Table of Contents

ToggleTerm Insurance vs Endowment Plan: Why Term Is No. 1 in Financial Planning for Teachers

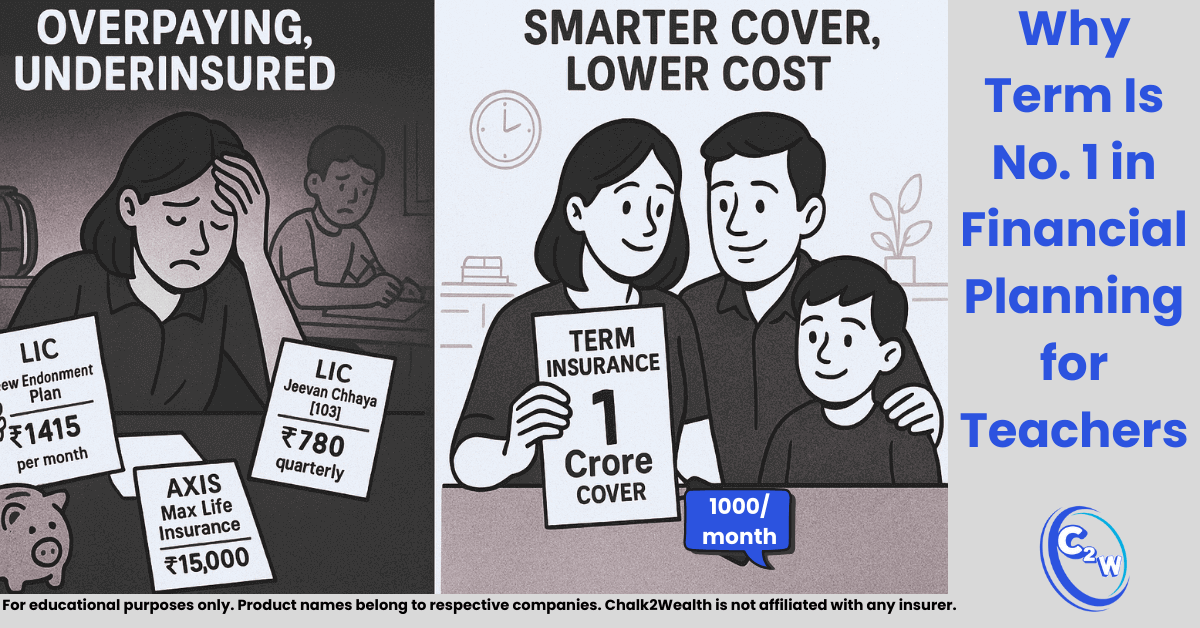

Last Sunday, over tea at my uncle’s house, our conversation drifted—as it often does—towards money matters. He pulled out a thick folder and proudly told me:

“Beta, I’m fully insured. See, I have three policies.”

Out came the documents:

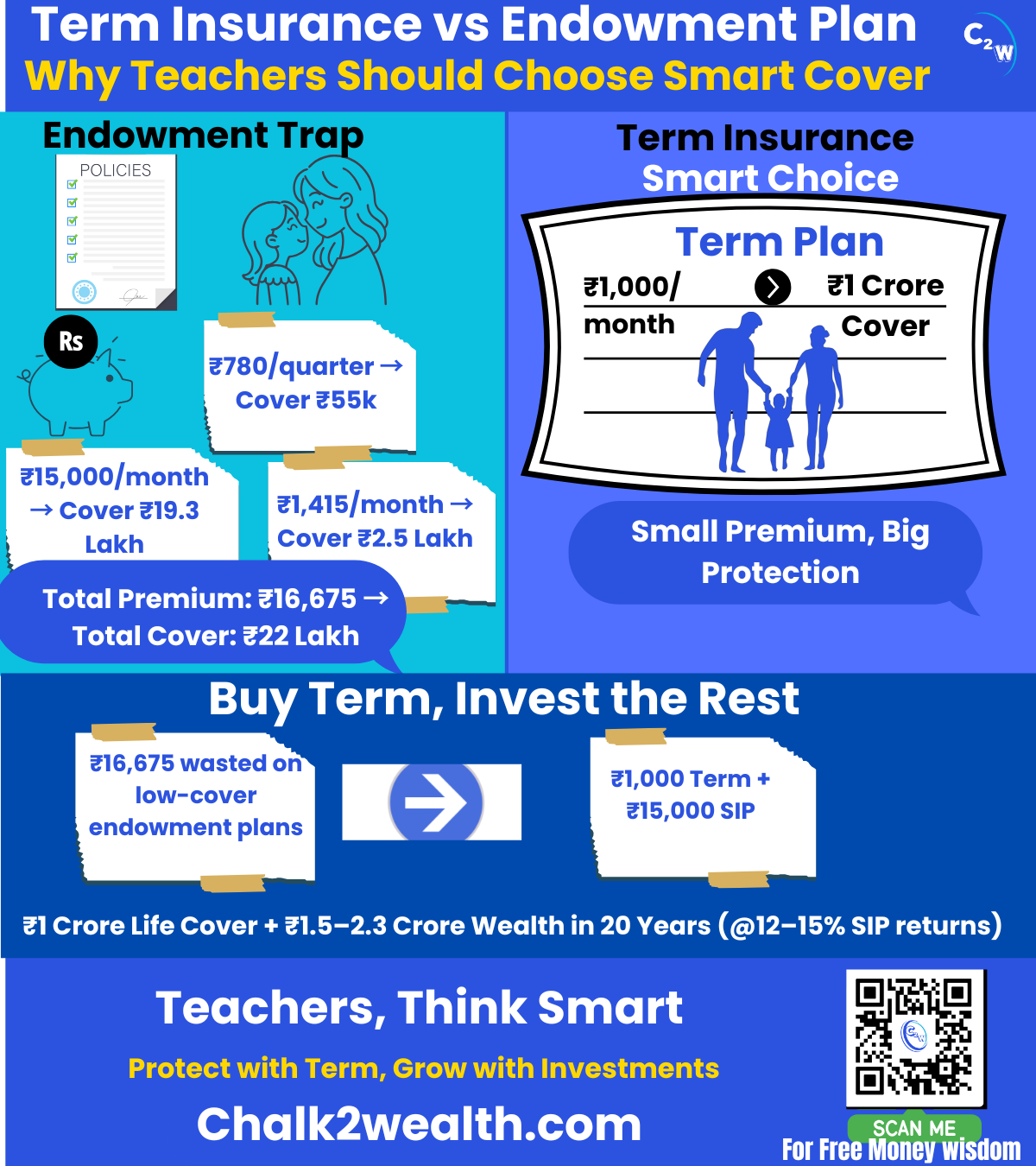

- LIC New Endowment Plan (814): ₹1,415 per month, life cover just ₹2.5 lakh

- LIC Jeevan Chhaya (103): ₹780 quarterly, life cover ₹55,000

- Axis Max Life Insurance: ₹15,000 per month, life cover ₹19.3 lakh

At first glance, it sounded like he was well protected. But when I added it all up, I was shocked. For nearly ₹17,000 every month—an amount that could easily fund a child’s college SIP or pay down a home loan—his total life cover was barely ₹22.3 lakh. That’s less than four years of his annual expenses.

This is the classic trap of endowment policies. Insurance agents present them as “safe investments with guaranteed returns” that give money back if nothing happens. Because of this sales pitch, many teachers and families—like my uncle—end up overpaying for inadequate cover and underwhelming returns. I’ve already shared in my post on 7 Costly Term Insurance Mistakes Teachers Must Avoid in 2025 how thousands of educators are caught in such traps every year.

This scenario isn’t unique. Many educators buy endowment plans thinking they’re protecting their families, when in reality, they’re locking themselves into high premiums for minimal cover and modest returns. A Term Insurance vs Endowment Plan comparison makes it clear: while endowment is often marketed as a “safe bet,” it rarely provides the real protection a family needs. Teachers are far better off pairing a term plan with proper Health Insurance Benefits for Teachers, ensuring both protection and peace of mind.

On the other hand, term insurance is often dismissed as “wasted money” since it doesn’t return anything at maturity. But that’s exactly why it works: you pay a small premium for a very large life cover, ensuring your family’s financial security. For a deeper dive into how term plans actually benefit teachers, check out my honest guide:Term Life Insurance for Teachers in India 2025: Honest Guide

What Is Term Insurance?

A term plan is pure life cover—you pay a small premium, and if you die during the term, your nominee receives the sum assured. There is no payout if you survive. Because there is no investment element, premiums stay very low, which allows you to buy substantial cover.

Think of it like this: with just a few thousand rupees a year, a teacher can secure as much as ₹1 crore of life cover. That’s enough to protect your family’s income, children’s education, or home loan in case something happens to you.

The reason term plans are affordable is simple: there’s no investment component and no complicated “bonus” promises. Every rupee goes purely towards protection, making it the cheapest and most effective way to safeguard your family.

Want to explore this further from a teacher’s perspective? Read my full guide here: Term Life Insurance for Teachers in India 2025: Honest Guide

What Is an Endowment Plan?

Let’s be straight: an endowment plan is insurance plus forced savings. You pay a high premium, and in return you get two things – a small life cover and a lump sum at maturity if you survive.

The problem? Both the cover and the returns are modest. Analyses from Moneycontrol show that traditional life insurance policies typically deliver only 4–6% annualized returns, and because part of your premium funds the savings component, the cost per rupee of cover is very high. That means you end up paying a lot, but your family remains underinsured.

Take my uncle’s case. He pays nearly ₹17,000 per month across three endowment policies, yet his total life cover is only ₹22 lakh—barely four years of income for a middle-class teacher. On top of that, his expected returns are around 4–6% per year, which hardly beats inflation.

In short: high cost, low cover, low returns. Endowment may suit extremely conservative savers, but for most teachers, it offers the worst of both worlds.

Term insurance Vs Endowment plan-Key Differences

Now that we’ve defined both, let’s compare term insurance and endowment plans on key parameters. This will make the differences crystal clear:

| Aspect | Term Insurance | Endowment Plan |

|---|---|---|

| Purpose | Pure risk protection (life cover only). The goal is income replacement for your family if you die during the term. | Dual purpose: insurance + savings. Provides life cover and also builds a lump sum for maturity. |

| Premium Cost | Very low for the amount of cover. Term plans are the most affordable way to get a high sum assured. Example: ₹1 crore cover can cost ~₹10,000/year (depending on age, health) – extremely cheap per lakh of cover. | High premiums. Because part of the premium goes into investment, you pay much more for the same cover. Example: ₹1 crore cover via endowment could require ₹5–6 lakh/year in premiums – often unaffordable for most. (People end up taking smaller covers due to cost.) |

| Payout Conditions | Death benefit only. If the policyholder passes away during the term, the nominee gets the sum assured. If the policyholder survives the term, nothing is paid (policy terminates). | Death or Maturity benefit. If the insured dies during the term, sum assured (plus any accrued bonuses) is paid to nominee. If the insured survives till the end of policy term, a maturity amount is paid to the policyholder (usually sum assured + bonuses). |

| Returns on Premium | Not applicable. There is no savings component, so you don’t “get back” anything on survival. However, the “return” is in the form of peace of mind and financial security. The real “gain” is that for a small cost you protected your family for a large amount. | Modest returns. Endowment plans invest your premiums in fixed income and sometimes equities (for bonuses). Expected returns are low – typically on the order of 4–6% annualized over the long term. These returns are generally tax-free (10(10D) applies) but still modest. Don’t expect endowment maturity to make you rich; it’s often comparable to a bank FD or Provident Fund in returns, not more. |

| Life Cover (Sum Assured) | High cover possible. Because of low cost, you can get large sum assured (₹50 lakh, ₹1 crore or more) that truly protects your family’s needs. Teachers can insure for big amounts to cover loans, future expenses, etc., without breaking the bank. | Lower cover for most buyers. High premiums mean people usually opt for smaller covers that fit their budget. Many endowment policies have sum assured like ₹2 lakh, ₹5 lakh, ₹10 lakh – which often isn’t sufficient protection if the breadwinner dies. Getting ₹1 crore cover via endowment is theoretically possible but prohibitively expensive for most (hundreds of times the term premium). |

| Liquidity & Flexibility | Flexible: If you stop paying premiums, the policy simply lapses (after grace period) – you lose coverage, but you’re not financially penalized (you also didn’t invest much anyway). You can choose policy term and increase cover by buying new policies when needed. Also easy to compare across insurers since term plans are similar across companies (IRDAI even introduced a standard term product, Saral Jeevan Bima, to simplify choices). | Inflexible: Long lock-in (at least 2-3 years) and recommended to hold till 15-20 years to see decent benefits. Surrendering early yields poor value (often getting back much less than you paid in initial years). You typically cannot access the money in the policy except via loans against policy or surrender after a few years. Endowments are also complex – different plans have different bonus rates, terms – making it hard to compare or switch insurers. |

| Goal and Use-Case | Ideal for income replacement and financial protection. Suitable for those who need large coverage for a specific period (e.g., till children grow up or a loan is repaid). Every earning teacher with dependents should have a term policy to safeguard their family’s future. | Marketed as “safe investment with insurance” for long-term goals. May suit individuals who are extremely risk-averse and undisciplined at investing elsewhere. However, even for conservative savers, other options (like PPF, NSC, etc.) alongside a term plan often yield better outcomes. |

| Mis-selling Aspect | Low commissions (term plans give minimal commission to agents compared to endowments), so they are less aggressively sold by agents. You’re less likely to be misled on term insurance features – it’s straightforward (no cash value, no “promises” of big returns). | High commissions and sales incentives. Unfortunately, endowment plans are often mis-sold – agents might gloss over the low returns or limited cover and pitch it as a must-have. Teachers should be cautious of sales pitches that sound too good. (Agents may push endowments because first-year commissions can be 20-35% of premium, a big moti |

In essence, term insurance vs endowment plan is like comparing apples to oranges because they serve different purposes – one is pure insurance, the other is a hybrid. But when it comes to financial planning for a family on a tight budget (like that of an average teacher), the term + separate investment route almost always outshines the endowment route in both protection and returns.

To truly grasp the difference, let’s look at a concrete example with real numbers.

Term Insurance vs Endowment Plan – My Uncle’s Costly Trap vs My Smarter Choice

My Uncle’s Path: Costly Cover, Low Returns

Revisit the story from earlier: my uncle pays around ₹17,000 each month across three endowment policies. After adding up the benefits, the total life cover is about ₹22 lakh, and the expected maturity value after 20 years might be ₹15–20 lakh. When we consider his family’s annual expenses, this cover is insufficient.

Moneycontrol’s analysis shows why: traditional plans deliver low returns (4–6 %) and leave policyholders underinsured. Even if a popular LIC endowment plan with ₹1 crore cover is purchased, the annual premium is approximately ₹5.7 lakh, and after 20 years the maturity amount would be around ₹1.98 crore. That sounds big until you compare alternatives.

My Strategy: Term Insurance + Investments

Like many educators, I have a home loan and children’s education to fund. I chose to separate insurance from investment. My ₹75 lakh term plan costs less per year than my uncle pays each month. The rest of my disposable income goes into SIPs (systematic investment plans), Public Provident Fund (PPF) and other instruments. Over time, these investments can compound at 10–12 % annually—far higher than the 4–6 % typical of endowment policies.

Even if someone buys a popular LIC endowment plan with ₹1 crore cover, the premium is nearly ₹5.7 lakh per year. After 20 years, the maturity may be ~₹2 crore—sounds big, but compare it with investing the same amount in mutual funds where the potential corpus could cross ₹3.5 crore. That’s why traditional plans underperform.

For teachers in their 50s, the numbers still favour term plus investment. Suppose you’re 55 and need ₹1 crore cover for 16 years. A term policy might cost about ₹4,000 per month. Redirecting the remaining ₹13,000 (in my uncle’s case) into a balanced mutual fund SIP growing at 12 % could yield roughly ₹75 lakh by the end of the term. Meanwhile, your family still enjoys ₹1 crore of protection.

Why Agents Push Endowment Plans

A big reason endowment plans stay popular is commissions. According to industry data, life insurance agents receive around 20 % of the first‑year premium as commission, and LIC’s ratio is closer to 30 %. For long‑tenure endowment and money‑back policies, the first‑year commission can reach 35 % of the annual premium. Term plans, by contrast, yield very small commissions, so agents have less incentive to sell them. As a result, many teachers are nudged toward expensive policies

Advice for Teachers: Term Insurance vs Endowment Plans

Based on evidence and my own experience, here’s a teacher‑centric roadmap:

- Calculate Adequate Cover. IRDAI recommends that life cover should be adequate to replace income and secure dependents — many advisors suggest 10× annual salary as a thumb rule.

- Choose Simple Term Plans. Select a policy from a reliable insurer with good claim settlement ratios. Standardized products like “Saral Jeevan Bima” make comparison easier.

- Invest Separately for Goals. Use mutual funds (equity or balanced), PPF, NPS or other vehicles to build wealth. Over long periods, these instruments have historically delivered higher real returns than endowment plans.

- Beware of Bundled Products. If a policy promises “guaranteed returns” plus life cover, scrutinize the effective yield. Moneycontrol warns that returns after recent tax changes fall below 4–6 %. Compare this with what you could earn elsewhere.

- Understand Commissions. High‑commission products may benefit agents more than policyholders. Always ask how much of your premium goes toward insurance versus investments.

FAQs: Term Insurance vs Endowment

1) Which is better — term plan or endowment plan?

For most families, especially teachers, a term plan is better. Term insurance gives large life cover at a very low cost, ensuring your family is financially protected. Endowment plans mix insurance with savings, so premiums are high, cover is small, and returns are modest. If your goal is true protection plus wealth building, “buy term, invest the rest” usually works best.

2) Why not buy endowment plans?

Endowment plans often look attractive because they return money at maturity, but the trade-off is high cost, low cover, and low returns (about 4–6% a year). This leaves families underinsured and barely beating inflation. They also pay high commissions to agents, which makes them heavily marketed. Unless you are extremely risk-averse and want forced savings, endowments don’t meet most teachers’ real needs.

3) Who should not buy term insurance?

Those without financial dependents usually don’t need term insurance. For example, a young professional teacher with no spouse, children, or loans may not require it yet. In such cases, savings and investments can take priority. But once you have dependents, a home loan, or children’s education responsibilities, term insurance becomes essential for family security.

4) How much cover should a teacher take?

At least 10× annual salary. Example: A teacher earning ₹6 lakh/year should aim for ₹60 lakh–₹1 crore cover.

5) Why are teachers often sold endowment plans?

Because agents earn 20–35% commission. Term plans pay low commission, so teachers get pushed into costly policies.

Final Thoughts

Financial security for our families is a non‑negotiable priority, especially for educators with dependants. Term insurance stands out because it does one job very well: it provides large life cover at a low cost. Endowment plans try to serve two masters—insurance and investment—and end up delivering neither effectively. They offer small covers, modest returns and high commissions.

As teachers, we encourage students to think critically. Apply the same rigor to your finances: separate protection from investment. Buy a term plan to secure your family’s future, and let disciplined investments grow your wealth. This simple strategy—buy term, invest the rest—is the most effective lesson in financial planning you can pass on.

Teachers, just as you teach your students to separate facts from myths, separate protection from investment in your own life. Buy term, invest the rest.

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.