Table of Contents

ToggleWhat is a Term Plan in Insurance? Honest 4-Step Guide for Families

A Staffroom Memory That Changed Everything

.In the staffroom, I found myself remembering my JNV classmate Om Prakash—whom we Navodayans fondly called Tundi.

He left us suddenly, far too early. A cheerful friend, a caring soul… and yet, his family was left unprepared for life without him.

Talking about his demise with a fellow teacher, I realised: we can’t predict tomorrow, but we can protect the people who depend on us. That’s exactly what a Term Plan in Insurance commonly known as a term insurance policy is—a simple life cover. No investments, no returns. Just pure protection for your family if something happens to you.

That day, I ran my own numbers—₹1 Crore was the answer.

Not for me—but for the family who will need it most.

What is a Term Plan in Insurance (Explained Simply for Families)

What is a Term Plan in Insurance – 4-Step Family Method

A term plan is pure risk cover. You pay a small premium every year; if the life assured passes away during the policy term, the family receives the sum assured. If you survive the term, there’s no maturity amount—because this product is built for protection, not returns.

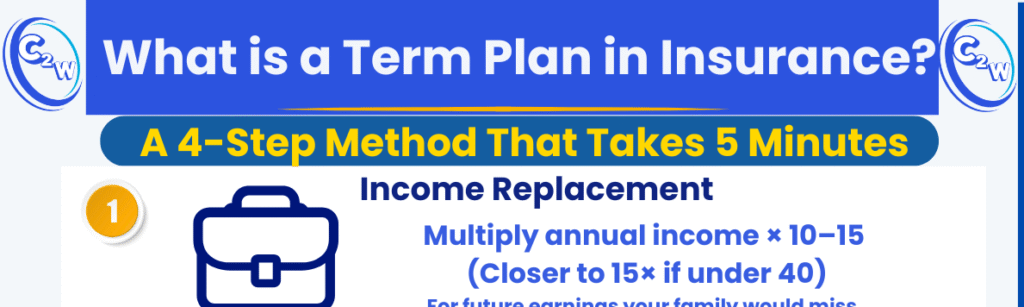

The 5-Minute, 4-Step Method (Teacher-Friendly)

Step 1: Income Replacement – Multiply your annual income × 10–15 (age & kids’ ages decide whether you choose 10, 12, or 15).

Step 2: Add Liabilities – Add all outstanding loans (home, personal, education).

Step 3: Add Big Goals – Add a rough estimate for children’s education + a spouse safety fund (6–12 months of expenses).

Step 4: Subtract Existing Buffers – Deduct employer cover and liquid investments already earmarked for family safety.

Quick tip: Employer group cover usually ends when you leave the job. Don’t rely on it as your only protection.

Quick Examples (So You Can See the Math)

Rani (35), Private School Teacher

- Annual income: ₹7 lakh → Step 1: ₹7L × 12 = ₹84L

- Liabilities: ₹10L (education/personal) → ₹94L

- Big goals: ₹10L (kid’s fund + spouse safety) → ₹104L

- Buffers: –₹4L (employer cover + savings) → ₹100L

Recommended cover: ₹1 Crore (rounded)

Mr. Arun (42), Government School Teacher

- Annual income: ₹8 lakh → Step 1: ₹8L × 12 = ₹96L

- Liabilities: ₹15L (home loan balance) → ₹111L

- Big goals: ₹20L (2 kids in middle school + spouse safety) → ₹131L

- Buffers: –₹11L (GPF/EPF + cash) → ₹120L

Recommended cover: ₹1.2 Crore

See also: How Much Term Insurance Do Teachers Need in India in 2025?

Pro Tips Teachers Ask Me in the Staffroom

- Policy Term: Usually till retirement age (60–65).

- Premium Thumb-Rule: Keep total term premiums within ~1–2% of annual income.

- Riders (Optional): Waiver of Premium (useful), Accidental Death Benefit (optional), be cautious with Critical Illness—it’s different from term cover.

- Buy Early, Disclose Honestly: Earlier age = lower premium; disclose health & habits truthfully.

Final Word

We all have someone depending on us. What is a Term Plan in Insurance? It’s not about returns—it’s about responsibility. Whether you call it a term insurance policy or a life cover plan, the meaning is the same: a promise that your loved ones will be financially safe even if you are not there tomorrow.

Take 5 minutes today, run your numbers, and give your family the shield they deserve.

Don’t postpone this. Open your calculator, run the 4 steps, and note your number today. Protection delayed is protection denied.

Aaj hi apna number nikaaliye—kal ka intezaar mat kijiye.