Table of Contents

ToggleBest Safe Investment Options for Teachers in India (2026–27 Complete Guide)

In the staffroom, Mr. Shiv Kumar, a science teacher, leans closer to his colleague and whispers:

“Sir, paisa toh hai thoda bachta… par dar lagta hai risky cheezon mein daalne se. Batao koi safe investment option jo return bhi accha de.”

(“Sir, I do manage to save a little money… but I’m afraid of putting it into risky things. Tell me a safe investment option that also gives good returns.”)

This isn’t just Shiv Kumar’s dilemma—it’s the heartbeat of most Indian teachers and middle-class families in 2026. For us, safety always comes first, while growth is often treated as an afterthought. Fixed deposits, recurring deposits, and provident funds feel secure, but the real question is: are these safe investment options enough to protect our money from rising inflation and the ever-increasing cost of education and healthcare?

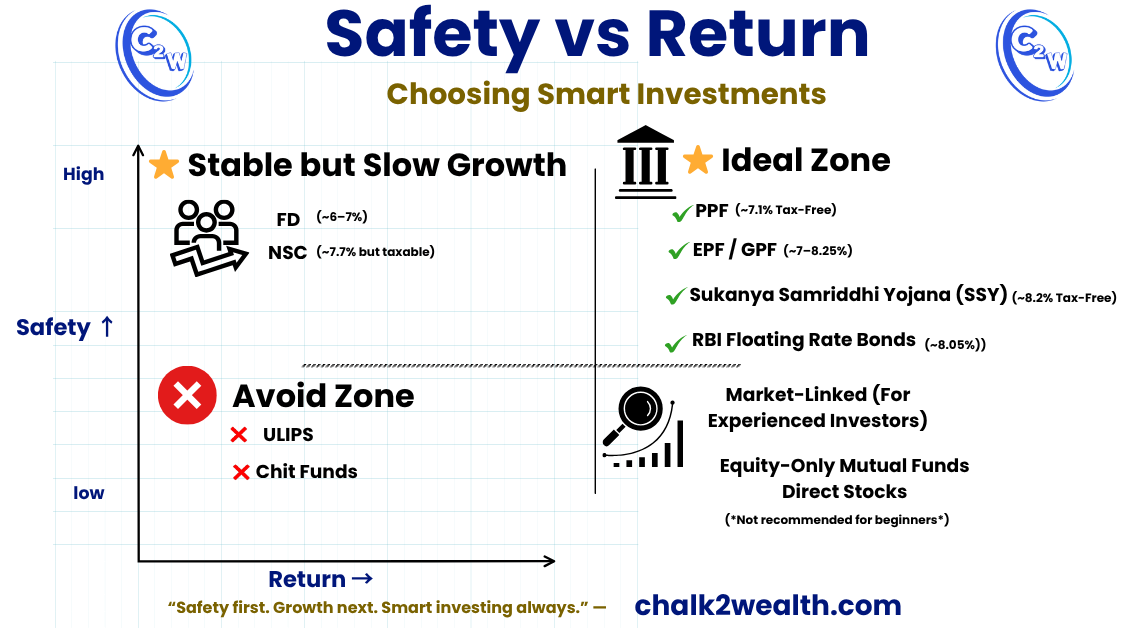

The encouraging truth is that safe investments in India with high returns do exist—if we define “high returns” correctly. These are not get-rich-quick schemes. Instead, they are well-structured safe investment options that protect capital while quietly beating inflation over time. The real challenge for teachers is separating genuinely safe choices (such as PPF, EPF, Sukanya Yojana, and RBI Bonds) from products often mis-sold as “safe,” like expensive insurance-investment plans or unregulated chit funds.

Before exploring these options, one rule comes first: never invest without a safety net. If you’re still building your financial base, start here with an emergency fund system designed especially for teachers—it forms the foundation of every safe investment journey.

For a broader perspective on where salaried Indians can place their money this year, you can also read:

Where to Invest Money in India (2026): 5 Safe & Inflation-Proof Investment Options for Salaried People

In this complete guide, we’ll explore how even the most cautious investors—teachers like Shiv Kumar or principals planning their retirement—can build wealth in 2026 using safe investment options that are secure, inflation-beating, and stress-free.

safe investment options with high returns: what they really mean for teachers

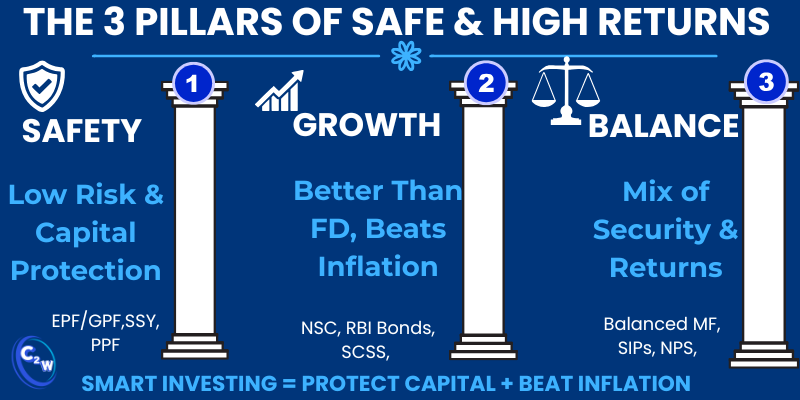

Use this simple three-pillar framework to judge any ‘safe’ investment.

“Safe” = Low Risk & Capital Protection

When we talk about safe investments in India with high returns, the first pillar is safety. A safe investment means your principal is protected, and the risk of loss is minimal. Most of these are backed by the government or come with guarantees. For example, small savings schemes such as PPF or Sukanya Samriddhi carry a sovereign guarantee—your interest and principal are 100% secure. Even if markets fluctuate, your hard-earned savings stay protected.

For teachers who want a step-by-step foundation, start with this guide: Safe Investment Options for Teachers Beyond GPF.

“High Returns” = Better Than FD, Beats Inflation

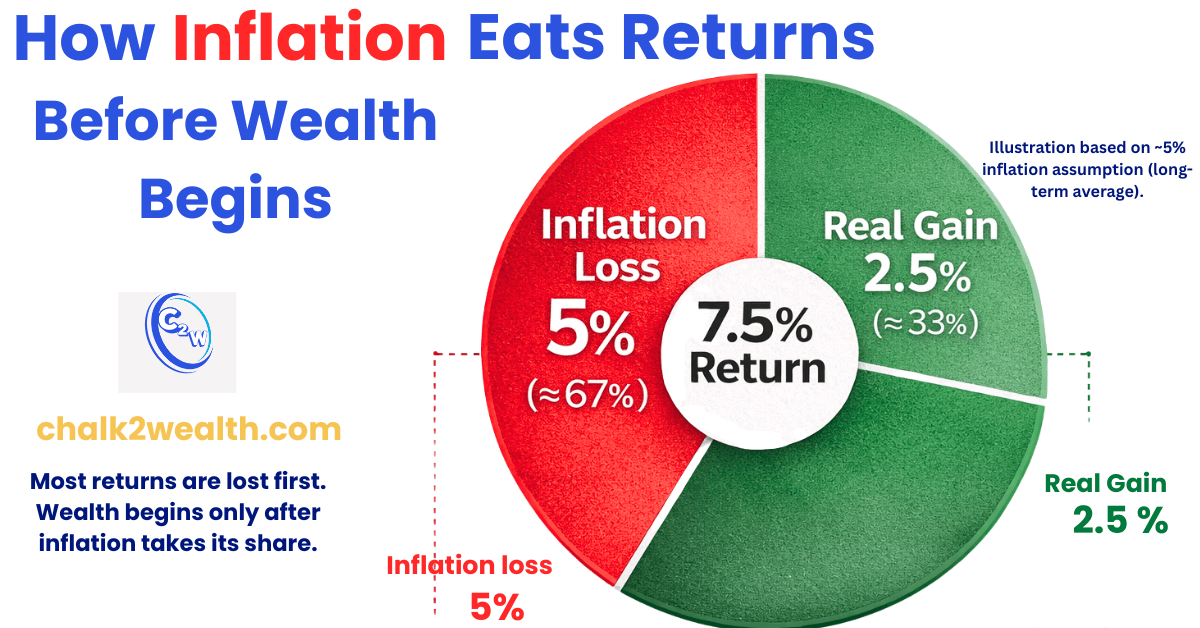

The second pillar is growth. “High returns” doesn’t mean doubling your money overnight—it simply means better than the ordinary. The real benchmark is beating both fixed deposit (FD) rates and inflation. If FD rates hover around ~5% while inflation is ~6%, you’re actually losing value. That’s why safe investments in India with high returns aim for 7–8% or more annually, so your savings grow in real terms and protect your purchasing power.

Before choosing any option, see how inflation reduces most nominal returns

Balancing Both = Smart Investing

The real art lies in balancing both pillars. True safe investments in India with high returns combine capital protection with steady growth. This often means keeping a foundation in ultra-safe products (for security) while allocating a portion to instruments that deliver slightly higher returns. By making informed choices, you can build a portfolio that preserves your capital, beats inflation, and steadily builds wealth over time.

See how this works in practice in our case study: Diversified Investment Portfolio – 6 Smart Lessons for Tutors.

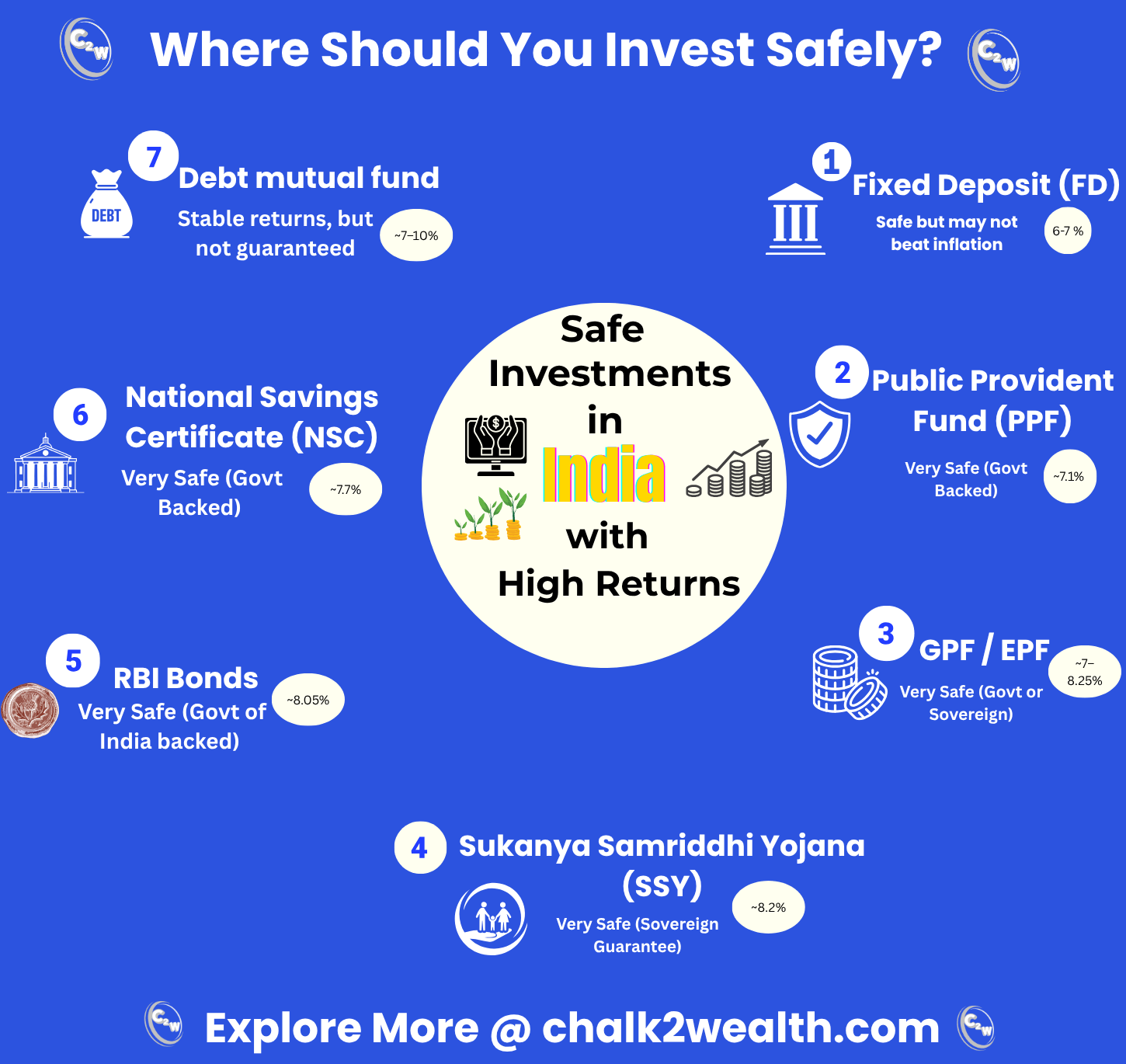

Best Safe Investment options in India with High Returns

Here is a quick snapshot of the most reliable safe investment options for teachers.

Safe investments in India with high returns don’t mean taking unnecessary risks. They are about stability, protection of capital, and growth that beats inflation. For teachers and other cautious savers, the Indian market in 2026 offers multiple government-backed and institution-backed choices that deliver peace of mind along with decent returns. Here are the most reliable options:

Public Provident Fund (PPF) – ~7.1% Annual Interest (Tax-Free)

PPF is one of the most trusted safe investments in India with high returns. Backed by the government with a 15-year lock-in, it currently pays ~7.1% interest, and the earnings are completely tax-free — making it one of the excellent for retirement planning for teachers.

But here’s a small trick most teachers don’t know: PPF Interest 2026-27: The 5th April Trick Every Teacher Must Know. If you deposit before the 5th of every month, especially in April, you earn interest for the full month. Depositing after the 5th means you lose one month of interest silently every year — and over 15 years, this makes a big difference in your final maturity amount.

Employees’ / General Provident Fund (EPF / GPF) – ~7–8% Annual Interest

For salaried employees, EPF and GPF remain rock-solid safe investments in India with high returns. EPF interest has been around 8%+ in recent years (subject to annual notification), while GPF for government teachers is ~7.1%. Both are backed by the government and are ideal for long-term corpus building, with tax benefits on withdrawal under prescribed rules. But remember, teachers have investment options beyond GPF that can provide better diversification and growth.

National Savings Certificate (NSC) – 7.7% Annual Interest (5-Year Lock-In)

If you want a government-backed, safe investment in India with high returns for a 5-year period, NSC fits perfectly. The NSC, available through post offices, offers 7.7% annual returns with sovereign security. With a 5-year lock-in, it works as a medium-term safe investment, and you can also claim tax deductions under Section 80C.

This brings us to an important question many investors ask:

National Savings Certificate (NSC): How Much Should You Have in Your Investment Portfolio?

Your NSC allocation depends on your financial goals, risk appetite, and medium-term (5-year) planning. NSC isn’t just about safety — it helps balance stability + guaranteed returns within your overall investment portfolio.

Sukanya Samriddhi Yojana (SSY) – 8.2% Annual Interest (Girl Child Scheme)

SSY is among the best safe investments in India with high returns, especially for parents of daughters under 10. Offering 8.2% tax-free interest, it’s a government-guaranteed scheme designed to fund education and marriage goals, with partial withdrawals allowed for higher studies.

RBI Floating Rate Bonds (2020) – ~8.05% Annual Interest (7-Year Bond)

Issued by the Reserve Bank of India, these bonds guarantee 8.05% interest. They reset every 6 months, pegged at 0.35% above the NSC rate. As government bonds, they carry zero credit risk, making them one of the most dependable safe investments in India with high returns for lump-sum investors.

Debt Mutual Funds / Liquid Funds – ~6–8% Annual Returns

For teachers looking for liquidity with reasonable growth, high-quality debt funds are relatively safe investments in India with high returns. By investing in bonds and government securities, they typically yield 6–8%. Short-duration funds reduce interest rate risk, though taxation must be considered. To understand the basics, start with this guide: What are mutual funds? 5 powerful reasons to start.

Balanced / Hybrid Mutual Funds (via SIP) – ~9–11% Potential Returns

Hybrid SIPs are a safe investment option in India with relatively high returns because they balance equity and debt. Hybrid funds blend equity and debt, offering a balanced path for conservative investors. SIPs in hybrid funds can deliver 9–11% annualized returns over the long term. While not risk-free, they qualify as moderate-risk safe investments in India with high returns, suitable for teachers willing to accept slight market exposure for higher growth. Learn how to mix safety with returns here: Diversified Investment Portfolio – 6 Smart Lessons for Tutors.

Other Notable Mentions

- Fixed Deposits (FDs): 6–7.5% (safe, but taxable and often below inflation).

- Senior Citizens’ Saving Scheme (SCSS): 8.2% with quarterly payouts. Perfect for retired teachers.

- National Pension System (NPS): ~9–11% long-term returns, combining tax benefits with diversified equity-debt exposure.

A final caution: Many teachers still confuse insurance with investment. Don’t fall into this trap—read this must-know guide on insurance frauds and mis-selling in India before locking money in policies disguised as “safe returns.”

“Safety does not mean sacrificing growth. A teacher’s best investment is one that protects hard-earned savings and beats inflation.”

— Chalk2Wealth, 2026

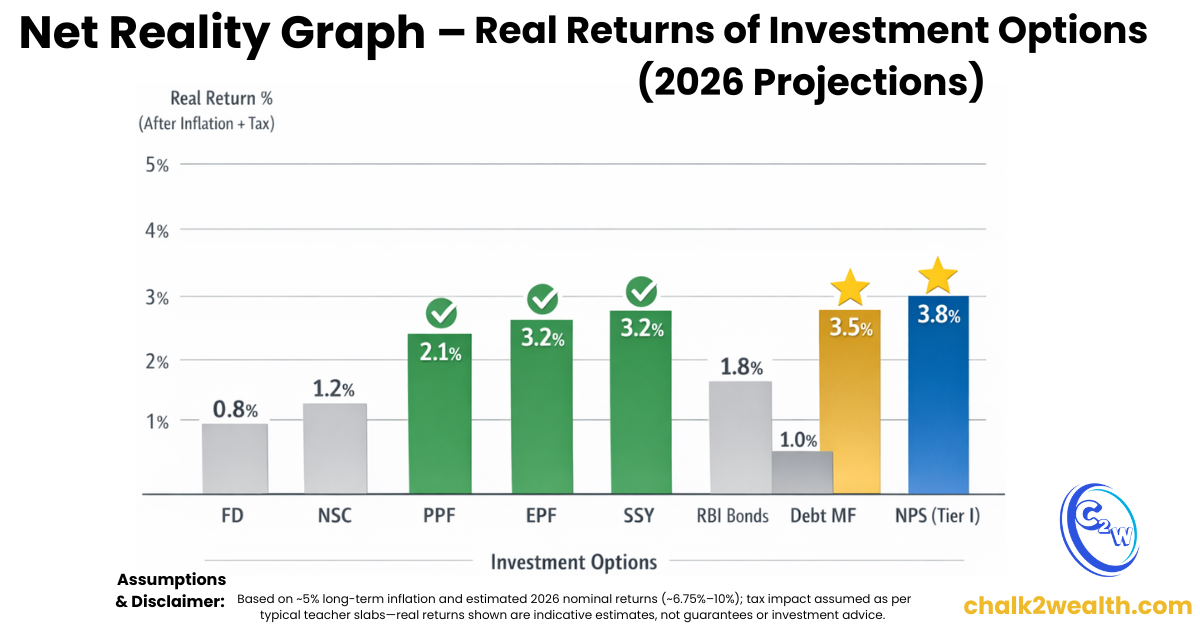

Comparison of Safe Investments options in India with High Returns

| Investment Option | Indicative Return (Latest Rates) | Lock-in / Tenure | Tax Treatment | Risk Level | Best For Teachers Who… |

|---|---|---|---|---|---|

| Public Provident Fund (PPF) | ~7.1% (tax-free) | 15 years (partial withdrawal after 5) | Interest fully tax-free | Very Low (Govt-backed) | Want guaranteed, long-term savings for retirement |

| Employees’ / General Provident Fund (EPF/GPF) | ~7–8% (EPF: 8.25% FY 2024-25, GPF: 7.1%) | Till retirement/job | Tax-free on withdrawal under rules | Very Low (Govt/EPFO backed) | Salaried teachers building a retirement corpus |

| National Savings Certificate (NSC) | ~7.7% | 5 years | Interest taxable, but investment qualifies for 80C | Very Low (Govt-backed) | Need medium-term safe savings with tax deduction |

| Sukanya Samriddhi Yojana (SSY) | ~8.2% (tax-free) | Till girl child turns 21 (partial allowed for education) | EEE: Exempt at all stages | Very Low (Govt-backed) | Parents saving for daughter’s education/marriage |

| RBI Floating Rate Bonds | ~8.05% (resets every 6 months) | 7 years | Interest taxable | Very Low (Govt of India) | Want lump-sum safe investment with assured semi-annual income |

| Debt Mutual Funds | ~6–8% | No fixed lock-in (suggest >3 years) | Taxable as per income slab | Low–Moderate | Need liquidity with slightly better returns than FD |

| Hybrid / Balanced Mutual Funds (via SIP) | ~9–11% (long-term) | Recommended 5+ years | Taxable as per MF rules | Moderate (Equity + Debt) | Want inflation-beating growth with moderate risk |

| Senior Citizens’ Saving Scheme (SCSS) | ~8.2% (quarterly payout) | 5 years (extendable to 8) | Interest taxable | Very Low (Govt-backed) | Retired teachers looking for pension-like income |

| Fixed Deposits (FDs) | ~6–7.5% | 1–5 years | Interest taxable | Very Low | Want short-term, ultra-safe parking of funds |

| National Pension System (NPS) | ~9–11% (long-term average) | Till age 60 | Tax benefits + taxed annuity | Moderate (Equity + Debt) | Senior teachers aiming for retirement planning + tax benefits |

Now compare the real return after inflation and tax across each investment option.

Safe Investment options for Teachers (Salary-Wise)

Every teacher’s financial journey is unique. A new graduate teacher in her first job, a mid-career educator balancing school fees and home loans, or a senior principal planning for retirement — each needs a different mix of safe investments in India with high returns. Here’s a salary-wise roadmap to balance safety and growth:

If Salary ≈ ₹30,000/month (New Teacher)

At the start of your career, the priority is safety + habit building.

- PPF: Begin with even ₹2,000–₹5,000/month. At ~7.1% tax-free, it builds a long-term, sovereign-backed safety net.

- Recurring Deposit (RD): Bank RDs (~5–6%) give liquidity for short-term needs while training the discipline of saving.

This stage is about building a safe corpus. Avoid high-risk products. Once your savings habit is set, you’ll be ready to explore better-return options.

If Salary ≈ ₹50,000/month (Mid-Career Teacher)

Now you can balance security with a touch of growth.

- PPF: Continue contributions up to ₹1.5 lakh/year under 80C.

- Hybrid Mutual Fund SIP: Start ₹5,000–₹10,000/month in a balanced/hybrid fund. These funds blend equity (~10% long-term growth) with debt (~6–8%), making them moderate-risk but effective for wealth building.

This mix — PPF + Hybrid SIP — often outperforms FDs, yet remains stable enough to give teachers peace of mind.

If Salary ≈ ₹1,00,000/month (Senior Teacher / Principal)

At this level, diversification is key.

- PPF: Max out contributions (₹1.5 lakh/year).

- NPS: Use the additional ₹50,000 tax benefit (ET Money). Even in a conservative asset mix, NPS has delivered ~9–11% long-term returns.

- Hybrid Fund SIP: Continue for inflation-beating growth.

- RBI Floating Rate Bonds / Debt Funds: Add for steady semi-annual income and safety.

This diversified portfolio — PPF + NPS + Hybrid Fund + RBI Bonds — is one of the best combinations of safe investments in India with high returns. It protects capital, optimizes tax savings, and blends in 8–10% potential returns without exposing you to undue risk.

Teacher’s Lesson: Whether your salary is ₹30k, ₹50k, or ₹1 lakh, the principle remains the same — build your foundation in guaranteed safe instruments, then gradually layer in moderate-risk, higher-return products. That’s how teachers can secure the present and grow for the future.

(Note: These are general plans; individual financial situations may differ. Always align your investments with your personal goals, risk comfort, and family needs.)

Myths Teachers Believe About “Safe Returns”

Finally, let’s clear up a few common myths that often hold back teachers (and others) from optimizing their investments:

Myth 1: “FDs are the safest and best way to save.”

It’s true that bank FDs are very safe, but sticking only to FDs can be a mistake. Why? Standard FD rates (~6–7% today) often barely beat inflation – if at all – and that too before tax. In real terms, money in a 5–6% FD might not grow at all. As one expert cautions, if your money grows less than inflation, its real value actually goes down .

So while FDs are safe, they may not preserve purchasing power, especially after you pay tax on the interest. It’s wise to use FDs for short-term needs or emergency funds, but for long-term goals, some of the alternatives we discussed (PPF, NSC, etc., which are equally safe but offer higher post-tax returns) are better choices.

Myth 2: “Mutual funds = very risky, not for conservative investors.”

The phrase “Mutual funds sahi hai” is common now, but many risk-averse folks still think all mutual funds are like playing the stock market casino. In reality, mutual funds come in many types – not all are high-risk.

- Debt mutual funds largely invest in bonds and can be as stable as FDs (with typical returns of 6–8%, as we saw) .

- Conservative Hybrid funds (75–90% bonds, little equity) are designed for safety-first investors.

So, it’s a myth that any mutual fund is too risky. You can choose funds with low volatility. Yes, equity-heavy funds are volatile in the short term, but products like balanced funds or debt funds are relatively safe (Value Research). Over the long run, a small equity exposure actually helps you beat inflation without taking on excessive risk.

In short, “Mutual funds” is a broad category. As an informed investor, you can pick ones that match your risk appetite. Don’t ignore them completely, or you might miss out on inflation-beating growth.

Myth 3: “Insurance policies are good ‘safe’ investments.”

Many teachers get lured by insurance agents into buying endowment plans or ULIPs, thinking these offer guaranteed returns with insurance – a two-in-one deal. The truth: insurance is not a great investment.

- Traditional life insurance policies (money-back, endowment) often yield only ~5% returns, which barely beat savings accounts.

- Industry data shows insurance companies in India often give just ~5–6% returns on those plans .

- You also lock-in money for long periods with poor liquidity.

The golden rule experts suggest: never mix insurance and investment . If it’s insurance, stick to pure term insurance for protection. If it’s investment, use the avenues we discussed. Don’t fall for the “safe returns” pitch of an insurance-cum-investment plan – you’ll likely get subpar returns and inadequate insurance.

Safe Investments options in India with High Returns: Teacher Investment Starter Checklist

This map makes it clear which options are safest—and which ones offer better growth.

Real returns shown are indicative estimates, not guarantees or investment advice

Final Thoughts

For most Indian teachers, the priority is security of money – and rightly so, as it’s hard-earned. The good news is that you don’t have to sacrifice growth for safety. By leveraging government-backed schemes (for a rock-solid foundation) and adding selective low-risk, higher-return investments (to boost overall returns), you can achieve a healthy balance.Teachers can choose safe investments in India with high returns that protect savings and beat inflation.

In recent years, options like PPF, EPF, NSC, Sukanya Yojana, RBI Bonds and more are offering attractive interest rates that beat inflation while keeping your money safe.

As Mr. Shiv Kumar’s and his colleagues might now realize, “safe investments” no longer mean settling for mediocre growth. With the right mix, a teacher can sleep peacefully knowing their capital is secure and wake up to a portfolio that’s growing robustly. Safe and high returns can go hand-in-hand when you make informed choices. Here’s to smart, safe investing – chalking the path to wealth, one secure step at a time!

Jagan Singh is a school leader and financial literacy educator who writes for teachers and salaried Indians. He has completed the Financial Literacy Course for Bharat conducted by NISM (National Institute of Securities Markets), a capacity-building initiative of SEBI (Securities and Exchange Board of India), and focuses on clarity, risk awareness, and long-term financial thinking.

Disclaimer: The content shared on Chalk2Wealth is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to consult qualified professionals before making financial decisions.

Q1. What are the safest investments in India with high returns in 2026?

The top safe investments with high returns in 2026 are:

- PPF – 7.1% (tax-free, sovereign-backed)

- EPF – 8.25% (for salaried employees)

- Sukanya Samriddhi Yojana – 8.2% (EEE tax benefit)

- NSC – 7.7% (5-year lock-in)

- RBI Floating Rate Bonds – 8.05%

All are government-backed, making them secure for teachers and middle-class families.

Q2. What is the current PPF interest rate in 2026, and is it safe?

The PPF interest rate is 7.1% (FY 2025-26). It is one of the safest investments in India with high returns because it is backed by the Government of India and fully tax-free.

Q3. Where to invest money for good return in 2026?

If you want good returns with safety, start with PPF, NSC, SSY, and RBI Bonds. For slightly higher returns, consider a Hybrid Mutual Fund SIP (9–11% long-term) or NPS (9–11%). A mix of these ensures both safety and inflation-beating growth.

Q4. Are Fixed Deposits (FDs) safe and better than inflation in 2026?

Yes, FDs are safe (insured up to ₹5 lakh by DICGC). In 2025, banks are offering 6%–7.5% (up to 8.25% for senior citizens). Since inflation in August 2025 was 1.69%, FDs currently deliver positive real returns — but long-term, they may not beat inflation after tax.

Q5. Which is the safest investment option in India right now?

The safest investments are those backed by the Government of India, such as PPF, SSY, EPF/GPF, NSC, RBI Bonds, and SCSS. These carry sovereign guarantees and almost zero risk. Among them, SSY (8.2%) and EPF (8.25%) are currently giving the highest returns in 2025.

Sources & References

- Moneycontrol – Small Savings & FD Rates

- Economic Times – EPF/GPF Updates

- Value Research – Mutual Fund Analysis

👉 Data last reviewed: Dec 2025 (used for 2026–27 projections). Verified from official or reputed financial platforms.

You are doing a great job sir…financial literacy is the need of hour.Everyone should understand this.Some people say that money is not everything but I would rather say that “It’s better to cry in a Mercedes than on a bicycle” .I am really proud that some as a teacher has taken up this genuine subject for teaching the whole society.Sometimes I really think that it’s an irony that our life hovers around money till death but still we don’t pay respect and importance to money which it deserve.Once again a great job sir from your side.God bless u.

Thank you so much, Rajan Sir, for your encouraging words 🙏.

You are absolutely right—financial literacy is the real need of the hour. We spend our entire lives around money, yet often don’t give it the respect it deserves. At Chalk2Wealth, my small effort is to make teachers, parents, and families more confident in managing their hard-earned money.

Money isn’t everything, but as you beautifully said, it surely gives us security, dignity, and choices in life. I’m grateful for your support. Do keep sharing your thoughts and also suggest topics you’d like me to cover—your feedback will help me serve our teaching community better.