Table of Contents

ToggleMoney Saving Tips: 7 Smart Ways to Cut Costs & Save More

From One Teacher to Another — Money Saving Tips for Smart Money Habits

I’ve spent most of my life walking through school corridors — teaching, guiding, shaping young minds, and pouring my heart into every lesson. But when it came to my own pocket, my own peace, I often felt lost. Not because I was careless, but because no one ever taught us practical money saving tips for teachers. We know how to manage classrooms, but when it came to managing money, I was simply guessing my way through life — quietly struggling, silently wondering where my salary disappeared every month.

Over the last few years, I slowly started discovering safer and smarter financial choices — from exploring Safe Investments in India with High Returns to even learning How Can I Invest in Gold Smartly in 2026 as part of building a strong personal portfolio. These small steps made a big difference.

This post isn’t just another money lesson — it’s my real story, written with the hope that it reaches fellow teachers searching for simple, practical budgeting tips. If you’ve ever stared at your bank balance, feeling helpless, you’re not alone. This story is for you.

So, from one teacher to another, let me gently walk you through the real-life money saving tips that changed the way I live, spend, and save — tips I wish someone had shared with me when I needed them the most.

Start With What You Have — The First Money Saving Tip Every Teacher Can Take

Take out a pen and paper — or simply open your phone notes — and write down your exact monthly income. That’s where I began in February 2017, when I finally decided to face my finances honestly, long before I even understood the power of simple money saving tips.

I sat down and listed every source of income, including my wife Usha’s salary. For the first time, I saw the full picture.

Our combined income that month was ₹97,818. That moment shook me — our income wasn’t as small as I had convinced myself. It simply needed direction and a few practical money saving tips to guide it with clarity. Later, as I learned more, I even explored basic investing through guides like Invest Money Where: 7 Rules to Win the Investing Marathon and beginner-friendly tools such as What Are Systematic Investment Plans (SIPs) and How They Work to build wealth steadily.

That day became a turning point. We stopped blaming our limited salaries and started guiding our money with purpose — a mindset shift that later became the foundation of all the money saving tips for teachers I now share.

Know Where It Goes — A Money Saving Tip Every Teacher Must Practice

On paper, our income wasn’t small. But in real life, we always felt stretched. That’s when I realised we didn’t just need budgeting — we needed simple money saving tips that worked for teachers like us.

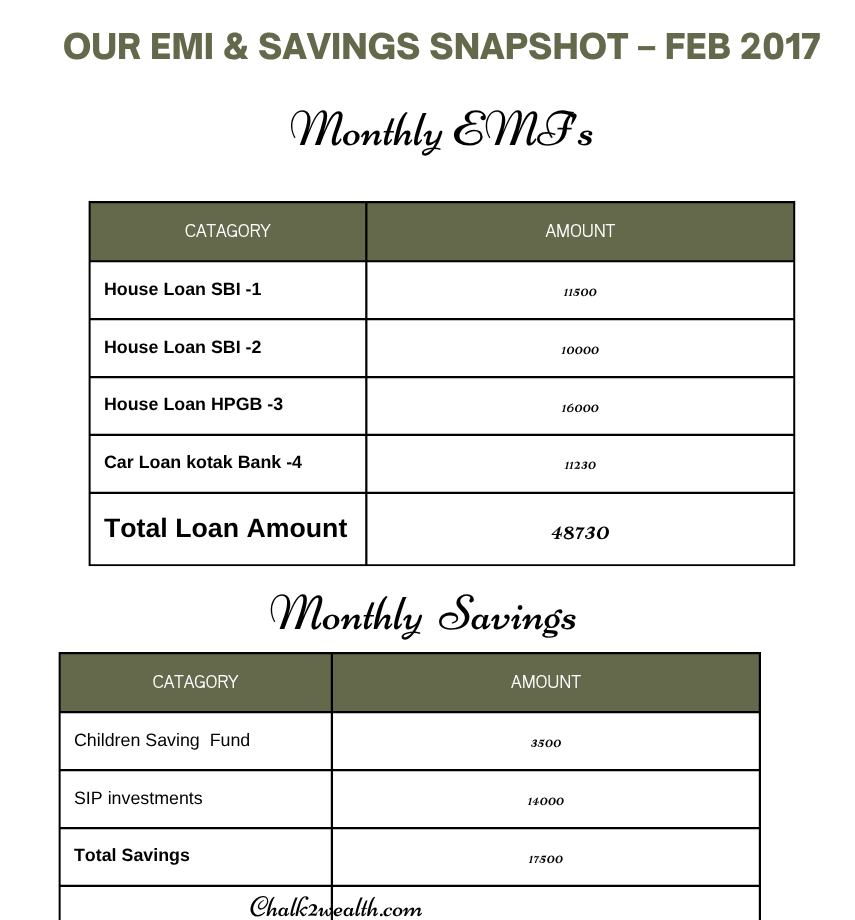

Here’s what we discovered:

- Monthly EMIs: ₹48,730 (three home loans + one car loan)

- Monthly Savings: ₹17,500 (₹14,000 in SIPs + ₹3,500 for children’s future)

After EMIs and savings, we were left with ₹31,588 for daily life: groceries, school fees, utilities, chai, treats, online orders, weekend dinners, and small gifts.

Those “small” expenses quietly drained our pockets. But we didn’t realise it until we tracked everything.

That day taught us — budgeting isn’t about cutting back. It’s about knowing where every rupee goes.

Here’s a quick snapshot from our family diary — February 2017. That evening, Usha and I sat with chai and a calculator, finally ready to face where our money was quietly disappearing.

We were paying ₹48,730 in EMIs across three home loans and a car loan. Still, we never compromised on our savings — ₹14,000 in SIPs and ₹3,500 for our children’s future, every month.

That day taught us a life-changing lesson: money saving tips for teachers aren’t just about cutting back — they’re about knowing exactly where every rupee goes and giving it a purpose.

The home loans at least offered some tax relief. But the car loan? It simply drained our pocket without adding future value — a comfort that came at a cost.

What We Tried to Save — And How Little Was Left

Even with heavy EMIs, Usha and I made a simple, non-negotiable promise — we would save every month.

Without fail, we consistently put aside:

₹3,500 for our children’s future

₹14,000 into SIPs

Total savings: ₹17,500 per month.

After EMIs and savings, we had just ₹31,588 left for daily life: groceries, school fees, utilities, chai, small treats, online orders, weekend dinners, and occasional gifts.

These small, daily expenses quietly drained our money. We finally realised — the money wasn’t disappearing, we just weren’t tracking it properly.

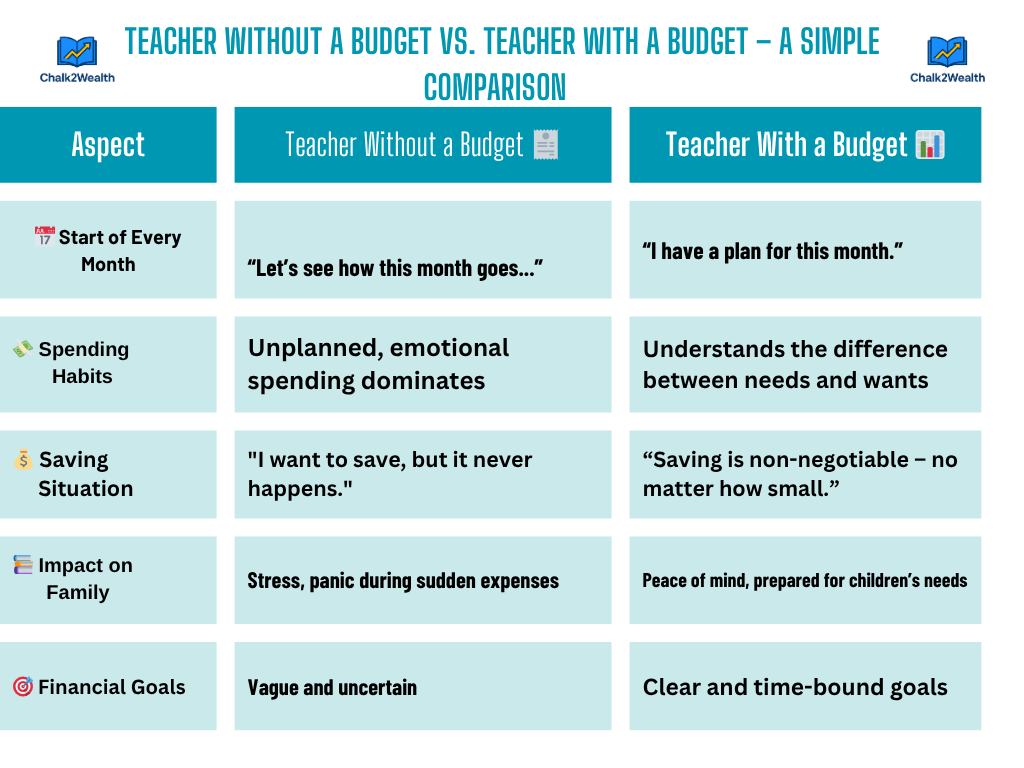

The Night That Changed How We Handled Money Forever

That February evening became a quiet turning point. We stopped blaming our salaries and asked better questions:

Where is our money actually going?

How can we save smartly, not just survive?

We divided our expenses into two simple buckets:

Fixed Expenses (Non-Negotiables)

EMIs, school fees, utilities, groceries (automated for discipline)

Flexible Expenses (Our Control Zone)

Dining out, clothes, festivals, chai breaks, weekend treats

We didn’t cut these out — we simply became aware. Tracking, not restricting, changed everything.

“Money doesn’t disappear. It quietly goes where you’re not looking.”

The Simple Money Saving Truth We Wish We Knew Earlier

Budgeting isn’t about saying no. It’s about knowing where every rupee goes — even that ₹30 chai or last-minute online order.

When both partners track money together, financial fights reduce, and peace slowly builds. That night changed us. Not because our salaries increased, but because we finally knew where every rupee was going.

Quick Takeaway for Fellow Teachers

If your salary feels like it disappears by the 20th of every month, you’re not alone. I’ve been there.Start by tracking, not restricting. Quietly watch where your money goes — and soon, you’ll tell it where to go. That’s where real financial peace begins.

Start simple. Use a notebook or free budgeting apps like Goodbudget or Money Manager. Track the small spends: chai, snacks, impulse buys.

That’s the heart of money saving tips for teachers — everyday awareness and mindful choices.

The 50-30-20 Formula That Changed My Life

hat night also introduced us to the 50-30-20 formula:

- 50% Fixed Expenses: EMIs, fees, utilities, groceries

- 30% Flexible Expenses: Dining out, clothes, celebrations

- 20% Savings: SIPs, children’s fund, future dreams

It became our map for managing loans, living well, and saving consistently.

Set Little Dreams With Big Impact

I didn’t jump to big savings overnight. I still remember when I first promised myself I would start saving seriously. I began with ₹14,000 a month. It wasn’t easy, but it felt like a quiet promise I was making to my future self.

Little by little, as my confidence and control over expenses grew, so did my savings. From ₹14,000, I pushed myself to ₹18,000, then ₹22,000, and finally, I reached a milestone I never thought possible — saving ₹30,000 every month.

Not because I earned a fortune — but because I stayed consistent.

📝 “Saving isn’t a race. It’s a rhythm. Start where you can… just make sure you start.”

Budgeting Became a Map of Our Dreams

Back in 2017, budgeting felt like a burden — like I was constantly saying no to little joys. No to a snack, no to a gadget, no to a casual dinner.

But something changed inside me. I stopped calling it a budget and started seeing it as a collection of small dreams — dreams for my family, for our peace of mind, for a life filled with intention.

Life at home was beautifully busy:

👧 Ipshita and 👦 Dhruv were growing up with their own little dreams and curiosities. 👩🏫 Usha was gracefully balancing life as a head teacher and as the soul of our home.

And I was quietly realising that even with my income of ₹56,818 per month, there was enough to create comfort, not just survive — if every rupee had a reason.

Every month, I set aside ₹3,500 for our children — not as a burden, but as a gift. It went towards books, school fees, shoes, and their growing worlds. That amount may seem small, but in our home, it meant something bigger: love, consistency, and a quiet promise.

I stopped buying things I didn’t need. I started saving for something that truly mattered:

🌄 A family vacation. Time with Usha and the kids. Moments to laugh, breathe, and make memories.

Because in the end, true wealth isn’t about luxury. It’s about peace, purpose, and freedom with the people you love most.

“A budget isn’t about saying no. It’s about saying yes — to what really matters.”

Make Friends With Tools

You don’t need an MBA to manage money. I used:

- 📊 Google Sheets: Monthly budget tracker (color-coded, simple)

- 🕒 Phone Reminders: EMI and bill alerts

- 🔄 Auto-Debit: For SIPs and bills

Budgeting became easy when I treated it like a school timetable: clear, repeatable, and even fun.

Pause. Reflect. Adjust.

At the end of every month, I open my budget sheet and my diary and ask myself:

- What worked?

- Where did I overspend?

- What can I do better next month?

It’s just like checking a student’s notebook. Find the mistake, guide it, and move forward. No guilt. Just growth.

“Financial progress isn’t about perfection. It’s about reflection.”

A Final Note — Teacher to Teacher

If you’re reading this, I know you care. Not just about your students, but about your home, your future, and your financial peace.

You don’t need to be rich to be financially strong. You just need clarity, consistency, and a little courage to begin.

So this month, take that first step. Open your diary. Write down your income. Set aside a few small dreams. And begin your own Chalk2Wealth journey — one rupee, one goal, one wise decision at a time.

Let’s grow together — not just in classrooms, but in confidence. 💪

1. What’s the Best Rule to Save Money?

Follow the 50/30/20 Rule: Spend 50% on needs, 30% on wants, and save 20%.

2What’s the Rule of 72 to Double Money?

Divide 72 by your investment’s interest rate — that’s how many years it takes to double your money.

3. 5 Quick Ways to Save Money:

✔️Track Your Expenses

✔️ Start a Monthly Budget

✔️ Save Before You Spend

✔️ Cut Unnecessary Subscriptions

✔️ Invest in SIPs for Growth rewrite it shortly

4 How can teachers start saving with a small salary?

Start with small, consistent savings like SIPs, track expenses, and cut avoidable costs.

5. What is the safest investment option for teachers?

Options like GPF, PPF, and Fixed Deposits offer safety with moderate returns, but diversification is key.

✅ Track your income

✅ Know your expenses

✅ Save for what truly matters

No matter how bad a crises gets..any sound investment will eventually pay off

You’re right — history shows that sound investments often recover and grow, even after major crises. But the key lies in choosing wisely, diversifying, and staying emotionally strong during tough times. Not every investment survives a storm — but disciplined investors do. What’s helped you stay strong during volatile periods

Any sound investment will eventually pay off

True — sound investments, when chosen wisely and given time, often do pay off. But patience and consistency are the real superpowers here. It’s not just about where you invest, but also how long you stay invested and how you react during market ups and downs. What’s one investment that you’ve seen grow over time?

A smart investor always take risks

Absolutely — smart investors do take risks, but they take calculated ones. The key difference is in doing proper research, setting clear goals, and staying disciplined over time. Blind risk is gambling, but smart risk is what builds long-term wealth. I’d love to hear — what’s one smart risk you’ve taken recently in your financial journey?