Table of Contents

ToggleWhat Are Mutual Funds? A 2025 Beginner’s Visual Guide to SIPs, Types & Risks

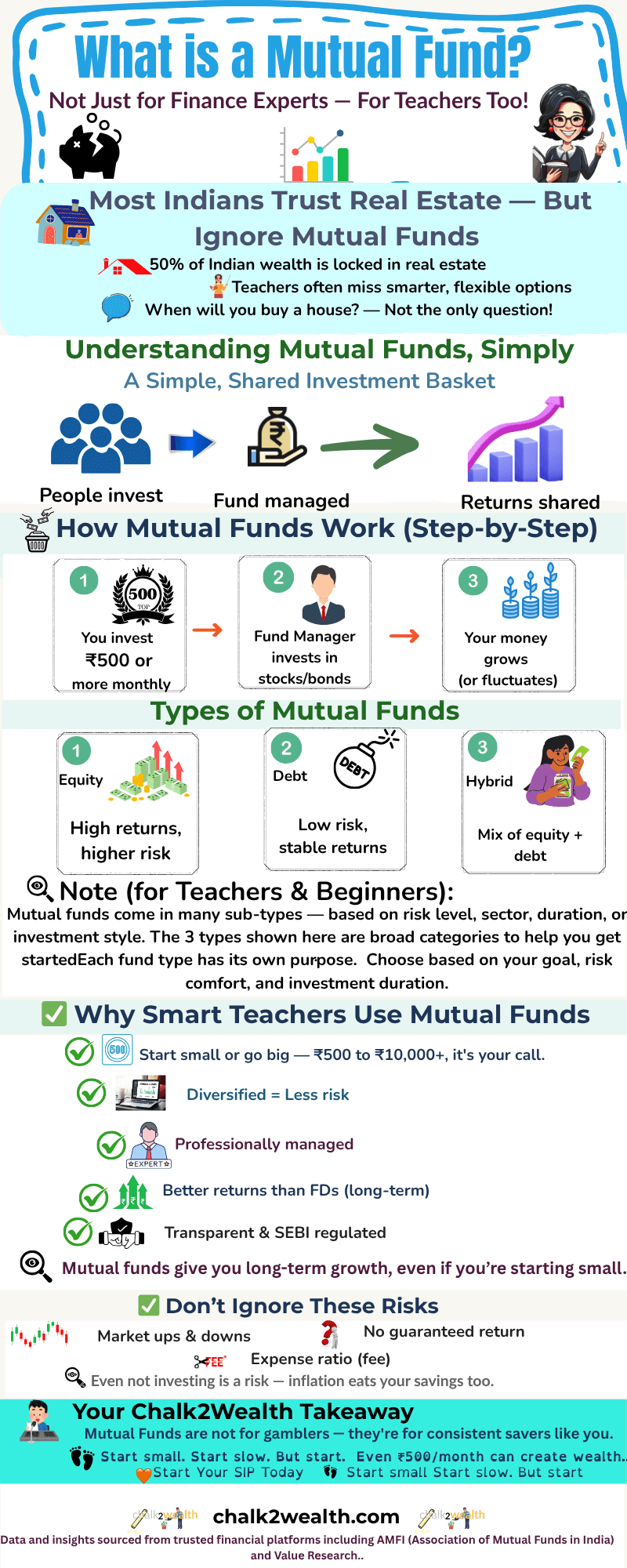

What are mutual funds? Whether you’re starting with ₹500 or ₹10,000 or ₹20,000 or more every month, mutual funds offer a simple and smart way to grow your money — without needing to be a finance expert. But still, many teachers, parents, and professionals hesitate — confused by terms like SIP, NAV, or fund type. That’s why we created this visual guide to help you clearly understand what are mutual funds, how they work, what types exist (equity, debt, hybrid), and even what risks to watch out for — all explained through real-life logic, not textbook definitions. So no matter how much you invest — ₹500 or ₹50,000 — this guide is your starting point toward smarter, more confident investing.

What are mutual funds infographic – beginner-friendly visual guide for Indian teachers explaining SIP, fund types, risks, and benefits

About the Author:

Jagan Charak is the Headmaster of a government school in Himachal Pradesh and the founder of Chalk2Wealth, a teacher-first financial literacy platform. He writes to help teachers and families understand money, avoid common traps like EMIs, credit card debt, and mis-sold insurance, and build long-term financial security. Being an educator himself, he firmly believes that financial education is as critical as academic education for a secure future.

This content is written for educational and informational purposes only. It is not financial advice. Please consult a qualified financial advisor before making investment decisions.

Articles That Helped Shape This Post

Still unsure which mutual fund fits your needs?

Use these free Mutual Fund Selector Tools from a trusted investment platforms. It helps you pick a fund based on your goals, risk level, and timeline — in just 2 minutes!

Want Help Choosing a Fund?

Now that you understand what mutual funds are, how they work, and how even ₹500 a month can build long-term wealth — the only thing left is to begin.Whether you’re starting with ₹500, ₹10,000, or ₹20,000, mutual funds offer a simple path to grow your savings — without needing to predict the market or become a finance expert.

Start small. Start slow. But start.

Still wondering which fund suits you best as a teacher or parent?

Ask in the comments — or explore more visual guides right here on Chalk2Wealth.

Final Thoughts – Start Small, Stay Consistent

#1. What are mutual funds in simple words?

–Imagine a classroom.

Now, instead of each student doing a different thing with their pocket money, they all pool it together.

A trusted teacher (a fund manager) takes this pooled amount and invests it smartly — in exams they can pass: some risky like stock tests (equity), some safe like notebook checking (debt), and some mixed like PTMs (hybrid).

That’s exactly what a mutual fund is —A pool of money from many people, invested by an expert, across various places to balance growth and safety.

#2. What if I invest 10,000 RS in mutual funds?

-If you invest ₹10,000 per month in mutual funds through a SIP (Systematic Investment Plan), here’s how your money can grow over time — just by staying consistent and giving your investment time to compound:

| Investment Period | Total Invested | Estimated Value (12% return p.a.) |

|---|---|---|

| 15 Years | ₹18,00,000 | ₹47,59,314 |

| 20 Years | ₹24,00,000 | ₹91,98,574 |

| 25 Years | ₹30,00,000 | ₹1,70,22,066 |

- The longer you stay invested, the more powerful compounding becomes.

- In 25 years, your ₹30 lakh investment could grow into over ₹1.7 crore — without changing your ₹10,000/month habit.

- You don’t need to time the market. You just need to give your money time.

#3. Is It Smart to Buy Mutual Funds?

-✅ Yes — and here’s why:

- Diversified Investment:-Your money is spread across many stocks or bonds, reducing risk.

- Expertly Managed:-Professional fund managers make smart decisions on your behalf.

- Start Small:-Begin with as little as ₹500/month through SIP — no need for lump sums.

- Beats Inflation Over Time:-Long-term mutual funds often deliver better returns than FDs or savings.

- Power of Compounding:-The longer you stay invested, the more your money grows.

Don’t wait for the perfect time. Just start — and don’t stop.

Confused? You're Not Alone — Let’s Clear a Few Doubts

In 2009, I was just like many teachers — earning ₹15,000 a month and saving whatever I could in a bank or GPF. One day, I decided to do something different — I started a ₹3,500/month SIP. It was bold for me, but I stayed consistent for 11 months.

But then fear hit. The market dipped. News channels screamed “crisis.” Friends warned me. I panicked and withdrew — all except ₹11,000 that I forgot in one fund. I moved on, believing I played it safe.

Fast forward to 2018 — that forgotten ₹11,000 had grown to ₹77,000. I stared at that number for a long time — not because it was huge, but because it showed me what patience could do. If I had continued with that SIP, my corpus would’ve been worth ₹15–20 lakh today.

That ₹11,000 taught me what no book or blog could — compounding needs time, not timing.

So today, whenever a teacher asks me, “Should I start with just ₹500?” — I smile and say: “Don’t wait to be perfect. Just start — and don’t stop.”