Table of Contents

Toggle7 Costly Term Insurance Mistakes Teachers Still Make in 2025 (Don’t Be #8!)

A ₹1 crore mistake can happen in silence when a teacher signs the wrong policy.

During a break at GHS Rang at Chowari last year, a fellow teacher leaned in and asked:

“My LIC agent says this endowment plan is savings + insurance. Should I take it?”

As a school leader and personal finance writer, I replied gently: You can’t protect your family with half-baked policies.

This isn’t the first time I’ve heard such confusion. At Chalk2Wealth, I’ve already shared how mis-selling traps ordinary teachers:

- In Insurance Frauds in India: How Banks Make Profits, I explained how banks and agents often push unsuitable products that generate commissions for them, not protection for you.

- And in my guide Term Life Insurance for Teachers in India 2025: Honest Guide, I broke down how a simple ₹1,000/month term plan can secure ₹1 crore cover—something no endowment or money-back plan can match.

Even the regulator IRDAI has raised red flags. In late 2024, Chairman Debasish Panda cautioned banks that “a lot of ills have crept into the system,” warning that bancassurance should remain incidental, not aggressive selling .

That’s why today, let’s demystify the 7 common mistakes teachers make with term insurance in 2025—and how to fix them.

For a full step-by-step buying guide, read our pillar post: Term Life Insurance for Teachers in India 2025: Honest Guide

Teachers, don’t let these mistakes cost your family’s future. Secure your cover today with pure term insurance.

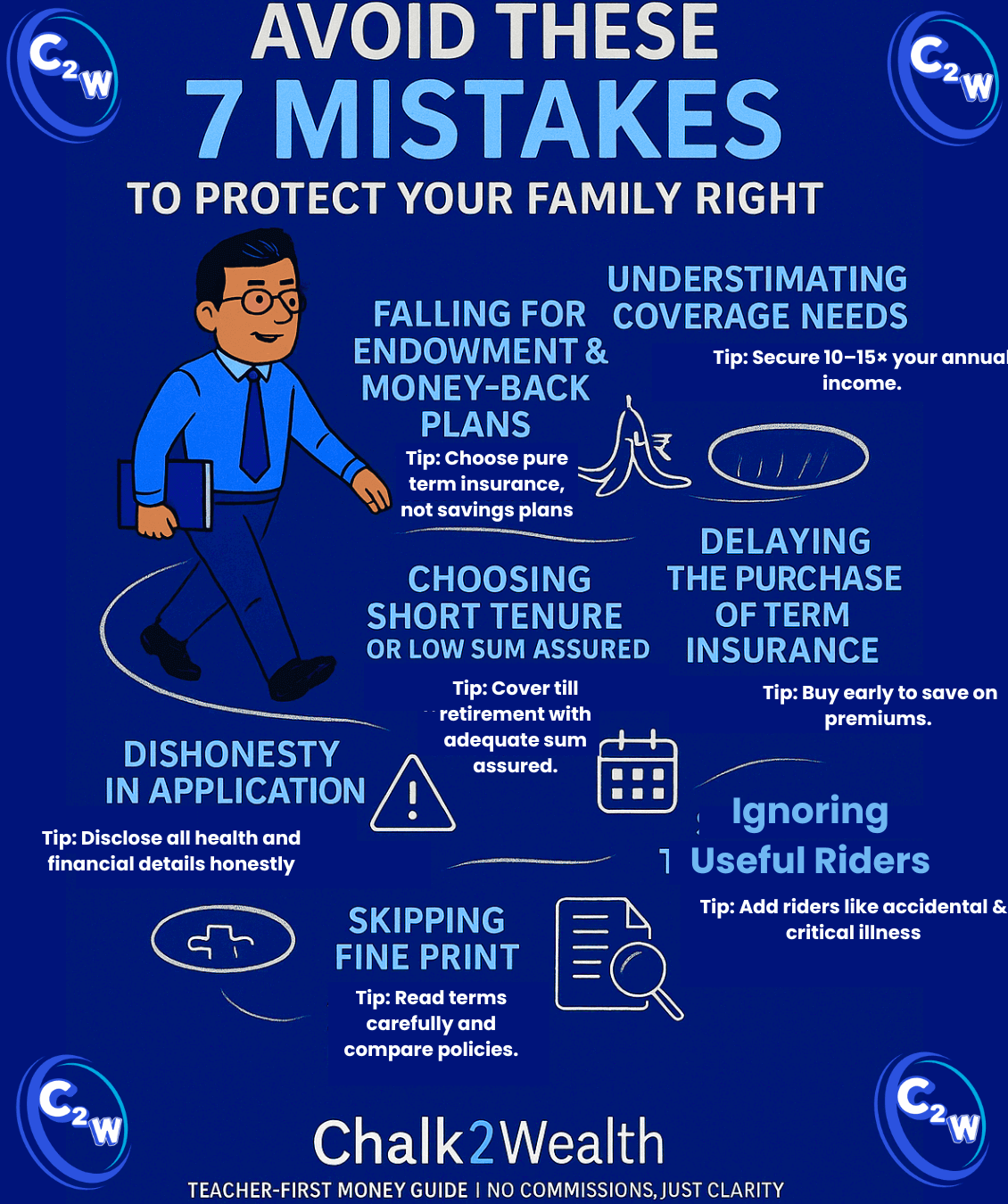

No. 1 Term Insurance Mistake: Underestimating Coverage Needs

Buying a ₹25 lakh cover when your family needs ₹1 crore is like bringing an umbrella in a monsoon—useless.

- Moneycontrol advises coverage of at least 10× your annual income, adjusted for liabilities like home loans and children’s education.

- Another article suggests taking 10–15× income as a starting point for term insurance.

Teacher tip: Use an IRDAI-endorsed Human Life Value calculator (available on government portals) or combine reasonable multipliers with your liabilities to get a real figure.

No. 2 Term Insurance Mistake: Falling for Endowment & Money-Back Plans

Endowments may sound like “insurance + investment,” but they provide low coverage at high costs.

- Term plans give 20–30× coverage for the same premium compared to endowment’s 4–5× multiple.

Teacher tip: Keep protection and investments separate. Use term insurance for cover; invest in SIPs, PPF, or Sukanya Samriddhi separately.

In our Term Life Insurance for Teachers in India 2025: Honest Guide , we break down why endowments fail teachers and how term plans solve this.

**Chalk2Wealth Note:**

IRDAI data shows mis-selling complaints were **0.41 per 100 policies in FY 2023-24**. While the number may look small, it still hurts thousands of families. This is why separating *insurance (pure term cover)* from *investment (SIPs, PPF, etc.)* is so important for teachers.

No. 3 Term Insurance Mistake: Choosing Short Tenure or Low Sum Assured

Many teachers pick a 15-year policy at 25 to save money—but this lapses just as responsibilities rise.

- Short tenure means higher future premiums and potential uninsurability.

- Moneycontrol also suggests cover lasting till your dependents are independent—often 30–40 years terms.

Teacher tip: Buy long-term while young and healthy. A ₹1 crore term policy for a healthy 30-year-old non-smoker costs around ₹700–₹900/month

No. 4 Term Insurance Mistake: Delaying the Purchase of Term Insurance

Every year you delay, premiums rise by up to 5%. On top of that, any future health issues can either increase your premium sharply or even lead to rejection of cover.

Early buyers always benefit: they lock in lower rates, enjoy wider eligibility, and secure continuous protection for their families. Remember, youth is your biggest asset when it comes to term insurance.

Teacher tip: Make term insurance a priority—even during your service probation. Don’t wait for life events to trigger purchase.

No. 5 Term Insurance Mistake: Dishonesty in Application

Some buyers try to hide smoking habits or family history to lower premiums—but most claim rejections actually stem from such misrepresentations.

Claim settlement ratios in recent years have been high, but misleading information can still put your family’s payout at risk.

Teacher tip: Always be truthful. Paying a slightly higher premium is worth the peace of mind—and ensures your family gets the protection you promised.

No. 6 Term Insurance Mistake: Ignoring Useful Riders

Riders cost a little but add a lot:

- Critical Illness Rider: Lump sum on cancer/heart ailment diagnoses.

- Accidental Death Rider: Adds extra cover for accidental demise.

- Waiver of Premium: Keeps policy active if you become disabled.

Moneycontrol confirms that such riders serve real, tangible needs with minimal premium impact.

Teacher tip: Add one or two riders that fit your personal risk profile—avoid adding every rider under the sun.

No. 7 Term Insurance Mistake: Skipping the Fine Print & Reviews

Policies often contain exclusions and waiting periods—read those. And as your life changes—marriage, child, loan—your cover should too. Experts advises reviewing coverage every 3–5 years or after major life events, and using the free-look period proactively.

Teacher tip: Use the 15-day free-look window to clarify terms. Set calendar reminders to revisit your policy regularly and update as needed.

Final Thoughts: Secure, Don’t Just Insure

IRDAI continues to caution against mis-selling via rural agents or school tie-ups. Claim settlement ratios for FY 2023-24 averaged 96.82%, yet honesty is non-negotiable for successful payouts .

To recap for teachers:

- Coverage = 10–15× annual income (adjust for liabilities).

- Choose pure term insurance—avoid endowment/money-back traps.

- Buy early, with long tenure, and honestly disclose health.

- Consider essential riders, read fine print, and review regularly.

As Chalk2Wealth reminds us, “For less than ₹1,000/month, a teacher can secure ₹50 lakh to ₹1 crore cover depending upon age factor.” That’s not spending—it’s safeguarding dedication, family, and legacy.

If you’re still deciding between different plans, go to our main guide here: Term Life Insurance for Teachers in India 2025: Honest Guide

Term Insurance Mistakes – FAQs

1. Why do Indian consumers ignore term insurance?

Many Indians ignore term insurance because it looks like a “pure expense.” Unlike endowment or money-back policies, term insurance doesn’t promise returns. Agents also push savings-linked plans because they earn higher commissions. As a result, consumers wrongly believe endowment = safer, while ignoring the fact that term insurance gives 10–15x coverage at the lowest cost, which is the real protection their family needs.

2. What is the 3-year rule in term insurance?

Under Section 45 of the Insurance Act (India), the 3-year rule states that once a life insurance policy (including term insurance) has been in force for 3 continuous years, the insurer cannot reject a claim for mis-statement, except in proven cases of fraud. This provision protects policyholders and ensures their families get the promised payout.

3. Why are term insurance claims rejected?

The biggest mistake people make is not disclosing facts honestly — hiding smoking habits, existing illnesses, or multiple policies. Other reasons include lapsed policies (missing premium payments) or giving wrong nominee details. Remember: honesty at the time of purchase = hassle-free claims later.

4. How many years is good for term insurance?

A common mistake is choosing too short a term. Experts suggest coverage till at least age 60–65 (your retirement age). For most teachers, a term of 30–40 years works best so that the family is protected through the earning years. Too short a term = risk of being uninsured when responsibilities are highest.

Teachers, for less than a cup of tea a day, you can secure your family’s tomorrow. Don’t delay.