Table of Contents

ToggleWhat Are Systematic Investment Plans (SIPs) and How They Work to Build Wealth

Disclaimer: For education only. Not investment advice. Mutual funds are subject to market risks

I still remember the afternoon when Mr. Sunil, a school principal and my brother’s good friend, walked into my office with a worn-out file. He smiled faintly and said, “Jagan ji, I’ve been investing regularly, but I don’t feel like I’m moving forward. Can you look at my portfolio?”

He told me that after reading my latest blog — Best SIP Plans: 5 Powerful Options for Wealth Growth in 2025 — he felt I was the right person who could help clarify his doubts.

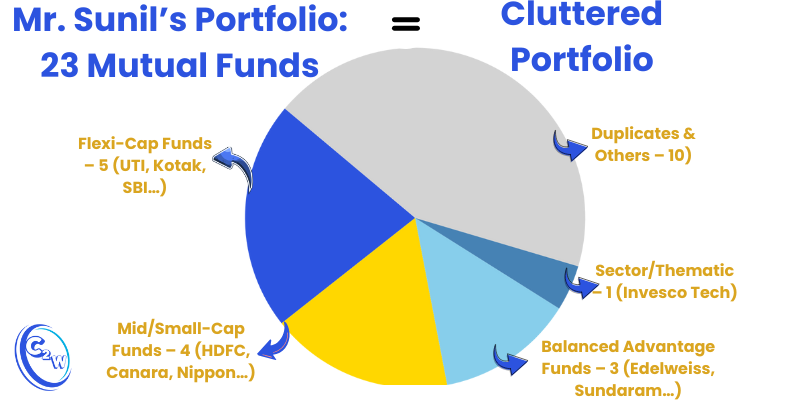

As I unfolded his file, I found 23 mutual fund schemes spread across different categories and styles. On the surface, it looked impressive. But beneath, it was cluttered and diluted.

This is the story of many teachers and middle-class families — we start investing with good intentions, but often end up lost in a maze of too many funds. And in this confusion, we forget to ask the most basic question: what are Systematic Investment Plans (SIPs), and how can they bring discipline instead of clutter?

If you’ve ever wondered the same, I suggest you also explore these detailed guides:

- Safe Investments in India with High Returns – a teacher’s roadmap to balancing safety and growth.

- Where to Invest Money in India 2025: Smart Ways to Beat Inflation – strategies to protect your hard-earned savings.

- Invest Money Where: 7 Rules to Win the Investing Marathon – timeless principles every educator should follow.

Here’s What We Uncovered in Mr. Sunil’s Portfolio (and What Are Systematic Investment Plans Teaching Us)

What are Systematic Investment Plans remind us that more funds don’t always mean better results. Mr. Sunil’s 23-fund portfolio looked diversified but was actually cluttered with overlaps and duplicates. SIPs bring focus, discipline, and long-term growth.

Disclaimer: This chart is for educational illustration only. It does not recommend or promote any specific mutual fund. Investments are subject to market risks. Please read all scheme-related documents carefully before investing.

- Flexi-Cap Funds: Five of them (UTI, Kotak, Canara Robeco, NJ, SBI) – essentially all doing the same job.

- Mid/Small-Cap Funds: Several names (HDFC Mid Cap, Canara Robeco Small Cap, Kotak Emerging, Nippon Small Cap) – multiple funds overlapping in the mid and small segments.

- Balanced Advantage Funds: Two different ones (Edelweiss Business Cycle and Edelweiss Balanced Advantage, plus Sundaram Balanced) – even duplicated entries of the same schemes.

- Duplicate Entries: Some funds appeared twice (Edelweiss Business Cycle and Balanced Advantage each had two accounts).

On the surface, Sunil’s collection of funds looked like he had “covered every angle.” But in reality, it was like carrying a heavy bag filled with coins—bulky and noisy, yet containing no crisp currency notes to actually move his wealth forward. This is exactly where understanding what are systematic investment plans (SIPs) can change the game: simplicity, discipline, and clarity matter more than cluttered diversification

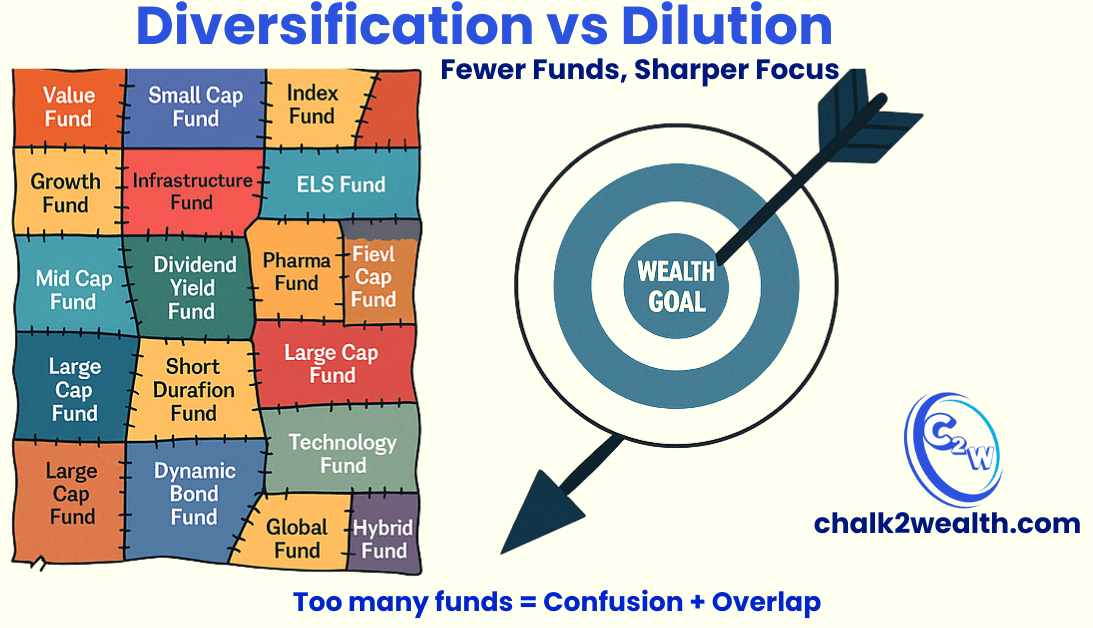

The Real Problem: What Are Systematic Investment Plans Without Focus? Lost Returns and Diluted Goals

Once we broke down the list, the issue was crystal clear: more funds did not mean better results. In fact, Mr. Sunil’s so-called diversification was nothing more than a patchwork of overlapping schemes. I gently explained that the real solution was not in adding yet another fund, but in simplifying. Instead of juggling 23 schemes, why not focus on just a few quality funds and invest in them regularly?

This is the point where I introduced him—and through him, many of my fellow teachers and concerned families—to a powerful approach often asked about in staffroom discussions: What Are Systematic Investment Plans (SIPs) and how can they truly help us build wealth with discipline.

What Are Systematic Investment Plans (SIPs)?

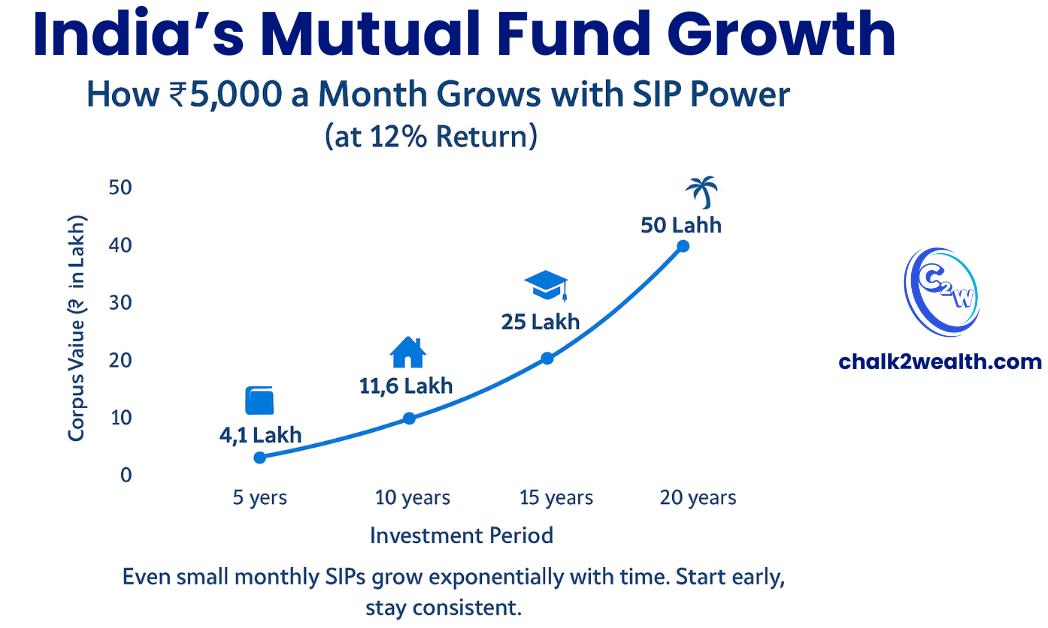

A Systematic Investment Plan (SIP) is a simple way to invest in mutual funds with discipline. In a SIP, you invest a fixed amount at regular intervals (usually monthly) from your bank account into a chosen mutual fund. This means if you decide to invest ₹5,000 every month, that amount is automatically debited and converted into units of the fund at the current Net Asset Value (NAV). You don’t need to worry about market timing. When markets fall, your fixed amount buys more units; when they rise, it buys fewer units, averaging out your purchase cost

As Business Standard highlights, even small but consistent SIP contributions can accumulate into significant wealth “through the power of compounding and rupee-cost averaging”. Value Research further explains that SIP investors tend to stay invested in the long term, which helps them avoid panic during market ups and downs.

In short, if you’ve ever wondered What Are Systematic Investment Plans and why teachers and families should care, the answer is simple: SIPs let you invest smartly without predicting the market, turning small monthly steps into a lifelong journey of wealth creation.

Why SIPs? Key Benefits of Regular Investing

Switching to a SIP gives several advantages over ad-hoc investing or a cluttered portfolio. For educators like Mr. Sunil, who have limited savings to spare each month, Systematic Investment Plans (SIPs) bring these clear benefits:

- Low Minimum Investment: SIPs allow you to start with as little as ₹100–₹500. This makes investing accessible to everyone, even on a teacher’s salary.

- Rupee-Cost Averaging: By investing a fixed sum monthly, you automatically “buy low” when the market dips and “buy less” when it rises. Over time, this lowers your average cost per unit.

- Power of Compounding: Each investment’s returns start earning returns of their own. The longer you stay invested, the more powerful compounding becomes. Even modest monthly contributions can snowball into a large corpus if given time.

- Investment Discipline: SIPs enforce a regular saving habit. You schedule it once and money flows automatically, taking emotions out of the game. This disciplined approach keeps you invested through market swings, which experts say is “an excellent way to build wealth over time.”

Even a small piggy bank can grow. As Business Standard points out, you can begin SIPs with tiny amounts (₹100 or ₹500), so any teacher can start saving easily. Feeding that piggy bank consistently – month after month – leads to a growing nest egg, thanks to discipline and compounding.

Time is your ally. The stacked coins and clock above illustrate that the longer you invest, the more compounding works in your favor. Experts note that “the longer the investment horizon, the more the potential impact of compounding.” By starting early with What are Systematic Investment Plans (SIPs)—even with small sums—and staying invested, those rupees multiply exponentially over years.

Consistency is key. This piggy bank is a reminder that SIPs automate saving. Unlike one-time decisions which you might delay, SIPs debit your account each month like clockwork. Value Research explains that SIP investors become “less susceptible to market fluctuations” because they keep investing even in downturns. In fact, financial experts emphasize discipline: by sticking with SIPs (and even increasing them gradually), you harness steady wealth accumulation.

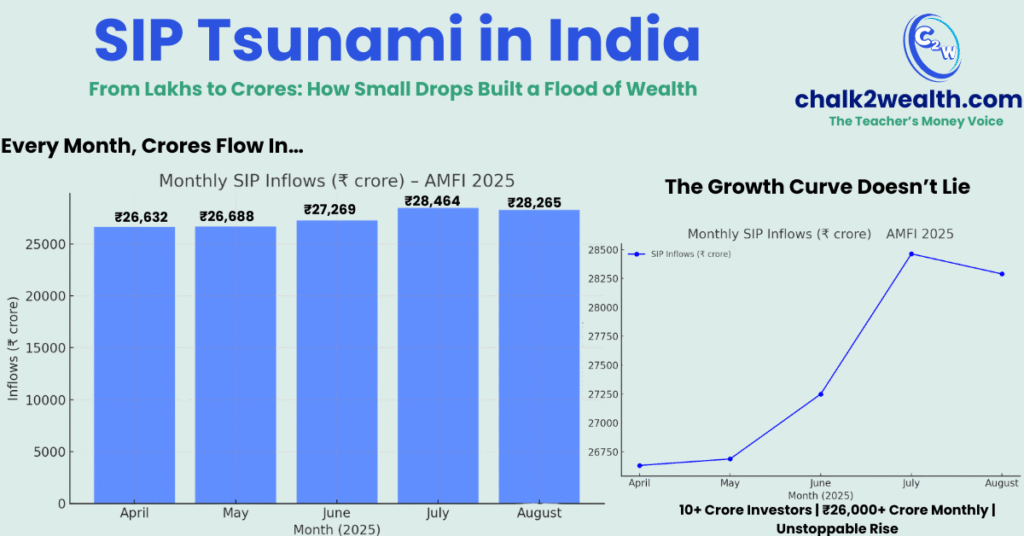

Exploring the Rising Popularity of SIPs in India

SIPs have exploded in popularity across India as investors embrace the steady, disciplined approach. AMFI data show the surge clearly: new SIP registrations rose to 6.8 crore in FY25 (vs 4.28 crore in FY24), while contributing accounts jumped 27% to 8.11 crore by March 2025. Monthly inflows also climbed, from ₹26,632 crore in April to a peak of ₹28,464 crore in July. With over 10 crore investors now relying on SIPs, this simple tool has become India’s preferred path to building wealth step by step.

Getting Started: How to Set Up an SIP

Starting a SIP is straightforward. First, clarify your goal (e.g. retirement, child’s education, a home). Then complete your KYC (identity and address proof, like PAN and Aadhaar) as required for any mutual fund. Link a bank account for automated deductions. Next, choose good funds that match your goals and risk tolerance – for example, a large-cap equity fund for steady growth, or an index fund for passive diversification. You can use AMC websites or popular platforms (Groww, Zerodha Coin, Value Research Fund Advisor, etc.) to compare and invest. Begin with an amount you’re comfortable with (even ₹500–₹1,000 per month). Over time, review and increase your SIP gradually. Experts suggest stepping up by 5–10% each year to beat inflation. The key is consistency: set it and forget it, but stay invested through the ups and downs.

Key Takeaways for Long-Term Wealth

- Small, Regular Investments Work: SIPs let you invest manageable sums periodically. Through rupee-cost averaging and compounding, even modest monthly SIPs can accumulate into substantial wealth. (If you’re exploring where to begin, read Best SIP Plans: 5 Powerful Options for Wealth Growth in 2025

- Start Early: The sooner you start your SIP, the more time your money has to grow. Experts emphasize that early action and patience allow compounding to create a much larger corpus. (You can also see how early investing helps in Invest Money Where: 7 Rules to Win the Investing Marathon

- Stay Disciplined: SIPs remove the guesswork of market timing. By investing through market highs and lows, you build wealth in a steadier fashion. This disciplined habit is especially powerful over a long horizon. (Learn the mindset behind disciplined investing in Safe Investments in India with High Returns – A Teacher’s Roadmap

- Data Supports SIPs: Millions of Indian investors contribute to SIPs every month (10+ crore accounts by 2025, and SIP inflows of ₹25,000+ crore/month). The trend is clear – SIPs have helped households steadily grow their financial muscle.

- Align SIPs to Goals: Use SIPs as a tool for goals like retirement, education, or buying a home. They are flexible and can be adjusted as needed. Importantly, choose funds wisely (prefer growth plans to capture compounding) and let SIPs work for the long term. (For inflation-beating strategies, check Where to Invest Money in India 2025: Smart Ways to Beat Inflation

In Mr. Sunil’s case, we rebuilt his portfolio around a few focused SIPs aligned to his goals. Within a year he felt confident and hopeful again. The lesson is universal: sometimes the simplest plan is the most powerful. Systematic Investment Plans turn a cluttered portfolio into a clear path for growth – one small investment at a time.

what is systematic investment plan?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount in mutual funds at regular intervals, usually monthly. Instead of investing a lump sum, SIPs allow you to invest small amounts consistently, helping you build wealth through the power of compounding and rupee cost averaging

what is systematic investment plan in mutual fund?

In mutual funds, a Systematic Investment Plan lets you automatically invest in a selected fund every month. The amount is debited directly from your bank account and invested in the fund, purchasing units based on the market’s Net Asset Value (NAV) on that date. It’s one of the simplest and most disciplined ways to invest in equity or debt mutual funds.

which systematic investment plan is best in India?

There is no single “best” SIP for everyone—it depends on your goals, risk appetite, and time horizon. However, some Best SIP Plans: 5 Powerful Options for Wealth Growth in 2025 include:

- Equity Mutual Funds (for long-term goals)

- Hybrid or Balanced Funds (for moderate risk)

- ELSS Funds (for tax saving under Section 80C)

You can compare performance and ratings on trusted sites like Value Research Online or Morningstar India before choosing.

How to start a Systematic Investment Plan?

To understand how to start systematic investment plan, follow these simple steps:

- Complete your KYC process with a registered mutual fund company or your bank.

- Select a mutual fund scheme based on your financial goals and risk appetite.

- Decide the investment amount and set the SIP date for monthly deductions.

- Submit the auto-debit mandate so the amount is invested automatically every month.

- Review your investments regularly to track progress toward your goals.

Knowing how to start systematic investment plan helps you build wealth gradually through consistent investing and the power of compounding.

Can I withdraw SIP anytime?

Yes, you can withdraw your SIP anytime. SIPs are fully flexible — you can stop future installments or redeem your invested amount whenever you want. However, some mutual funds may have an exit load if withdrawn before a specific period (usually 1 year)

Is SIP risky?

SIP itself is not risky, but the risk depends on the type of mutual fund you choose. Equity SIPs carry market risk, while debt SIPs are relatively safer. Investing through SIP helps reduce risk by averaging your cost over time and promoting long-term discipline.

Is SIP safe?

SIP is a safe and disciplined way to invest, but not completely risk-free. Its safety depends on the mutual fund type — debt SIPs are more stable, while equity SIPs fluctuate with the market. Over the long term, SIPs help reduce risk through regular investing and compounding.

How is SIP return calculated?

SIP returns can be measured in three main ways — Absolute Return, CAGR, and XIRR.

- Absolute Return shows the total percentage gain or loss over the entire investment period.

- CAGR (Compounded Annual Growth Rate) indicates how much your investment grew annually if it had compounded evenly every year.

- XIRR (Extended Internal Rate of Return) is the most accurate method for SIPs, as it considers multiple investment dates and amounts.

Thus, SIP return is best calculated using the extended XIRR formula, which reflects real, time-weighted returns on your periodic investments.

Disclaimer: This article is for educational purposes only and is not investment advice. All mutual fund investments are subject to market risks. Past performance does not guarantee future returns. Please read scheme documents carefully and/or consult a SEBI-registered financial advisor before investing