Table of Contents

ToggleWhy Term Insurance Claims Get Rejected and How Teachers Can Avoid It

A few days back, my brother-in-law — a college professor — read my Chalk2Wealth post on insurance and said something that made me pause: “I think insurance is a scam. Even if you buy it, claims often get rejected when the family needs it most.” Aur sach kahun, yeh soch teachers aur middle-class families mein aam hai.

That concern is shared by millions of teachers and middle-class families. Term insurance claims do get rejected — sometimes because of mis-selling, sometimes due to small mistakes.

At Chalk2Wealth, I’ve already explained why pure term plans are the only real protection in Term Life Insurance for Teachers in India 2025: Honest Guide and how mis-selling traps educators in 7 Costly Term Insurance Mistakes Teachers Still Make in 2025 (Don’t Be #8!).

Yet, even after choosing the right product, there’s still one big fear left: what if the claim gets rejected?

According to the Insurance Regulatory and Development Authority of India (IRDAI), 98.45% of individual life insurance death claims were settled in 2022–23. While that sounds reassuring, it also means about 1.5% went unpaid — and for those families, the shock was devastating.

So why do claims get rejected? And more importantly, how can teachers and families avoid that nightmare? This guide breaks down the top reasons — and the simple steps to make sure your policy actually pays out.

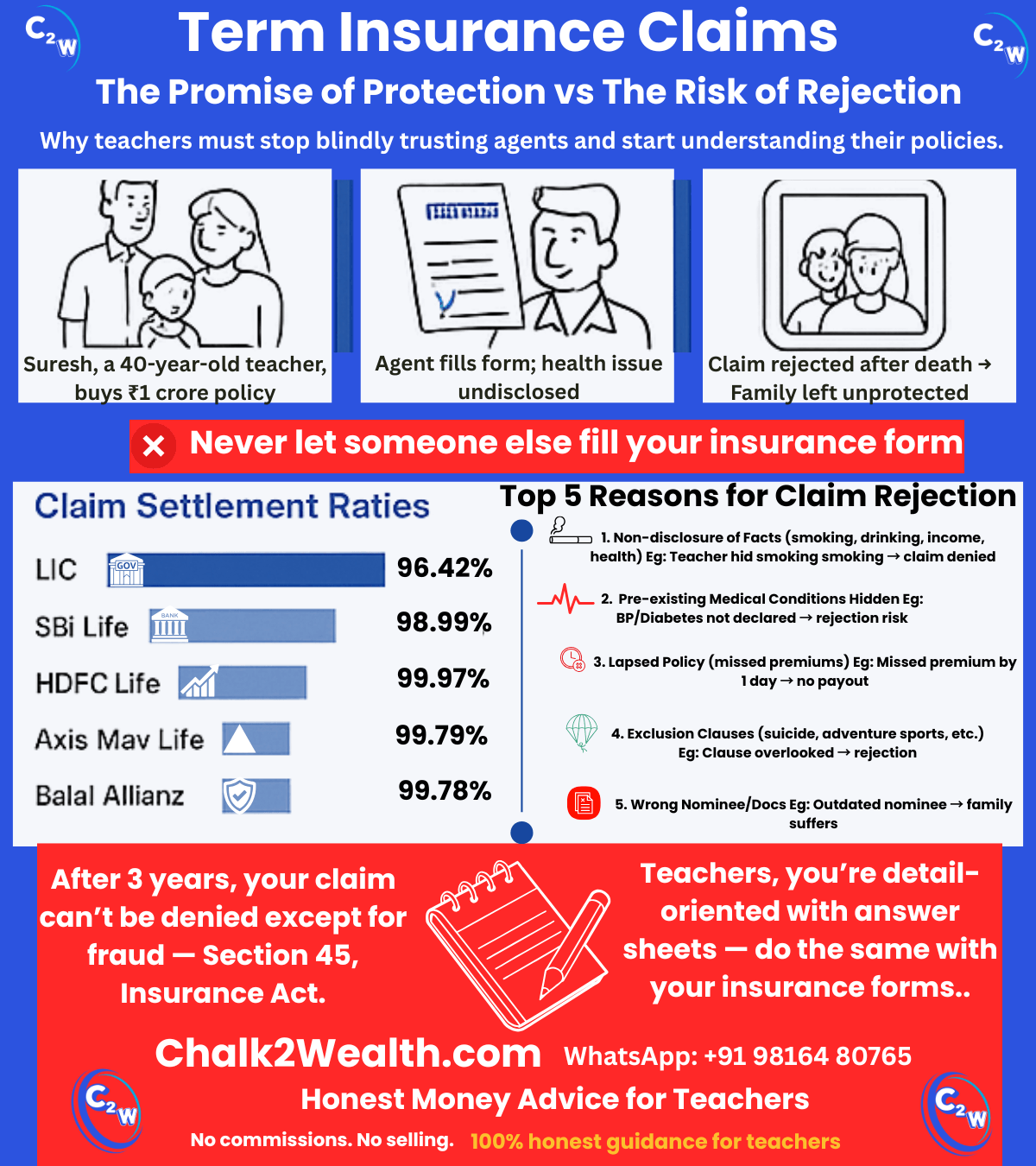

Term Insurance Claims: The Promise of Protection vs The Risk of Rejection

Term insurance is often chosen for its affordable high coverage — a ₹1 crore policy has become common among salaried professionals, including teachers. The promise is simple: if the insured person dies during the term, the insurer pays the sum assured to the nominee (usually a family member). On paper, it looks straightforward. But in practice, every policy carries conditions, and that’s where problems can arise.

Take the case of Suresh, a 40-year-old school teacher from New Delhi. He purchased a ₹1 crore term plan to safeguard his wife and children. Trusting his insurance agent, he let the agent fill out the proposal form. Tragically, a few years later, Suresh passed away due to a health condition. When his wife filed the claim, it was rejected because the form had incomplete health details — a pre-existing illness hadn’t been disclosed. Despite his good intentions, the family was left unprotected (reported by Moneycontrol).

In fact, during one of our staffroom conversations, a colleague once admitted that he too had “just signed where the agent told me to.” Teachers are meticulous with exam answer sheets, but when it comes to insurance forms, even we sometimes rush — and that’s where trouble begins.

Such stories are not rare. They highlight how vital it is to get things right when buying a policy and throughout its term. Insurers do pay genuine term insurance claims, but they also invoke the fine print if there are gaps in disclosure or paperwork. Experts note that the risk of claim rejection rises sharply when incorrect, incomplete, or hidden information is present in the original application.

Quick Data Check

Claim Settlement Ratios of Life Insurers in 2025 (15,000+ Policies & LIC) -According to IRDAI’s latest Handbook on Indian Insurance Statistics (released in 2025, covering FY 2023–24 data)

| Insurance Company | Total Policies (2023–24) | Policies Paid Within 30 Days | % of Claims Paid Within 30 Days |

|---|---|---|---|

| LIC | 8,29,318 | 7,99,612 | 96.42% |

| SBI Life | 37,724 | 37,344 | 98.99% |

| Axis Max Life | 19,569 | 19,529 | 99.79% |

| HDFC Life | 19,338 | 19,333 | 99.97% |

| Bajaj Allianz | 14,695 | 14,662 | 99.78% |

Source: Handbook on Indian Insurance Statistics 2023–24, IRDAI; Economic Times

(All data pertains to 2023–24)

For teachers and middle-class families, the data tells two stories. On one hand, LIC dominates in sheer volume — handling over 8.29 lakh policies in 2023–24 — but its claim settlement ratio is 96.42%, lower than the private sector average. On the other hand, private insurers like HDFC Life (99.97%), Axis Max Life (99.79%), and Bajaj Allianz (99.78%) settle fewer policies overall, but boast near-perfect ratios. SBI Life also stands strong at 98.99% with significant volumes.

The takeaway for teachers? Don’t just go with the “most popular” option in your colony or staffroom. Look at both — reach and reliability — before choosing your plan.

Top Reasons Term Insurance Claims Get Rejected in India

Understanding why claims are denied can help you steer clear of those mistakes. Based on insurer reports and IRDAI insights, here are the five most common reasons for term insurance claim rejections:

1. Non-disclosure or False Information

When buying a term plan, the proposal form asks about age, income, occupation, lifestyle habits (smoking, drinking), health conditions, and existing policies. If any of this information is misrepresented — whether intentionally or by mistake — the claim can be denied later.

Example: Hiding smoking or alcohol use to get a lower premium is risky. If medical records show otherwise, insurers may reject the claim for misrepresentation. In Suresh’s case above, an undisclosed health issue became the reason for rejection.

2. Concealing Pre-existing Medical Conditions

Health history is a critical part of underwriting. Many applicants omit illnesses like diabetes, hypertension, or past surgeries fearing higher premiums. But this often backfires. If death occurs due to a long-standing condition that wasn’t declared, the insurer can repudiate the claim as “material non-disclosure.”

Bottom line: Always disclose medical history truthfully. Non-disclosure of health conditions remains one of the leading causes of claim rejection.

3. Policy Lapse Due to Non-Payment of Premiums

This is a surprisingly common reason. If premiums are not paid within the due date or grace period, the policy lapses. Any claim after that will not be honored — even if premiums were paid diligently in earlier years.

Example: A teacher misses his annual premium due in June, and the policy lapses in July. If he passes away in August, the claim will be denied. Even a one-day lapse can nullify the benefit.

4. Claims Falling Under Exclusion Clauses

All term policies have exclusions. The most common is suicide within the first policy year. Others may include death due to hazardous activities (racing, paragliding, scuba diving), illegal acts, or substance abuse.

While many modern term policies have reduced exclusions, families often face painful surprises when they assume “all deaths are covered.” Reading the exclusion list carefully is essential.

5. Nominee & Documentation Issues

Sometimes rejection happens not due to fraud, but due to paperwork gaps. If nominee details are outdated (for example, a parent was named but has since passed away) or if legal heirs are disputed, the claim may be delayed or denied until clarity is established.

Another factor is incomplete or late submission of documents like the death certificate, medical records, or ID proofs. Excessive delays in claim intimation can also trigger heavier scrutiny or rejection.

Key Insight

IRDAI data shows most insurers settle 98–99% of term insurance claims, but the small percentage of rejections usually comes down to these five reasons. By avoiding these pitfalls, you can ensure your family’s claim is honored without hurdles.

Sources: IRDAI Annual Report 2022–23; Moneycontrol; Economic Times

How to Avoid Term Insurance Claim Rejection

Follow this checklist to keep your term insurance claims rejection-proof.

- Fill the form yourself

Don’t let agents do it. Double-check all personal, health, lifestyle, and nominee details. Accuracy here prevents future disputes. - Disclose everything honestly

Mention all medical history, habits (smoking, drinking), and existing policies. Non-disclosure is the #1 reason claims get rejected. - Pay premiums on time

A lapsed policy = no coverage. Use auto-debit to avoid missing deadlines. Even a one-day lapse can void a claim. - Read the fine print

Know your policy’s exclusions (suicide clause, risky hobbies, etc.). Awareness now avoids painful surprises later. - Keep nominee details updated

Update nominee info if your life situation changes. Share policy details with your family so they know how to file a claim. - File claims promptly and correctly

Inform the insurer quickly, submit required documents (death certificate, ID, hospital records), and respond to queries without delay

FAQs on Term Insurance Claims and Rejections in India (2025)

1. What should I do if my term insurance claim is rejected?

Ask the insurer for the rejection reason in writing. Submit missing documents if any. If unresolved, escalate to the grievance cell or file a complaint through IRDAI’s IGMS portal.

2. What is the 3-year rule in term insurance claims?

Under Section 45 of the Insurance Act, once a policy completes 3 years, insurers cannot reject claims for non-disclosure or misrepresentation—except in proven fraud cases.

3. How can I appeal a rejected term insurance claim?

If you disagree with the insurer’s decision, you can approach:

- The insurer’s grievance redressal team

- IRDAI or the Insurance Ombudsman

- Consumer courts, if needed

Many claims are approved at the appeal stage with proper evidence.

4. Can nominee details be updated after buying the policy?

Yes. Nominee details can be changed anytime by submitting a form to the insurer. Keeping them updated avoids disputes during settlement.

5. Can government teachers rely only on GPF instead of term insurance?

No. GPF is savings, not protection. If a teacher passes away, GPF may not cover family expenses for long. A term plan provides large cover (₹50 lakh–₹1 crore) at low cost, ensuring true security.

Term insurance gives peace of mind — your family’s future is secure even if you’re not around. But that promise holds only if you do your part: be honest on the form, pay premiums on time, know the exclusions, and keep nominee details updated.

Remember, under Section 45 of the Insurance Act, once a policy crosses 3 years, insurers cannot reject claims except for fraud. So if you’ve been truthful, your family’s claim is almost certain to be paid.

Bottom line: treat your policy like a key financial document. Maintain it well, keep your family informed, and you’ll ensure that when it matters most, your term insurance truly delivers.

Teachers, make your term insurance claims 100% claim-ready today. review your policy form, update nominee details, and mark your premium dates. A 10-minute check now can save your family months of financial stress later.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

Also Read on Chalk2Wealth

7 Costly Term Insurance Mistakes Teachers Still Make in 2025

Term Life Insurance for Teachers in India 2025: Honest Guide

Which of these five reasons for claim rejection surprised you the most? Do you think teachers are aware of these risks? let me know in comments or whatsapp 9816480765

Nice article.

Thank you, Surjeet ji! 🙏 I’m glad you found the article useful. Most people focus only on buying insurance but forget that small mistakes in disclosure or paperwork can cost families later. That’s why awareness is the first protection. Keep following Chalk2Wealth—we’ll keep bringing more teacher-friendly money insights.