ₹1.5 lakh, making it a popular pillar of financial planning for conservative investors.

The current PPF interest rate, reviewed quarterly by the Government of India, adds to its appeal — offering steady, predictable growth compared to market-linked instruments. Since PPF is backed by the government, your capital remains secure, and the interest earned is completely tax-exempt, offering an EEE (Exempt-Exempt-Exempt) benefit — contributions (under Section 80C), interest, and maturity proceeds are all tax-free.

This unique combination of safety, stable PPF interest, and tax savings makes the Public Provident Fund especially appealing to teachers, salaried individuals, and retirees looking for risk-free growth of their money.

Once you’ve maximized your PPF interest, it’s time to diversify — explore Top Investment Options for Teachers Beyond GPF to balance safety and growth.

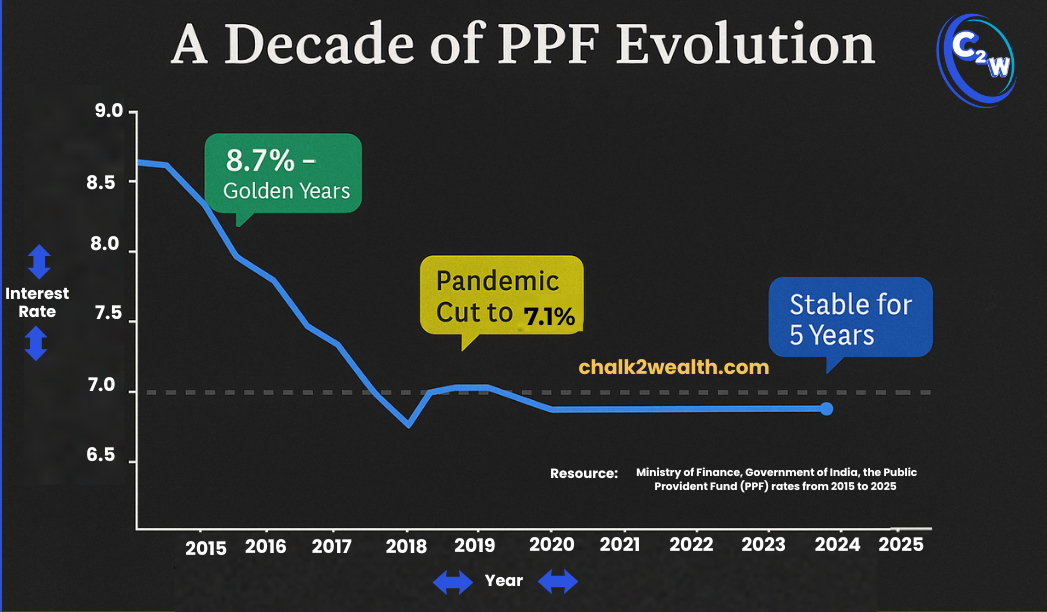

PPF Interest Rate Trends in 2026

As of January 2026 , the PPF interest rate stands at 7.1% per annum, compounded annually. The rate is reviewed and set by the Ministry of Finance every quarter, but notably, it has remained unchanged at 7.1% for several years now. In fact, for the October–December 2025 quarter, the government again maintained PPF at 7.1%, prioritizing stability for small savers. This stability is seen as a protective move for risk-averse investors in a time of volatile markets. While other small-savings schemes like National Savings Certificates and Senior Citizen Savings Scheme have seen rate hikes recently, PPF has been kept steady. The upside of a steady 7.1% is that it still beats many bank fixed deposits in post-tax returns, since PPF interest is tax-free. For instance, an equivalent taxable investment (like an FD) would need to offer over 10% interest to match PPF’s net yield for someone in the highest tax bracket. Thus, even at 7.1%, PPF remains one of the most tax-efficient fixed-income options available.

How PPF Interest Works (and Why Timing Matters)

Understanding how interest is calculated is key to maximizing your PPF returns. Interest on PPF is calculated each month on the lowest balance in the account between the 5th and the last day of that month. However, the interest is credited only once a year (on March 31st) after being computed monthly. What this means is timing your deposits can give you an extra edge:

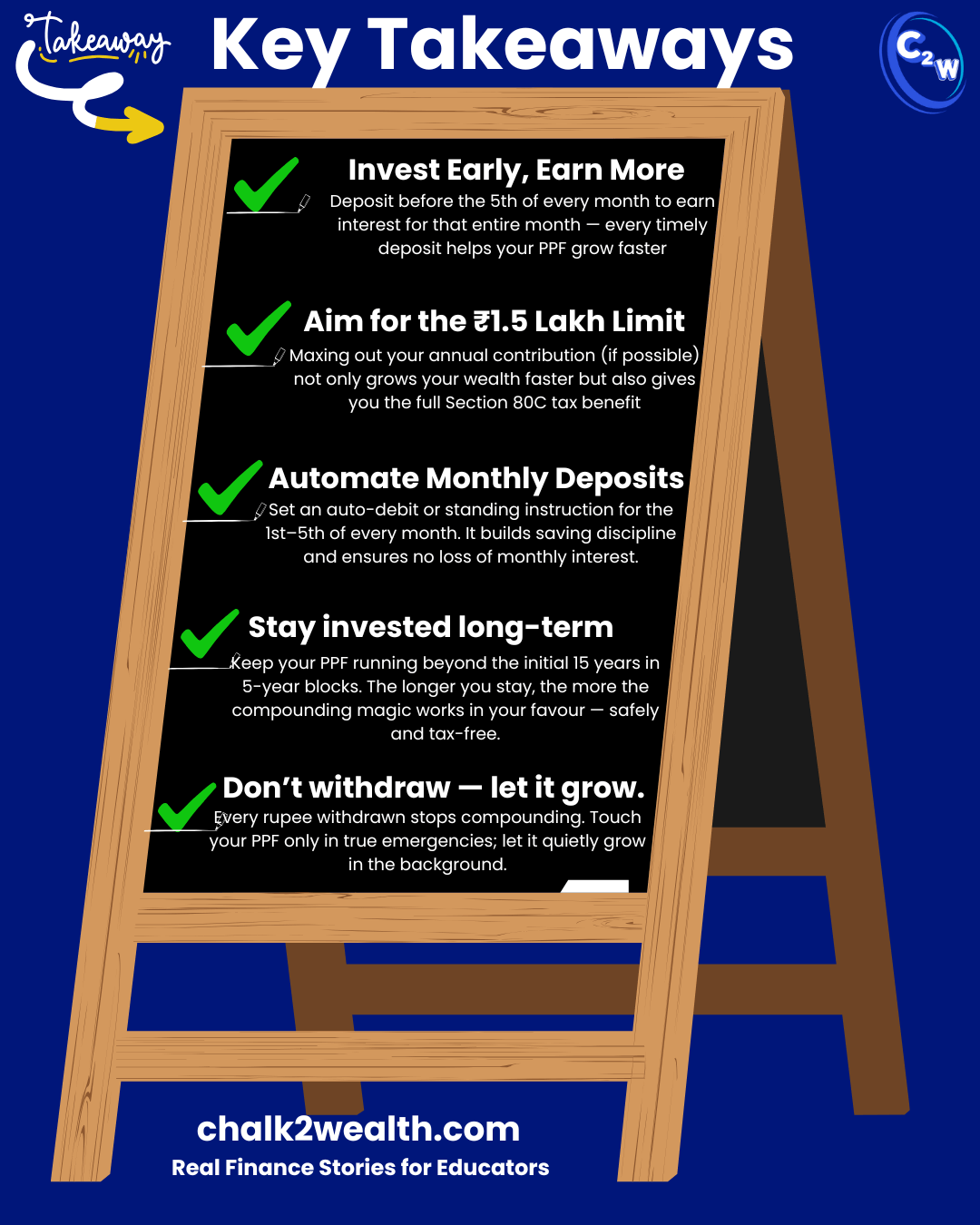

- A money control article recommends to deposit before the 5th of the month: If you put money into PPF on or before the 5th, it counts toward that month’s interest calculation. A deposit made after the 5th earns no interest for that month. For example, investing ₹1.5 lakh on July 4 ensures you earn interest for July, whereas investing on July 6 means you miss out on interest for that whole month. Simply advancing your contribution by a few days can get you 12 months of interest instead of 11 in a year – a free boost to your returns.

- Annual lump-sum vs monthly deposits: PPF allows flexibility in contributions – you can invest a lump sum up to ₹1.5 lakh once a year, or spread it out in monthly installments. From a pure interest standpoint, investing the full ₹1.5 lakh as early as possible in the financial year (ideally by April 5) yields the maximum interest for that year. Every month that your money stays in the account, it earns interest – so a lump sum in April earns for 12 months, whereas monthly contributions spread across the year earn on a staggered timeline. Financial planners recommend that if you have the funds, invest your PPF contribution in April itself (or as soon as you can) to take full advantage of compounding. On the other hand, if lump-sum investment is not feasible, monthly automated deposits are a good discipline – just ensure they hit the account by the 5th each month to maximize monthly accruals.

Bottom line: Whether you contribute monthly or annually, be consistent and timely. This costs nothing extra but can meaningfully increase your effective return over the 15-year term. The power of compounding in PPF is best unleashed when your money is invested as early and for as long as possible.

Practical Tips to Maximize Your PPF Interest and Returns

- Max out the Limit:

Aim to invest the maximum ₹1.5 lakh per year if your finances permit. This not only maximizes your eventual corpus but also secures the full tax deduction under 80C (if you’re using the old tax regime). Smaller contributions are fine if ₹1.5 lakh is too high, but try to gradually increase your annual contribution towards the cap to leverage compounding fully and make the most of your PPF interest. - Invest at the Start of the Year:

As discussed, contribute as early in the financial year as possible. A lump sum by April 5 will earn PPF interest for the entire year. For example, if you put ₹1.5 lakh in April, that money works for you for 12 months. If you wait till late in the year, you lose months of potential growth. Every year’s early deposit significantly boosts the maturity amount over 15+ years. - Monthly Contributions Strategy:

If you opt for monthly contributions (a common approach for salaried folks), set a standing instruction to deposit by the 1st or before 5th each month. This way, you never miss the cutoff date for PPF interest calculation. Automating the process also enforces saving discipline. Over 15 years, these extra bits of monthly interest add up to a noticeable difference in your total corpus. - Stay Invested for the Long Haul:

PPF interest truly shines over time. The initial 15-year tenure can be extended in 5-year blocks indefinitely. If you don’t need the money immediately at maturity, consider letting it ride to earn further guaranteed, tax-free PPF interest. Many retirees keep their PPF account active after 15 years for this reason (more on this below) - Avoid Withdrawals and Loans Unless Necessary: PPF permits partial withdrawals from year 7 and loans against your balance from year 3. While these features provide flexibility for emergencies, any amount taken out stops earning PPF interest. To maximize returns, leave your funds untouched to compound. Use withdrawals only for critical needs where no cheaper source of funds exists.

By following these strategies, you ensure you’re squeezing out every bit of return that PPF interest can offer — without taking on any additional risk. Remember, consistency and patience are key – PPF rewards the tortoise, not the hare!

Conclusion: Safe, Tax-Free, and Effective

In a world of myriad investment choices, PPF stands out as a conversative investor’s best friend – it’s simple, safe, and rewarding in its own steady way. By keeping up with the latest rules (like the current 7.1% rate and quarterly reviews) and following smart strategies (timely contributions, full utilization of limits, and long-term commitment), you can maximize your PPF returns effectively. Whether you’re a young professional just starting out, a mid-career individual balancing various goals, or a retiree seeking stability, PPF can play a valuable role in your financial plan. Its tax-free compounding and government guarantee provide a comfort that few other products can match. And while it’s wise to diversify into higher-return investments for growth, the PPF gives you a solid foundation of risk-free wealth to build on. So stay disciplined, think long-term, and let the power of PPF help secure your financial future – 15 years at a time!.

Keep in mind PPF is a great foundation for stability. But to grow faster, teachers can also explore other risk-free avenues in our post — Top Investment Options for Teachers Beyond GPF.

FAQ on PPF interest

Is PPF interest taxable?

No – PPF enjoys an Exempt‑Exempt‑Exempt (EEE) status under Indian tax law, which means your contributions, the annual interest earned, and the final maturity amount are all completely tax‑free

How interest is calculated on PPF?

PPF interest is worked out through a compound interest system that’s applied yearly but calculated every month. Simply put, the government adds interest each month to your balance, but it’s officially credited once a year. If you deposit money before the 5th of a month, that amount earns interest for that month too; if you deposit after the 5th, interest starts from the next month. You can use any trusted online PPF calculator — such as those provided by SBI Securities or ICICI Bank— to easily estimate your maturity amount and interest.

In short, your PPF balance grows through monthly compounding, and the earlier you deposit each month, the more interest you earn over time.

When can I withdraw my PPF?

You can withdraw money from your PPF in three ways:

- Partial withdrawal: Allowed once a year after completing five full financial years. You can withdraw up to 50% of the balance, calculated on the lower of the 4th or previous year’s balance.

- Full withdrawal: After 15 years, you can withdraw the entire amount (principal + interest) or extend the account in 5-year blocks.

- Premature closure: Allowed after 5 years only for serious illness, higher education, or change in residency, with a 1% interest penalty.

PPF is mainly a long-term savings plan with limited early access for genuine needs.

How can I withdraw money from PPF account?

You can withdraw money from your PPF account in three ways:

- Partial Withdrawal:

After completing five full financial years, you can withdraw up to 50% of your balance. Only one withdrawal is allowed per financial year. - Full Withdrawal at Maturity:

After 15 years, you can withdraw the entire amount (principal + interest) by submitting Form C. You may also extend your account in 5-year blocks if you wish to continue investing. - Premature Closure:

Allowed after five years only in special cases—such as serious illness, higher education, or change in residency status—with a 1% reduction in the applicable interest rate.

PPF is designed for long-term savings, so early access is limited to protect your growing corpus.

Can I withdraw money from PPF account before maturity?

Yes, you can — but only partially and after 5 full financial years.

PPF rules allow one partial withdrawal per financial year once five complete financial years have passed from the end of the year in which the first deposit was made.

You can withdraw up to 50% of your balance, calculated as the lower of:

- The balance at the end of the 4th year before the withdrawal year, or

- The balance at the end of the previous year.

Full withdrawal is allowed only after 15 years (maturity).

In exceptional cases — like serious illness, higher education, or change of residency — you may also close the account early after 5 years, but with a 1% interest penalty.

How to withdraw PPF amount online?

You can start the PPF withdrawal process online, but some banks still ask you to visit the branch for final submission.

- Log in to your bank account and go to your PPF section → Withdrawal/Form C.

- Download and fill Form C with your account details, withdrawal amount, and savings account number.

- Attach your PPF passbook copy and submit the form online (if your bank allows) or at the branch.

- The bank processes it and credits the amount to your linked savings account.

You can make only one partial withdrawal per year after five full financial years. Full withdrawal is allowed only at maturity (15 years). Premature closure is permitted only for special cases (medical or education) with a 1 % interest cut.

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

If this article helped you, share it with one fellow teacher today. Together, we can build financial literacy in our staffrooms. And before you leave—drop a comment below: which investment option do you trust the most in 2025? Your experience can guide other teachers too