Table of Contents

ToggleTerm Life Insurance for Teachers in India 2026: Honest Guide

A few weeks ago, my sister’s brother-in-law — a sincere teacher who lives on a single income — told me something that bothered me deeply. A “friendly” agent had been chasing him for weeks, insisting he must buy a safe policy “before the offer expires.” Guaranteed returns, tax benefits, lifelong security… the pitch was polished, emotional and perfectly designed to trap a teacher who simply wanted to protect his family.

But when we opened the documents, the truth punched harder than any sales speech: It wasn’t security — it was an endowment plan dressed as protection. High premiums, low cover, almost no real safety. If life took a wrong turn, his family would receive barely enough to survive a few months.

This is exactly the kind of mis-selling I exposed in Insurance Frauds in India: How Banks Make Profits. Agents and banks get richer; teachers and families get poorer — one signature at a time.

And then there’s Mrs Sharma from Himachal Pradesh. A hardworking teacher who believed she was building a future by paying ₹1 lakh annually for an endowment policy. Three years later, she learned the truth:

Cover: ₹10 lakh.

Surrender value: painfully low.

Financial safety: almost zero.

These stories are not rare. They are happening in staffrooms, WhatsApp groups and parent–teacher meetings across India. Teachers are being pushed expensive plans instead of real protection… and their savings are bleeding because of it. If you genuinely want safe and sensible options, explore our guide on Safe Investments in India with High Returns — it shows what true financial security looks like.

Because here’s the truth nobody tells teachers:

One good decision protects your family. One wrong policy puts them at risk.

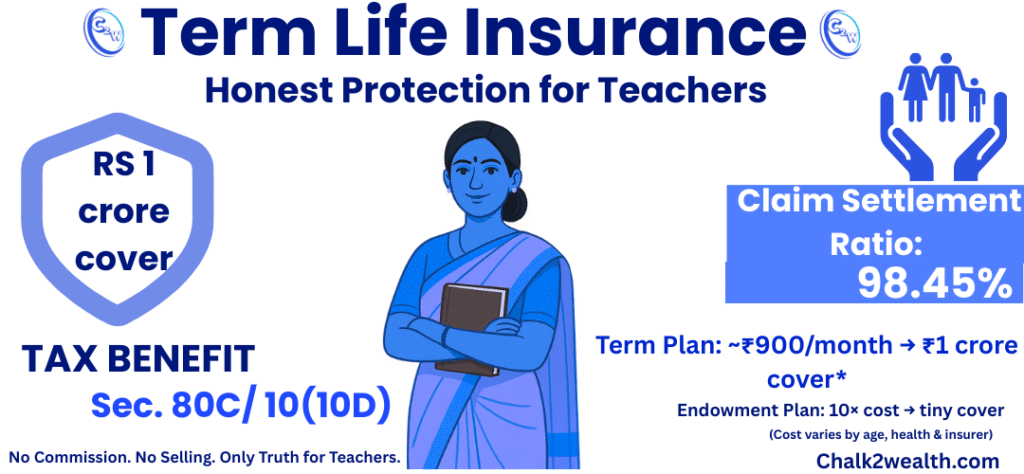

This is where term life insurance becomes non-negotiable. For less than ₹1,000 a month, a teacher can secure ₹50 lakh to ₹1 crore of real, no-nonsense protection. No fake promises. No maturity illusions. No hidden commissions. Just pure financial safety — exactly when your family would need it the most.

And in 2026, with rising costs and uncertain futures, teachers cannot afford to gamble with the only insurance that actually works.

This is why Chalk2Wealth exists —

not to sell, not to mislead, not to earn commissions — but to protect teachers with the truth.

What Is a Term Life Insurance Policy?

A term life insurance policy is the simplest, cleanest and most honest form of insurance. You pay a fixed premium for a specific number of years (such as 20, 30 or even 40 years). If the policyholder passes away during that period, the insurer pays a lump-sum amount to the nominee. If the policyholder outlives the term, there is no payout — and that’s exactly why it’s so affordable.

The reason term insurance is highly recommended by financial planners is simple:

- It has no investment or savings component

- It gives very high coverage for a very low premium

- It focuses only on protection, nothing else

Because most people complete the term without claiming the benefit, insurers face lower risk —and premiums remain incredibly low compared to endowment or money-back policies.

This also means:

- No maturity amount

- No bonus

- No guaranteed returns

- ✔ Only pure protection for your family

This is why term insurance stands in complete contrast to endowment plans. Endowment policies mix insurance with investment, making them expensive and ineffective. Term insurance removes all the clutter and focuses on what truly matters: protecting your family’s future. And if you’re wondering where to invest the money saved by avoiding these costly endowment plans, read our guide: Invest Money Where: 7 Rules to Win the Investing Marathon.

A Simple Analogy

Think of term insurance as renting a powerful security umbrella. You pay a small amount each month to keep your family safe from unexpected financial storms. If the weather stays clear (you live through the term), you don’t get anything back — but your family stayed protected every single day at a fraction of the cost.

Why Teachers Should Prefer Term Life Insurance

Term life insurance is the safest and most affordable way for teachers to protect their families. A 30-year-old non-smoker can get ₹1 crore cover for just ₹600–₹900 per month, while endowment plans cost several thousand for the same cover because they mix investment with insurance.

Term plans focus only on protection — no maturity amount, no confusing returns — which allows teachers to invest separately in transparent options like PPF or mutual funds for long-term wealth.

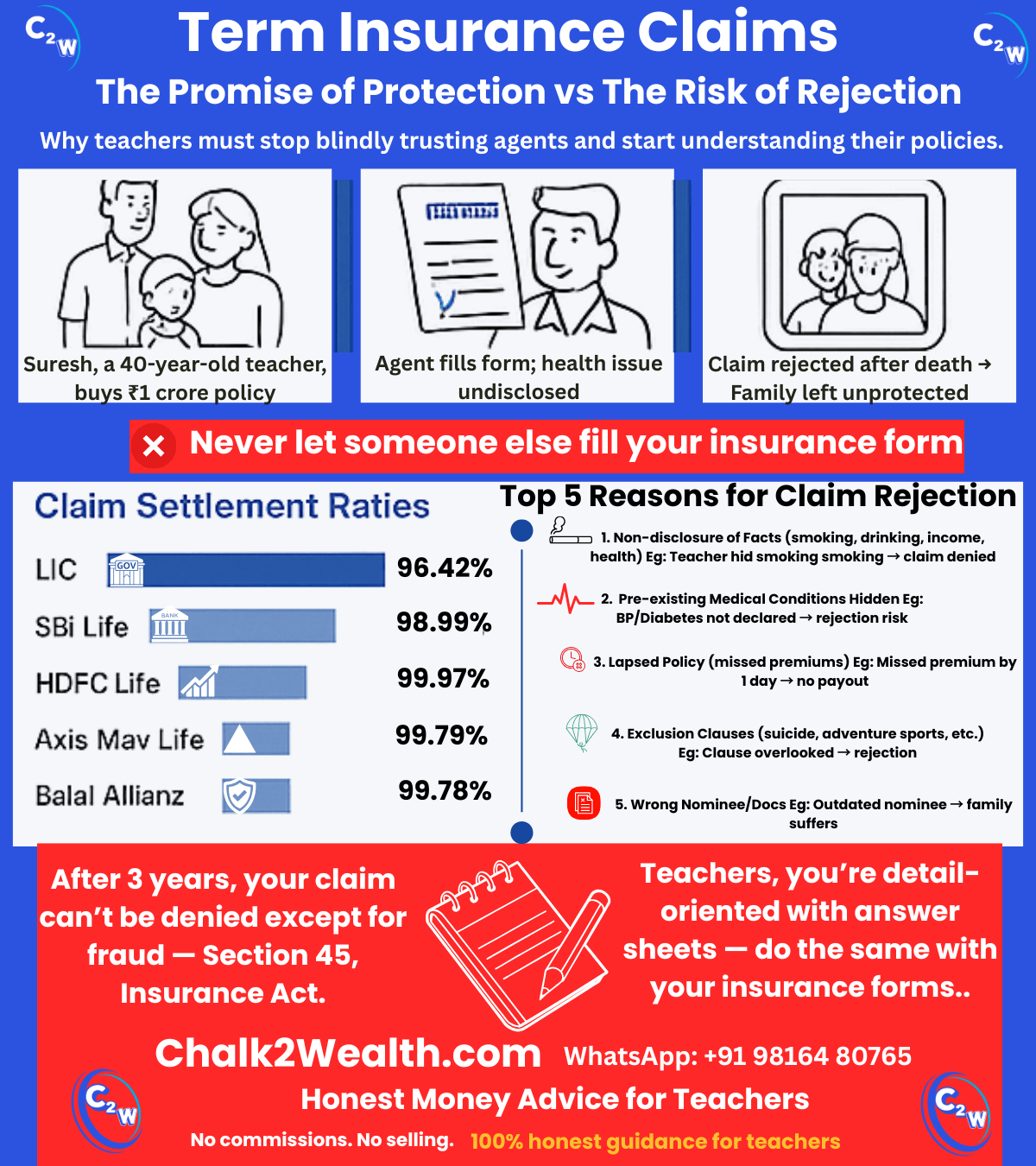

Claim reliability is also strong. The industry’s individual death claim settlement ratio touched 98.45% in 2022-23, with top insurers like Max Life (99.51%) and HDFC Life (99.39%) honoring most genuine claims.

Teachers also benefit from tax deductions under Section 80C, and death benefits remain tax-free under Section 10(10D). Premiums for riders such as critical illness may qualify for Section 80D as well.

Most importantly, term life insurance ensures your children’s education, home expenses and your spouse’s future stay protected — even if life takes an unexpected turn.

Common Traps & Mis-Selling Tactics to Avoid

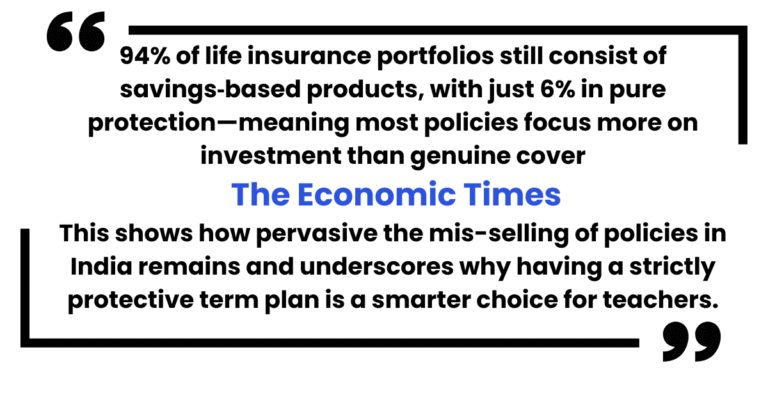

“94% of life insurance portfolios still consist of savings‑based products, with just 6% in pure protection—meaning most policies focus more on investment than genuine cover.”

Economic times

This shows how pervasive the mis-selling of policies in India remains and underscores why having a strictly protective term plan is a smarter choice for teachers

Teachers often trust agents, but mis-selling in life insurance is widespread. Watch out for these traps:

- Endowment plans sold as “safe deposits”: Some agents disguise endowment or money-back plans as fixed deposits, locking teachers into high annual premiums.

- Guaranteed returns gimmick: Endowment plans offer low returns and cannot match long-term FD or market returns. Never buy insurance for returns.

- Churning: Agents may push you to surrender old policies and buy new ones to earn commissions, causing heavy surrender losses.

- Hidden surrender charges & exclusions: Many teachers only learn about these when it’s too late. Always read the benefit illustration carefully.

- Bundled sales by banks: Relationship managers may club multiple policies or “gift policies,” creating unsustainable premium burdens.

Tip: Choose a plain-vanilla term life insurance policy and invest your savings separately. If an agent cannot explain the difference between term and endowment, that’s your signal to walk away.

How Much Coverage Should Teachers Take? (Real-Life Examples)

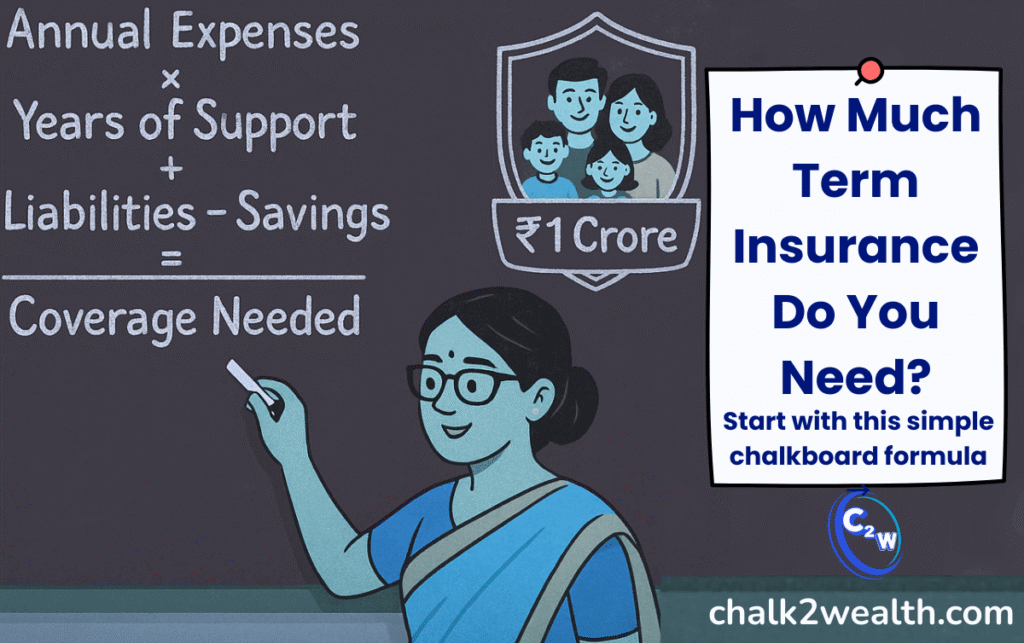

Choosing the right term life insurance cover is simple. Experts suggest 8–10× your annual income, but because of rising costs, many now recommend 15–20×, especially for young teachers.

Recommended Coverage Multiples

- Age 25–35: 20× annual income + outstanding loans

- Age 36–45: 15× annual income + loans

- Age 46–55: 10× annual income + loans

Quick Formula

Coverage = (Annual Expenses × Years Your Family Needs Support) + Liabilities – Existing Savings

Example (Shortened)

Mrs Sharma earns ₹6 lakh, spends ₹4 lakh yearly, expects her children to be independent in 15 years, and has a ₹10 lakh home loan with ₹5 lakh savings.

- Expenses: ₹4 lakh × 15 = ₹60 lakh

- Liabilities: ₹10 lakh

- Savings: ₹5 lakh

Recommended cover = ₹65 lakh

Most teachers round up to ₹1 crore for inflation and safety.

How to Choose the Best Term Life Insurance Plan in 2026

- Check claim settlement and solvency ratios: The claim settlement ratio indicates the percentage of claims the insurer has honoured; choose companies with ratios above 95 %. For example, Max Life’s 99.51 % and HDFC Life’s 99.39 % ratios show strong claim‑paying ability.

- Compare premiums and features: Use online premium calculators. As seen earlier, ₹1 crore cover for a 30‑year‑old non‑smoker costs about ₹600–₹900 per month. Compare across insurers for the same coverage and term.

- Look for flexibility in payout options: Some term plans let nominees choose a lump sum, monthly income or a combination. Teachers may prefer monthly payouts to cover regular expenses.

- Consider riders: Critical‑illness, accidental‑death and waiver‑of‑premium riders can provide additional protection. Choose riders based on your health profile and financial needs.

- Check claim process and customer service: Insurers with seamless online claim processes and dedicated support reduce the stress on your family.

- Avoid return‑of‑premium (ROP) plans: ROP term plans refund premiums if you survive the term, but they are significantly more expensive. You can achieve better results by buying a pure term plan and investing the difference elsewhere.

Term Life Insurance vs Other Products: The Honest Comparison

Term Insurance vs Other Products: The Honest Comparison table

| Feature | Term Insurance | ULIP | Endowment Plan | Money‑Back Plan |

|---|---|---|---|---|

| Purpose | Pure protection; pays death benefit only | Combines insurance with market‑linked investment | Insurance + guaranteed savings | Insurance + periodic returns during policy term |

| Premium cost | Lowest; ₹600–₹900 per month for ₹1 crore cover | Higher because part of premium goes to investment and charges | Higher; dual benefits mean higher premiums | Higher; includes survival payouts |

| Returns | None (unless ROP variant) | Market returns; subject to equity/debt fund performance | Low, guaranteed bonuses; not linked to market | Periodic money‑back payouts but overall return is low |

| Sum assured | Highest; typically 10–20× income | Lower sum assured; part of premium funds investments | Lower than term; combination of protection and savings | Lower; periodic payouts reduce final sum |

| Flexibility | Choose term (10–40 years), payout mode and riders | Choose funds (equity, debt, balanced) and switch between them | Rigid; limited flexibility | Some flexibility in payout schedule |

| Transparency | Simple; easy to understand | Charges (fund management, mortality, policy administration) reduce returns | Complex terms; surrender values often unclear | Complex; includes survival benefits, bonuses and payouts |

| Best suited for | Individuals seeking high cover at low cost | Investors comfortable with market risk wanting insurance + investment | People preferring forced savings with moderate cover | Those wanting periodic payouts (e.g., for milestones), but at |

Teacher-Friendly Action Plan for Term Life Insurance 2026

- Assess your needs: List dependents, monthly expenses, outstanding loans and future goals. Calculate the coverage using the formula above.

- Decide the term: Choose a term that covers you until the age when your children will be financially independent or your loans are repaid.

- Compare and shortlist insurers: Use reputable comparison portals to compare premiums and features. Focus on insurers with high claim settlement ratios.

- Select riders wisely: Add critical‑illness or disability riders only if you need them; each rider increases the premium.

- Buy online to save costs: Online policies generally have lower premiums because they eliminate agent commissions.

- Read the policy document thoroughly: Understand exclusions, waiting periods and claim procedures. Use the 15‑day free‑look period to cancel if necessary.

- Review your cover regularly: Review the sum assured every 3–5 years or whenever there is a major life event (marriage, birth of a child, home purchase).

5 Questions Every Teacher Must Ask Before Buying Term Life Insurance

Which term life insurance is best in India in 2026?

The best term life insurance in India in 2026 depends on your age, income, health, and family needs, not on a single company. That said, insurers with strong claim settlement ratios, low premium-to-coverage ratio, and simple claim processes consistently rank higher. As of now, the top-performing plans include LIC Tech Term, HDFC Click2Protect, Tata AIA Sampoorna Raksha Supreme, and ICICI Pru iProtect Smart.

Choose the best term plan by checking:

- Claim Settlement Ratio (CSR) above 97%

- Premium for at least ₹1–2 crore coverage

- Coverage till age 70–80

- Riders like Critical Illness, Accidental Death, Waiver of Premium

- Medical exam–based underwriting (safer for claim approval)

The best term insurance is the one that fits your family’s financial gap—not the cheapest premium.

What term life insurance means?

Term life insurance is a pure protection plan that provides a fixed amount of money (sum assured) to your family if you pass away during the policy term. Unlike traditional insurance, term insurance has no maturity benefit, which makes it highly affordable. You pay a low premium (monthly or yearly), and in return, your dependents receive financial security through a large cover—often ₹1–2 crore—so they can manage expenses like education, loans, and daily living without financial stress.

What is term life insurance?

Term life insurance is a pure protection plan that pays your family a fixed sum of money (sum assured) if you pass away during the policy term. It offers high coverage at very low premiums because it has no maturity benefit—you’re paying only for protection, not investment. For most families, especially teachers and salaried individuals, term insurance is the most cost-effective way to ensure financial security for children, spouse, and dependents.

Which Term Life Insurance Company Is the Best in India?

There is no single “best” company for everyone, but insurers with the strongest claim settlement ratios, financial stability, and simple claim processes tend to perform better. As of 2025, the most reliable companies include LIC, HDFC Life, Max Life, ICICI Prudential Life, Tata AIA, and SBI Life.

Choose the best company by checking:

- Claim Settlement Ratio above 97%

- Affordable premium for ₹1–2 crore cover

- Coverage till age 70–80

- Medical-test-based underwriting (more reliable for claims)

- Strong customer service record

The best term insurance company is the one that offers the right balance of trust, high claim ratio, and lowest premium for your health profile and age.

Which term insurance is best in India in 2026?

The best term insurance plans in India in 2025 can be ranked by Claim Settlement Ratio (CSR), which shows how reliably an insurer pays claims. Based on 2023–24 IRDAI data, the strongest performers include:

Best Term Insurance Plans in India 2025 (Ranked with Claim Ratios)

- Max Life Smart Secure Plus — Claim Settlement Ratio: ~99.6%

- HDFC Life Click2Protect — CSR: ~99.4%

- Tata AIA Sampoorna Raksha Supreme — CSR: ~99.1%

- ICICI Prudential iProtect Smart — CSR: ~98.62%

- LIC Tech Term Plan — CSR: ~98.15%

- SBI Life eShield Next — CSR: ~97.50%

When choosing among these, prioritise:

- CSR above 97% for reliability

- Coverage till age 70–80

- ₹1–2 crore sum assured

- Medical-test-based policy

- Riders (critical illness, accidental death, waiver of premium)

These ranked plans give the highest confidence that your family will receive the claim without hassle.

What Is Term Insurance With Return of Premium?

Term insurance with return of premium (TROP) is a type of term plan where your family gets the full sum assured if you pass away during the policy term — but if you survive the entire term, the insurer returns 100% of the premiums you paid (excluding GST and rider charges). It offers the protection of term insurance plus the reassurance of money-back benefits. However, premiums are 30–50% higher than pure term plans. TROP is ideal for someone who wants life cover + refund, but if your goal is maximum coverage at lowest premium, pure term insurance is usually better.

Conclusion: Honest Advice for Teachers

“Why pay for returns, when all you really need is protection?”

Indiatimes

Teachers play a critical role in shaping society, yet they often face financial uncertainty. Term life insurance is the most honest and cost‑effective way to protect your family. It is not an investment; it is a safety net. Do not let agents persuade you into complicated products with high premiums and low coverage. When you hear of guaranteed returns and bonus payouts, remember Mrs Sharma’s story and the widespread mis‑selling complaints.

By choosing a pure term plan and investing separately for wealth creation, you control your financial future. Chalk2Wealth’s motto—“No selling. No commissions. Only truth for teachers.”—reminds us that transparency and simplicity are the cornerstones of financial well‑being. Stay informed, ask questions, and prioritise protection over complicated products. Your family deserves honest security.

About the Author

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

Teacher’s Corner: Let’s Talk About Term life Insurance

Teachers, your experiences matter!

Do you know how much real cover your current insurance policy provides?

Have you ever been offered an endowment or money-back plan disguised as “safe investment”?

What challenges do you face while choosing the right policy?

Share your thoughts in the comments section below — your story could help another teacher avoid mis-selling traps.

Further Reading & Industry Context

If you’d like to dive deeper into how India’s insurance market is evolving, here are two insightful resources I found valuable while researching this blog: